Sherman County Assignment of Trust Deed by Beneficiary or Successor in Interest Form

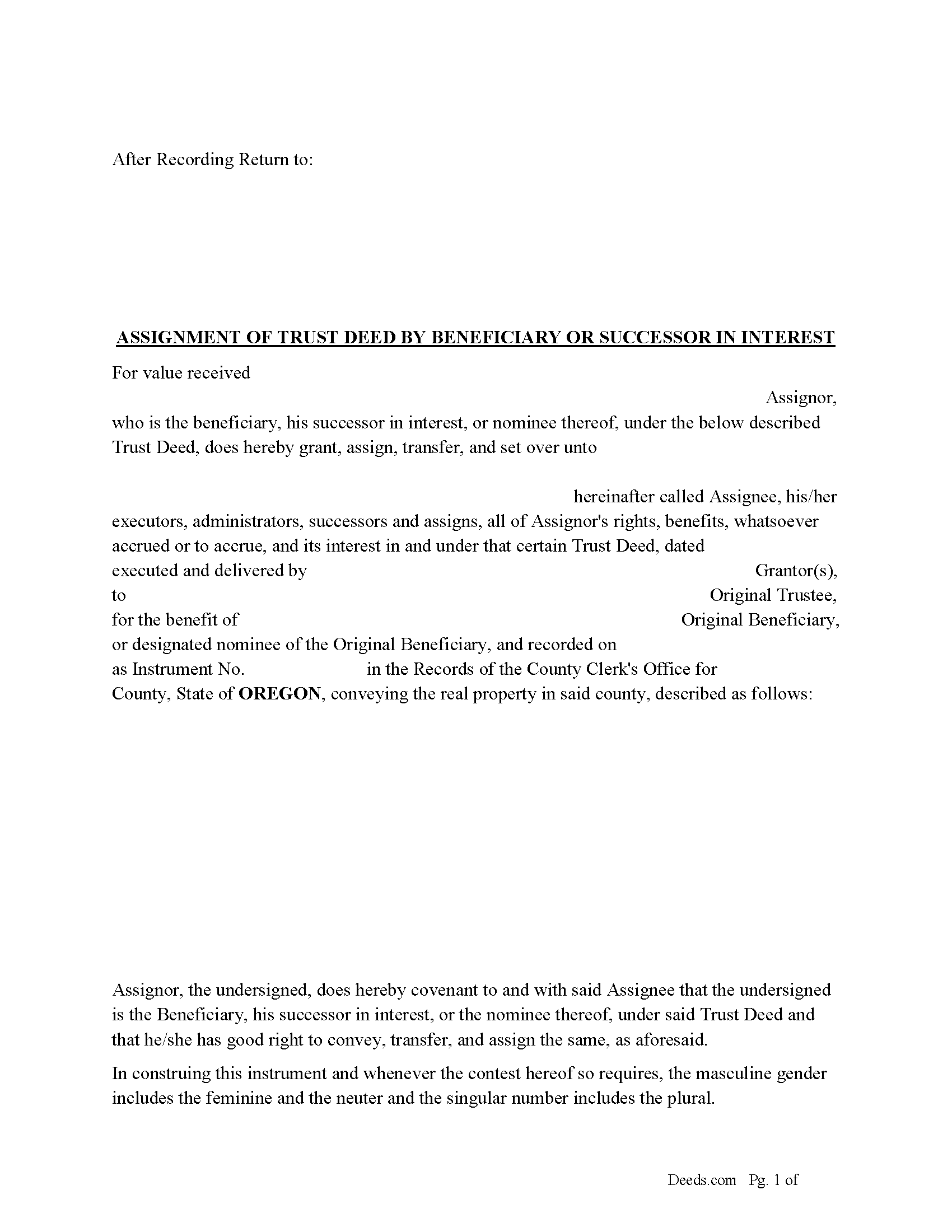

Sherman County Assignment of Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

