Aiken County Affidavit of Deceased Joint Tenant Form (South Carolina)

All Aiken County specific forms and documents listed below are included in your immediate download package:

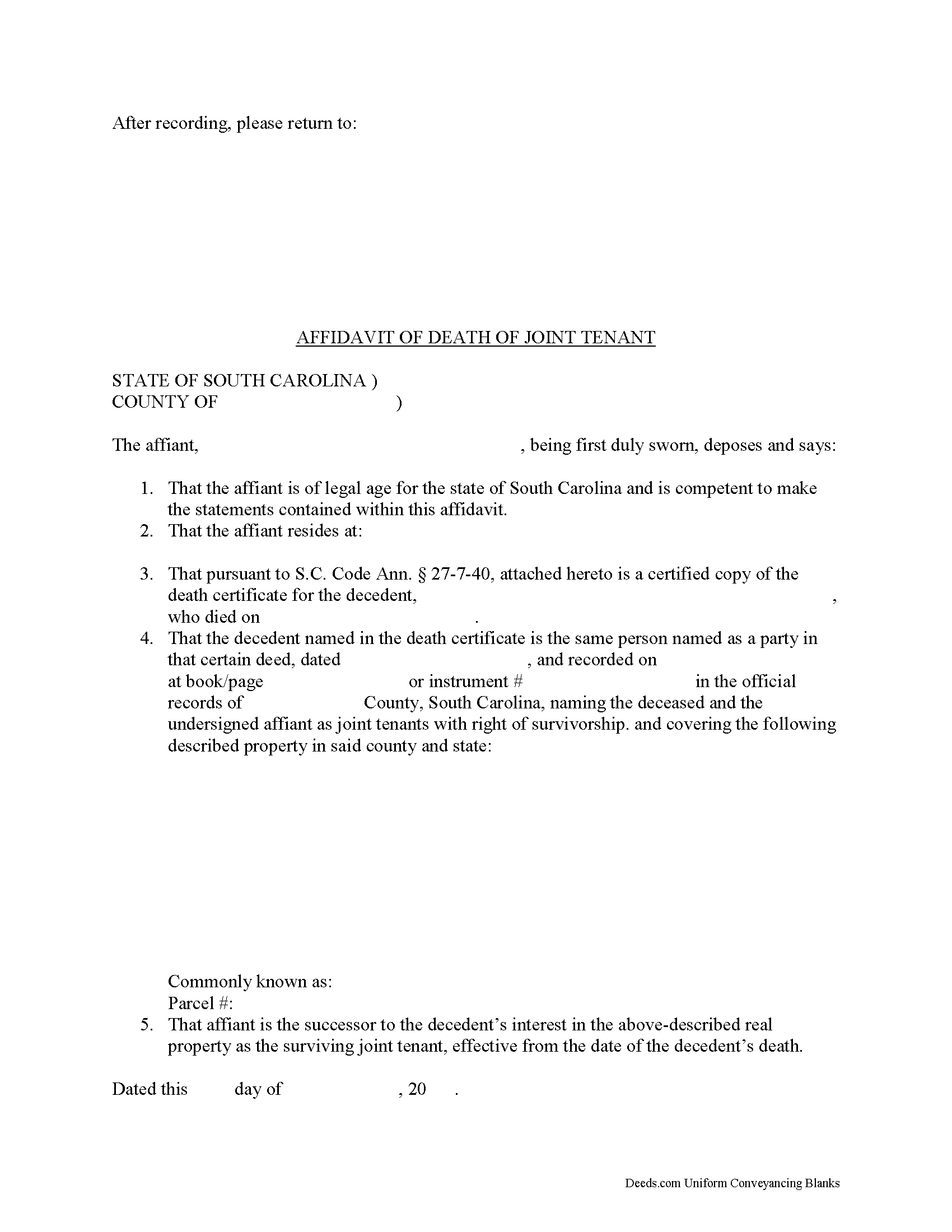

Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Aiken County compliant document last validated/updated 5/9/2025

