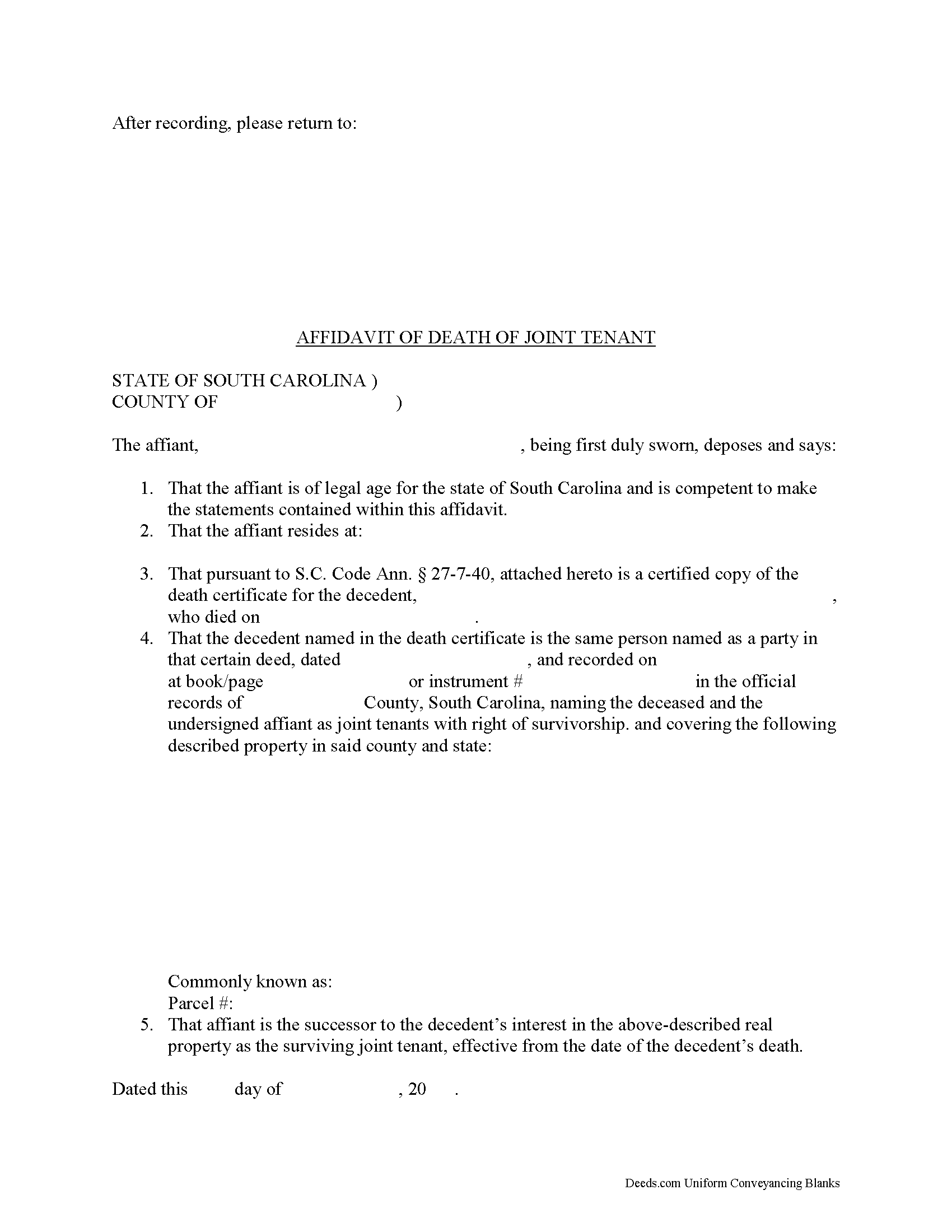

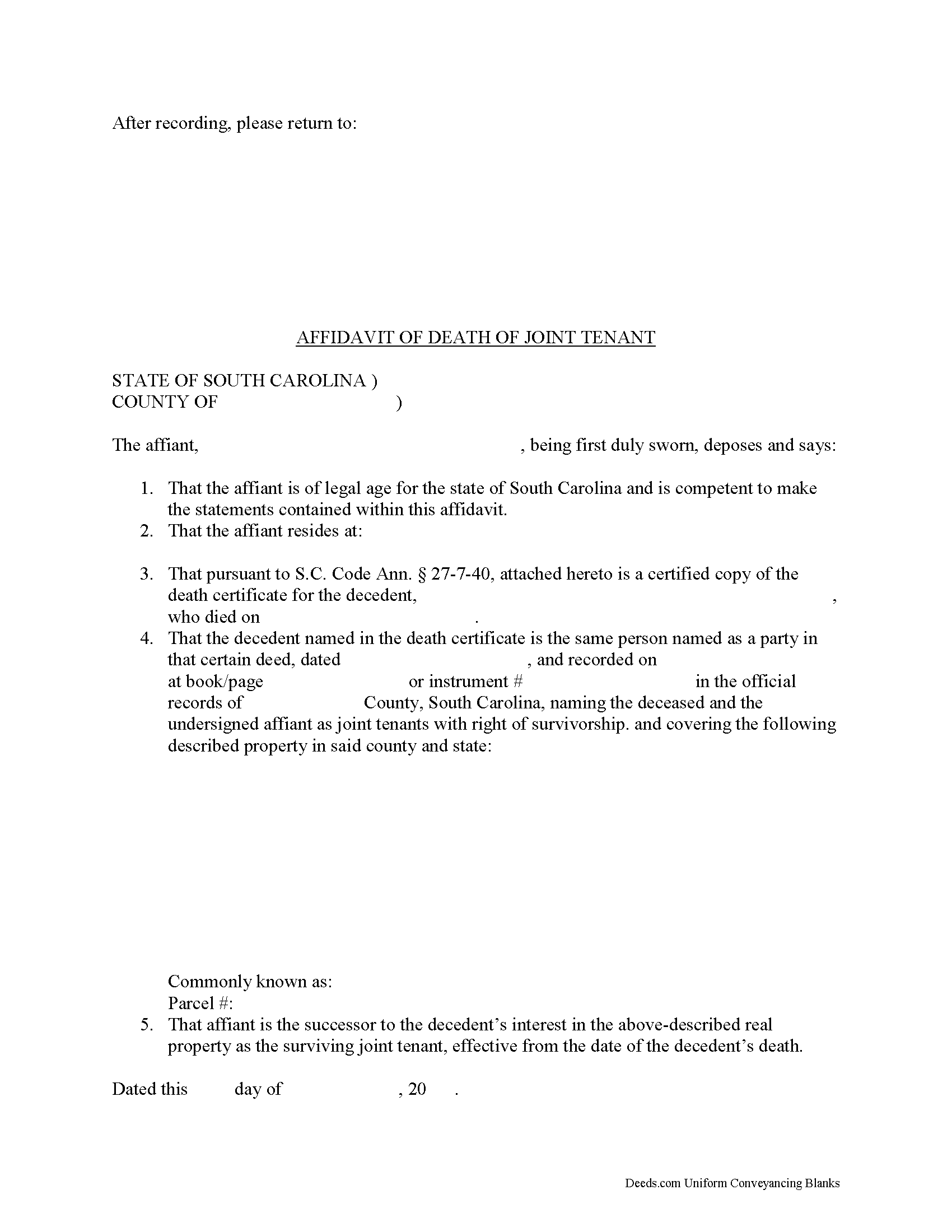

Download South Carolina Affidavit of Deceased Joint Tenant Legal Forms

South Carolina Affidavit of Deceased Joint Tenant Overview

Joint tenancy in South Carolina is governed by S.C. Code Ann. 27-7-40.

When two or more people share ownership of real property, they have choice of ways in which to hold title -- either as tenants in common or as joint tenants with the right of survivorship.

Tenancy in common is the standard form of co-ownership. In it, each person owns a percentage of the land, and when the owner dies, that portion passes to his/her estate where it is distributed during the probate process.

Joint tenancy, on the other hand, must be declared in the text of the deed: "whenever any deed of conveyance of real estate contains the names of the grantees followed by the words 'as joint tenants with rights of survivorship, and not as tenants in common' the creation of a joint tenancy with rights of survivorship in the real estate is conclusively deemed to have been created" ( 27-7-40(a)).

The statutes go on to explain that in the "event of the death of a joint tenant, and in the event only one other joint tenant in the joint tenancy survives, the entire interest of the deceased joint tenant in the real estate vests in the surviving joint tenant, who is vested with the entire interest in the real estate owned by the joint tenants" ( 27-7-40(a)(i)).

If one or more joint tenant survives the deceased owner, "the entire interest of the deceased joint tenant vests equally in the surviving joint tenants who continues to own the entire interest owned by them as joint tenants with right of survivorship" ( 27-7-40(a)(ii)).

