Sully County Transfer on Death Revocation Form

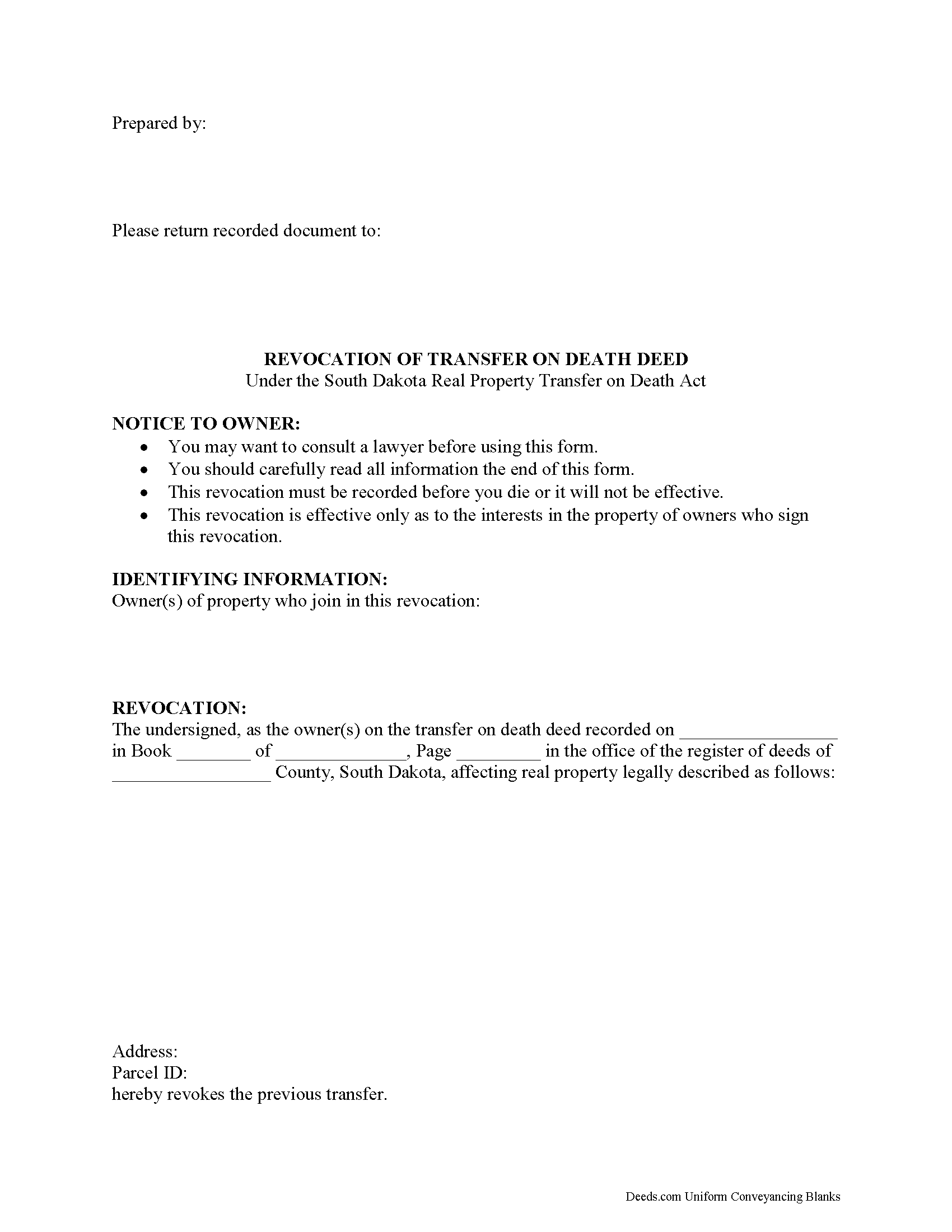

Sully County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

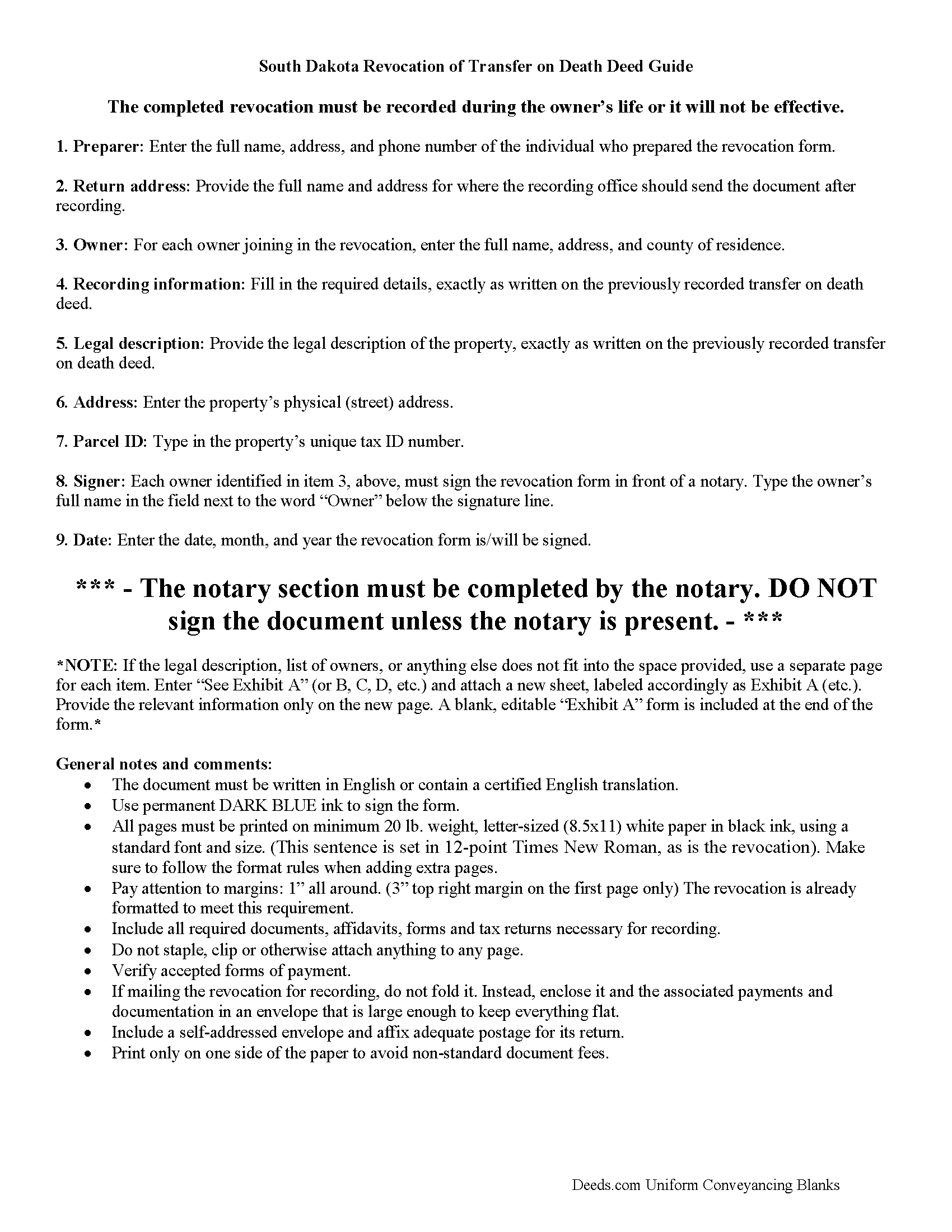

Sully County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

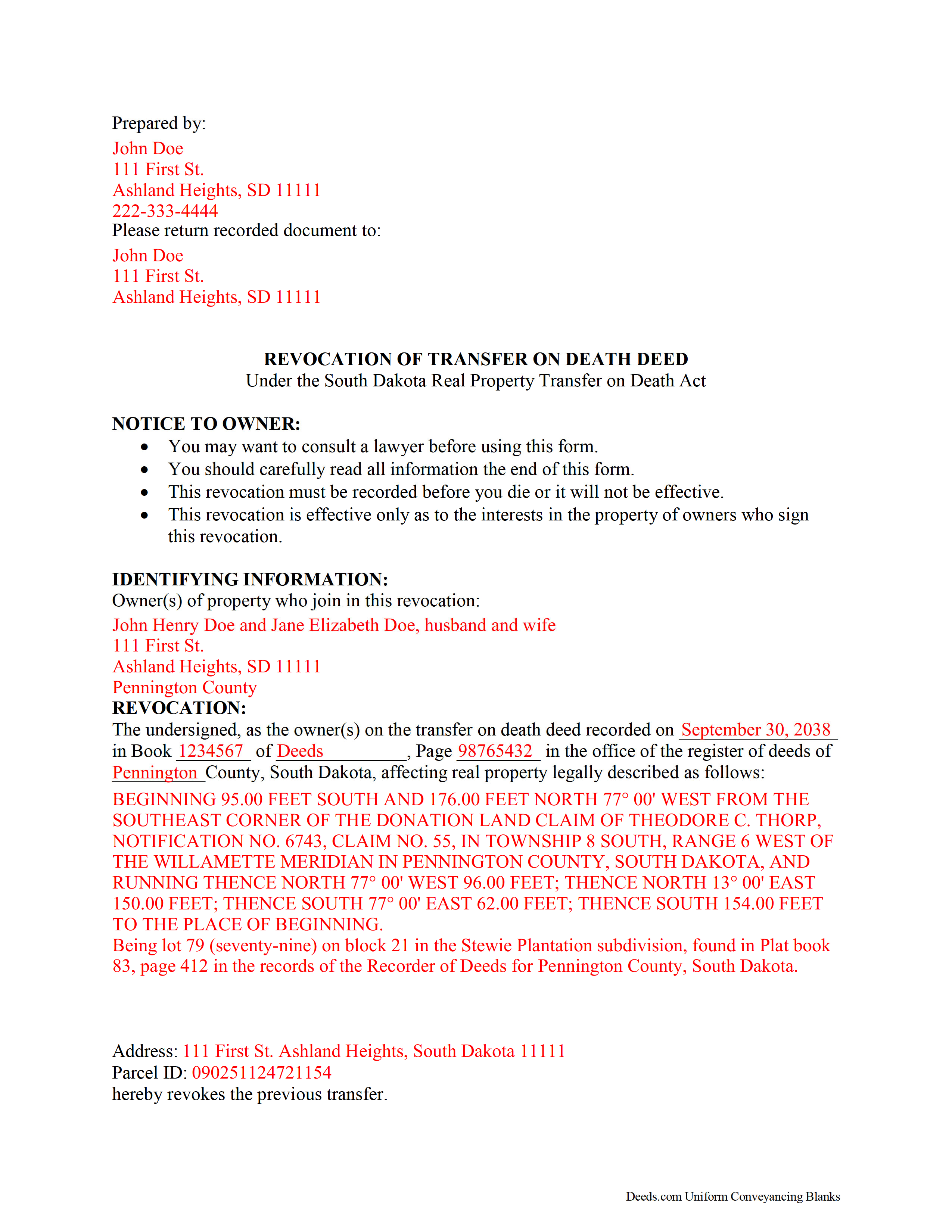

Sully County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Sully County documents included at no extra charge:

Where to Record Your Documents

Sully County Register of Deeds

Onida, South Dakota 57564

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 258-2331

Recording Tips for Sully County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Sully County

Properties in any of these areas use Sully County forms:

- Agar

- Onida

Hours, fees, requirements, and more for Sully County

How do I get my forms?

Forms are available for immediate download after payment. The Sully County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sully County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sully County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sully County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sully County?

Recording fees in Sully County vary. Contact the recorder's office at (605) 258-2331 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in South Dakota

The South Dakota Real Property Transfer on Death Act (SDCL 29A-6-401 et seq) went into effect on July 1, 2014. It offers owners of real estate in South Dakota an option for distributing their land after death by recording a transfer on death deed (TODD). They retain absolute control over and use of the land during their lives. The transferors may even modify or revoke the future transfer without penalty, and there is no need to update their wills or subject the property to probate.

