Roberts County Quitclaim Deed Form (South Dakota)

All Roberts County specific forms and documents listed below are included in your immediate download package:

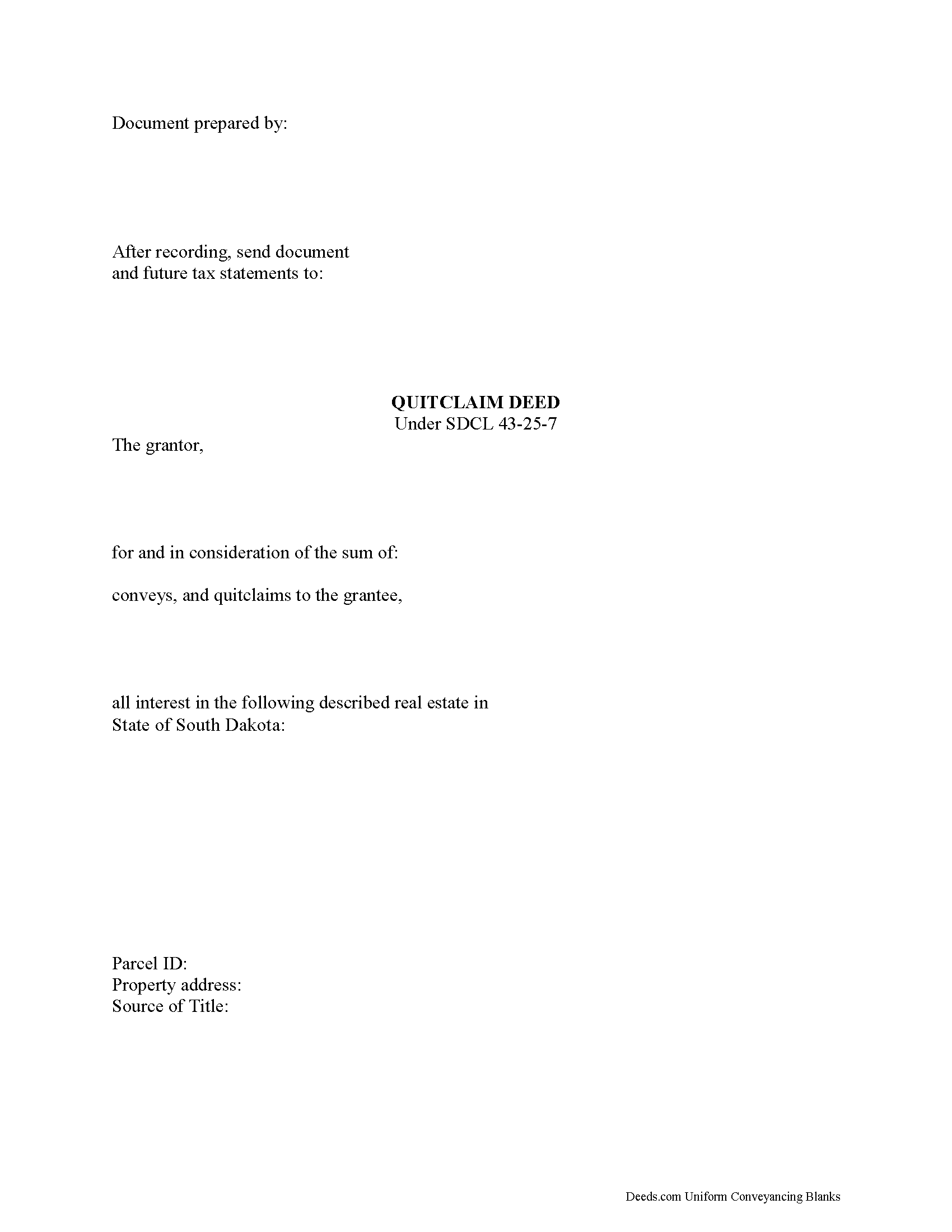

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all South Dakota recording and content requirements.

