Miner County Trustee Deed Form

Miner County Trustee Deed Form

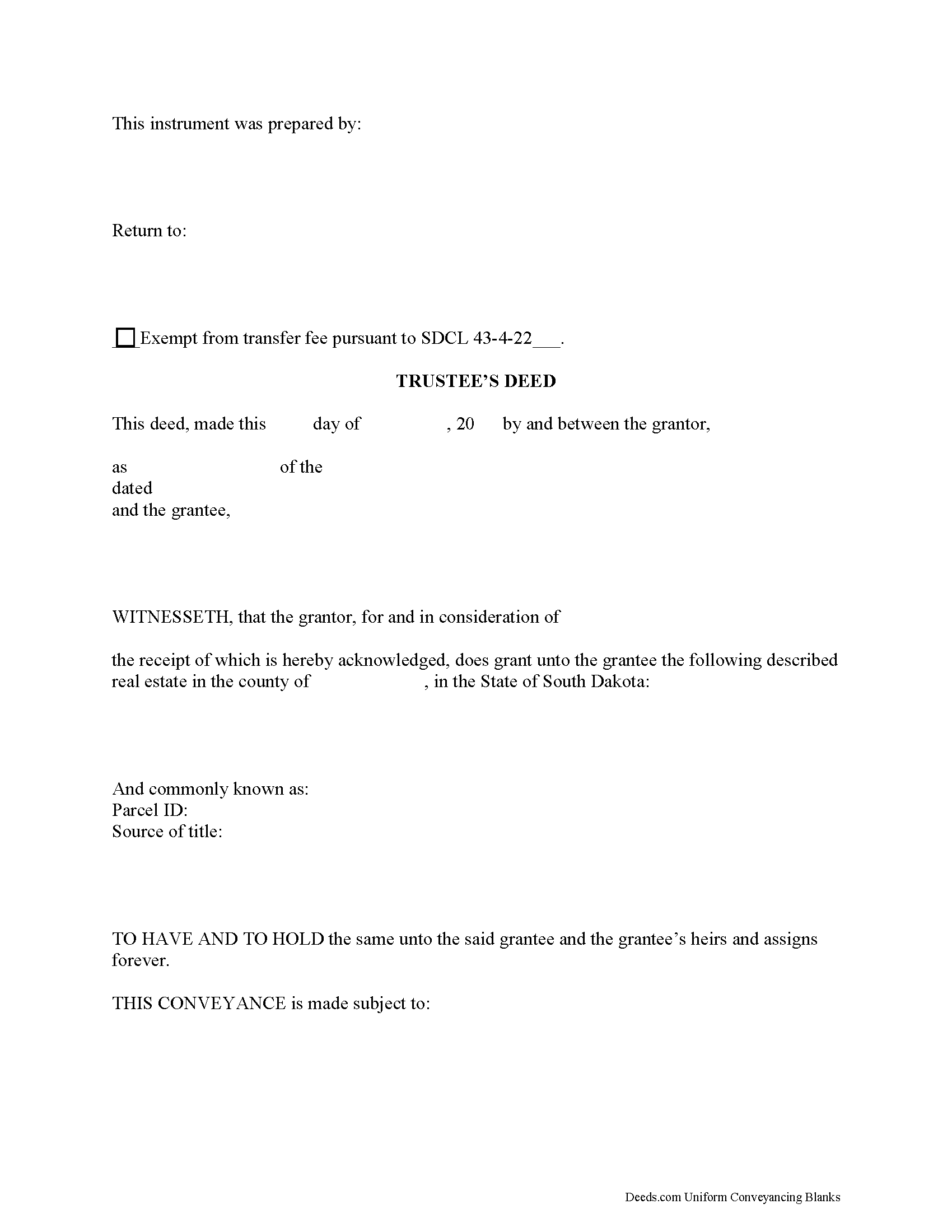

Fill in the blank form formatted to comply with all recording and content requirements.

