Lake County Conditional Lien Waiver on Final Payment Form

Lake County Conditional Lien Waiver on Final Payment Form

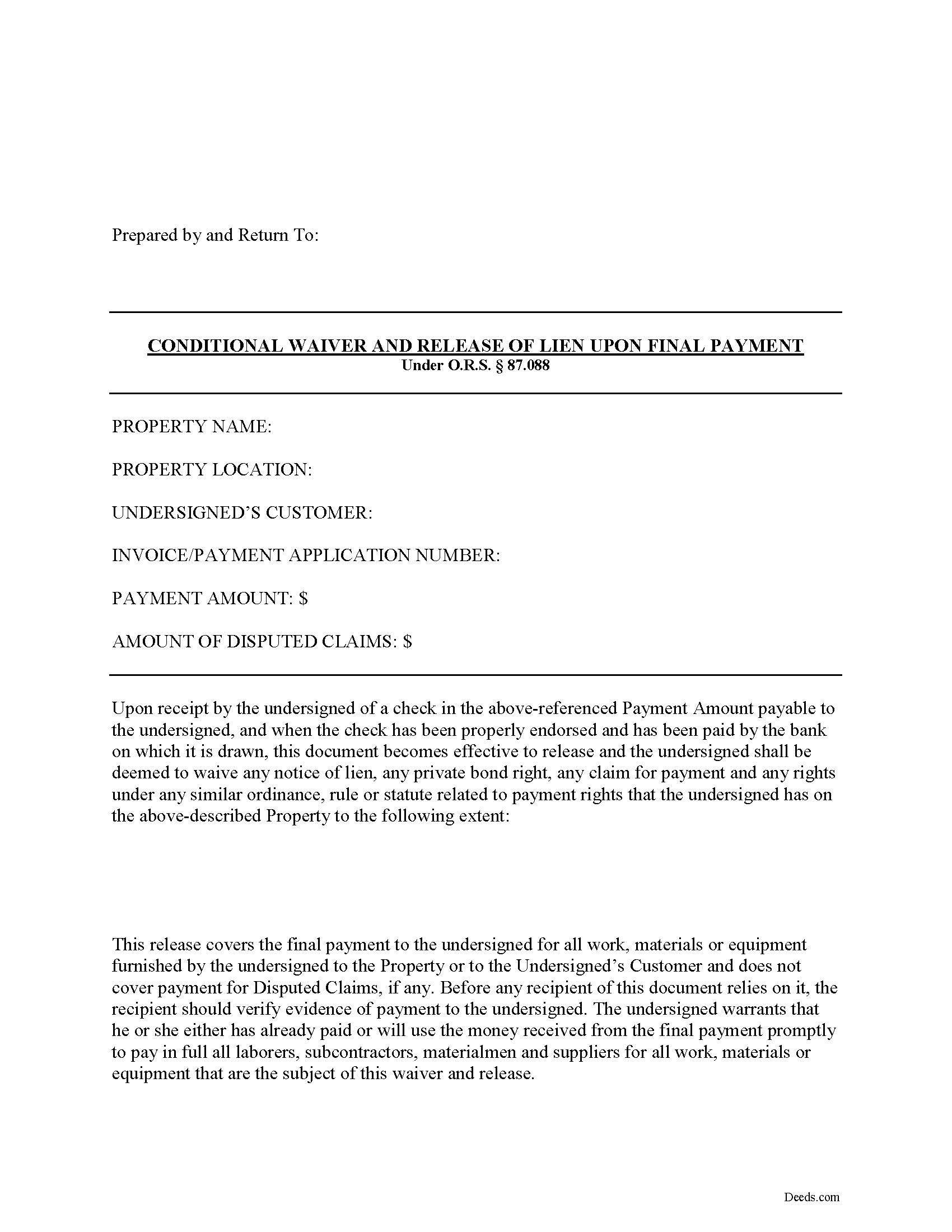

Fill in the blank Conditional Lien Waiver on Final Payment form formatted to comply with all Oregon recording and content requirements.

