Miner County Mortgage Security Agreement and Promissory Note Form

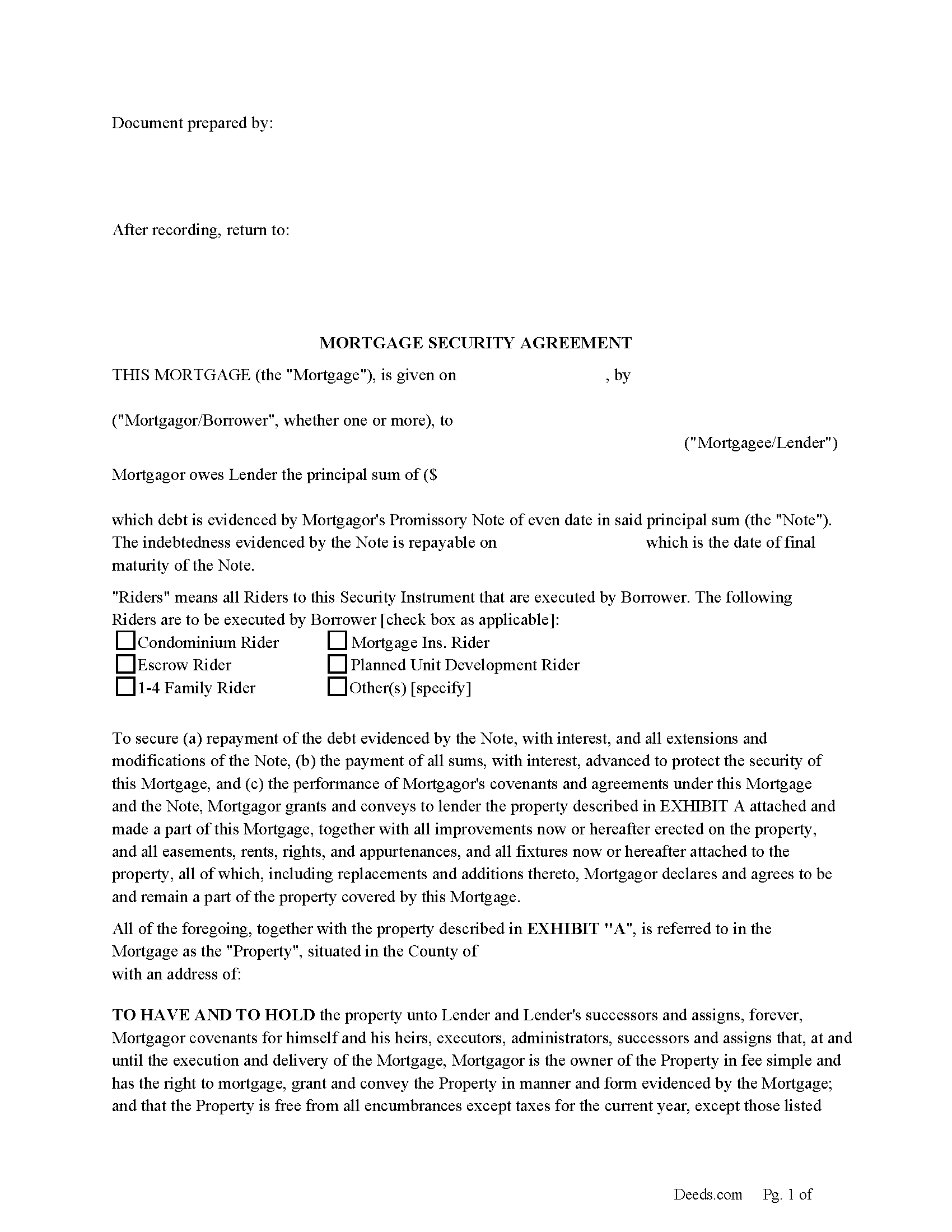

Miner County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

