Wheeler County Transfer on Death Affidavit of Survivorship Form (Oregon)

All Wheeler County specific forms and documents listed below are included in your immediate download package:

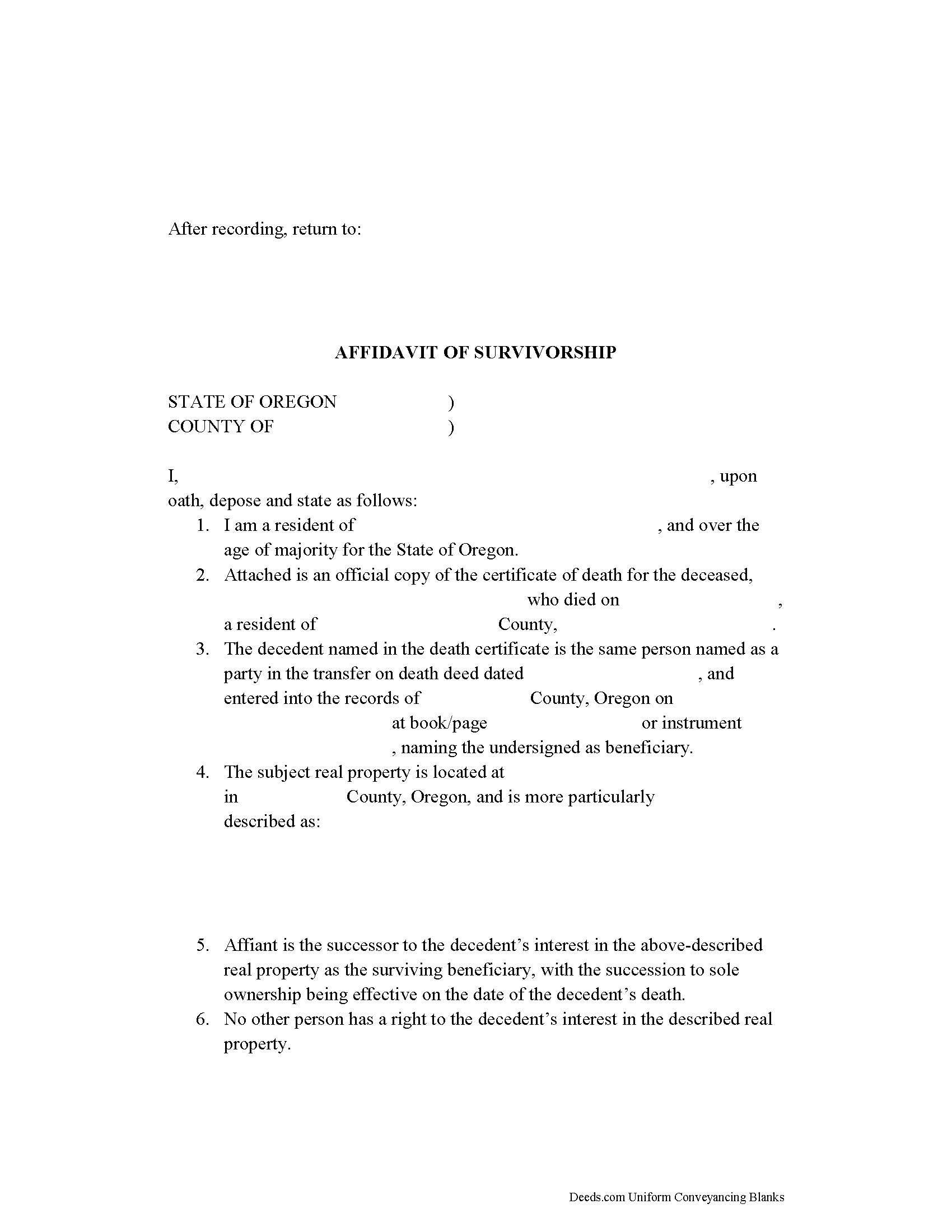

Transfer on Death Affidavit of Survivorship Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wheeler County compliant document last validated/updated 6/6/2024

