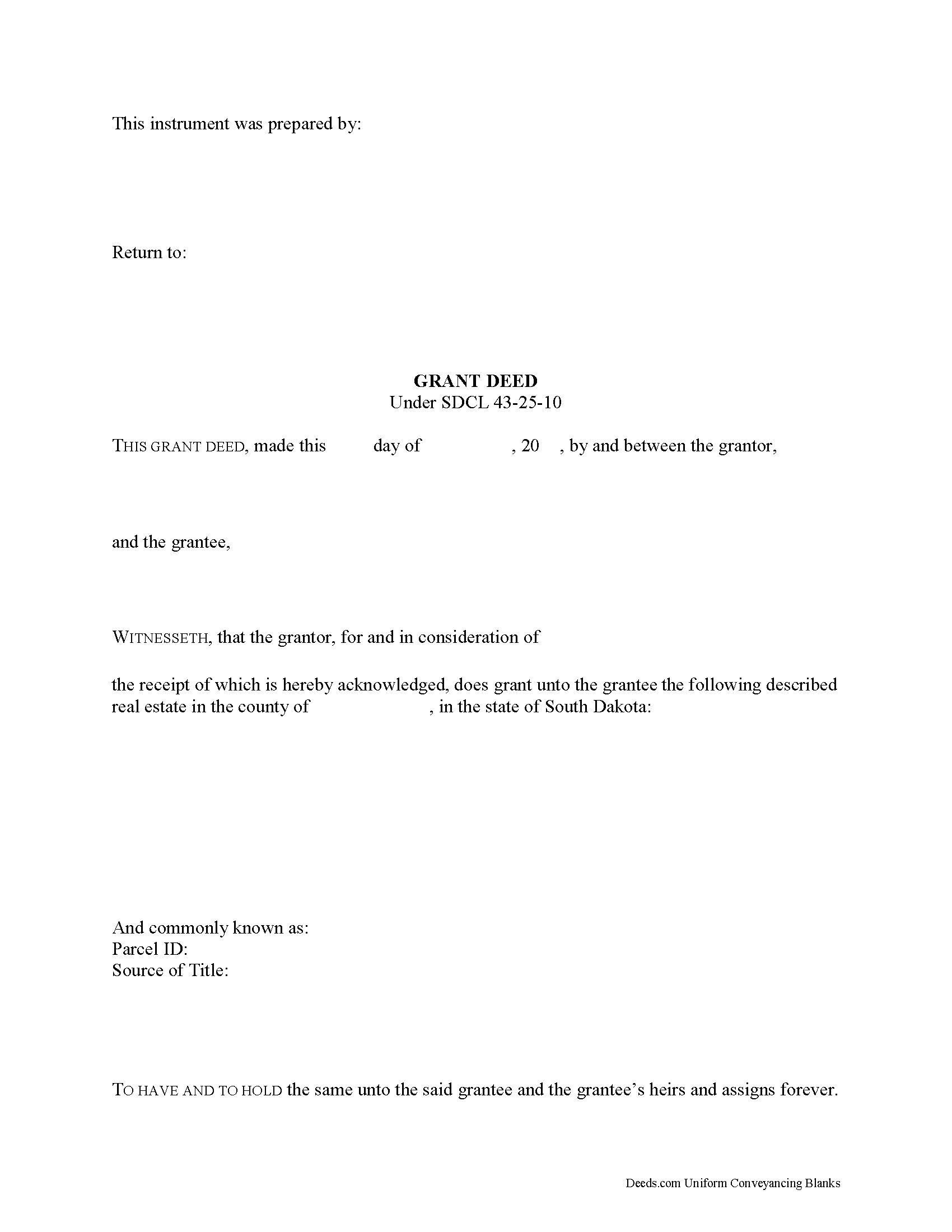

Gregory County Grant Deed Form

Gregory County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

