Marion County Quitclaim Deed Form

Marion County Quitclaim Deed Form

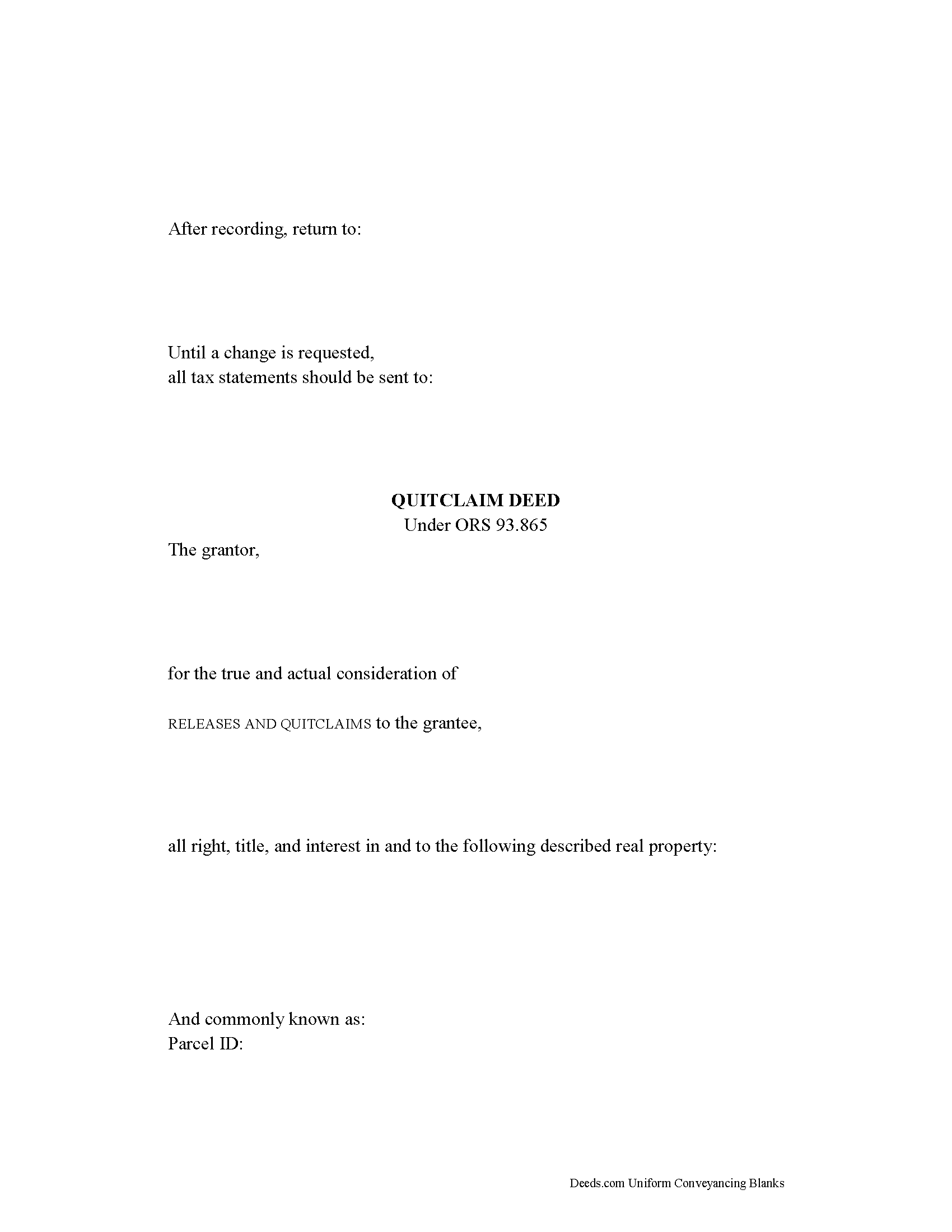

Fill in the blank Quitclaim Deed form formatted to comply with all Oregon recording and content requirements.