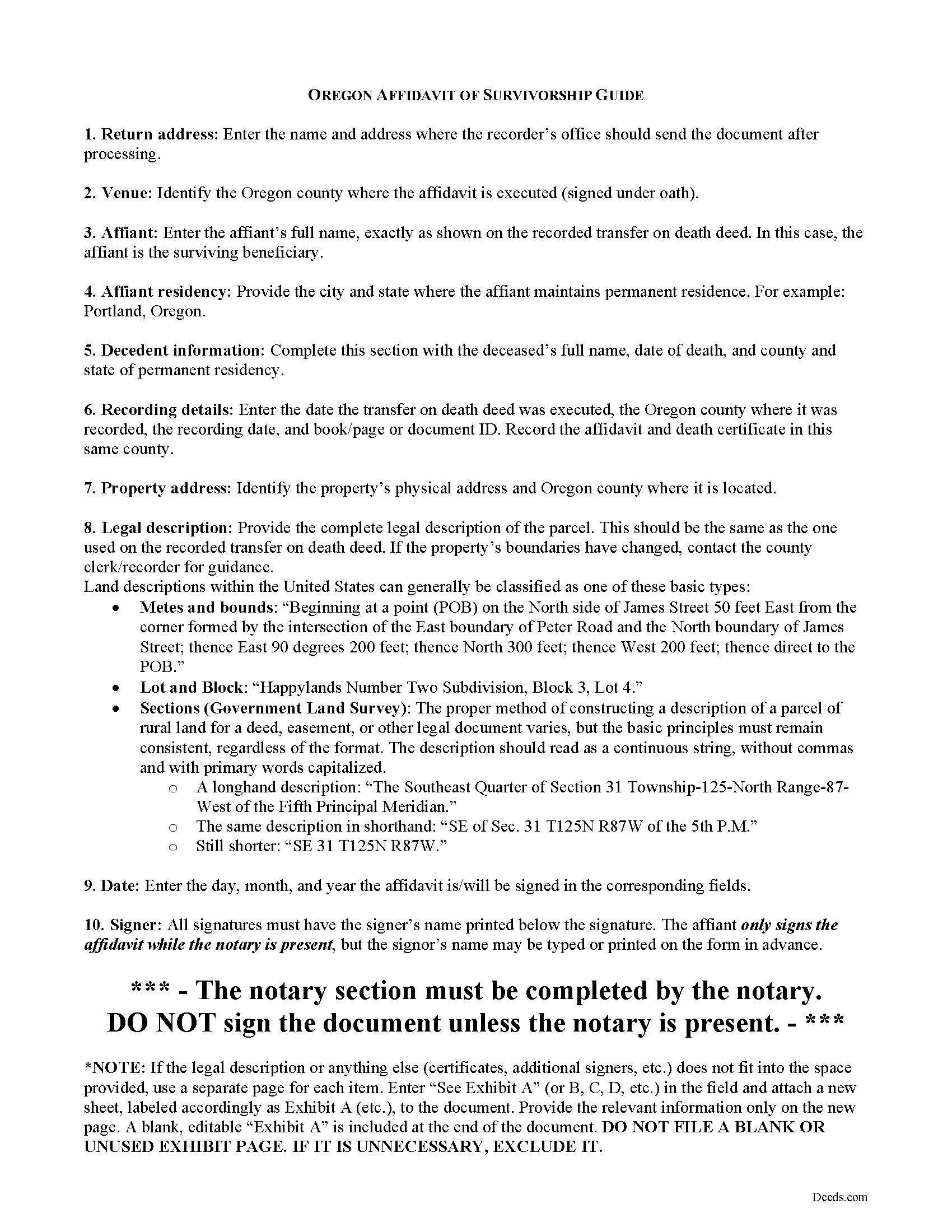

Transfer on Death Affidavit of Survivorship Guide

Line by line guide explaining every blank on the form.