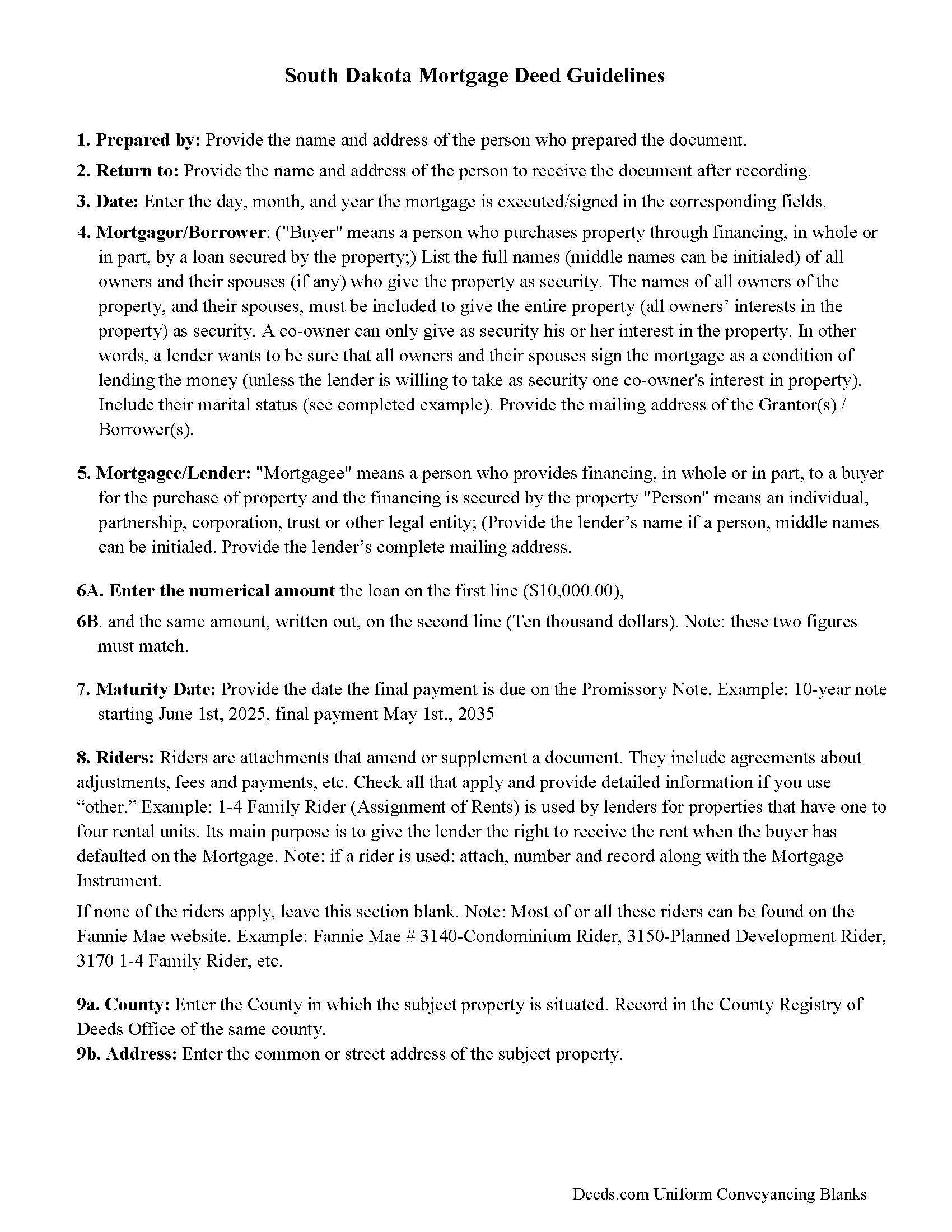

Miner County Mortgage Guidelines

Line by line guide explaining every blank on the form.

