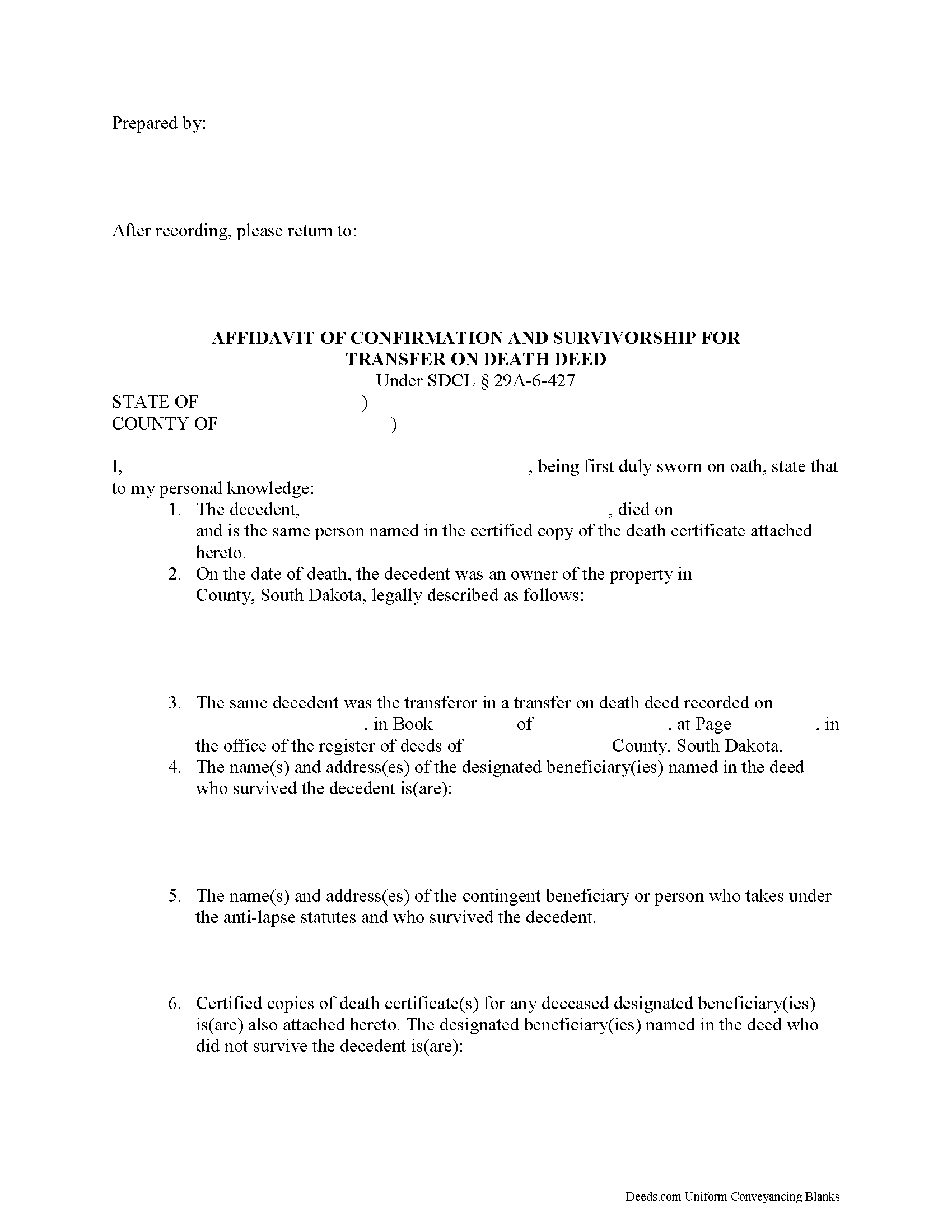

Mccook County Transfer on Death Affidavit Form

Mccook County Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

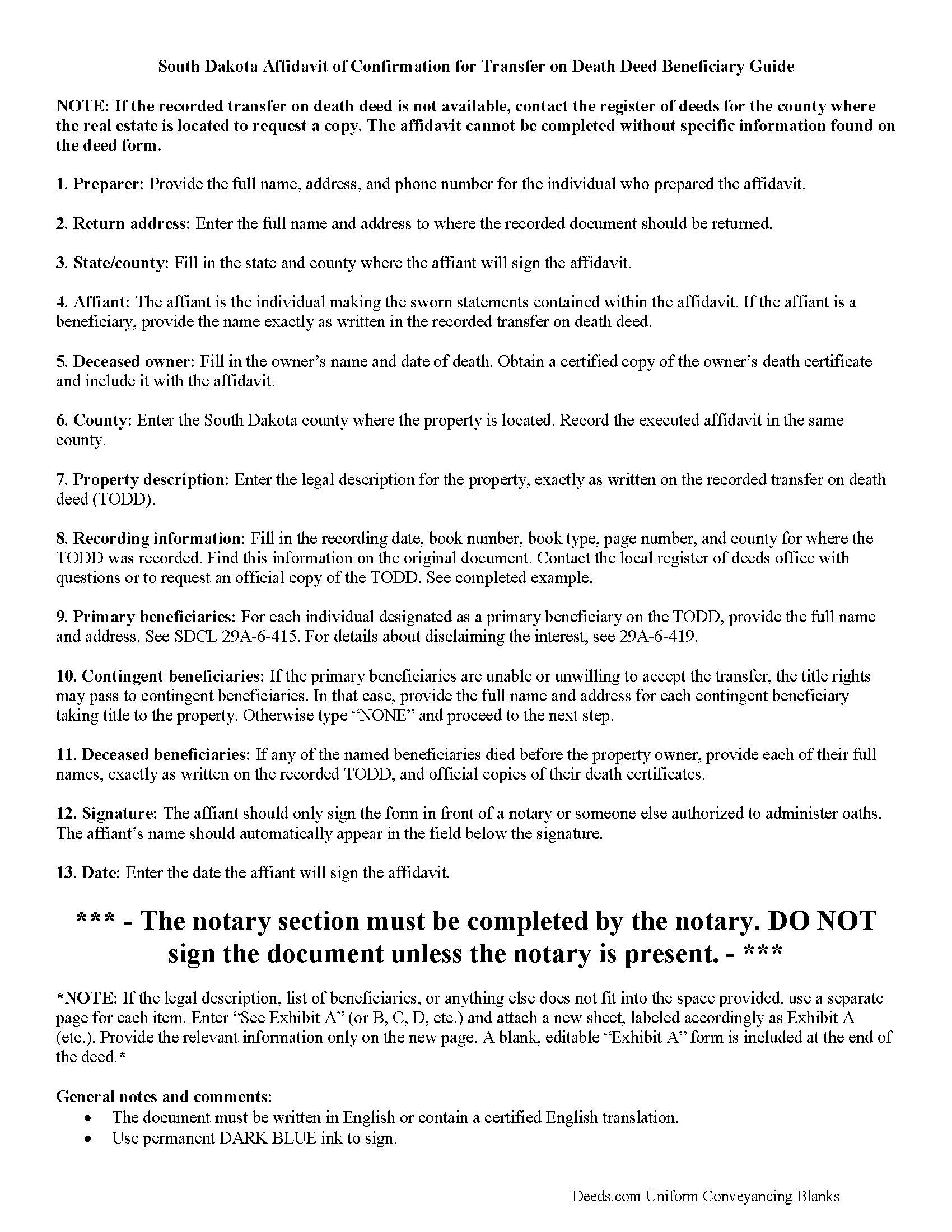

Mccook County Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

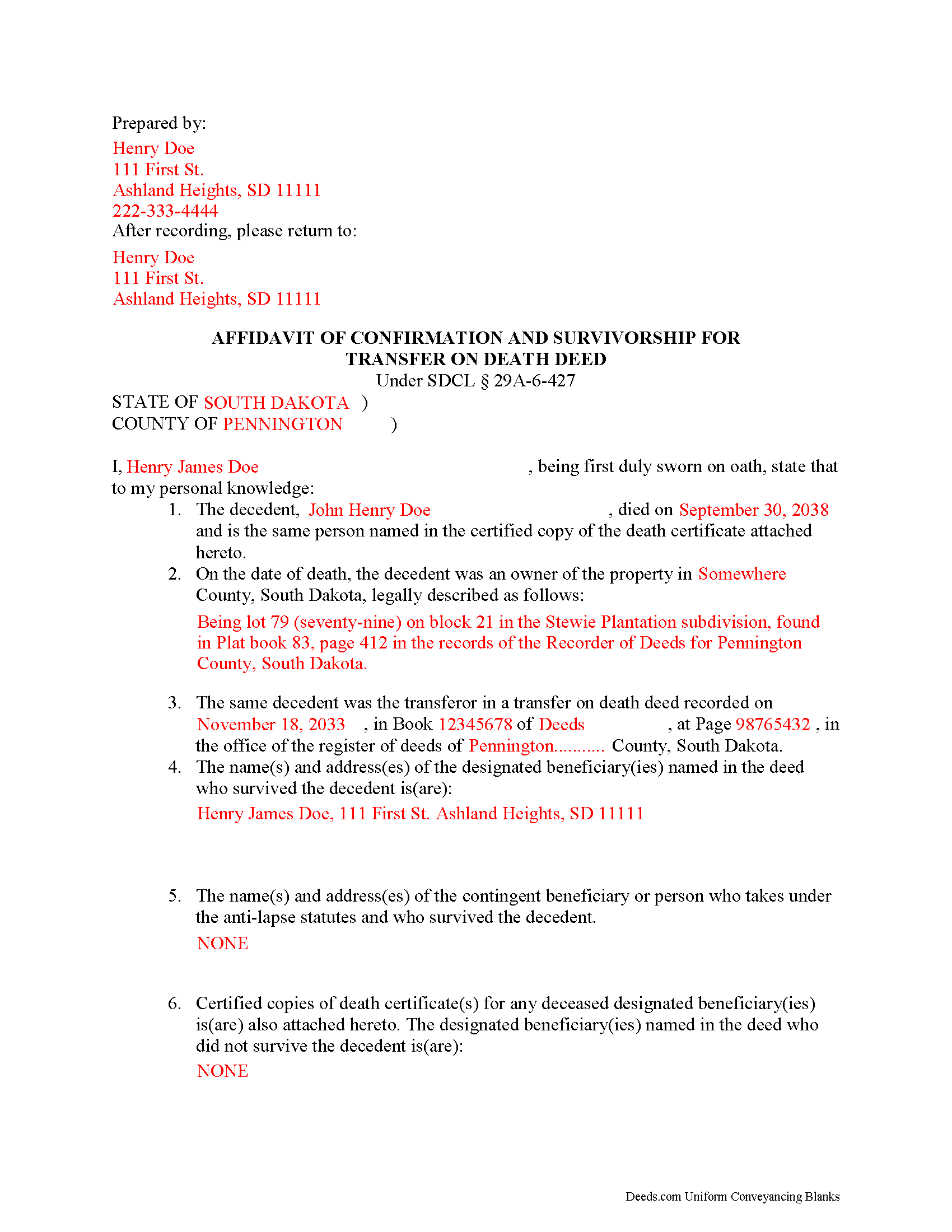

Mccook County Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Mccook County documents included at no extra charge:

Where to Record Your Documents

McCook County Register of Deeds

Salem, South Dakota 57058-0338

Hours: 8:30am to 4:30pm.M-F

Phone: (605) 425-2701

Recording Tips for Mccook County:

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Mccook County

Properties in any of these areas use Mccook County forms:

- Bridgewater

- Canistota

- Montrose

- Salem

- Spencer

Hours, fees, requirements, and more for Mccook County

How do I get my forms?

Forms are available for immediate download after payment. The Mccook County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mccook County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mccook County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mccook County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mccook County?

Recording fees in Mccook County vary. Contact the recorder's office at (605) 425-2701 for current fees.

Questions answered? Let's get started!