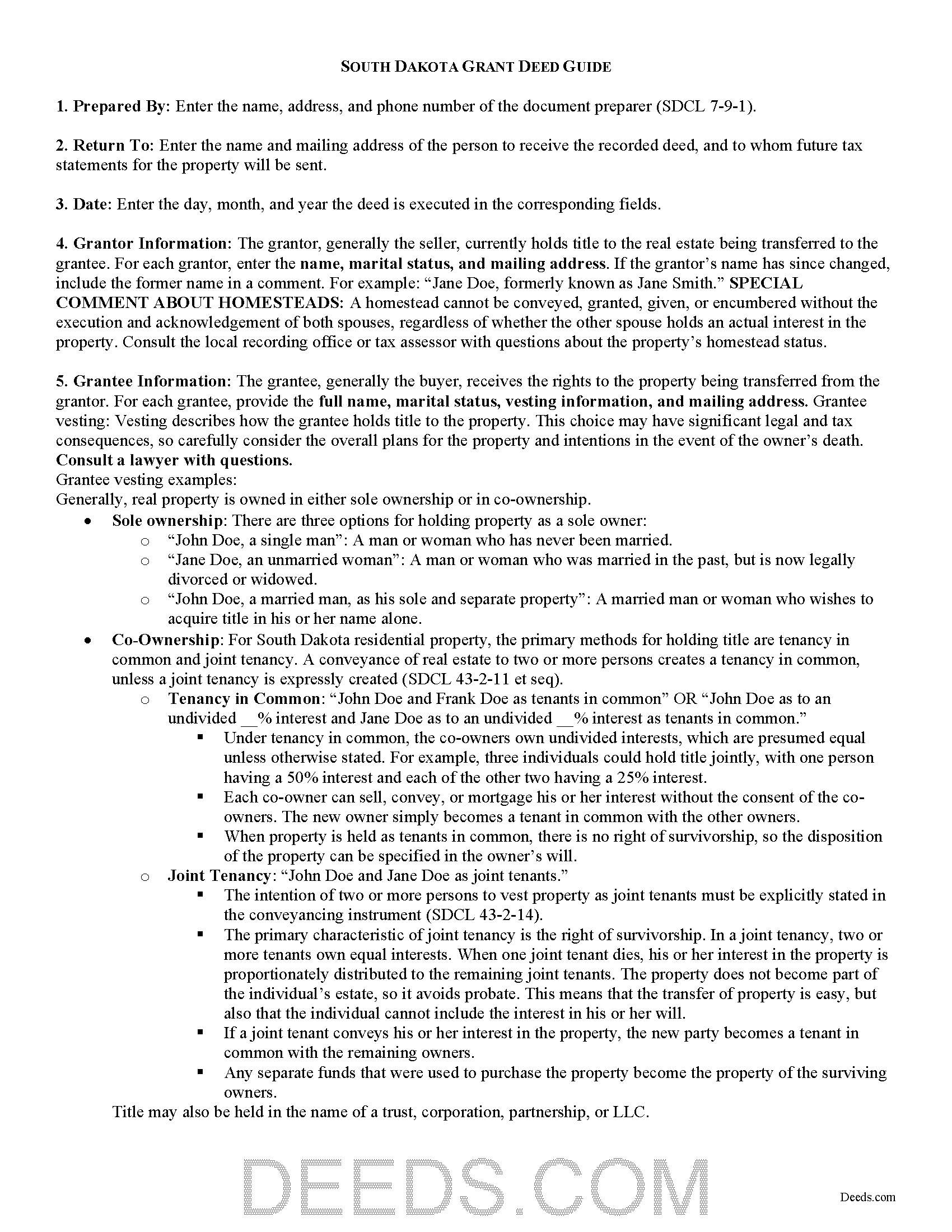

Gregory County Grant Deed Guide

Line by line guide explaining every blank on the form.