Included Roberts County compliant document last validated/updated 4/16/2025

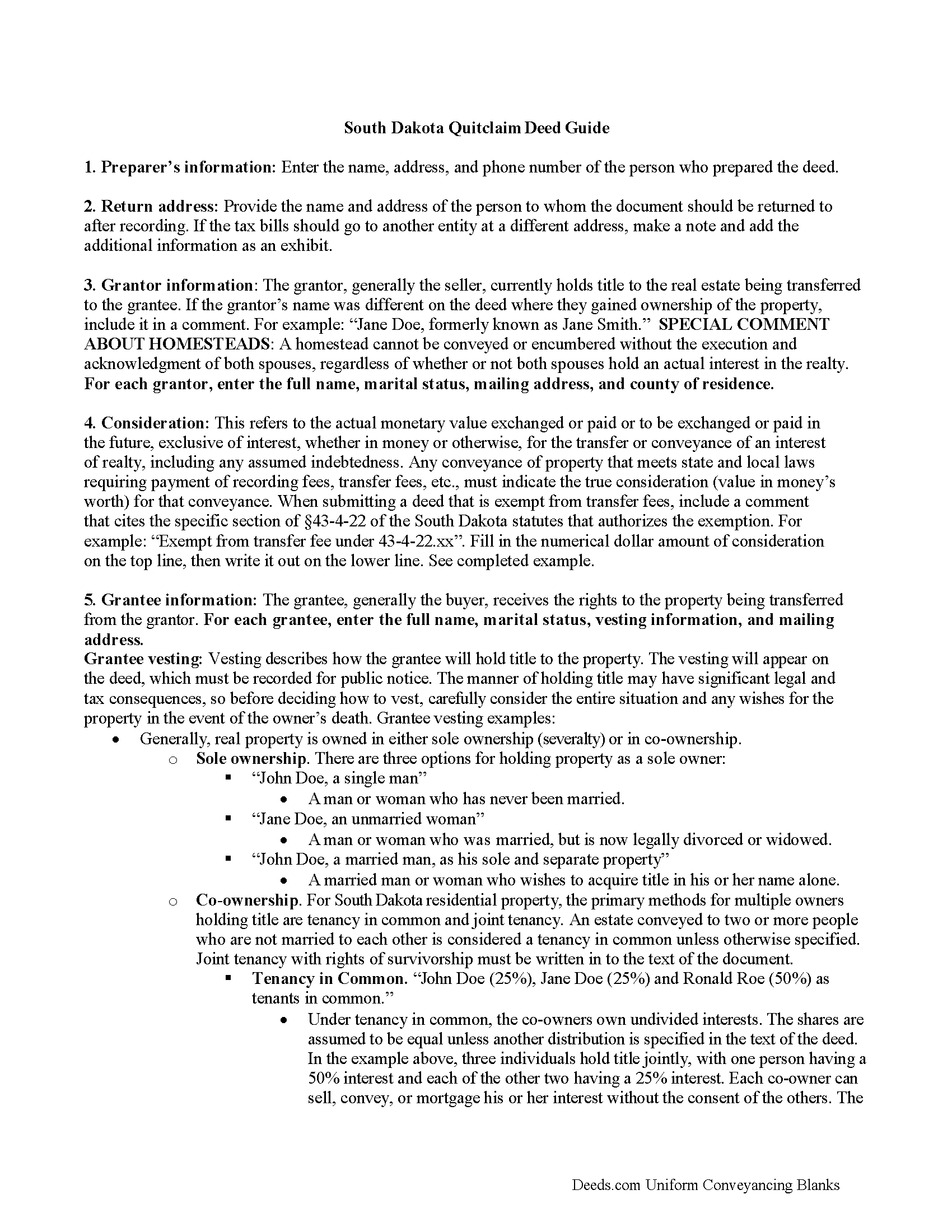

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Roberts County compliant document last validated/updated 6/17/2025