Included Wheeler County compliant document last validated/updated 1/3/2024

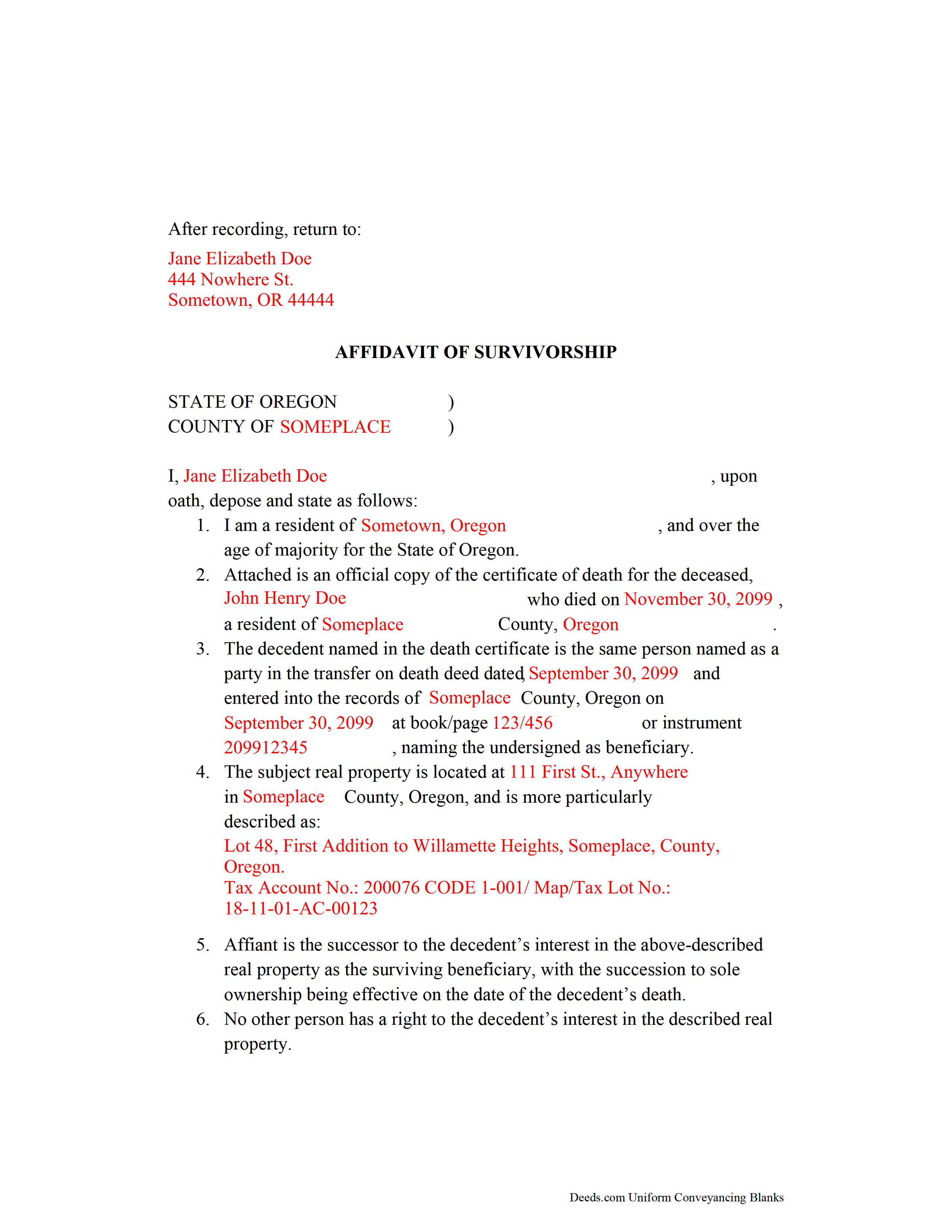

Completed Example of the Transfer on Death Affidavit of Survivorship Document

Example of a properly completed form for reference.

Included Wheeler County compliant document last validated/updated 6/3/2024

The following Oregon and Wheeler County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Affidavit of Survivorship forms, the subject real estate must be physically located in Wheeler County. The executed documents should then be recorded in the following office:

Wheeler County Clerk

701 Adams St, Rm 204 / PO Box 327, Fossil, Oregon 97830

Hours: M-F 8am - 12pm & 1pm - 4pm

Phone: (503) 763-2400, 763-2374, 763-2373

Local jurisdictions located in Wheeler County include:

- Fossil

- Mitchell

- Spray

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wheeler County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wheeler County using our eRecording service.

Are these forms guaranteed to be recordable in Wheeler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wheeler County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Affidavit of Survivorship forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wheeler County that you need to transfer you would only need to order our forms once for all of your properties in Wheeler County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Wheeler County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wheeler County Transfer on Death Affidavit of Survivorship forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Completing the Transfer from an Oregon Transfer on Death Deed

The Uniform Real Property Transfer on Death Act was integrated into Oregon's laws at ORS 93.948-93.979 (2011). When applied correctly, owners of real property in Oregon can, while still alive, use transfer on death deeds to direct and modify what happens to their land when they die.