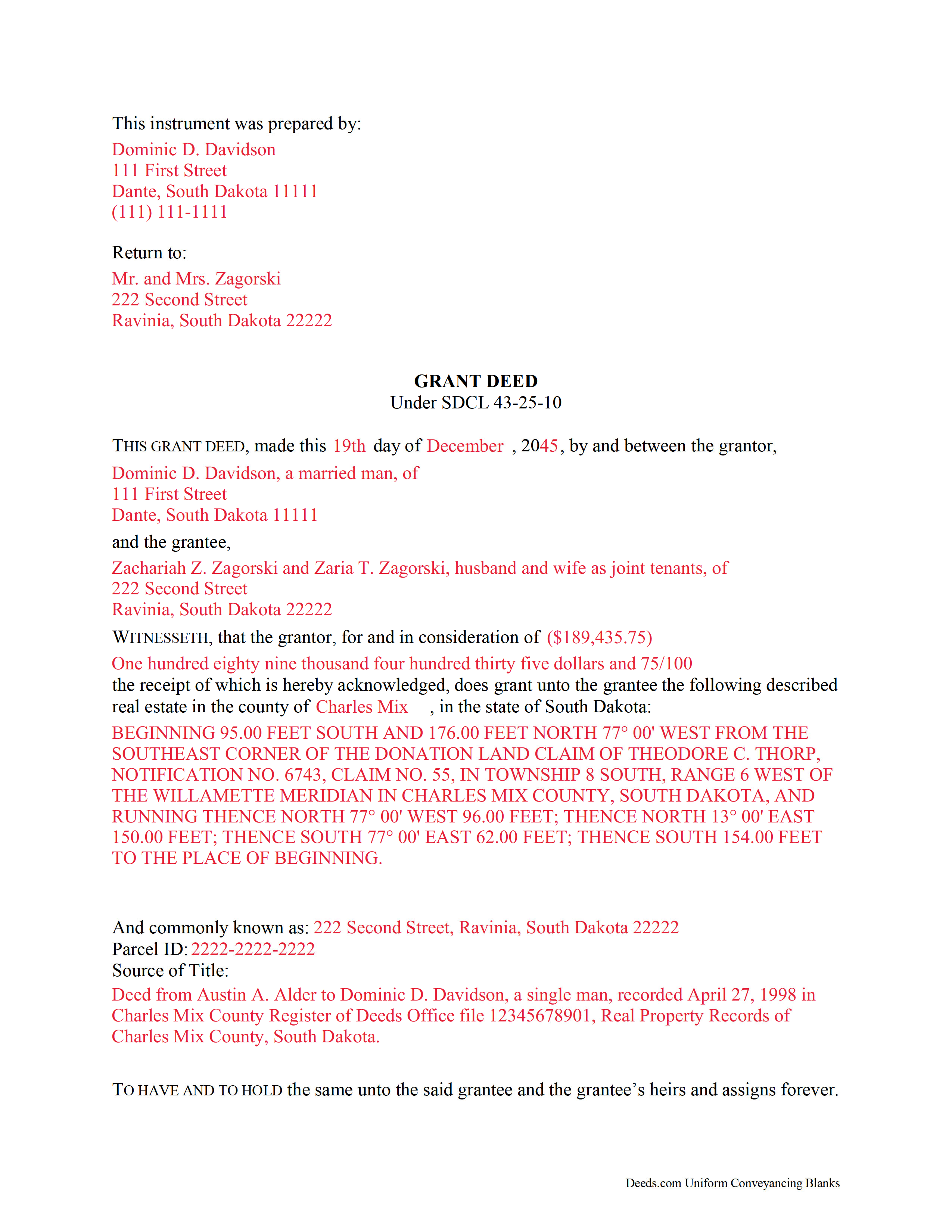

Gregory County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Gregory County documents included at no extra charge:

Where to Record Your Documents

Gregory County Register of Deeds

Burke, South Dakota 57523-0415

Hours: 8:00 to 4:00 Monday through Friday

Phone: (605) 775-2624

Recording Tips for Gregory County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

Cities and Jurisdictions in Gregory County

Properties in any of these areas use Gregory County forms:

- Bonesteel

- Burke

- Dallas

- Fairfax

- Gregory

- Herrick

- Saint Charles

Hours, fees, requirements, and more for Gregory County

How do I get my forms?