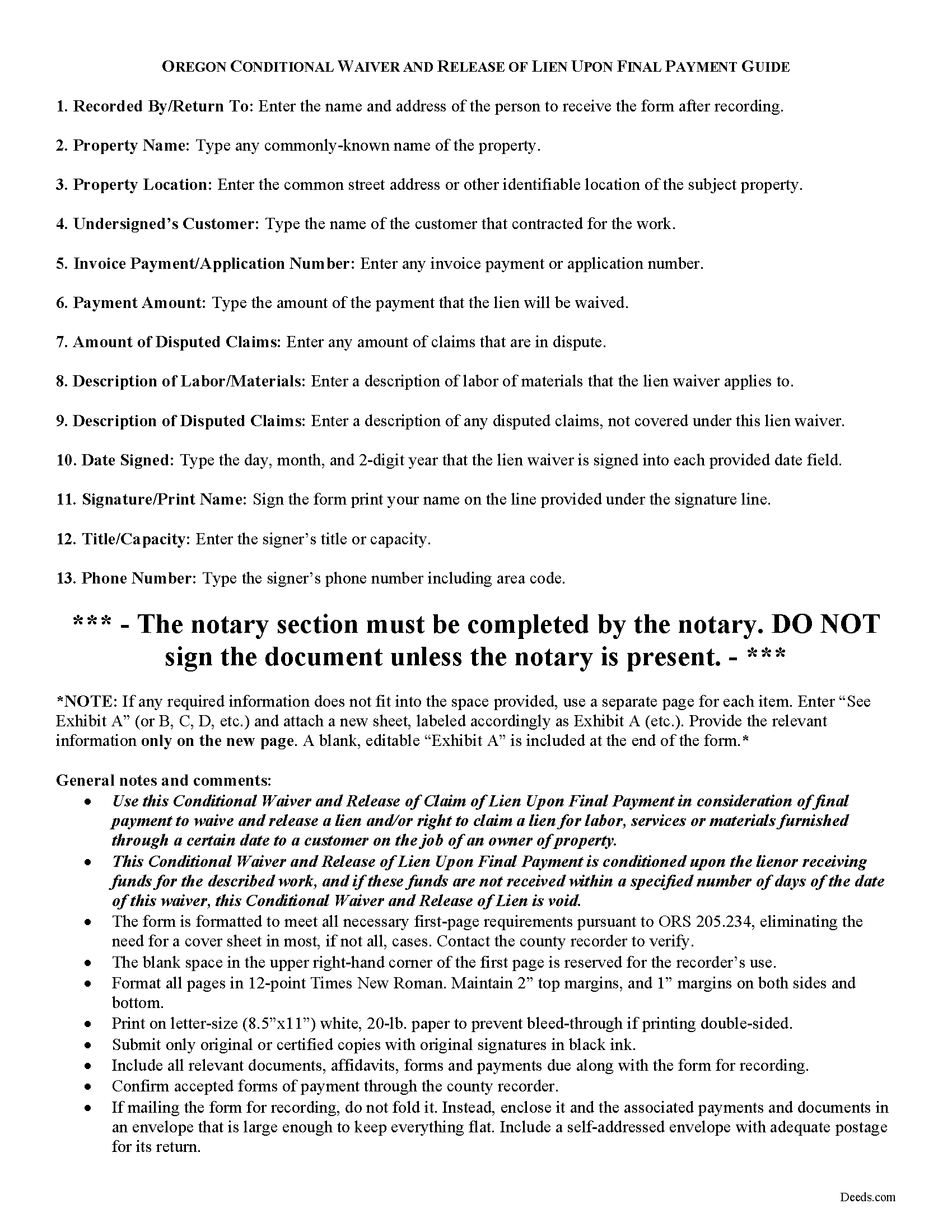

Lake County Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

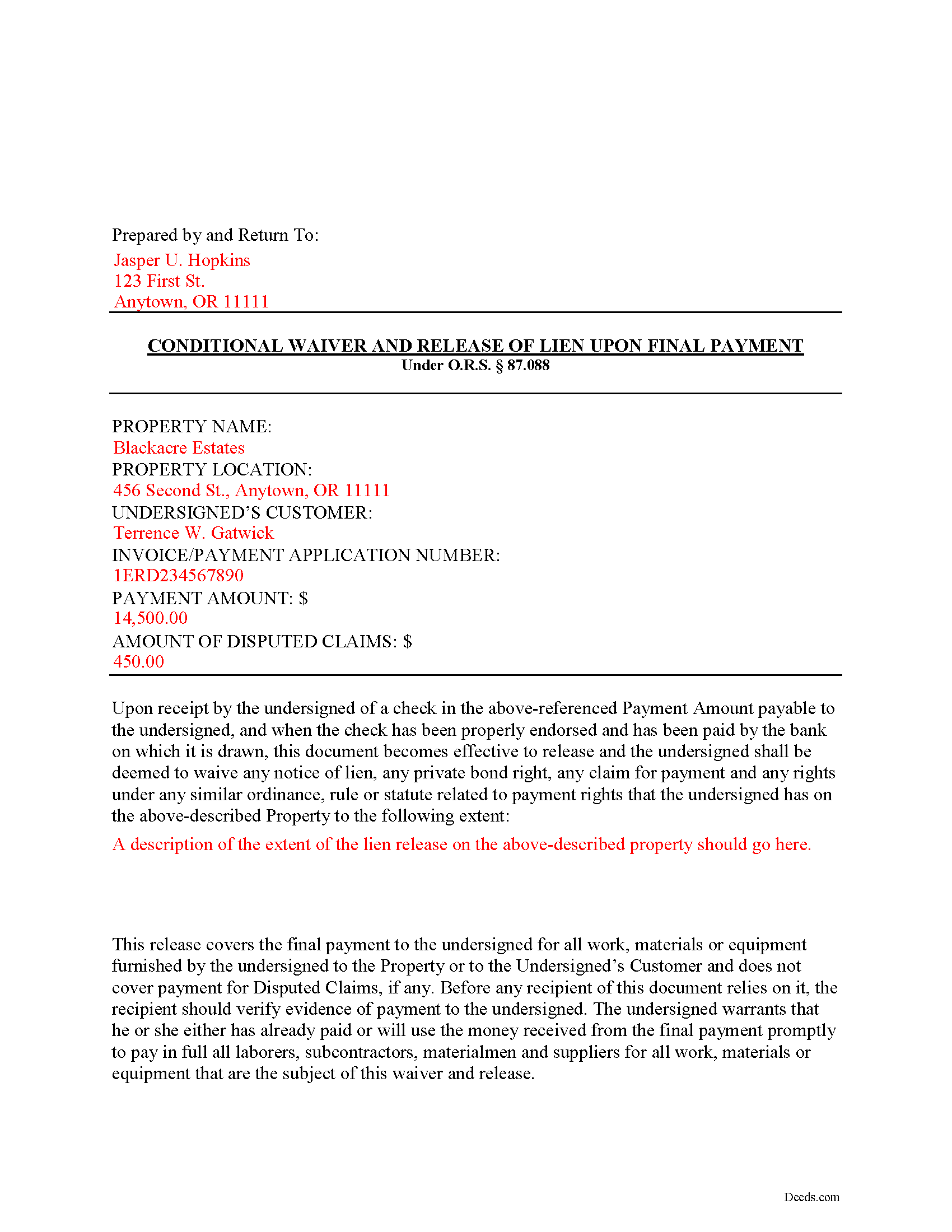

Lake County Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Lake County documents included at no extra charge:

Where to Record Your Documents

Lake County Clerk

Lakeview, Oregon 97630

Hours: 8:30am to 5:00pm M-F

Phone: (541) 947-6006

Recording Tips for Lake County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Lake County

Properties in any of these areas use Lake County forms:

- Adel

- Christmas Valley

- Fort Rock

- Lakeview

- New Pine Creek

- Paisley

- Plush

- Silver Lake

- Summer Lake

Hours, fees, requirements, and more for Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lake County?

