Codington County Mortgage Security Agreement and Promissory Note Form

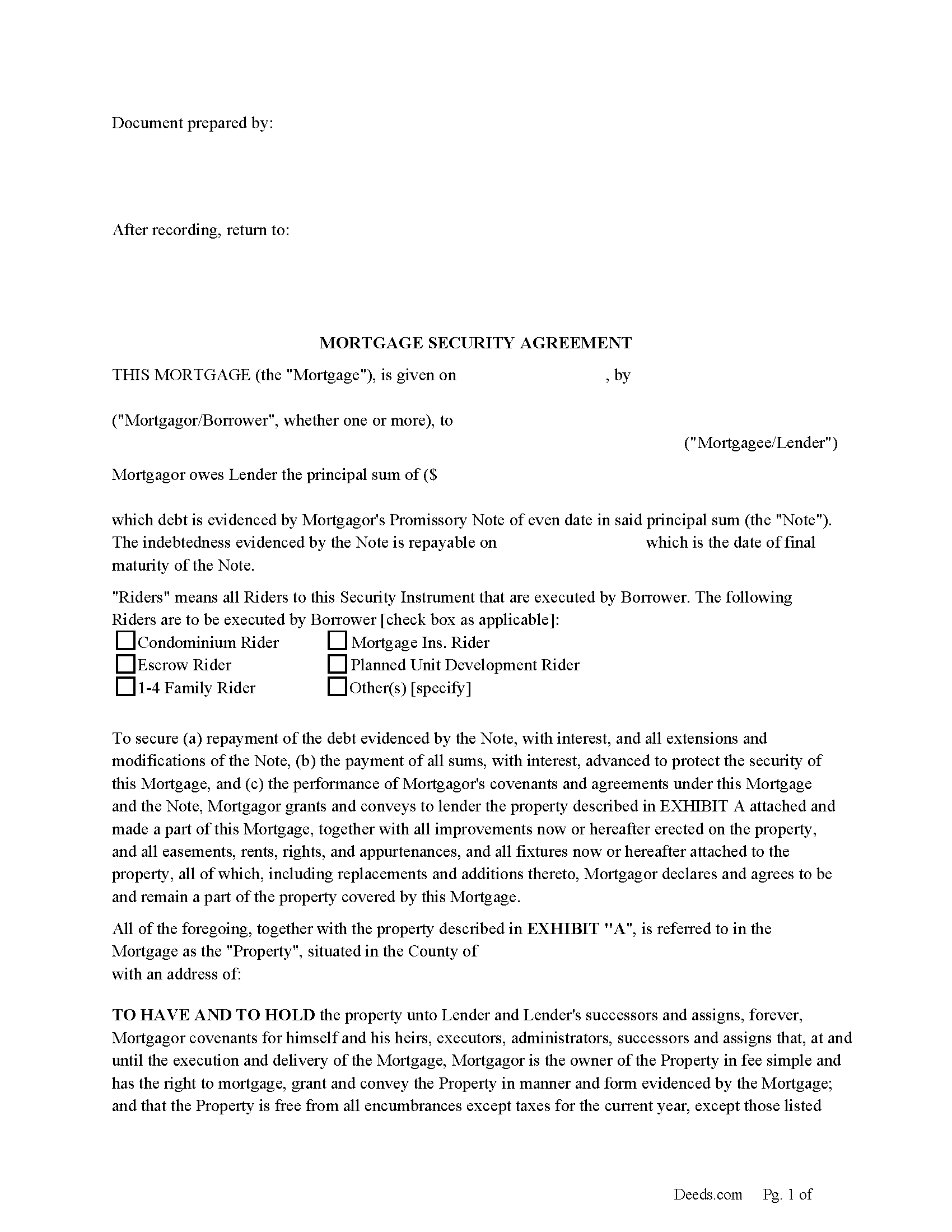

Codington County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