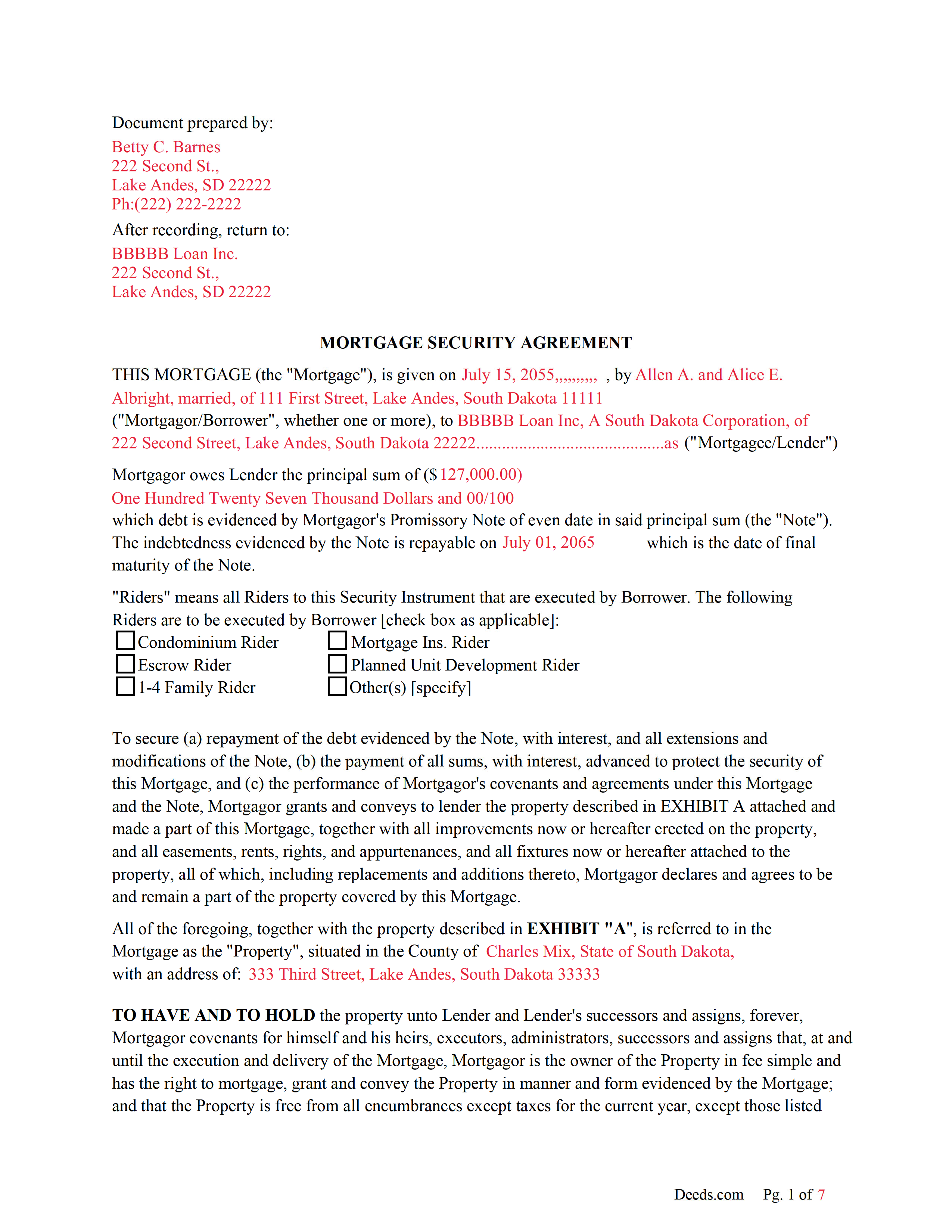

Miner County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