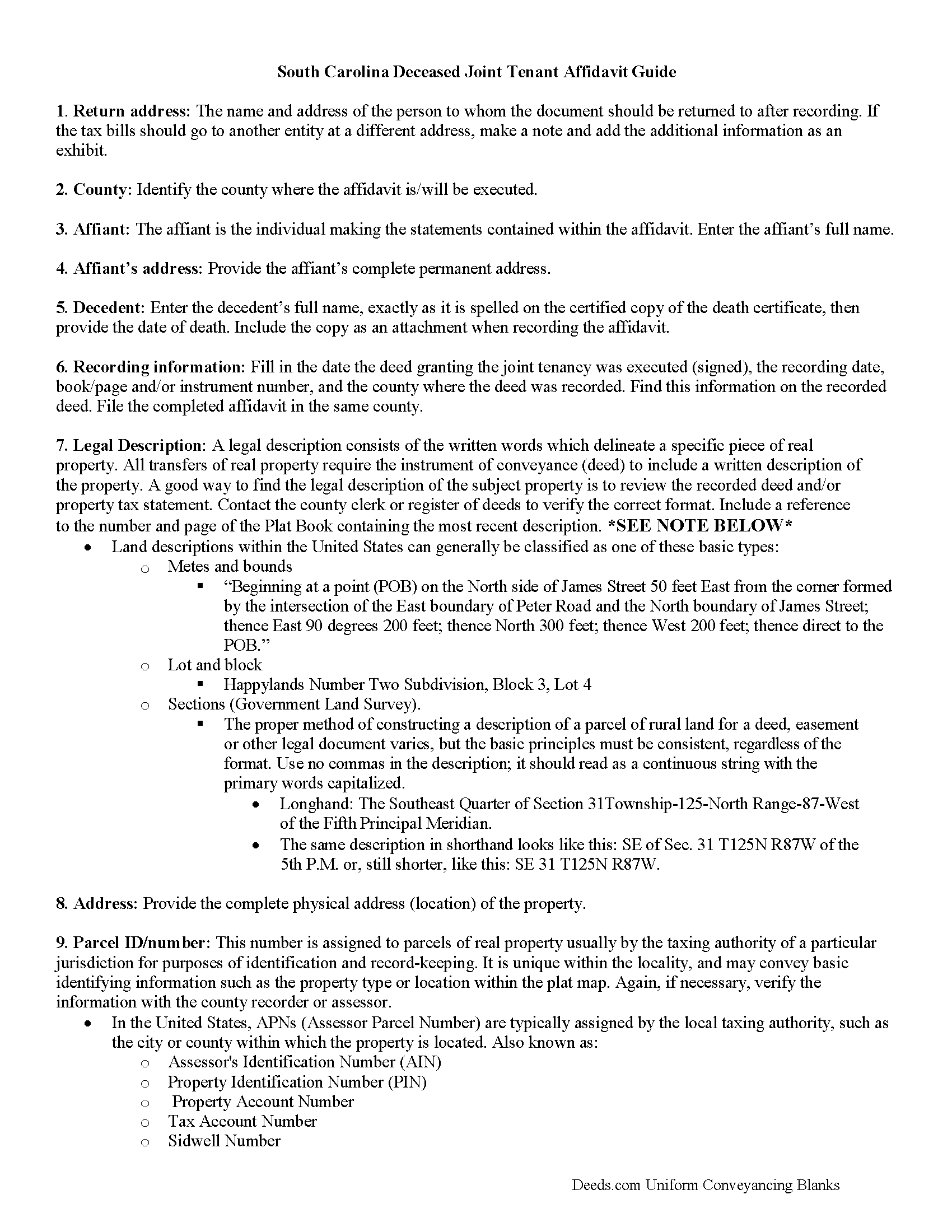

Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

Included Aiken County compliant document last validated/updated 5/20/2025

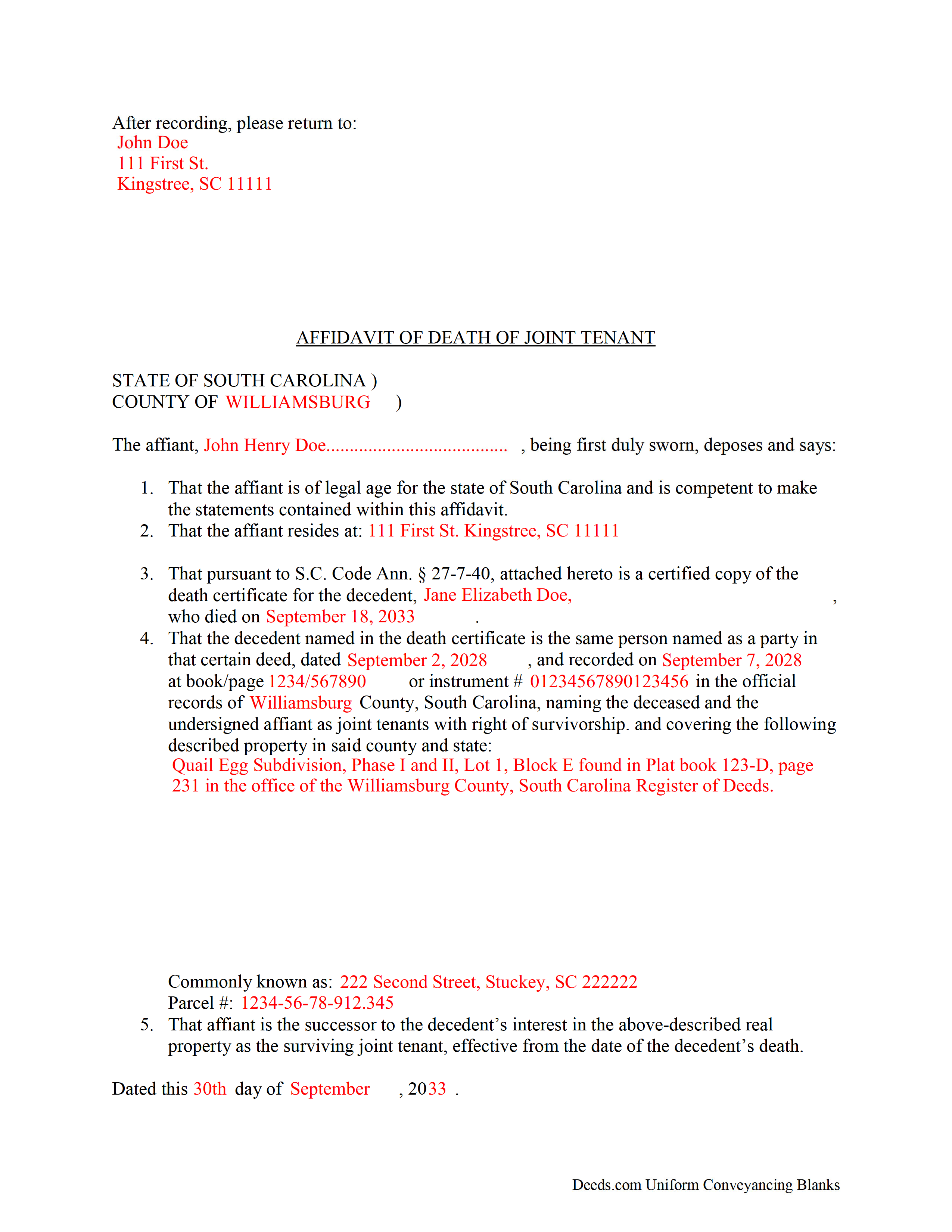

Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

Included Aiken County compliant document last validated/updated 4/30/2025

The following South Carolina and Aiken County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Deceased Joint Tenant forms, the subject real estate must be physically located in Aiken County. The executed documents should then be recorded in the following office:

Aiken County Registrar

Government Center - 1930 University Parkway, Suite 2100, Aiken, South Carolina 29801

Hours: 8:30am to 5:00pm Monday through Friday / Recording until 4:30pm

Phone: (803) 642-2072

Local jurisdictions located in Aiken County include:

- Aiken

- Bath

- Beech Island

- Clearwater

- Gloverville

- Graniteville

- Jackson

- Langley

- Monetta

- Montmorenci

- New Ellenton

- North Augusta

- Salley

- Vaucluse

- Wagener

- Warrenville

- Windsor

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Aiken County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Aiken County using our eRecording service.

Are these forms guaranteed to be recordable in Aiken County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Aiken County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Deceased Joint Tenant forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Aiken County that you need to transfer you would only need to order our forms once for all of your properties in Aiken County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by South Carolina or Aiken County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Aiken County Affidavit of Deceased Joint Tenant forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Joint tenancy in South Carolina is governed by S.C. Code Ann. 27-7-40.