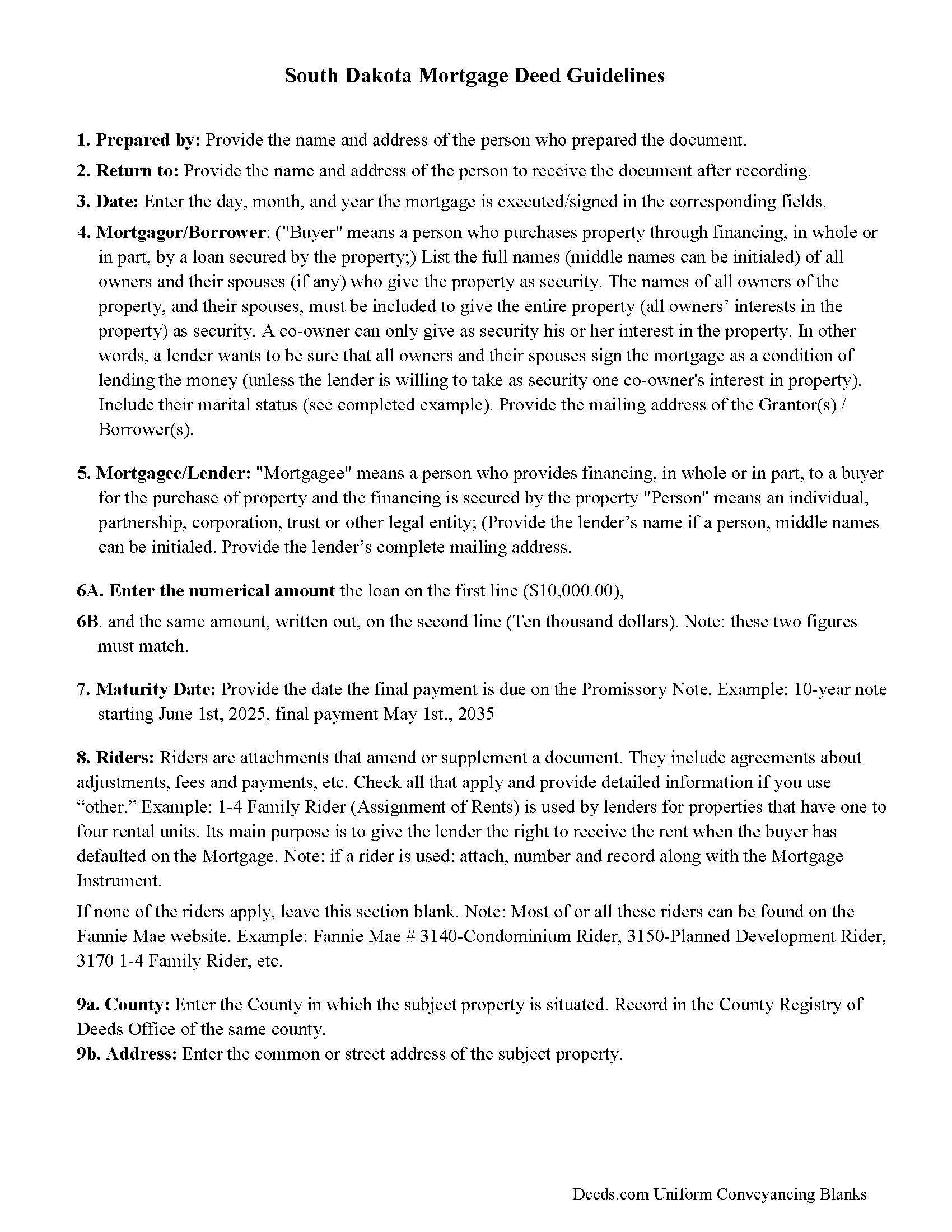

Codington County Mortgage Guidelines

Line by line guide explaining every blank on the form.