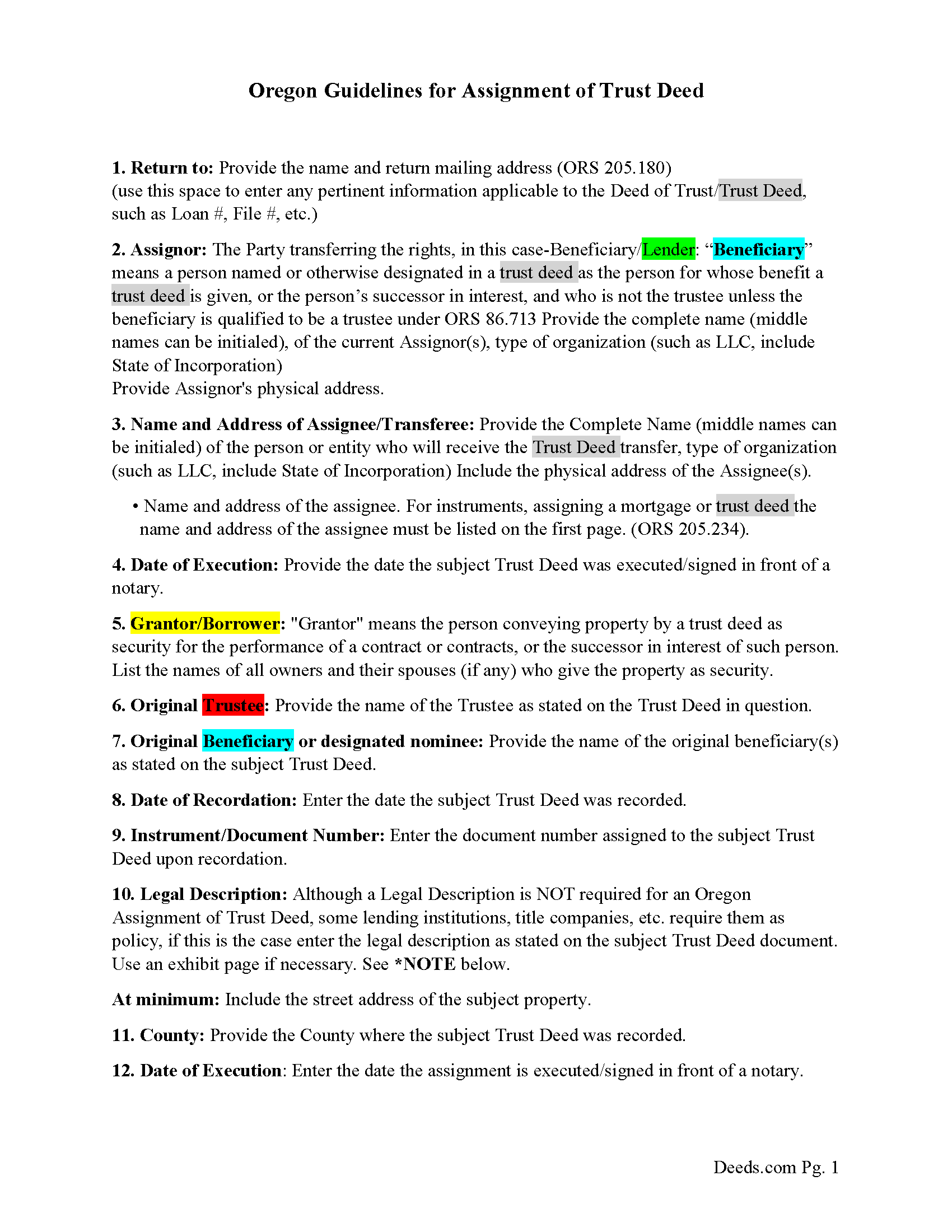

Sherman County Assignment of Trust Deed Guidelines

Line by line guide explaining every blank on the form.