Marion County Quitclaim Deed Guide

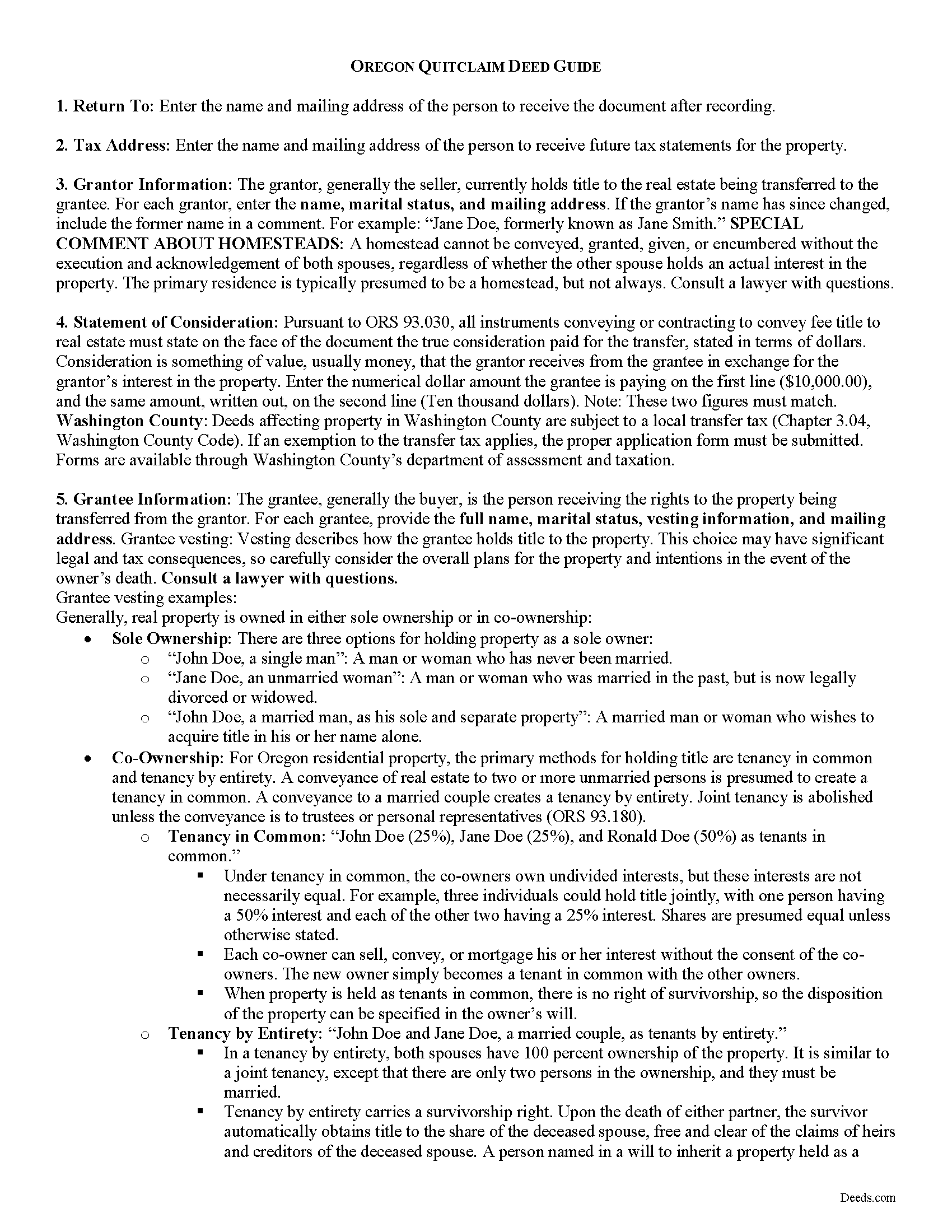

Line by line guide explaining every blank on the Quitclaim Deed form.

