Lawrence County Unconditional Lien Waiver on Final Payment Form

Lawrence County Unconditional Lien Waiver on Final Payment Form

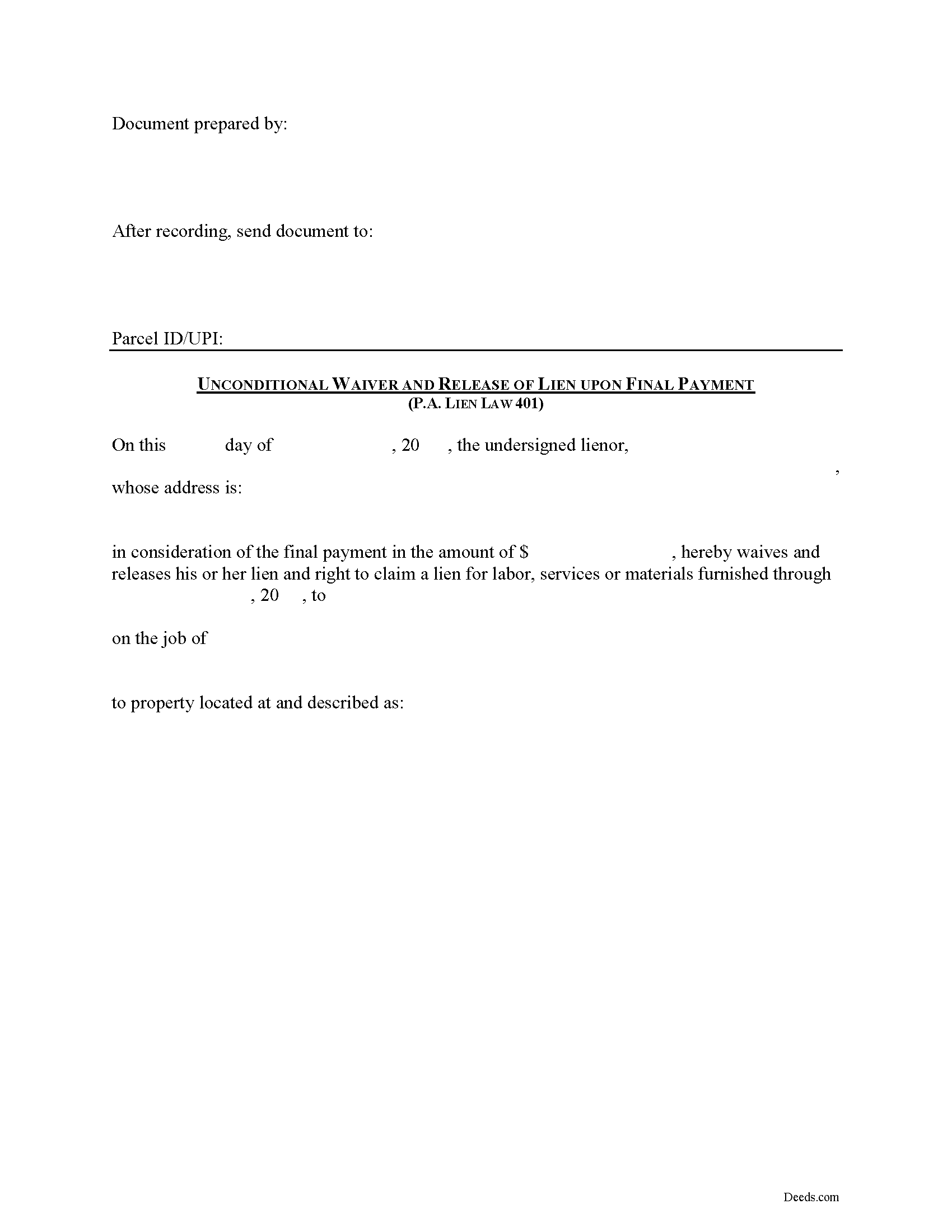

Fill in the blank Unconditional Lien Waiver on Final Payment form formatted to comply with all Pennsylvania recording and content requirements.

