Calhoun County Quitclaim Deed Form (South Carolina)

All Calhoun County specific forms and documents listed below are included in your immediate download package:

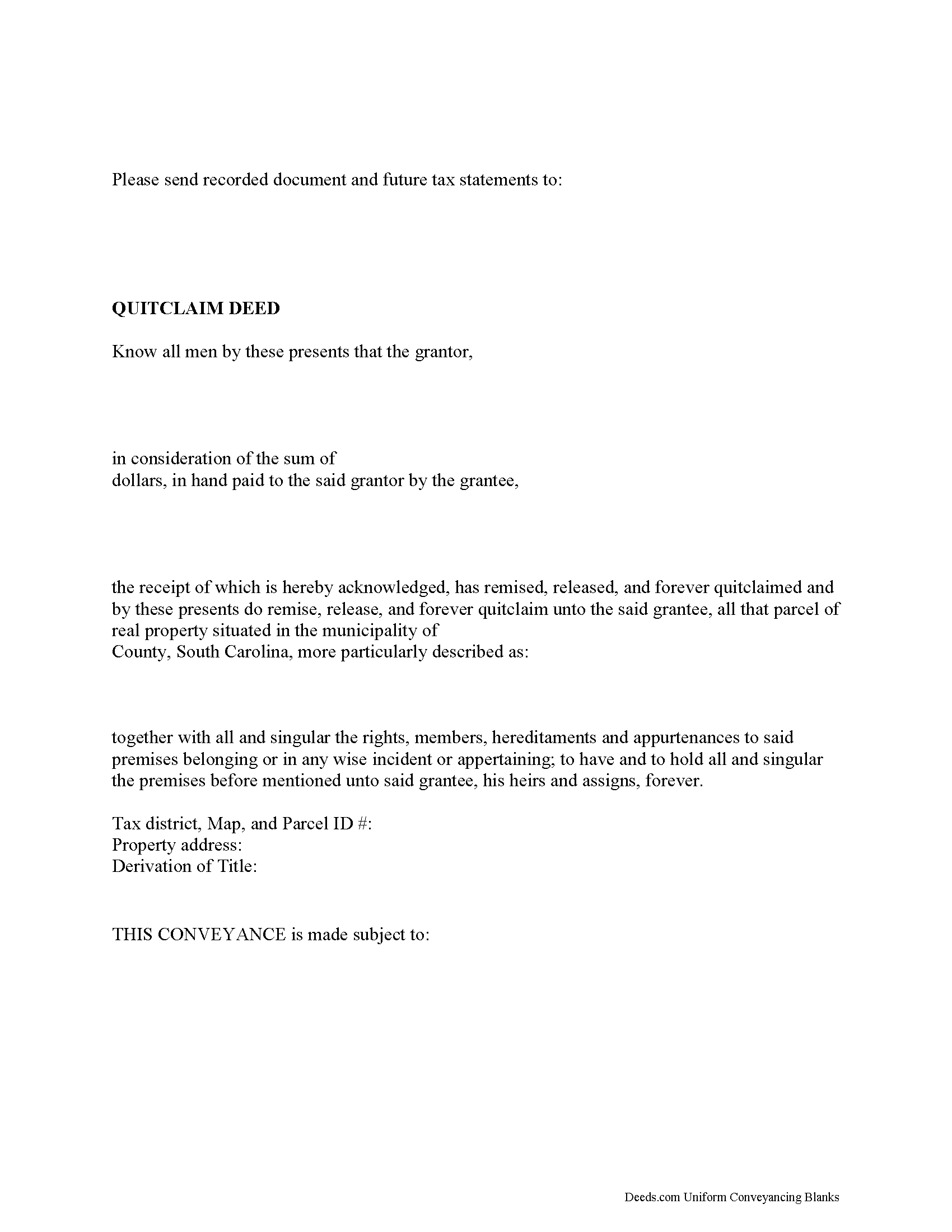

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all South Carolina recording and content requirements.