Recording fees in Lake County vary. Contact the recorder's office at (541) 947-6006 for current fees.

Questions answered? Let's get started!

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

Liens are instruments, recorded with the land records for the locality where the relevant real property is situated, that document the agreement between the owner/customer and the contractor. They identify the primary parties and generally include a description of the work requested, a tentative schedule, and an information about charges and payments.

Contractors and other authorized parties (claimants) use construction liens to protect their interests while improving someone else's property. To encourage payment, the contractor may offer to waive lien rights.

Altogether, there are four separate lien waivers: partial conditional, partial unconditional, final conditional, and final unconditional. A conditional waiver offers more protection to the lien claimant, and depends on the payment clearing the bank, meaning that there are no bounced checks or other complications. An unconditional waiver offers more protection to the owner and is effective regardless of payment receipt.

For example, let's say a customer pays the total balance due. After the payment clears the bank, the claimant completes and records a conditional waiver on final payment form, which identifies the parties, the nature of improvement, the property, and the relevant dates and payments applied. By recording, the claimant releases all rights reserved by the earlier lien.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Please contact an Oregon lawyer with any questions about waivers or other issues related to construction liens.

Important: Your property must be located in Lake County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Final Payment meets all recording requirements specific to Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

James M.

July 22nd, 2023

Great selection of documents. Easy to use, with guidance material.

Thank you for taking the time to leave your feedback James. We appreciate you.

Evelyn L.

June 30th, 2021

very easy to print

Thank you!

Griselle M.

April 9th, 2020

Great service - it was my first time using the service and really recommend it. Due to COVID-19, my County Recorder's Office is closed and I was able to create the document using their vast templates, notarize it, and upload it into the system. The recording process took about 7 working days which is not bad considering that most people are working remotely. I will share this website and its many resources with my relatives and friends.

Thank you Griselle, glad we could help.

Norma J H.

April 27th, 2022

Your forms have been very helpful. I thank you very much for making them easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane G.

August 5th, 2022

easy to use

Thank you!

Jennifer L L.

November 19th, 2024

So far this has been a great experience. Very easy to use the deeds.com website and download the forms. Very nice that they give example forms and guides to help you fill out the forms. I just have to wait to make sure that the forms are accepted and recorded with no issues.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Masud K.

June 20th, 2020

Deeds.com did an excellent job in providing me the Real Estate documents I needed. You delivered the documents fast and they were accurate. I greatly appreciate your help. Thanks for everything

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Petre A.

April 9th, 2022

Easy @ useful

Thank you!

Richard L.

December 17th, 2020

Service was very convenient; I received prompt assistance with my document - staff was very helpful.

Thank you!

Kathy Ann M.

June 26th, 2020

Got the report. However, Retrieving process was not clear.

Thank you for your feedback. We really appreciate it. Have a great day!

John S.

April 22nd, 2021

The website is very user-friendly. Easily to download forms.

Thank you!

Garrison T.

April 24th, 2021

Excellent service & very easy to use.

Thank you!

Nicole T.

February 9th, 2021

Absolutely Amazing Service! I learned about Deeds.com, created my Account, uploaded my documents into my Recording Package, paid my Invoice and received my Three Recorded Deeds all in less than two hours! Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michele S.

February 10th, 2019

This is a great service if you know what youre looking for. Unfortunately it just wasnt right for me and my situation.

Thank you!

LuAnn F.

September 8th, 2022

Simple and quick access to the form I needed

Thank you!