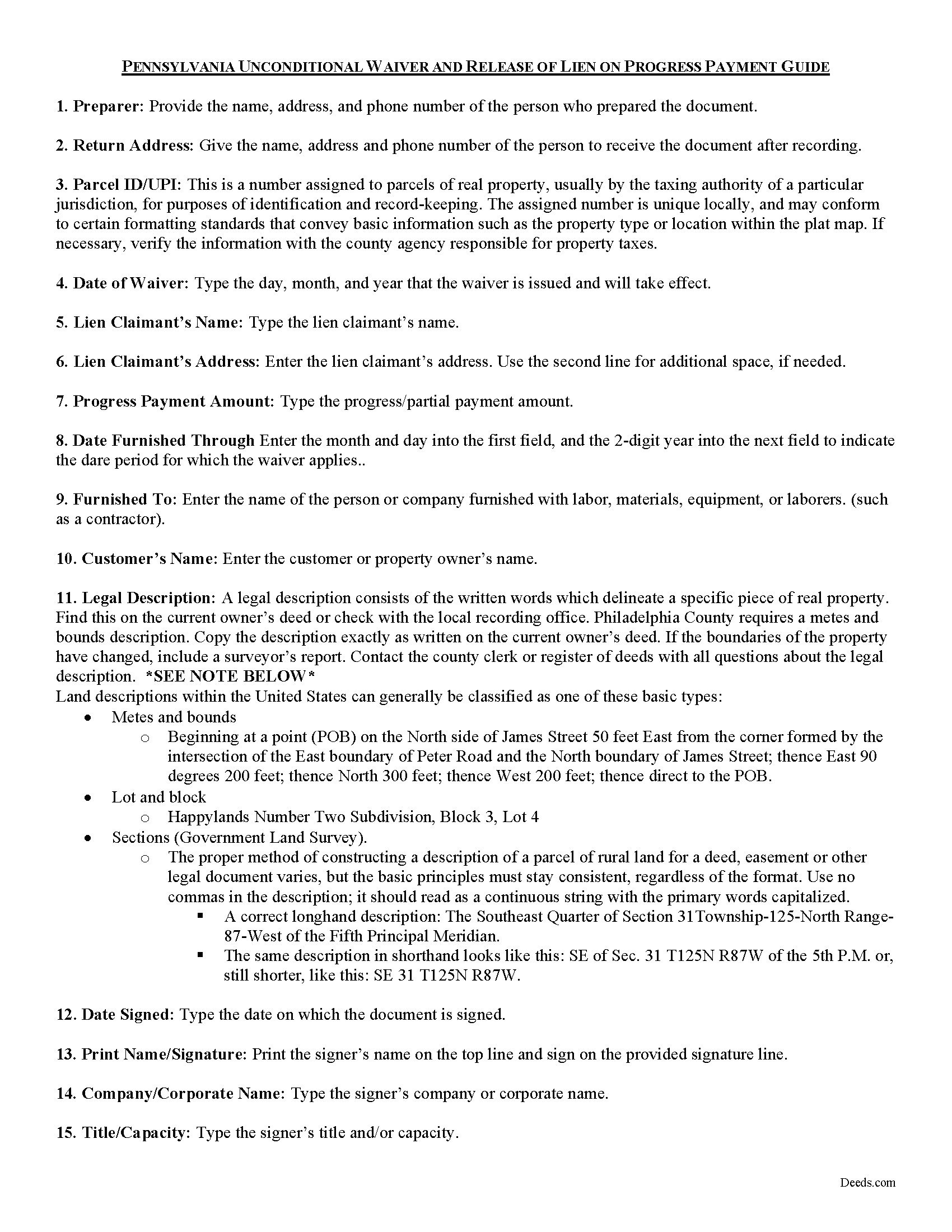

Lawrence County Unconditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the Unconditional Lien Waiver on Final Payment form.