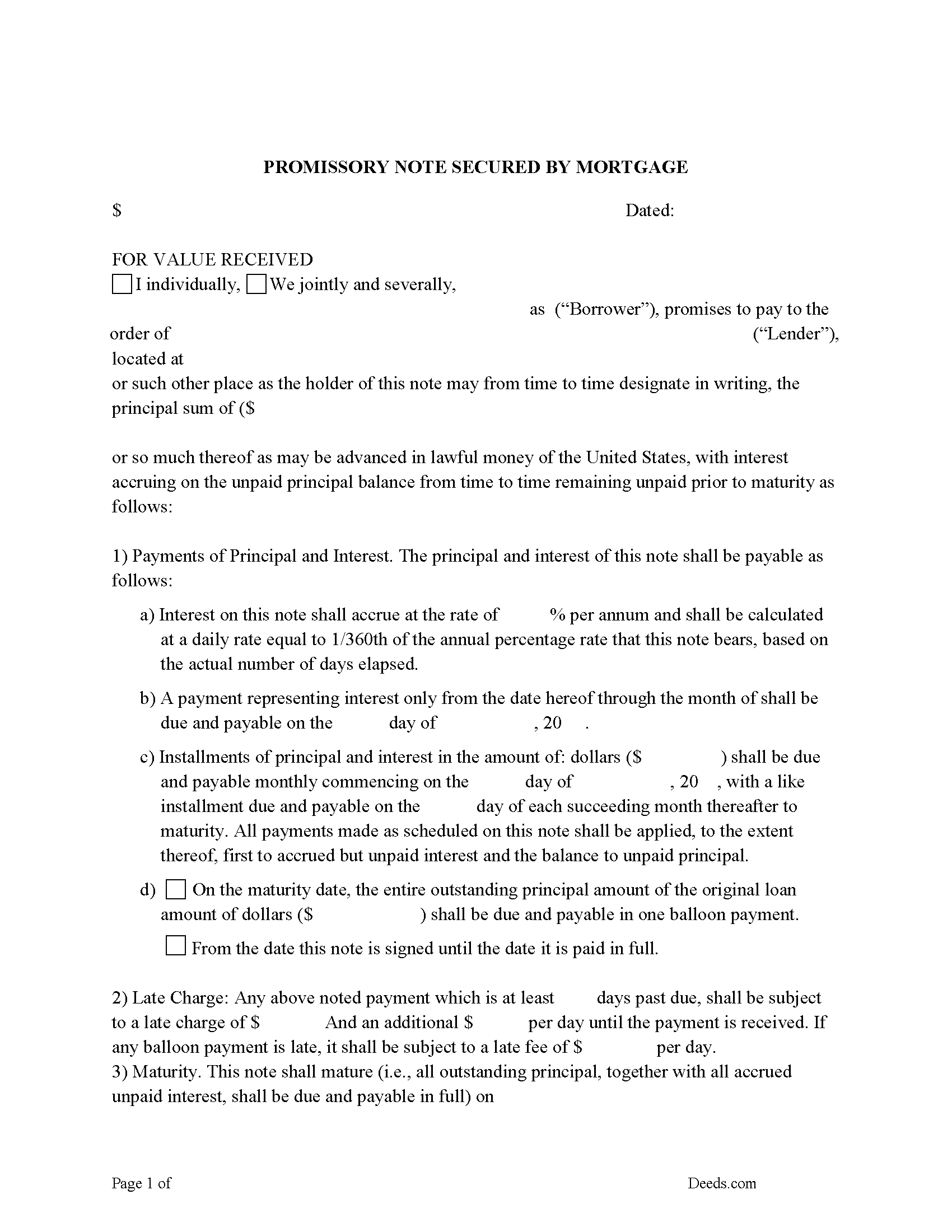

Miner County Promissory Note Form

Note that is secured by the Mortgage Agreement.