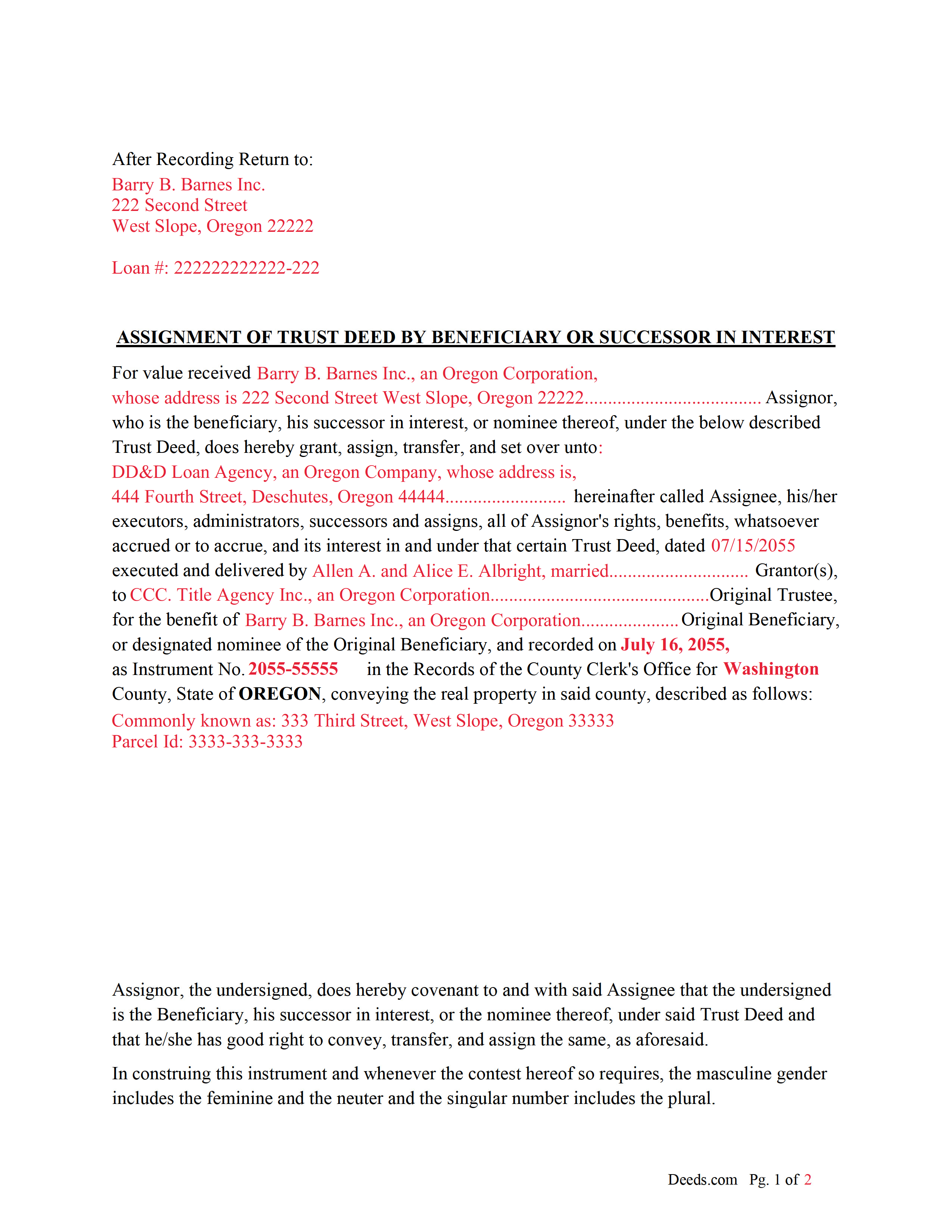

Sherman County Completed Example of Assignment of Trust Deed Document

Example of a properly completed form for reference.