The statutes contain forms and specific instructions for the landowners, but provide very little information for the surviving beneficiaries. According to 93.969(1)(a)(A), when the transferor/owner dies, his/her interest in the property transfers "to the designated beneficiary in accordance with the deed if the designated beneficiary survives the transferor." There is, however, scant additional guidance for the beneficiary who wishes to officially initiate the transfer.

While there are no specific statutory steps, one way for the surviving beneficiary to formalize the conveyance is by executing and recording an affidavit of survivorship. This document, when accompanied by a certified copy of the deceased owner's death certificate, provides official notice of the change in ownership.

Land ownership comes with duties and obligations. Sometimes the named beneficiaries are unable or unwilling to meet those responsibilities. In those cases, the beneficiary may opt out of the transfer by disclaiming all or part of his/her interest as provided in 105.623 ( 93.971).

A "beneficiary takes the property subject to all conveyances, encumbrances . . . and other interests to which the property is subject at the transferor's death" ( 93.969(2)). In addition, land conveyed using a "transfer on death deed transfers property without covenant or warranty of title even if the deed contains a contrary provision" ( 93.969(4)). The beneficiary must also be aware that, for the first 18 months following the owner's death, there might be liability for creditor claims from the transferor's estate. See 93.973.

Maintaining current ownership information is important for numerous reasons. For example, if the local property taxes are unpaid, the delinquency could lead to fines, penalties, and possibly even sale of the property to cover the lost revenue and collection expenses. Another motivating factor is the benefit of preserving a clear chain of title. The chain of title, or ownership history for a specific parcel of real estate, should show an unbroken sequence from one owner to the next, with no gaps in time, reversals, or other details out of sequence. Recording the affidavit of survivorship keeps the series of owners intact, and the resulting continuity will allow a future purchaser to obtain title insurance more easily.

(Oregon TOD Affidavit of Survivorship Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wheeler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wheeler County Transfer on Death Affidavit of Survivorship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4363 Reviews )

AARON D.

July 26th, 2024

Forms were great ! Cancelled my lawyer's appointment & utilized your forms.rn

We are grateful for your feedback and looking forward to serving you again. Thank you!

Anne H.

July 25th, 2024

After some initial general confusion -- (we sold a small piece of land privately and therefore do not typically prepare such documentation (!)) -- we were able to purchase and download all forms from Deeds.com and understand how to complete it/them. The help is all there, we just needed to read and study it - the "Example" helped alot. We were able to complete the Document per your online form(s) and then take it to be signed/notarized - and take the completed paper document to the Registry -- and it is now all registered and we are All Set. rn Took the morning (only). THANK YOU. A wonderful tool!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Meredith B.

January 5th, 2021

Clean and easy process. Super attentive and helpful.

Thank you!

Duane L.

September 5th, 2020

Easy to use with very helpful directions.

Thank you!

Kevin C.

August 22nd, 2021

Easy to use but the quit claim deep looked old and dated. The example of how to fill out should have asterisks stating what is need and what can be skipped

Thank you for your feedback. We really appreciate it. Have a great day!

Willie T.

March 8th, 2019

Great

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret D.

October 7th, 2020

They deliver!

Thank you!

Marilyn T.

June 30th, 2020

This is an extremely user friendly site! I had been searching the internet for days for the proper Gift Deed document. I had no idea that my state, the great state of Mississippi had their own site. I am truly looking forward to using this site for additional available documents. Many more blessings to the creator of this site! Keep them coming!

Thank You!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

September 28th, 2021

Excellent service. Unbelievably rapid and detailed responses. Was not happy to have to pay the fee but totally worth it.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT H.

January 11th, 2019

No review provided.

Thank you!

Debora E.

August 19th, 2020

I was amazed! This company is so incredibly fast! They promised 10 minutes, it was actually less and I had the exact info I was needing! Definitely worth the cost!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rodney S.

October 7th, 2021

Good service; thank you.

Thank you!

Joseph B.

March 30th, 2021

Awesome!

Thank you!

Gina G.

April 17th, 2024

This service is fantastic! Took a few tries to scan the document correctly, but their patience and quick turn around made this a far better experience than going to the County myself.

We are delighted to have been of service. Thank you for the positive review!