Included Calhoun County compliant document last validated/updated 3/26/2025

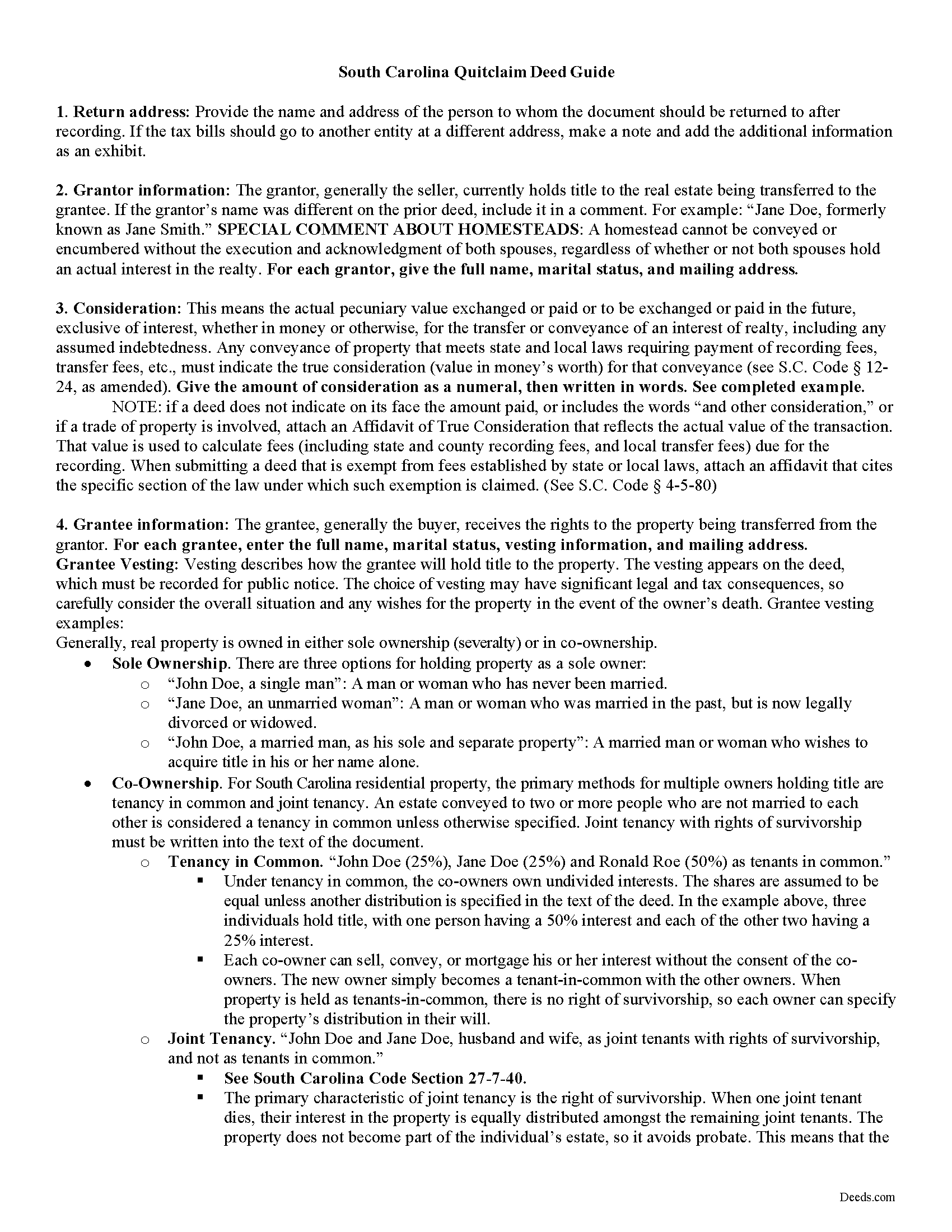

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Calhoun County compliant document last validated/updated 4/30/2025