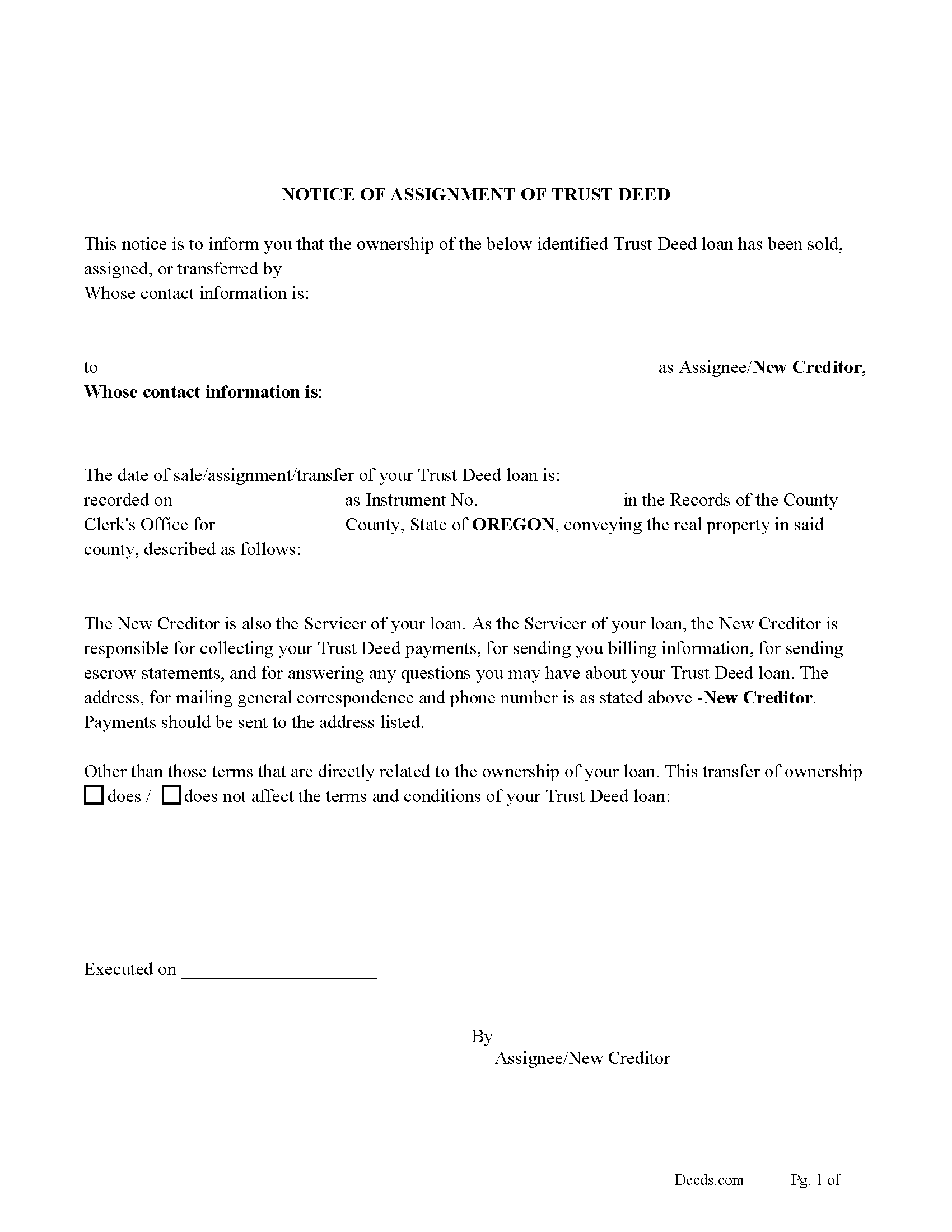

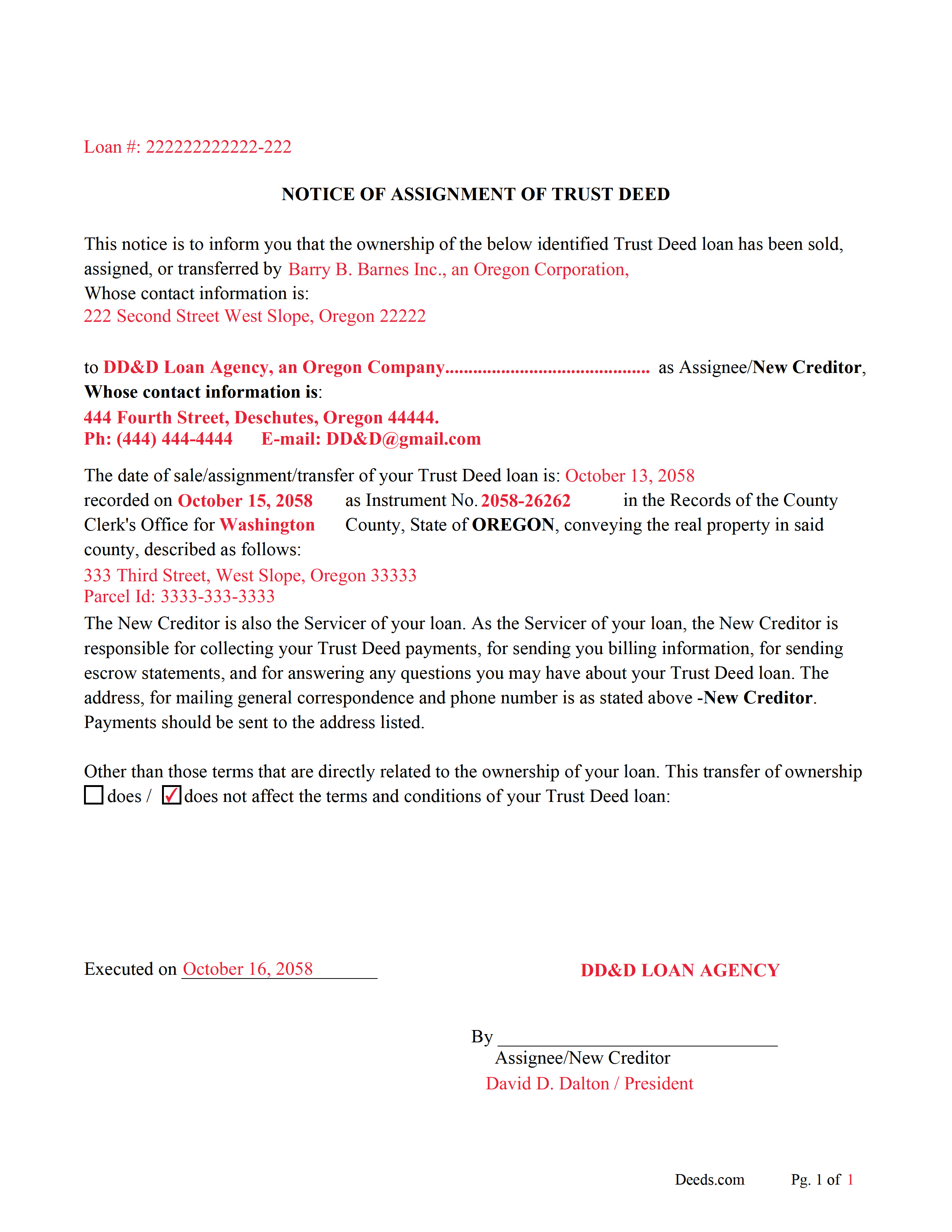

Sherman County Notice of Assignment of Trust Deed Form

Fill in the blank form formatted to comply with content requirements.