So, how does the survivorship process work? The statutes direct the surviving joint tenant or tenants to file with the Register of Deeds of the county in which the real estate is located a certified copy of the certificate of death of the deceased joint tenant. The fee to be paid to the Register of Deeds for this filing is the same as the fee for the deed of conveyance. The Register of Deeds must index the certificate of death under the name of the deceased joint tenant in the grantor deed index of that office. The filing of the certificate of death is conclusive that the joint tenant is deceased and that the interest of the deceased joint tenant has vested by operation of law in the surviving joint tenant or tenants in the joint tenancy in real estate" ( 27-7-40(b)).

While there is no specific statutory obligation to submit the certified copy of the death certificate with an affidavit attesting to the details of the change in ownership status, it makes sense to do so. An affidavit contains statements, made under oath, which can be admitted as evidence in court. By recording an affidavit of deceased joint tenant along with the death certificate, the surviving owner(s) protect the title to the real estate. Maintaining a clear chain of title leads to less complicated sales in the future because the title search will show a continuous series of owners and transfers, which reduces the likelihood of unexpected claims against the title.

Even though recording the affidavit of deceased joint tenant and the official copy of the death certificate initiates the process of distributing the decedent's share of the real property, the only way to remove his/her name from the title is to record a new deed with the updated information.

(South Carolina AODJT Package includes form, guidelines, and completed example)