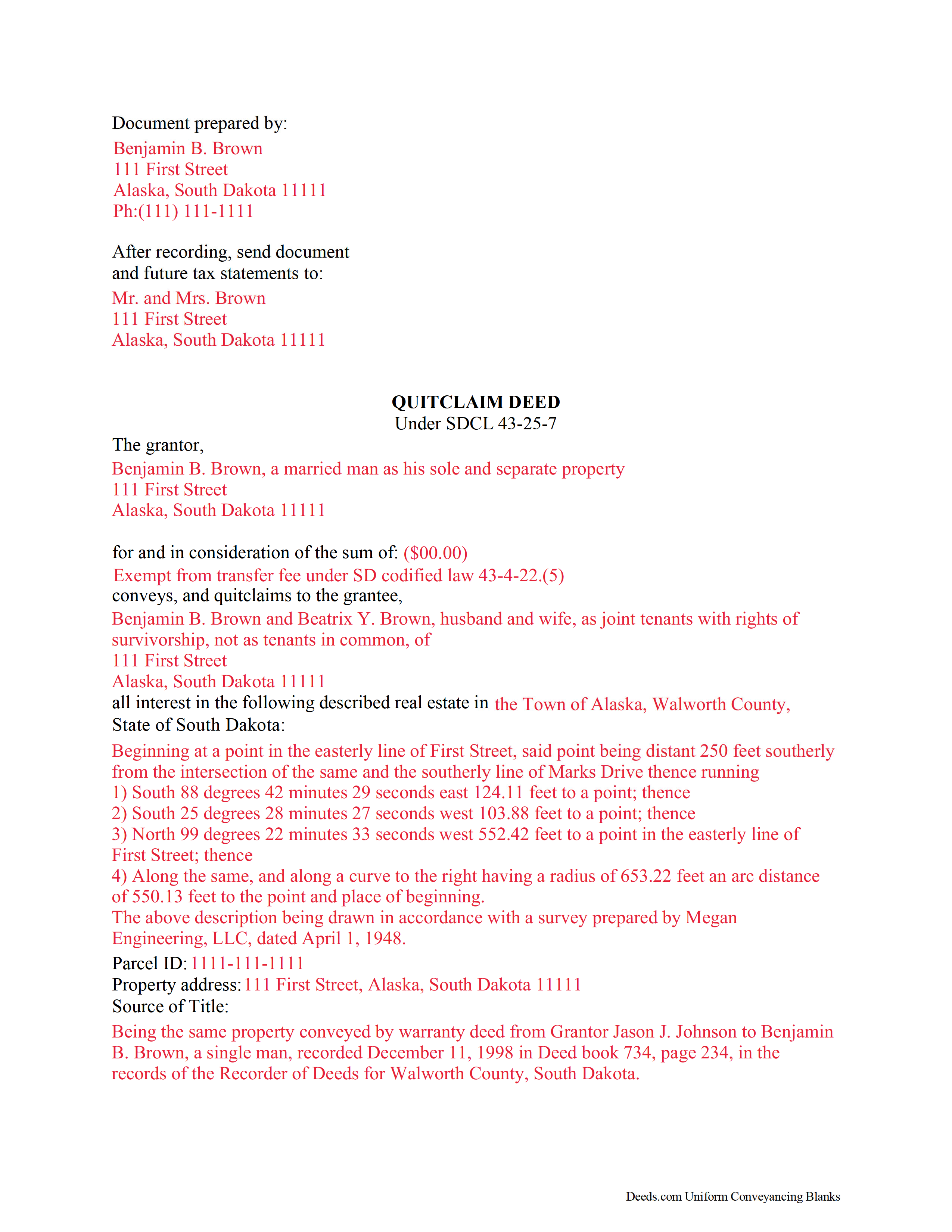

Completed Example of the Quitclaim Deed Document

Example of a properly completed South Dakota Quitclaim Deed document for reference.