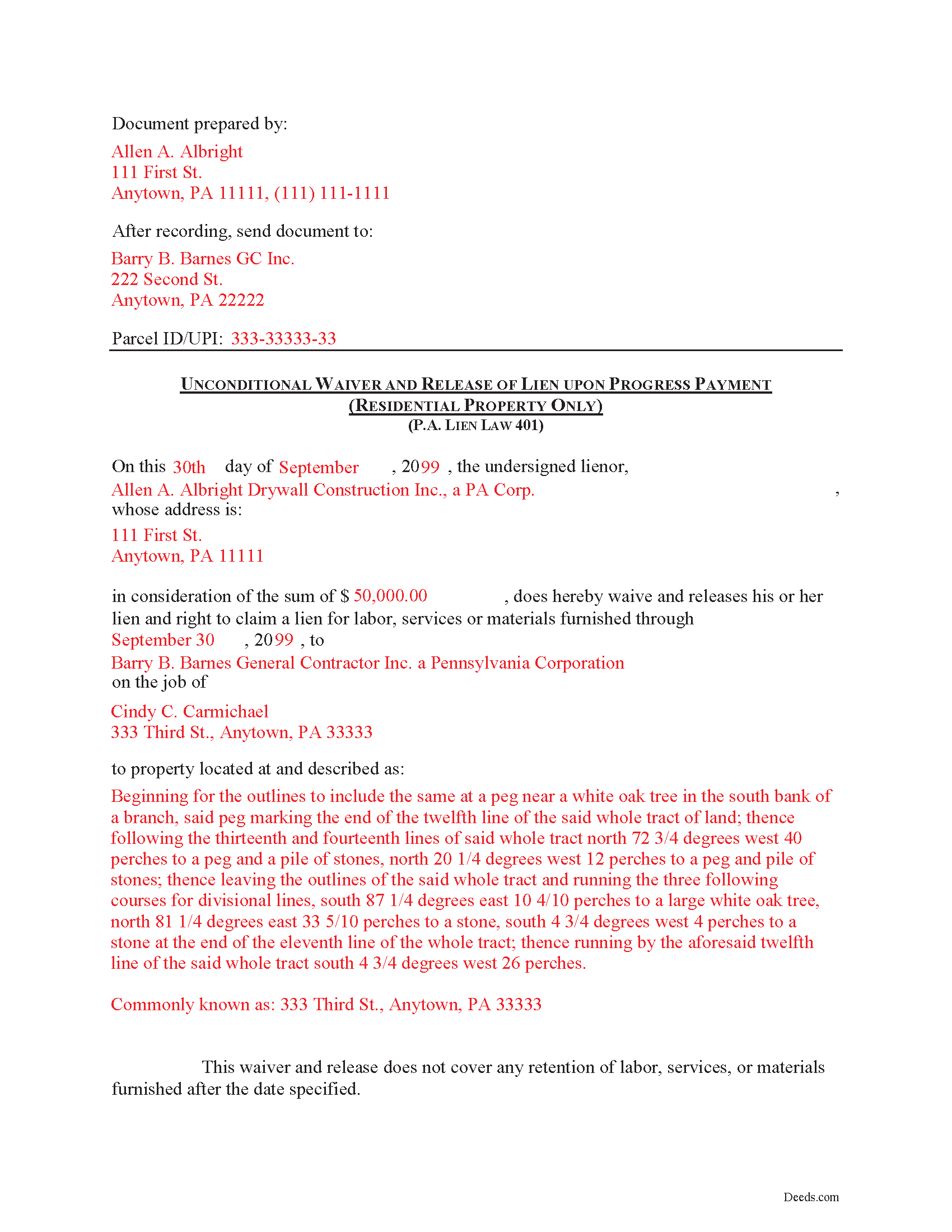

Lawrence County Completed Example of the Unconditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Lawrence County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds - County Government Center

New Castle, Pennsylvania 16101

Hours: 8:00am to 3:45pm M-F

Phone: (724) 656-2131

Recording Tips for Lawrence County:

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Lawrence County

Properties in any of these areas use Lawrence County forms:

- Bessemer

- Edinburg

- Ellwood City

- Enon Valley

- Hillsville

- New Bedford

- New Castle

- New Wilmington

- Pulaski

- Villa Maria

- Volant

- Wampum

- West Pittsburg

Hours, fees, requirements, and more for Lawrence County

How do I get my forms?

Forms are available for immediate download after payment. The Lawrence County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lawrence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lawrence County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lawrence County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lawrence County?

Recording fees in Lawrence County vary. Contact the recorder's office at (724) 656-2131 for current fees.

Questions answered? Let's get started!