Forms are available for immediate download after payment. The Gregory County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gregory County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gregory County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gregory County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gregory County?

Recording fees in Gregory County vary. Contact the recorder's office at (605) 775-2624 for current fees.

Questions answered? Let's get started!

In South Dakota, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer title with the implied covenants that guarantee that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it (43-25-10). The word "grant" in the conveyancing clause transfers fee simple title (SDCL 43-25-10).

Grant deeds offer the grantee (buyer) more protection than quitclaim deeds, but less than warranty deeds. A grant deed differs from a quitclaim deed in that the latter offers no warranty of title, and only conveys any interest that the grantor may have in the subject estate. A warranty deed offers more surety than a grant deed because it requires the grantor to defend against claims to the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For South Dakota residential property, the primary methods for holding title are tenancy in common and joint tenancy. A conveyance of real estate to two or more persons creates a tenancy in common, unless a joint tenancy is expressly created (43-2-11 et seq).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary. Finally, the document must meet all state and local standards of form and content for documents pertaining to real property in South Dakota. See SDCL 43-28-23.

A transfer fee is levied based on the consideration paid. Pursuant to SDCL 43-4-23, if the transfer is exempt from the transfer fee, the deed should cite any exemption claimed. A list of exemptions can be found at 43-4-22. Real estate transfer fees are due upon recording, unless an exemption is claimed. Contact the appropriate Register of Deeds office for up-to-date information on transfer fees. The deed must also be recorded with a Certificate of Real Estate Value (SDCL 7-9-7(4)).

Record the original completed deed, along with any additional materials, at the Register of Deeds office in the county where the property is located. Contact the appropriate Register of Deeds to verify accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a South Dakota lawyer with any questions related to grant deeds or the transfer of real property.

(South Dakota GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Gregory County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Gregory County.

Our Promise

The documents you receive here will meet, or exceed, the Gregory County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gregory County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Jenny B.

October 30th, 2019

Thank you! Will use you again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kelly M.

August 27th, 2021

Deeds.com made it so easy and convenient to get my homestead document recorded. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark M.

October 20th, 2022

Quick, easy everything that i was looking for and then some.

Thank you for your feedback. We really appreciate it. Have a great day!

Antonia J.

March 26th, 2025

Great Family Planner

Thank you!

Deborah D.

January 12th, 2021

Very easy to use, got everything I needed. Reasonable price.

Thank you!

Brian H.

May 1st, 2019

Forms are good. But need to be able to fill in information and blanks so these can be filed. Disappointed.

Thank you for your feedback. The forms are fill in the blank, Adobe PDFs. As is noted on the site, make sure you download the documents to your computer and open them with Adobe. Sounds like you may be trying to complete them online in your browser.

Matthew G.

February 19th, 2019

Second time using Deeds.com. Easy and professional

Thank you Matthew. Have a great day!

Bonnie V.

May 10th, 2019

I was very pleased with Deeds.Com. It was easy to use.

Thank you!

Imari E.

June 11th, 2020

QUICK SERVICE

Thank you!

Johnny B.

December 24th, 2019

This site was a breeze using.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

suzanne m.

April 9th, 2020

Finding what I needed was quick and easy.

Thank you!

Gary O.

March 11th, 2019

Easy to use,makes things easier,Thanks! Great Idea!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph M.

January 4th, 2021

Very easy to use the service and responses came very quickly.

Thank you!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer. I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

JAMES D.

November 5th, 2022

Fast and easy. Sample completed form & guidelines very useful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!