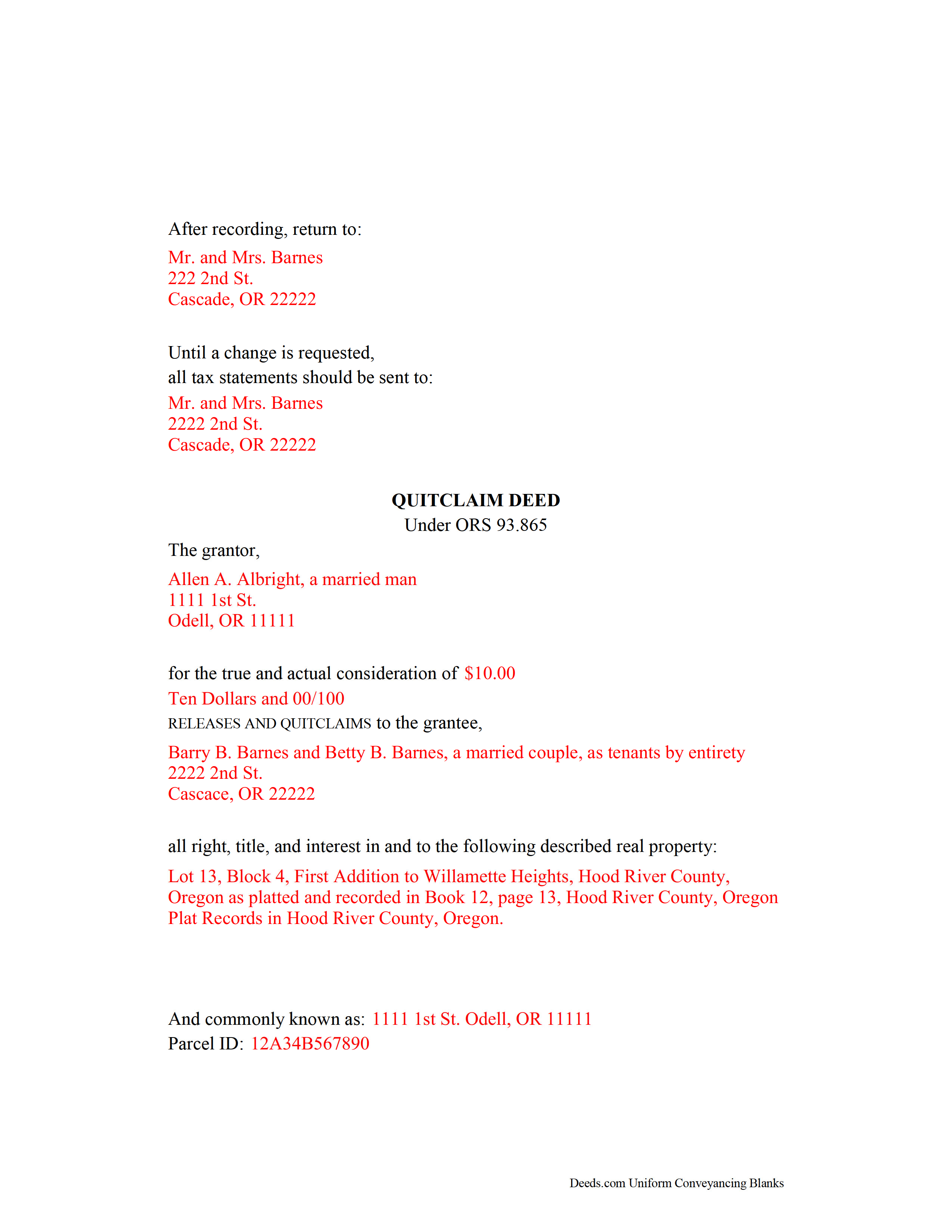

Marion County Completed Example of the Quitclaim Deed Document

Example of a properly completed Oregon Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion County Clerk