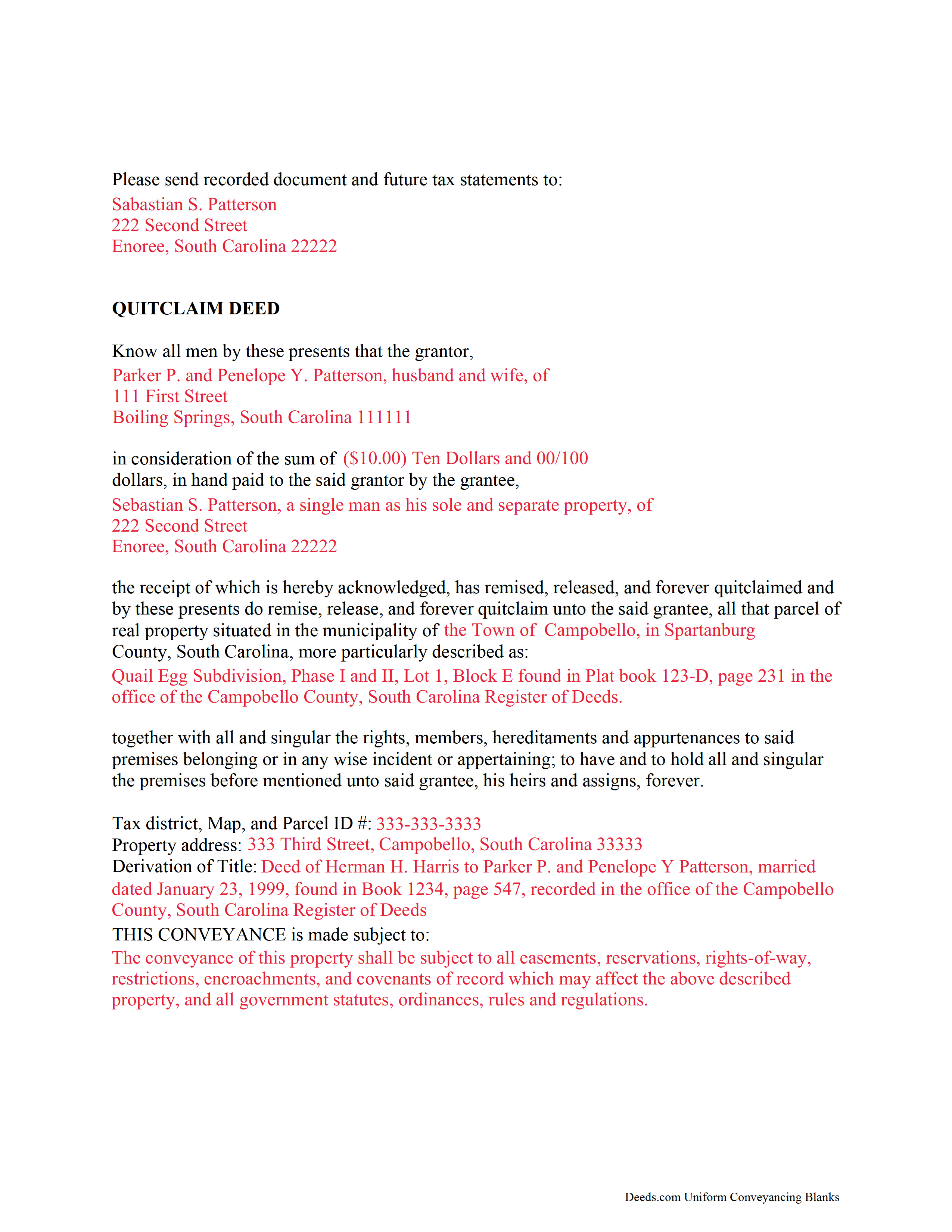

Completed Example of the Quitclaim Deed Document

Example of a properly completed South Carolina Quitclaim Deed document for reference.

Included Calhoun County compliant document last validated/updated 5/13/2025

The following South Carolina and Calhoun County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Calhoun County. The executed documents should then be recorded in the following office:

Calhoun County Clerk of Court

902 FR Huff Dr / PO Box 709, St. Matthews, South Carolina 29135

Hours: 9:00 to 5:00 M-F

Phone: 803-874-3524

Local jurisdictions located in Calhoun County include:

- Cameron

- Saint Matthews

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Calhoun County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Calhoun County using our eRecording service.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Calhoun County that you need to transfer you would only need to order our forms once for all of your properties in Calhoun County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by South Carolina or Calhoun County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Calhoun County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The grantor must sign the quitclaim deed in the presence of two credible witnesses. The quitclaim deed must also be subscribed by the two witnesses. The address of the grantee is needed in order to record this type of real estate document. The Registrar of Deeds does not require a derivation clause to be on a quitclaim deed in South Carolina. The Uniform Recognition of Acknowledgement Act must be complied with, the details of which are described in 30-5-30. For information on the content and format of a quitclaim deed, visit the county links listed under South Carolina.

A quitclaim deed of conveyance of lands is valid to subsequent creditors or purchasers for valuable consideration without notice, only after it is recorded in the office of the register of deeds in the county where the property is located. In the case of a subsequent purchaser of real estate (or a subsequent lien creditor on real estate) for valuable consideration without notice, the instrument evidencing the subsequent conveyance or lien must be filed for record in order for its holder to claim under section 30-7-10 of the South Carolina Code as a subsequent creditor or purchaser for value without notice, and the priority is determined by the time of filing for record.

(South Carolina QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Larry C.

July 7th, 2021

Very easy and convenient, thank you so much.

Thank you!

Robert B.

April 2nd, 2019

Excellent, easy to operate, saved $$$ by doing this TOD deed myself. WILL BUY AGAIN!!

Thank you Robert. Have a fantastic day!

James R.

August 10th, 2022

This site is a blessing in disguise-/>

Thank you!

Julie R.

December 16th, 2020

Seamless and prompt service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen Z.

April 22nd, 2019

Very simple. By creating the deed and filing it myself, I am saving a legal fee of $300!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina H.

April 15th, 2021

The process was straightforward, quick and reasonably priced.

The agents provided updates every step of the way.

Thank you!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Tonni L.

June 15th, 2021

Quick and easy with great instructions and accurate documents. I plan to make this site a part of our financial planning. Highly recommend. Saved big by this DIY process.

TL

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin V.

January 5th, 2022

Quick and trouble free experience!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael R.

April 11th, 2023

This process was so easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald C.

May 25th, 2019

Pros, quick purchase and document availability including instructions and examples.

Cons, For the cert. of trust, the form would not accept the length of our trust name with no way to get around. The pdf file printing did not meet the requirements for 2.5" top margin and .5" other margins as well as the 10pt font size as the form information was shrunk down even when normal printing.

Thank you for your feedback. We really appreciate it. Have a great day!

Tami C.

May 11th, 2021

Excellent service, easy to follow instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!