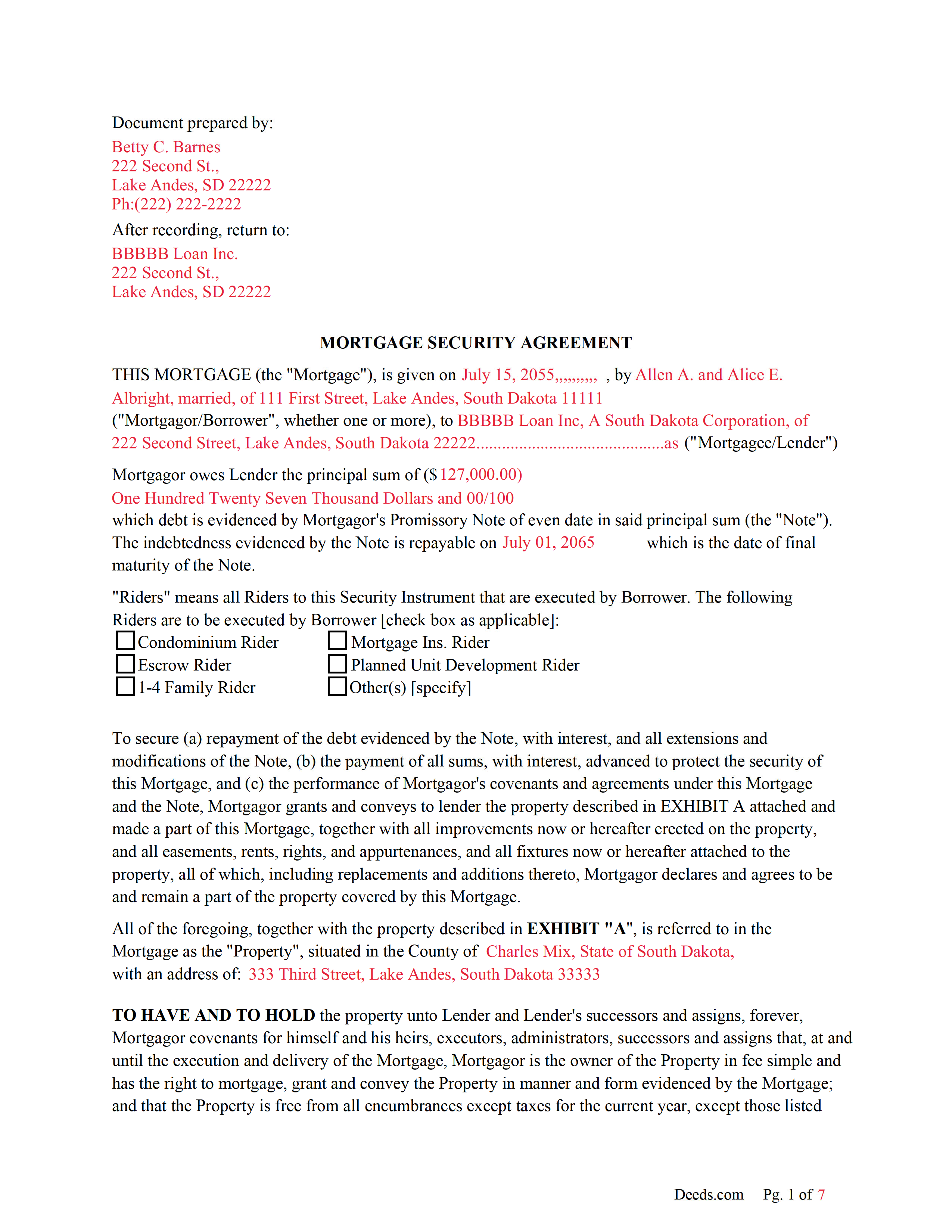

Codington County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