Included Roberts County compliant document last validated/updated 6/6/2025

The following South Dakota and Roberts County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Roberts County. The executed documents should then be recorded in the following office:

Roberts County Register of Deeds

411 2nd Ave East, Suite #5, Sisseton, South Dakota 57262-1495

Hours: Call for hours

Phone: (605) 698-7152

Local jurisdictions located in Roberts County include:

- Claire City

- Corona

- New Effington

- Ortley

- Peever

- Rosholt

- Sisseton

- Summit

- Wilmot

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Roberts County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Roberts County using our eRecording service.

Are these forms guaranteed to be recordable in Roberts County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Roberts County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Roberts County that you need to transfer you would only need to order our forms once for all of your properties in Roberts County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by South Dakota or Roberts County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Roberts County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The form of a quitclaim deed in South Dakota (South Dakota Codified Laws, 43-25-7) requires, among other items, the grantor's signature and an acknowledgment of that signature. The mailing address of the grantee to the quitclaim deed and a legal description of the property being conveyed are both required at the time of recording (43-28-21). A quitclaim deed presented to a county recorder in South Dakota must be accompanied by a Certificate of Value.

Any person holding real estate under the terms of a quitclaim deed as defined in 43-25-11 will be deemed a purchaser in good faith and for a valuable consideration, unless the person had, at the time of execution and delivery of such conveyance, actual notice or knowledge of a prior unrecorded conveyance affecting title to such real property.

An unrecorded quitclaim deed in South Dakota is valid between the parties named in the instrument and those who have notice of it (43-28-14). In order to provide constructive notice to all purchasers or encumbrancers of the contents within, recording of the quitclaim deed with the county clerk in the appropriate county is necessary (43-28-15). Every conveyance of real property is void against any subsequent purchaser or encumbrancer in good faith and for a valuable consideration whose conveyance is first duly recorded. The Property Title in the South Dakota Codified Laws discusses quitclaim deeds and other real estate documents in further detail.

(South Dakota QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Roberts County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Roberts County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stacey S.

January 27th, 2022

The system was easy to use and download my documents but the way the packages are set up it was confusing and I wish there was a way to delete an item from a package if you make a mistake.

Thank you for your feedback. We really appreciate it. Have a great day!

Debbra .S C.

June 1st, 2023

Very easy and nice website to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Russell N.

March 16th, 2021

Very simple process to purchase and download. Made it easy to understand the different forms and their uses and how to select the right form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah M.

June 24th, 2021

Absolutely great. The staff is responsive and knowledgeable. The online interface is excellent. The total cost for finalizing the sale on our property (minus state filing fees) was $39. A wonderful experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Westcliffe C.

November 3rd, 2022

Like the setup

Good idea on forms that help at a great price

Thank you for your feedback. We really appreciate it. Have a great day!

JAMES E.

November 22nd, 2020

Easy to use and excellent software.

Thank you!

MARIZON M.

November 4th, 2020

This site/service is amazing! The response is almost real-time and the fees are super reasonable. I will be using this again in the future should I need to file any other documents with the county and will also recommend it to others! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

kabir r.

May 11th, 2022

Wonderful quitclaim forms, very happy

Thank you!

Linda C.

February 23rd, 2019

If I hadn't spent my career as an escrow officer (albeit in another state), I may have had a hard time figuring out exactly which deed I needed and how to prepare them, even with the back-up informational, how-to pdf documents, without an attorney. My experience speaks to how much the general public doesn't understand and how confusing it can be. Nonetheless, the access to so many documents at a fairly reasonable cost, the basic how-to docs made available along with the purchased doc makes all the difference. I appreciate having such things available to the public. Many thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Howard N.

March 26th, 2025

I tried several other online sites for lady bird deed. The county said they didn't contain the correct information. The form from Deeds.com was the right one.rnThank you rnHoward Nielsen

Thank you for your positive words! We’re thrilled to hear about your experience.

Dorien C.

March 25th, 2023

Easy to use, thank you.

Thank you!

Joyce F.

March 31st, 2019

The forms are simple to follow. I was hoping I would be able to add my personal info. That would make the forms even more simple.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!