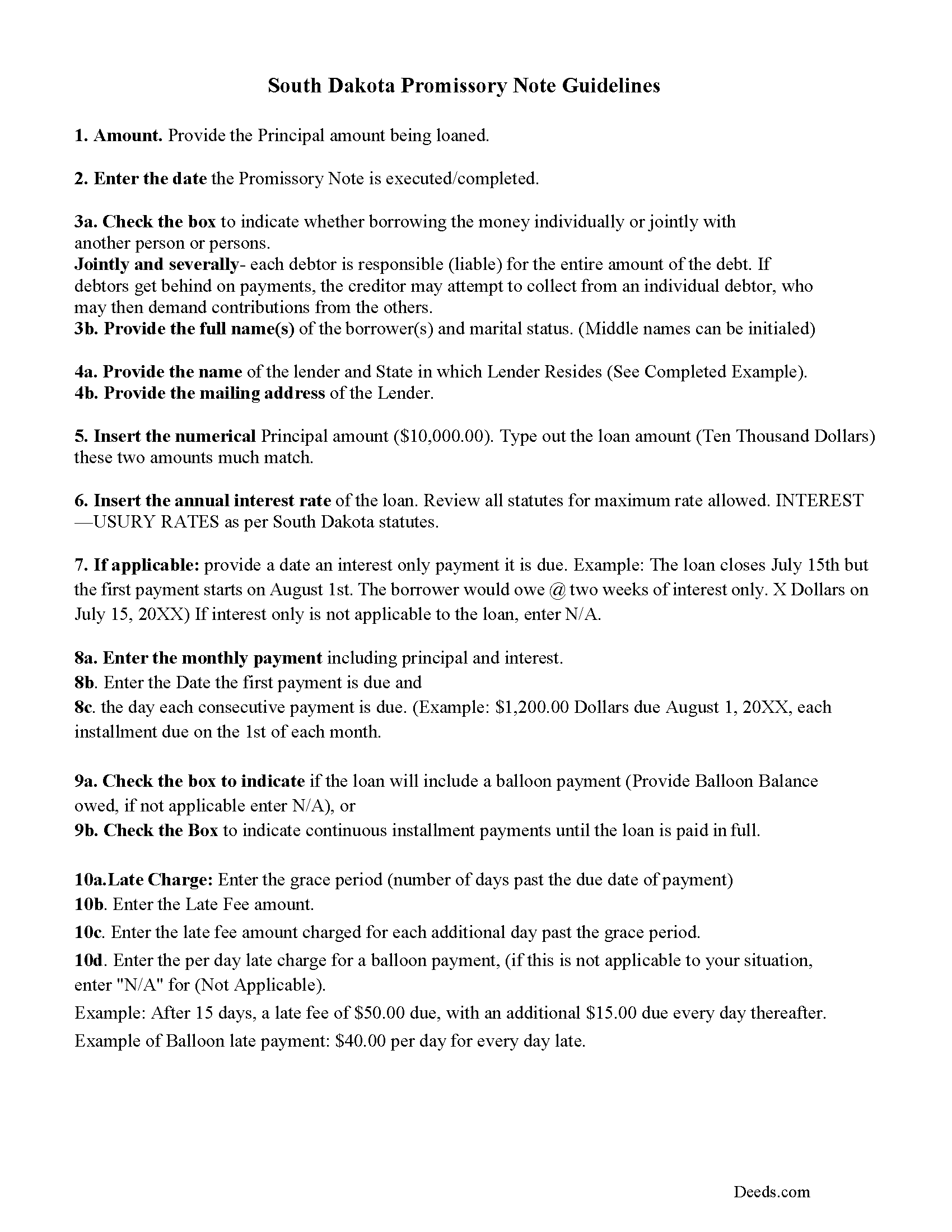

Miner County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

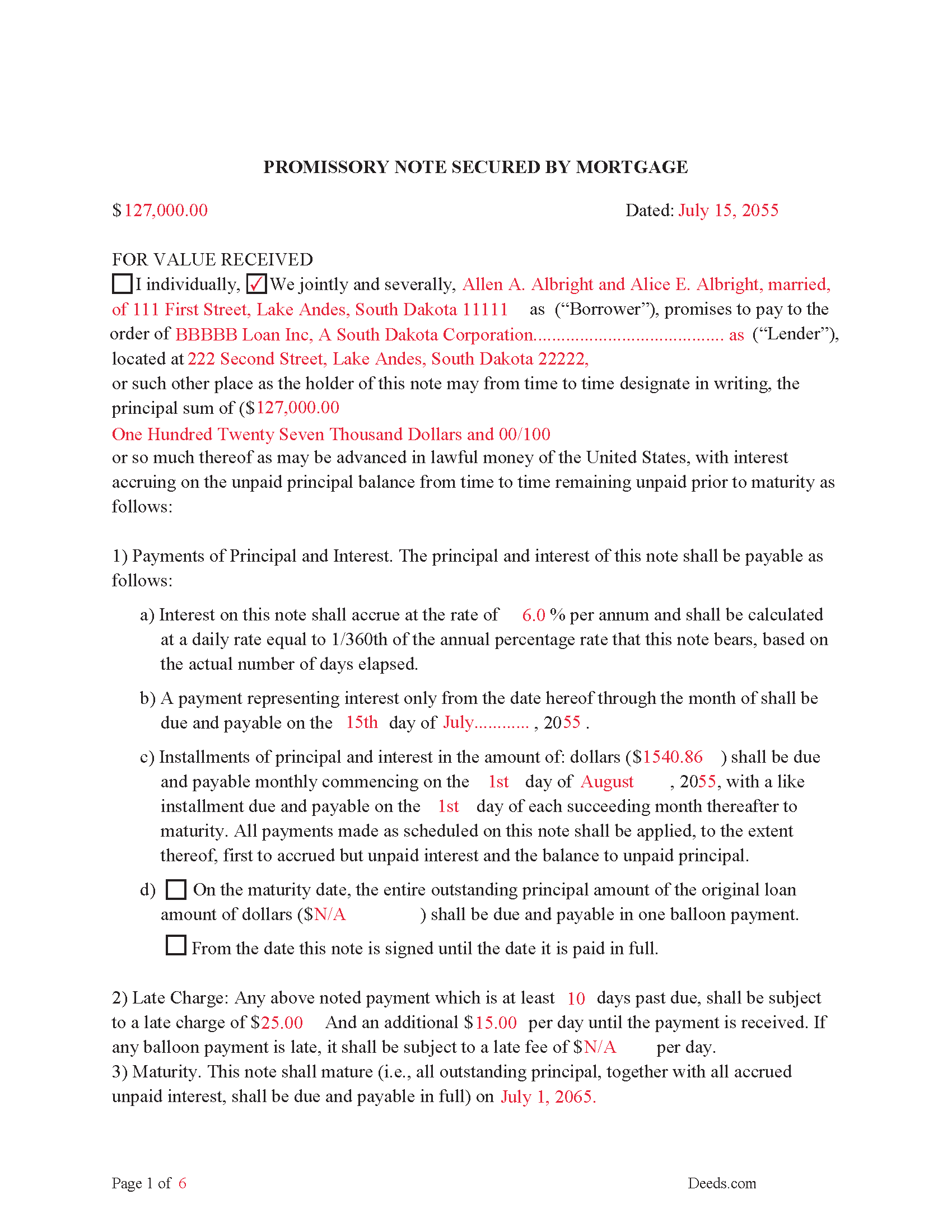

Miner County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

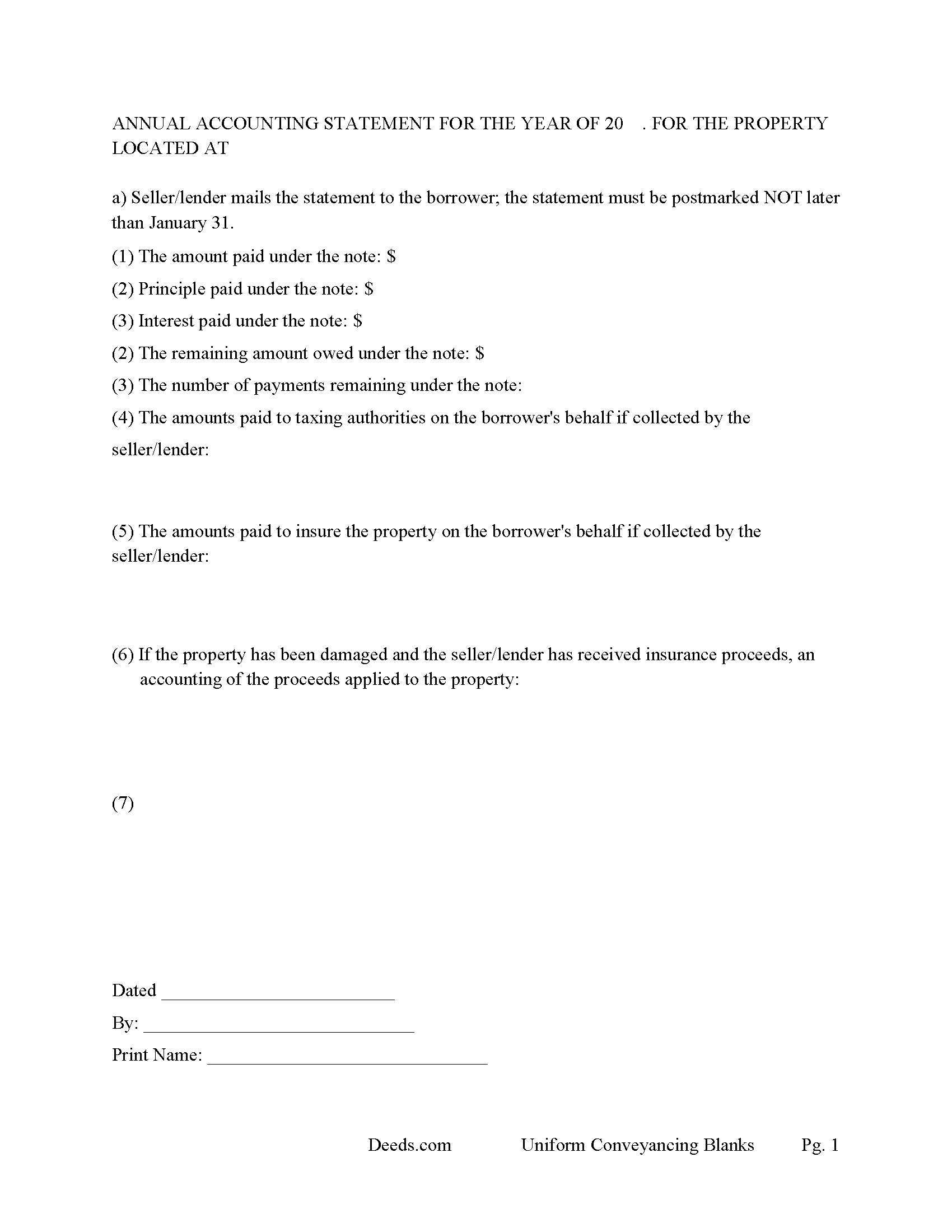

Miner County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Miner County documents included at no extra charge:

Where to Record Your Documents

Miner County Register of Deeds

Howard, South Dakota 57349

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 772-5621

Recording Tips for Miner County:

- White-out or correction fluid may cause rejection

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Miner County

Properties in any of these areas use Miner County forms:

- Canova

- Carthage

- Fedora

- Howard

Hours, fees, requirements, and more for Miner County

How do I get my forms?

Forms are available for immediate download after payment. The Miner County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Miner County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Miner County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Miner County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Miner County?

Recording fees in Miner County vary. Contact the recorder's office at (605) 772-5621 for current fees.

Questions answered? Let's get started!

This is a recordable mortgage that serves (as notice to all subsequent purchasers and encumbrancers.) (44-8-10) Included is a Power of Sale clause, considered more favorable to lenders because it uses a non-judicial foreclosure, saving time and expense. [In case of default in the payment of said principal sum of money or any part thereof, or interest thereon at the time or times above specified for payment thereof, or in case of nonpayment of any taxes, assessments, or insurance as aforesaid, or of breach of any covenant or agreement herein contained, then and in either case, the whole, principal and interest, of said note -- shall at the option of the holder thereof, immediately become due and payable, and this mortgage may be foreclosed by action, or by advertisement as provided by statute or the rules of practice relating thereto, and this paragraph shall be deemed as authorizing and constituting a power of sale as mentioned in said statutes or rules, and any amendatory thereof.] [44-8-3]