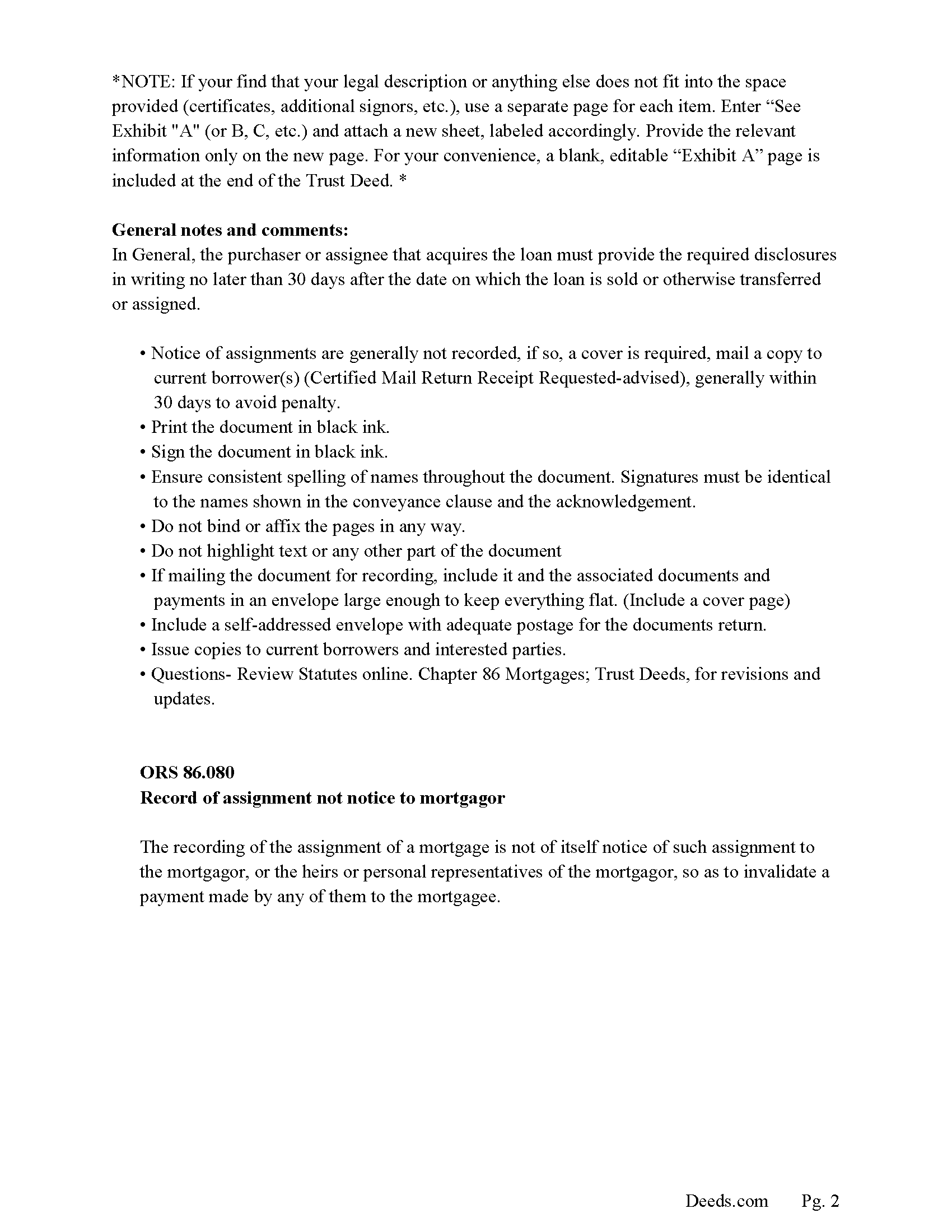

Sherman County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Sherman County Notice of Assignment-Completed Example

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Sherman County documents included at no extra charge:

Where to Record Your Documents

Sherman County Clerk

Moro, Oregon 97039

Hours: 8:00 to 4:30 M-F

Phone: (503) 565-3606

Recording Tips for Sherman County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

Cities and Jurisdictions in Sherman County

Properties in any of these areas use Sherman County forms:

- Grass Valley

- Kent

- Moro

- Rufus

- Wasco

Hours, fees, requirements, and more for Sherman County

How do I get my forms?