When two or more people share ownership of real property, they have choice of ways in which to hold title -- either as tenants in common or as joint tenants with the right of survivorship.

Tenancy in common is the standard form of co-ownership. In it, each person owns a percentage of the land, and when the owner dies, that portion passes to his/her estate where it is distributed during the probate process.

Joint tenancy, on the other hand, must be declared in the text of the deed: "whenever any deed of conveyance of real estate contains the names of the grantees followed by the words 'as joint tenants with rights of survivorship, and not as tenants in common' the creation of a joint tenancy with rights of survivorship in the real estate is conclusively deemed to have been created" ( 27-7-40(a)).

The statutes go on to explain that in the "event of the death of a joint tenant, and in the event only one other joint tenant in the joint tenancy survives, the entire interest of the deceased joint tenant in the real estate vests in the surviving joint tenant, who is vested with the entire interest in the real estate owned by the joint tenants" ( 27-7-40(a)(i)).

If one or more joint tenant survives the deceased owner, "the entire interest of the deceased joint tenant vests equally in the surviving joint tenants who continues to own the entire interest owned by them as joint tenants with right of survivorship" ( 27-7-40(a)(ii)).

So, how does the survivorship process work? The statutes direct the surviving joint tenant or tenants to file with the Register of Deeds of the county in which the real estate is located a certified copy of the certificate of death of the deceased joint tenant. The fee to be paid to the Register of Deeds for this filing is the same as the fee for the deed of conveyance. The Register of Deeds must index the certificate of death under the name of the deceased joint tenant in the grantor deed index of that office. The filing of the certificate of death is conclusive that the joint tenant is deceased and that the interest of the deceased joint tenant has vested by operation of law in the surviving joint tenant or tenants in the joint tenancy in real estate" ( 27-7-40(b)).

While there is no specific statutory obligation to submit the certified copy of the death certificate with an affidavit attesting to the details of the change in ownership status, it makes sense to do so. An affidavit contains statements, made under oath, which can be admitted as evidence in court. By recording an affidavit of deceased joint tenant along with the death certificate, the surviving owner(s) protect the title to the real estate. Maintaining a clear chain of title leads to less complicated sales in the future because the title search will show a continuous series of owners and transfers, which reduces the likelihood of unexpected claims against the title.

Even though recording the affidavit of deceased joint tenant and the official copy of the death certificate initiates the process of distributing the decedent's share of the real property, the only way to remove his/her name from the title is to record a new deed with the updated information.

(South Carolina AODJT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Aiken County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Aiken County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Susan K.

July 13th, 2021

They were unable to complete the task and my money was immediately refunded.

Thank you for your feedback Susan, sorry we were unable to assist.

Lisa D.

February 21st, 2019

It was an easy site to use and very a good price. Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John B.

January 23rd, 2019

Forms are as advertised and easy to access.

Thank you for your feedback. We really appreciate it. Have a great day!

william h.

September 26th, 2022

got what I needed.

Thank you!

Roberta M.

February 21st, 2022

I found a lot of useful information regarding the Lady Bird Deed and feel it will serve my needs as opposed to a Revocable

Living

Trust. The information was easy to understand and very helpful. The forms seem easy to complete and I plan to get them notarized and filed at the courthouse very soon.

Thank you for your feedback. We really appreciate it. Have a great day!

Anna S.

July 17th, 2020

You guys are awesome, The service, expertise and quick communication were amazing. I think you guys are charging to little, but you didn't hear that from me. Thank you for making this process quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Niranjan C.

August 24th, 2021

Whole process was very easy and quick. Forms were easy to fill, examples were quite appropriate. Recommended.

Thank you!

Elizabeth M.

August 18th, 2021

So fare easy and straight forward

Thank you for your feedback. We really appreciate it. Have a great day!

Amy L B.

March 12th, 2025

easy to download forms and help is there if you need it!

Thank you, Amy! We appreciate your kind words and are glad you found the forms easy to download. Our team is always here if you ever need assistance. Thanks for choosing us!

Celeste G.

January 23rd, 2019

Very helpful!!! Thanks again.

Thank you Celeste.

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!

Karen L.

October 3rd, 2022

Good service could give a little more detail on where to location some of the information needed. Overall fairly simply to use.

Thank you for your feedback. We really appreciate it. Have a great day!