Completing a Transfer on Death Using South Dakota's Affidavit of Confirmation

The South Dakota Real Property Transfer on Death Act can be reviewed in its entirety at SDCL 29A-6-401 et seq. By applying this law, owners of real estate located in South Dakota may designate one or more beneficiaries to gain title to their land after the transferor's death, without a will or the need for probate distribution. A lawfully executed and recorded transfer on death deed (TODD) allows owners to retain absolute possession of and control over their property. The TODDs are revocable, so the owners may also modify or even cancel the potential future interest without penalty.

The act contains the specific requirements for conveying ownership after the owner's death (29A-6-427). According to this section, the beneficiary must complete an affidavit of confirmation and submit it for recording to the register of deeds in the county where the property is located. The affidavit of confirmation must be verified before a person authorized to administer oaths and must be accompanied by a certified copy of the death certificate for the deceased owner and for each designated beneficiary who died while the owner was still alive.

A valid affidavit of confirmation provides the name and address of each transfer on death beneficiary who survives the deceased owner. If the named beneficiary is deceased, include the name and address of the contingent beneficiary or person who takes under the anti-lapse statutes. It must also contain the date of the owner's death, the legal description of the property, names and addresses of all primary beneficiaries identified on the original TODD.

Because each situation is unique, please contact an attorney with specific questions or for complex circumstances.

(South Dakota TOD Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Mccook County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Affidavit meets all recording requirements specific to Mccook County.

Our Promise

The documents you receive here will meet, or exceed, the Mccook County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mccook County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Rebecca M.

December 28th, 2021

This was pretty easy to fill out. The directions on all of the forms was very good. This should make life much easier at the County Recorder. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine P.

January 15th, 2019

I was hoping to find information of a property belonging to my grandparents. Your site says it can go back 10-20 years I will just have to go to the courthouse and research. But very good site if your looking for recent information.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory h.

February 15th, 2023

OUtsdtanding. Quick and easy, both of which are a huge plus

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

scott m.

February 21st, 2021

thanks- easy as pie.

Thank you!

Kenneth-Wayne L.

August 20th, 2020

1) I was very pleased when the staff mentioned your service since the three referenced on the Recorder's website all wanted HUGE Account set-up and maintenance fees AND BIG fees per recording, and yours has no set-up fee AND nominal per-recording fee; 2) My (few) recordings will be NON-LAND Related, summary or entire record(s) of Administrative (Procedures Act) records, Other than the Border width and Cover Sheet, do you anticipate any other special requirements for such recording(s)? NOTE: I just sent one by Snail Mail, and they just informed me that due to the GERMIPHOBIA 'Pandemic' the ONLY open and record Snail Mail ONCE A MONTH On the first of each chmonth!

Thank you!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

Pierre M.

October 13th, 2020

The form was very easy to fill out. The instructions were clear. Overall, a very user friendly product that made my job easier. Thanks you.

Thank you!

Janice H.

June 21st, 2023

Thank you, easy to fill out forms. Now I can relax, knowing that this is done.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kristie B.

August 19th, 2022

Horrible. As an agent, trying to find a simple answer was never accomplished.

Sorry to hear that Kristie. We do hope that you found what you were looking for elsewhere.

DONNA P.

July 21st, 2020

Deeds.com was quick, efficient, and cost effective. Deeds.com works with individuals where I found other companies only offer services to title companies, settlement companies, etc. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Cathy S.

November 11th, 2021

My experience on the site was very easy to navigate to find just what I needed.

Thank you!

Katherine Y.

January 22nd, 2019

It was easy to use the form. The notary said it contained the most recent language which is also helpful.

Thanks Katherine!

calvin b.

February 21st, 2023

They offer a great service. Also they have been responsive and professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis S.

October 24th, 2020

I am still working on the forms. I am having problems doing the forms as you can only save as pdf and it is difficult to change or modify the pdf. You have to purchase a pdf convertor program. but all seems to be there to do the deed submittals.

Thank you for your feedback. We really appreciate it. Have a great day!

Remi W.

April 13th, 2020

Submitting documents electronically through Deeds.com saved me time and provided the best possible service for me in the comfort of my own home. There's no faster, better way to record documents than e-recording with Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!