In Pennsylvania, a contractor or subcontractor may waive his right to file a claim against residential property by a written instrument signed by him or by any conduct which operates equitably to estop such contractor from filing a claim. 49 P.S. 401(a).

Contractors use lien waivers to forfeit or give up their right to claim a mechanic's lien. Usually, the purpose of a waiver is to alleviate concerns by a property owner or other contractor that a lien will be levied on the property. In return for waiving lien rights, the owner or other party makes a full or partial payment. The type of waiver used depends on the type of payment made.

Use a conditional waiver when payment hasn't been made at the time of the waiver or the payment method takes time to clear (such as a check or bank draft). Unconditional waivers are appropriate when a full or final payment has been made and evidence of the payment can be verified. Within each of these two categories, waivers can be granted for a full payment or a partial (or progress) payment.

In regard to subcontractors, a waiver by a subcontractor of lien rights is against public policy, unlawful and void, unless given in consideration for payment for the work, services, materials or equipment provided and only to the extent that such payment is actually received, or unless the contractor has posted a bond guaranteeing payment for labor and materials provided by subcontractors. 49 P.S. 401(c).

Use the Unconditional Waiver and Release of Lien on Final Payment when a final payment is made for the amount due and in return for the payment, the contractor agrees to waive a lien right towards the final amount. Because the waiver is unconditional, it should only be used when the final payment has been made and after verification of such payment.

A valid waiver identifies the parties, the location where the work or improvement took place, relevant dates, and amounts paid. In addition, the form must meet state and local standards for recorded documents. Submit the completed waiver to the recording office for the county where the property is situated.

Mechanic's Liens are governed by Title 49 of the Pennsylvania Consolidated Statutes.

This article is offered for informational purposes only and is not legal advice. This information should not be relied upon as a substitute for speaking with an attorney. Please speak with a Pennsylvania attorney familiar with lien laws for questions regarding lien waivers or any other issues with mechanic's liens.

Important: Your property must be located in Lawrence County to use these forms. Documents should be recorded at the office below.

This Unconditional Lien Waiver on Final Payment meets all recording requirements specific to Lawrence County.

Our Promise

The documents you receive here will meet, or exceed, the Lawrence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lawrence County Unconditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

JORGE S.

August 22nd, 2019

Excelent! I cannot believe I found this company. Thanks!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Donna D.

March 20th, 2020

Easy to use. Good information. Would use again.

Thank you!

Eddy O.

August 20th, 2022

Your site was very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Shirley L.

April 19th, 2022

I am very happy with the results of my service received from Deeds.com. I found exactly what I needed in short order. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Angela D.

August 19th, 2020

The only problem I had was that it doesn't let you create a file for all documents to go into as one. Mahalo Angie

Thank you for your feedback. We really appreciate it. Have a great day!

Bobby W.

January 3rd, 2019

The site delivered just what it promised - I needed a specific deed formatted for a specific county/state, and they delivered it at a great price. One note for improvement - it is not intuitively obvious that I could go back and re-download if necessary and this caused me stress, but a follow up email alleviated this. Great service!

Thank you for the kind words Bobby, have a great day!

David K.

March 25th, 2019

Worked Great! First time go at the courthouse

Thank you!

Susan G.

February 17th, 2023

This is very helpful.

Thank you!

Geraldine B.

December 7th, 2019

Top notch real estate forms. Easy to use, printed out nice, and the guide and example are priceless. You're not going to find anything better anywhere.

Thank you for the kind words Geraldine! Have an incredible day!

Jan David F.

January 5th, 2019

Your data doesn't go deep enough in time to be useful to me. I needed deeds from 1911 to 1966.

Thank you for your feedback Jan. It does look like staff canceled your order after discussing your needs with you.

barbara s.

May 2nd, 2020

you provided the service requested for a reasonable fee

Thank you!

Rosalinda R.

January 4th, 2023

THESE FORMS ARE JUST WHAT I NEEDED, SHORT AND TO THE POINT. EXCELLENT QUESTIONS FOR MY NEED. THAK YOU!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

James C.

January 15th, 2021

Satisfactory. I was confused and somwhat lost on what to do and what I was getting.

Thank you!

Donna T.

April 23rd, 2020

Very clear instructions. All documents were easy to download and print.

Thank you for your feedback. We really appreciate it. Have a great day!