Miner County Trustee Deed Guide

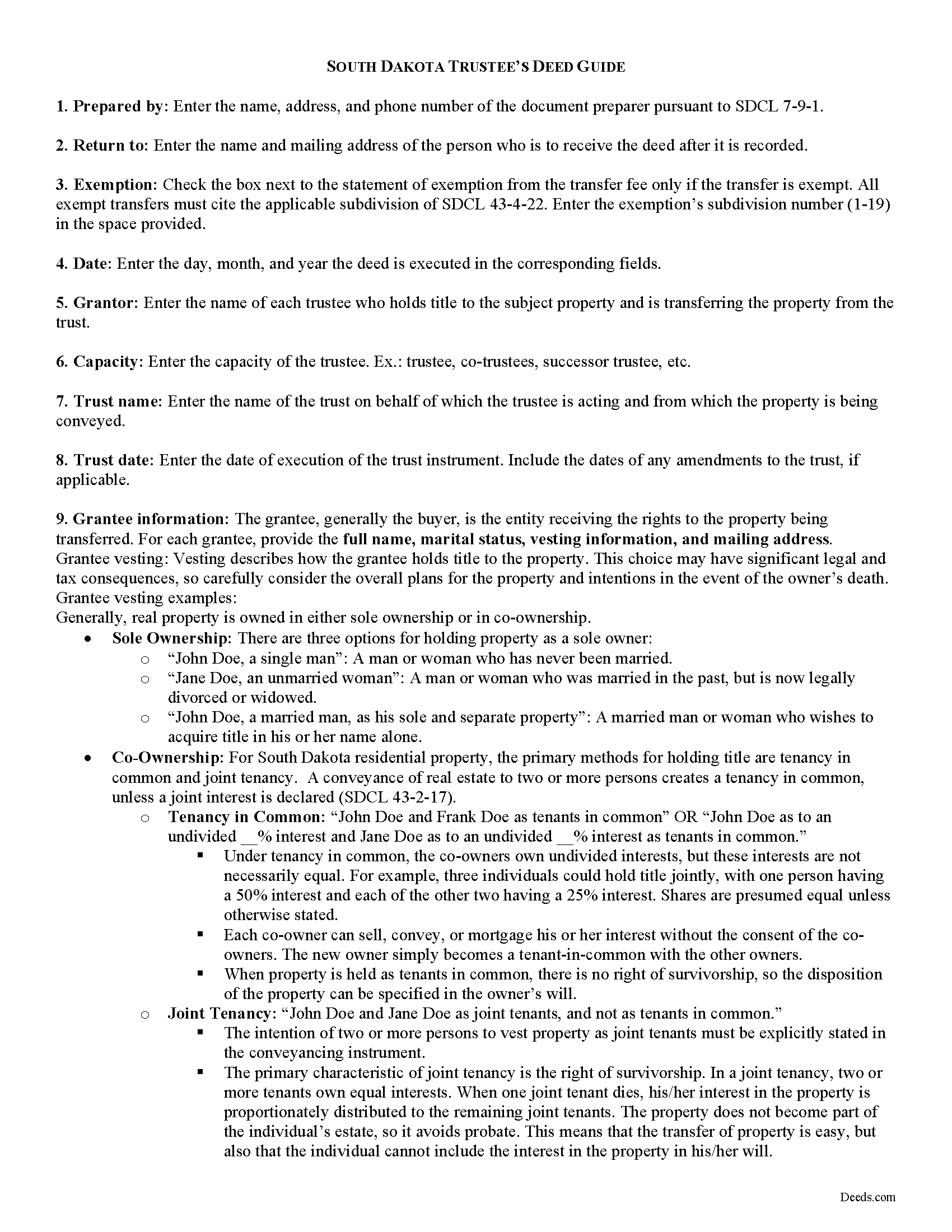

Line by line guide explaining every blank on the form.