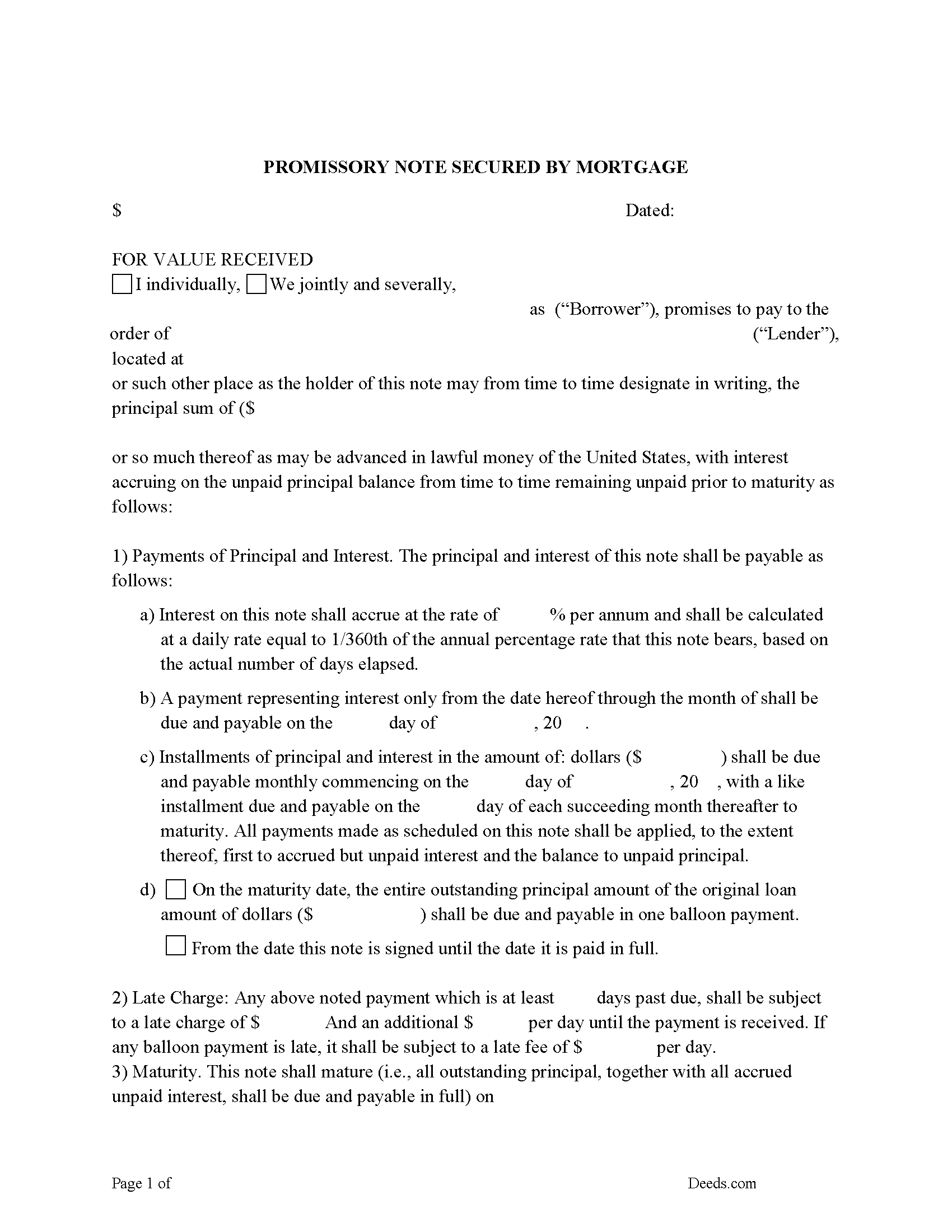

Codington County Promissory Note Form

Note that is secured by the Mortgage Agreement.