This mortgage contains a (due-on-sale clause) which (is a provision of a real estate mortgage which requires that the note secured by the mortgage be paid at the time the property is transferred and no assumption of the original note is permitted.) (44-8-27). This is done because [No lender may enforce a due-on-sale clause unless the real estate mortgage includes such clause.] [44-8-28]

44-8-21. Mortgage securing note for purchase price of real estate--No negotiability--Enforcement of liability--Endorsement of note. In all cases where a note given by the purchaser and grantee of real estate to the vendor and grantor thereof to secure payment of all or any part of the purchase price is secured by a mortgage on such real estate, such note shall bear an endorsement upon its face to the effect that it is given for such purpose, and thereafter the same shall not be negotiable, nor shall any liability of any kind be enforced upon it either by action at law, or by set-off, or counterclaim, or otherwise, excepting by foreclosure of the mortgage. The rights of any party to said note, or of any assignee, or purchaser thereof, shall not be affected by the absence of such endorsement but shall be the same as though such note had been properly endorsed. Nothing herein contained shall apply to such note given prior to July 1, 1933.

44-8-22. Rights of payee of note given in payment of purchase price--Deficiency judgment prohibition inapplicable unless note secured by real estate mortgage.

Nothing contained in 44-8-20 or 44-8-21 shall affect the rights of a payee or other owner of a note given in payment of all or part of the purchase price of real estate unless such note is secured by a real estate mortgage.

A mortgage and promissory note secured, including stringent default terms can be beneficial to the lender. Use these forms for residential, commercial, rental property, condominiums, vacant land and planned unit developments.

(South Dakota Mortgage Package includes forms, guidelines, and completed examples) For use in South Dakota only.

Important: Your property must be located in Miner County to use these forms. Documents should be recorded at the office below.

This Mortgage Security Agreement and Promissory Note meets all recording requirements specific to Miner County.

Our Promise

The documents you receive here will meet, or exceed, the Miner County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Miner County Mortgage Security Agreement and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Walton A.

February 3rd, 2022

Thanks ..this was very helpful and easy!

Thank you!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Esfir K.

October 3rd, 2022

I had to call 3 times, two calls were hanged up on me. Thank you to 3rd representative, who helped me with my question. Unfortunately, I do not know her name. She was very patient, kind, professional. I am very thankful for her help.

Thank you!

Patricia K.

August 8th, 2019

Able to find the information that I needed.

Thank you!

Darrell D.

June 6th, 2023

Thx. Easy to research and download. Now proof is in the pudding. :-)

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa P.

October 23rd, 2020

Your forms are worth the investment. The guide and example were very helpful and thorough.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy O.

July 27th, 2023

Outstanding forms and service. Liked that the main deed forms were PDF so I could fill them out on my laptop, in my own time, instead of some online Q/A auto populate system. Guide was helpful, as was the completed sample. Used the erecording service to file the deed, amazing.

Thank you for your wonderful review Nancy! Our team takes pride in providing helpful resources, and we are pleased that the guide and completed sample were beneficial to you throughout the process. Making the deed filing journey smoother for our users is always our top priority.

Joseph B.

March 30th, 2021

Awesome!

Thank you!

Tim H.

July 30th, 2019

Found the service useful and straightforward. The only recommendation would be to send an e-mail notification to the request or when their package is ready for download. Mine, apparently, was ready within and hour or so after placing the request but did not go back onto the site until a day later to find it was ready.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda M.

February 3rd, 2021

I was glad that I paid to get a copy of the gift deed it help me out a lot and the copy of the example how to fill everything out was great

Thank you for your feedback. We really appreciate it. Have a great day!

Hanne R.

November 17th, 2020

excellent

Thank you!

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

LuAnn F.

September 8th, 2022

Simple and quick access to the form I needed

Thank you!

Zehira D.

August 19th, 2025

Great service! fast, reliable, and very affordable. No contract, no subscription

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.