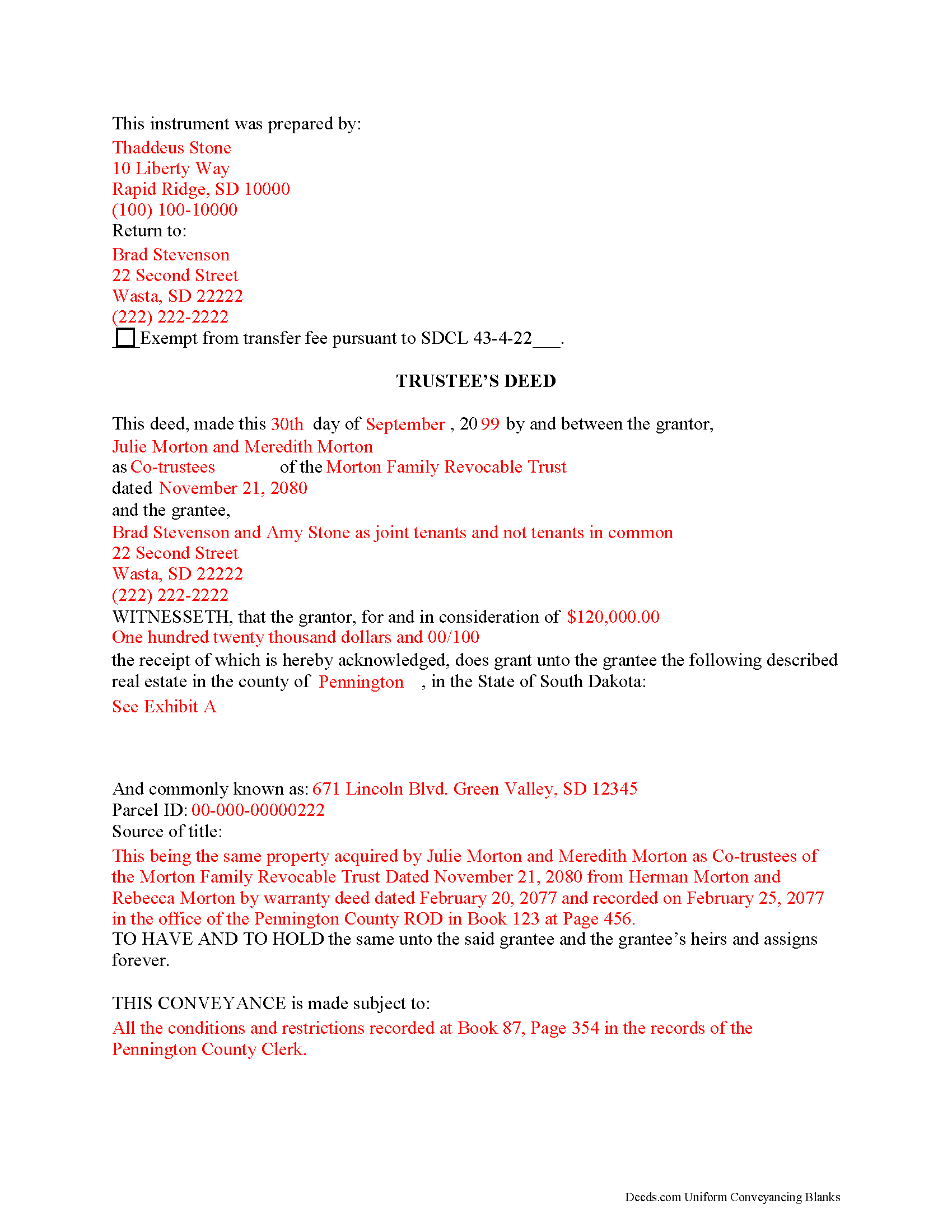

Miner County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Miner County documents included at no extra charge:

Where to Record Your Documents

Miner County Register of Deeds

Howard, South Dakota 57349

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 772-5621

Recording Tips for Miner County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Miner County

Properties in any of these areas use Miner County forms:

- Canova

- Carthage

- Fedora

- Howard

Hours, fees, requirements, and more for Miner County

How do I get my forms?

Forms are available for immediate download after payment. The Miner County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Miner County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Miner County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Miner County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Miner County?

Recording fees in Miner County vary. Contact the recorder's office at (605) 772-5621 for current fees.

Questions answered? Let's get started!