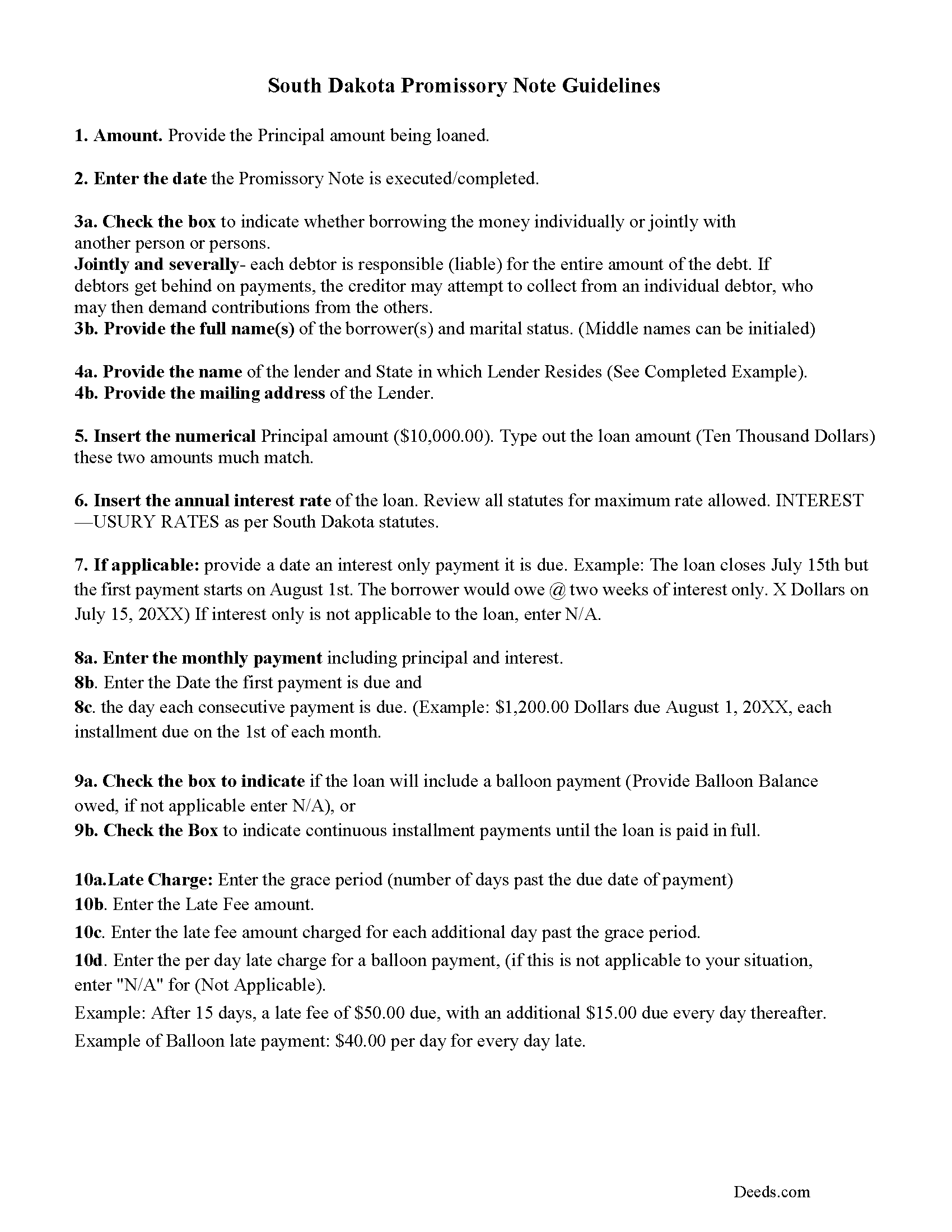

Codington County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

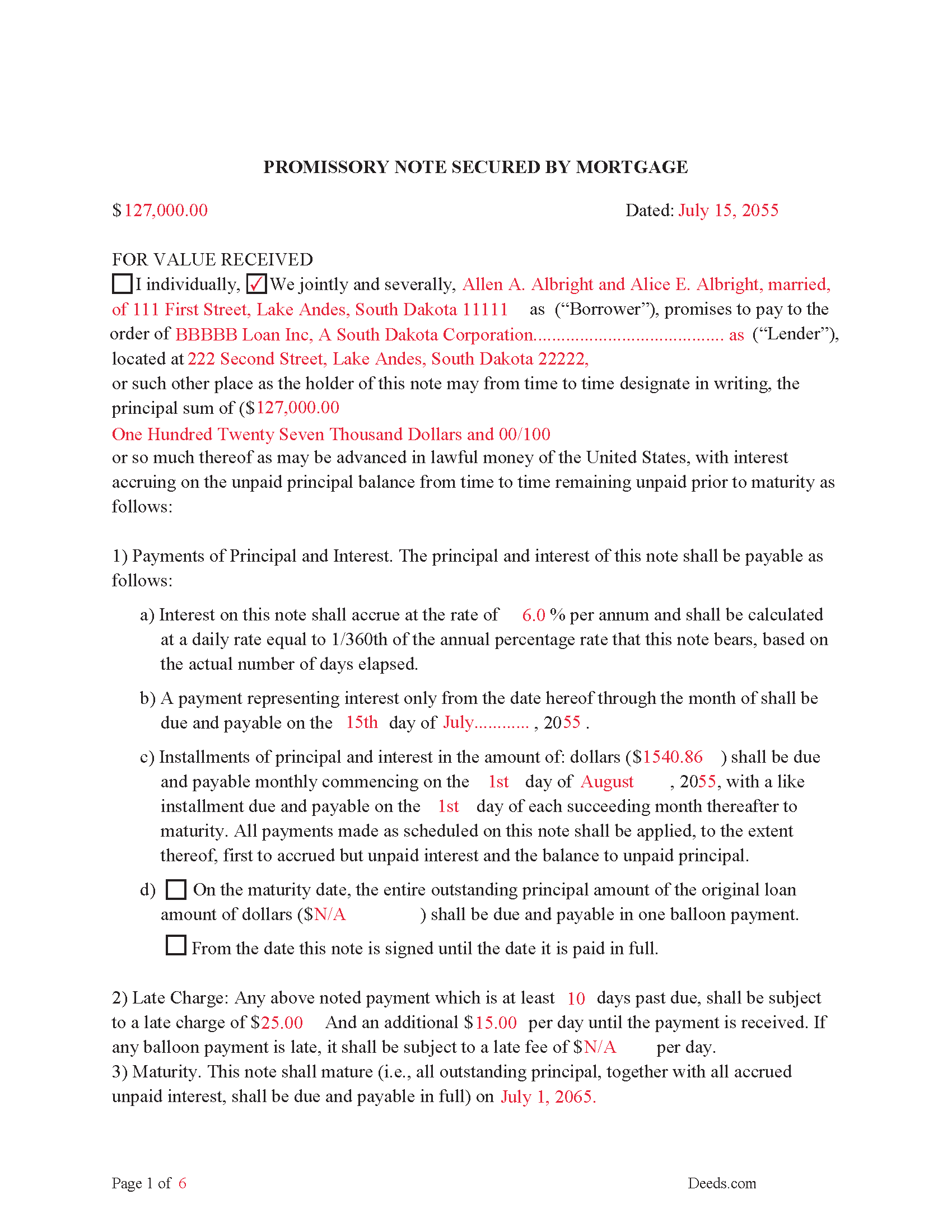

Codington County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

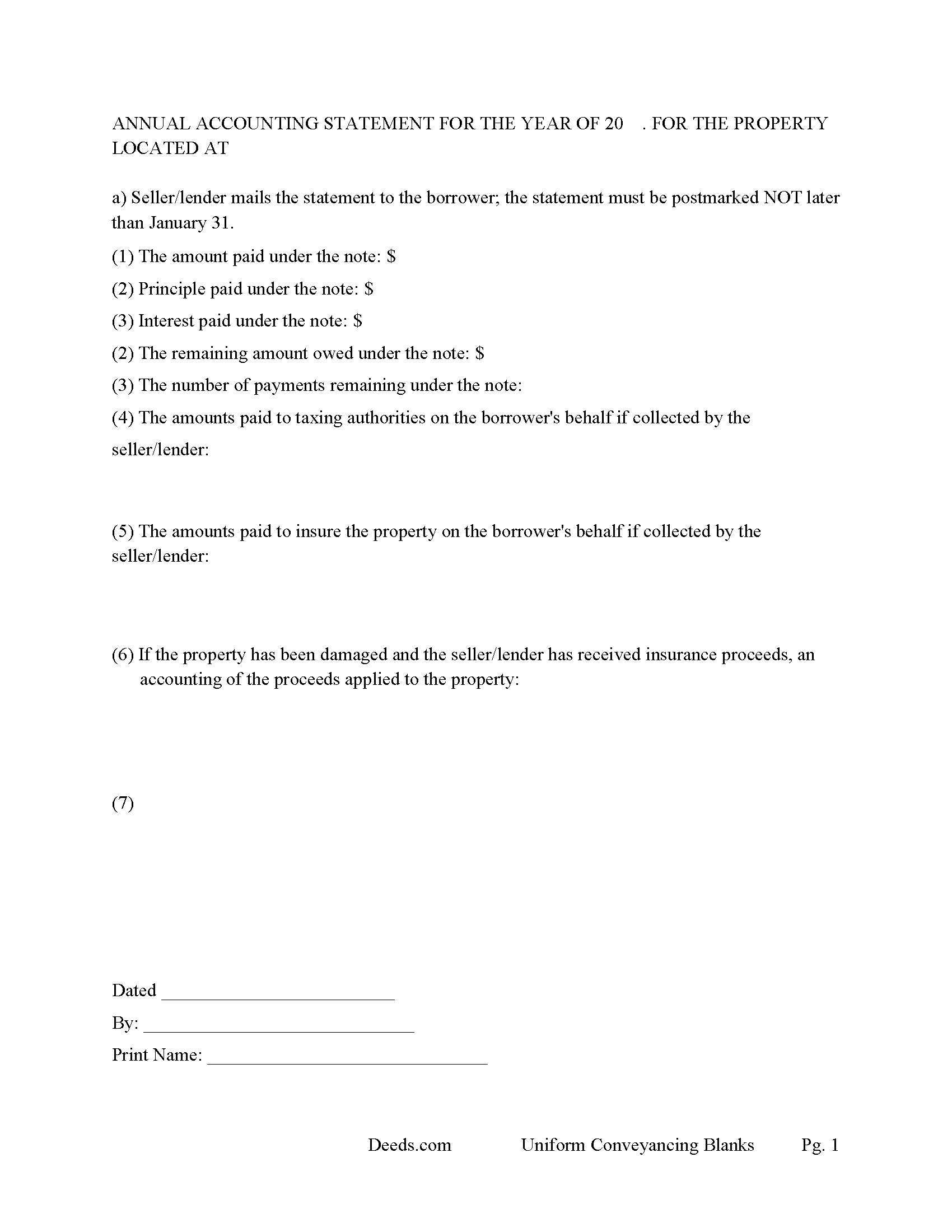

Codington County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Codington County documents included at no extra charge:

Where to Record Your Documents

Codington County Register of Deeds

Watertown, South Dakota 57201

Hours: 8:00am-5:00pm M-F

Phone: (605) 882-6278

Recording Tips for Codington County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Codington County

Properties in any of these areas use Codington County forms:

- Florence

- Henry

- Kranzburg

- South Shore

- Wallace

- Watertown

Hours, fees, requirements, and more for Codington County

How do I get my forms?

Forms are available for immediate download after payment. The Codington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Codington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Codington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Codington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Codington County?

Recording fees in Codington County vary. Contact the recorder's office at (605) 882-6278 for current fees.

Questions answered? Let's get started!

This is a recordable mortgage that serves (as notice to all subsequent purchasers and encumbrancers.) (44-8-10) Included is a Power of Sale clause, considered more favorable to lenders because it uses a non-judicial foreclosure, saving time and expense. [In case of default in the payment of said principal sum of money or any part thereof, or interest thereon at the time or times above specified for payment thereof, or in case of nonpayment of any taxes, assessments, or insurance as aforesaid, or of breach of any covenant or agreement herein contained, then and in either case, the whole, principal and interest, of said note -- shall at the option of the holder thereof, immediately become due and payable, and this mortgage may be foreclosed by action, or by advertisement as provided by statute or the rules of practice relating thereto, and this paragraph shall be deemed as authorizing and constituting a power of sale as mentioned in said statutes or rules, and any amendatory thereof.] [44-8-3]