Salem, Oregon 97309

Hours: 8:30 to 5:00 M-F

Phone: (503) 588-5225

Recording Tips for Marion County:

- Ask if they accept credit cards - many offices are cash/check only

- Bring extra funds - fees can vary by document type and page count

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Aumsville

- Aurora

- Detroit

- Donald

- Gates

- Gervais

- Hubbard

- Idanha

- Jefferson

- Keizer

- Mehama

- Mount Angel

- Saint Benedict

- Saint Paul

- Salem

- Scotts Mills

- Silverton

- Stayton

- Sublimity

- Turner

- Woodburn

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (503) 588-5225 for current fees.

Questions answered? Let's get started!

In Oregon, title to real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory in Oregon under ORS 93.865, and they convey real property in fee simple with no warranties of title. This type of deed only conveys the interest the grantor has at the time the deed is executed, and it does not guarantee that the grantor has good title or right to the property.

In Oregon, a lawful quitclaim deed includes the grantor's full name, mailing address, and marital status; the true consideration paid for the transfer (ORS 93.030); and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Oregon residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more unmarried persons is presumed to create a tenancy in common. A conveyance to a married couple creates a tenancy by entirety. Joint tenancy is abolished unless the conveyance is to trustees or personal representatives (ORS 93.180).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary.

Deeds affecting property in Washington County are subject to a local transfer tax (Chapter 3.04, Washington County Code). If an exemption to the transfer tax applies, the proper application form must be submitted. Forms are available through Washington County's department of assessment and taxation.

Record the original completed deed, along with any additional materials, at the clerk's office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an Oregon lawyer with any questions related to the transfer of real property.

(Oregon QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4575 Reviews )

Judy F.

May 27th, 2022

The site was easy to use, I just wasn't sure which of all these documents I needed.

Thank you!

Mary S.

January 25th, 2019

I am so excited to find this site. Thank you

Thank you Mary. We appreciate your enthusiasm, have a great day!

Nicholas F.

February 26th, 2020

Thankyou for your easy to use website and prompt service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jay R.

December 1st, 2020

First time user. Great service, a little costly though

Thank you!

Norman K.

August 13th, 2021

Easy to use, would like to convert to a Word doc though

Thank you!

SheRon F.

March 21st, 2022

It was a quick and easy process and deeds.com was very helpful and dealt with a very stressful situation, painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine K.

March 26th, 2021

This site was fast and easy to use. I would highly recommend using them. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linley S.

April 22nd, 2020

This website is extremely easy to use and provides exactly what is needed to record things. I am very appreciative of this service, especially when I can't get to the court right now due to them being closed due to COVID-19 right now. Thank you!

Thank you Linley, glad we are able to help.

Richard R.

June 28th, 2022

Kind of expensive for a 3 page item...but I received it pronto and it will fill the bill.

Thank you!

BARRY D.

March 24th, 2024

Could not have been easier. Instructions were clear. Guidelines and example were clearly written. Erecording worked fast and let me skip a dreaded trip downtown to be ignored by government employees who hate their jobs.

Thank you for your positive words! We’re thrilled to hear about your experience.

JIM H.

July 21st, 2022

Excellent service Always find the documents in minutes. Supporting docs is a super plus!

Thank you!

Helen L.

February 1st, 2023

The website was easy to navigate but only needed one form. The guide was helpful also. Cost want high but contains many documents that I didn't need but may someday. Could not save form after completed but printed copies that needed to be court filed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dwayne H.

November 3rd, 2020

The Oregon TODD transfer on death deed template worked great and was easy to use. They had instructions and a guide that had good pointers to filling everything out. It took about 2 weeks to mail in my filled TODD and receive it back from the county with their stamp. Would definitely use this service for other documents

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fernando C.

April 13th, 2019

I was able to get what I needed!! Easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

dorothy f.

March 27th, 2019

Thank you, for help.

Anytime Dorothy, have a great day.