This revocability is one of the most useful features about transfer on death deeds (TODDs) under the new law is (29A-6-405). It states that a TODD "is revocable even if the deed or another instrument contains a contrary provision." This is possible for two main reasons:

<ul><li>there is no obligation for consideration from or notice to any named beneficiaries (29A-6-409); and </li>

<li>until the owner's death, the beneficiaries have no actual, or present, interest in the property (29A-6-414).</li></ul>

Find the rules for revoking a previously recorded TODD at 29A-6-410. Subject to 29A-6-411, there are three primary ways to revoke or change the future transfer: Execute and record<ul>

<li>a new transfer on death deed that revokes the earlier TODD;</li>

<li>an instrument of revocation that expressly revokes the deed or part of the deed; or</li>

<li>an "standard" deed, such as a warranty or quitclaim deed that expressly revokes the transfer on death deed or part of the deed.</li></ul>

Note that, just as with the original transfer on death deed, any instrument of revocation must be recorded before the transferor's death in the public records in the office of the register of deeds in the county where the deed is recorded. See 29A-6-411 for information about joint owners.

Life is uncertain, and the flexibility of TODDs helps landowners respond to changes in circumstances with relative ease. Each case is unique, so contact an attorney with specific questions or for complex situations.

(South Dakota TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Sully County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Sully County.

Our Promise

The documents you receive here will meet, or exceed, the Sully County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sully County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kimberly E.

July 6th, 2019

It was very easy to order,download, and print. The only issue I have is that the guide that came with my form really did not help me filling it out. I feel the explanations could have been better and suited more for the standard person. I was still confused when filling it out and will probably have to get a lawyer to make sure it's filled out correctly

Thank you for your feedback. We really appreciate it. Have a great day!

Masud K.

June 20th, 2020

Deeds.com did an excellent job in providing me the Real Estate documents I needed. You delivered the documents fast and they were accurate. I greatly appreciate your help. Thanks for everything

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kim H.

October 17th, 2020

Great site. quick turnaround and communication. I needed an exception that they told me I needed and where to get the info within hours. I returned warranty deed with exception and the deed was recorded the same day! Great turnaround!

Thank you for your feedback. We really appreciate it. Have a great day!

John P.

August 11th, 2020

very good. received what i ordered in a timely fashion despite my incompetence.

Thank you for your feedback. We really appreciate it. Have a great day!

Brian R.

January 15th, 2022

A waste of my time

We do hope that you found something more suitable to your needs elsewhere Brian. Have a wonderful day.

Christina A G.

December 19th, 2020

It was easy to locate, purchase, and download the documents I needed on the Deeds.com website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

steven l.

July 29th, 2020

As a first time user and not having knowledge of how your site worked it was awkward to upload a file and not know what to do next. I found out there is nothing to do next but that after some time looking for a submit button or some kind of confirmation that I was doing the right thing. Ended up being very easy, just wasted time trying to figure out what to do when there was nothing left to do.

Thank you!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

Trace A.

June 3rd, 2023

Deeds.com had much better and fuller information than any other help i found (90% complete vs 60 % complete); they tout how up-to-date they are on all the counties in the country and the idiosyncrasies of each county's forms and procedures; but some minor points of the info i needed were missing or confusing. Including that they sold me on e-Recording my deed through them, only to find out after i had done all the prep for that, that they had failed to tell me upfront (or i missed it somehow) that the county i was dealing with did not yet accept online recording. So, they were by far the best i found, but not 100%.

Thank you for your honest and thorough feedback Trace. We will review your concerns carefully in an effort to improve our services. Hope you have an amazing day.

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Amanda S.

April 3rd, 2019

Thank you! My husband and I went in the get notary stamps for a Special Warranty Deed and a Post Nuptial Agreement. The representative was very knowledgeable and thorough with the notary process. She made sure we read and understood all documents that we were signing and they required us to recite in sworn statements that everything there was true and understood! I will be using the notary service again at Bank of America! The representative was very respectful and had a nice smile the entire time to make our visit great!

Thank you!

John B.

November 15th, 2023

Fantastic service, easy to use, and supported the entire way through every process. Excellent service!

We are motivated by your feedback to continue delivering excellence. Thank you!

Audra M.

December 28th, 2020

It was easy to e-record and will/would recommend it to everyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

Deborah G.

June 4th, 2019

Great website and very easy to use

Thank you for your feedback Deborah, we really appreciate it. Have a great day!