Forms are available for immediate download after payment. The Sherman County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sherman County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sherman County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sherman County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sherman County?

Recording fees in Sherman County vary. Contact the recorder's office at (503) 565-3606 for current fees.

Questions answered? Let's get started!

In this form the assignment/transfer of a Trust Deed/Deed of Trust is made by the beneficiary/lender or successor in interest.

("Trust deed" means a deed executed in conformity with ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) that conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Beneficiary" means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).) (ORS 86.705(2))

ORS 86.060 Assignment of mortgage Mortgages may be assigned by an instrument in writing, executed and acknowledged with the same formality as required in deeds and mortgages of real property, and recorded in the records of mortgages of the county where the land is situated.

ORS 86.715 Trust deed deemed to be mortgage on real property A trust deed is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced), in which event the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) shall control. For the purpose of applying the mortgage laws, the grantor in a trust deed is deemed the mortgagor and the beneficiary is deemed the mortgagee.

Included are "Notice of Assignment of Trust Deed" forms. The current Mortgagor/Borrower/Grantor must be notified of the assignment, generally within 30 days to avoid penalty.

ORS 86.080 Record of assignment not notice to mortgagor

The recording of the assignment of a mortgage is not of itself notice of such assignment to the mortgagor, or the heirs or personal representatives of the mortgagor, so as to invalidate a payment made by any of them to the mortgagee.

(Oregon Assignment Package includes form, guidelines, and completed example) For use in Oregon only.

Important: Your property must be located in Sherman County to use these forms. Documents should be recorded at the office below.

This Assignment of Trust Deed by Beneficiary or Successor in Interest meets all recording requirements specific to Sherman County.

Our Promise

The documents you receive here will meet, or exceed, the Sherman County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sherman County Assignment of Trust Deed by Beneficiary or Successor in Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

janice m.

August 1st, 2025

Great system!

Thank you!

Raymond N.

September 7th, 2023

The process of obtaining the forms that I wanted was very easy and the cost reasonable. The site is easy to follow and explains everything. Thank you for being here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brian B.

May 13th, 2021

Very good price. It came with instructions and a sample filled out. Very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

February 20th, 2020

Does everything I expected it to do. Very helpful. It is in compliance with applicable Nevada State regulations

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Ann P.

August 19th, 2025

Was hoping I would be sent copies on paper so I can fill them out without a desk computer

We appreciate your feedback. Our forms are delivered instantly as digital files, so customers can download and print as many copies as they need. This way, you have the flexibility to complete them by hand if you prefer.

Jacqueline B.

November 7th, 2020

Very easy process to have this document recorded through Deeds.com! The amount of time it saved me was greatly appreciated. highly recommend Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

James J.

December 27th, 2019

Downloaded and used the Ladybird Warranty Deed for a county in Florida with no issues. Cost for the download and subsequent recording fee of the deed totaled less than $40. No reason to pay hundreds. I assume the subsequent transfer upon death will go smoothly, but I of course, will never know. The "example" of a completed form was very beneficial. Also, get a copy of the current deed and make sure legal description of real estate is exactly the same on the new deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Scott D.

March 31st, 2025

I am very satisfied with the quality of the product I ordered. I have done similar property transfers/recording in the past on my own but paying for the forms and guidance is well worth it. The AI question area is extremely helpful. The example for the forms is perfect (as it has to be). I will absolutely use Deeds.com in the future for any related property needs. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Aldona P.

April 9th, 2020

Awesome Job! thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Veronica F.

April 24th, 2019

Im so happy with this site. It was quick and painless and worth the money hassle free if I ever need to settle another deed I will be back.

Thank you Veronica, we really appreciate your feedback.

Sallie S.

January 24th, 2019

Great speedy service with access to areas beyond my reach.

Thank you Sallie, have a great day!

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Desiree R.

August 19th, 2024

very easy to use

We are delighted to have been of service. Thank you for the positive review!