This mortgage contains a (due-on-sale clause) which (is a provision of a real estate mortgage which requires that the note secured by the mortgage be paid at the time the property is transferred and no assumption of the original note is permitted.) (44-8-27). This is done because [No lender may enforce a due-on-sale clause unless the real estate mortgage includes such clause.] [44-8-28]

44-8-21. Mortgage securing note for purchase price of real estate--No negotiability--Enforcement of liability--Endorsement of note. In all cases where a note given by the purchaser and grantee of real estate to the vendor and grantor thereof to secure payment of all or any part of the purchase price is secured by a mortgage on such real estate, such note shall bear an endorsement upon its face to the effect that it is given for such purpose, and thereafter the same shall not be negotiable, nor shall any liability of any kind be enforced upon it either by action at law, or by set-off, or counterclaim, or otherwise, excepting by foreclosure of the mortgage. The rights of any party to said note, or of any assignee, or purchaser thereof, shall not be affected by the absence of such endorsement but shall be the same as though such note had been properly endorsed. Nothing herein contained shall apply to such note given prior to July 1, 1933.

44-8-22. Rights of payee of note given in payment of purchase price--Deficiency judgment prohibition inapplicable unless note secured by real estate mortgage.

Nothing contained in 44-8-20 or 44-8-21 shall affect the rights of a payee or other owner of a note given in payment of all or part of the purchase price of real estate unless such note is secured by a real estate mortgage.

A mortgage and promissory note secured, including stringent default terms can be beneficial to the lender. Use these forms for residential, commercial, rental property, condominiums, vacant land and planned unit developments.

(South Dakota Mortgage Package includes forms, guidelines, and completed examples) For use in South Dakota only.

Important: Your property must be located in Codington County to use these forms. Documents should be recorded at the office below.

This Mortgage Security Agreement and Promissory Note meets all recording requirements specific to Codington County.

Our Promise

The documents you receive here will meet, or exceed, the Codington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Codington County Mortgage Security Agreement and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Antonia J.

March 26th, 2025

Great Family Planner

Thank you!

Jo Carol K.

October 17th, 2020

The information/forms/and ease of filling in the blanks provided me with the confidence to "do it myself". Excellent customer service. Thank you for being there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara J.

October 7th, 2023

Process was simple and fast. Awaiting response form agency. I’m happy to have found deeds.com for a speedy service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenia B.

August 31st, 2020

Very convenient and efficient. I will recommend it, definitely.

Thank you!

JOHN S.

October 16th, 2021

They had everything for a living trust but the form to transfer your house into the living trust

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda G.

August 22nd, 2021

I like it so far- now I just need to complete my filing in the County seat!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald C.

February 22nd, 2019

No review provided.

Thank you!

RONNIE C.

February 20th, 2019

Excellent service and the time the documents send back to me was also excellent

Thank you!

Michael S.

September 16th, 2024

Great product and service. So convenient.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Deb D.

January 31st, 2019

Excellent website - easy to use, and found exactly the form I needed right away. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy E.

May 4th, 2025

Took me awhile to figure out and get the information printed so I can use it later. Thank you.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Ivory J.

August 1st, 2020

Haven't processed any deed documents so far. I do agree that Deed.com website browsing tool will be helpful.

Thank you!

GEORGE Q.

May 9th, 2019

Assistance from the associate was good. He told me what I needed to hear and took the time to look up deeds that I was looking for. Though the deed was not available he gave me recommendation on my future calls to ask. Great personality and very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Shonda S.

January 21st, 2023

This is the best thing I have ever done with this being my first time doing a quick claim. This has save me and my family money instead of paying a lawyer. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline H.

February 4th, 2021

Thank you for all your assistance and patience in doing the deed. I can honestly say that DEEDs.com will be permanently on my list as a go to company. I will use the company as a referral to friends and family.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!