Transferring Real Property by Trust in South Dakota

In a trust arrangement, a settlor transfers property (which may include real estate) to another person (called the trustee) for the benefit of another (called the beneficiary). Trusts that take effect during the settlor's lifetime are called living (inter vivos) trusts, and trusts that take effect upon the settlor's (testator's) death through the provisions of a will are called testamentary trusts.

In a living trust, a settlor may serve in all three capacities, as long as he is not the sole beneficiary. Living trusts are estate planning tools that take effect during a settlors' lifetime and allow them to determine how their assets will be managed upon death.

In South Dakota, trusts relating to real property must be created by a written instrument signed by the trustee (SDCL 43-10-4). The trust instrument establishes the trust's provisions, determines how the trust will be managed, designates the trustee and the trustee's powers, and identifies the trust beneficiary. Trust instruments are generally unrecorded in order to maintain the privacy of the settlor's estate plan. Transfers of real property to into trust can either occur concurrently with execution of the trust instrument, or the settlor can execute a later deed titling the property in the name of the trustee on behalf of the trust.

Unless otherwise limited by the terms of the trust, a trustee has a statutory power to "acquire, sell, or otherwise dispose of an asset" (SDCL 55-1A-11). Most trust instruments specifically include a power of sale. Transferring real property from a living trust requires a trustee's deed. A trustee's deed is named for the executing party rather than for the type of warranty conveyed.

In South Dakota, a trustee's deed carries the implied covenants typically associated with a special warranty deed. The word "grant" in the granting clause implies that "the grantor has not conveyed the same estate...to any person other than the grantee" and that "such estate is...free from encumbrances done, made, or suffered by the grantor, or any person claiming under him" (43-25-10).

In titling the property in the name of the grantee, the form of the trustee's deed names each granting trustee and the name and date of the trust on behalf of which the trustee is acting. A valid instrument also includes all requirements for documents relating to real property, such as a legal description of the subject parcel, and compliance with the recording prerequisites established at SDCL 43-28-23. Transfers of property in South Dakota require a certificate of real estate value and payment of applicable transfer fees.

Before recording the deed in the applicable county, it must be signed by each granting trustee in the presence of a notary public. At the time of conveyance, the trustee may also execute a certificate of trust in support of a real property transaction under SDCL 55-4-51.3 to confirm the trust's existence and his authority to convey the property.

Consult a lawyer in the preparation of a trustee's deed in South Dakota. Trust law can quickly become complex, and each situation requires unique attention.

(South Dakota TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Miner County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Miner County.

Our Promise

The documents you receive here will meet, or exceed, the Miner County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Miner County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Heidi G.

July 20th, 2019

I have not yet actually completed the entire process. However, the preliminary documents, ability to try them and ease of filling them out is pretty nice, so far.

Thank you!

Lahoma G.

February 3rd, 2021

Got it very fast !! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Billy R.

May 18th, 2021

Thank you...........easy process........Billy C

Thank you!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Ruth K.

October 11th, 2022

this is the only site that helped me out

Thank you!

Kimberly R.

March 18th, 2024

Love this site. Very informative and helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Saul N.

June 13th, 2023

Great and fast service. Would have been grate to have seen a little more detail or a pre-filled sample in the fields. Had a little confussion in some of the lines to fill out since the guide only explains a few of the lines not all of them. Otherwise, is really great to have this service with low cost. Thank you.

Thank you for taking the time to provide us with your feedback Saul, we appreciate you.

Jennifer A.

May 20th, 2020

Great site

Thank you!

Tom D.

May 4th, 2019

I have one suggestion and couple of question I would think that most TOD's would be from married couples. It would be real helpful to have a example of the I(we) block for married couples. Why would I check or not check the "property is registered (torrents)" Do I need a notarized signature of the Grantee

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa B.

July 15th, 2021

Very helpful and fast.

Thank you!

JUDITH-DIAN W.

June 28th, 2023

I didn't have any problem downloading and filling out the form on my computer and printing it yesterday. I didn't know what to put for "Source of Title". I called the county recording office; they didn't know either and said to leave it blank. I got the form notarized at my bank and took it in to the recording office. They checked it, accepted it, I paid a fee, and it's done. So easy. My children will appreciate that I've done this. Added note: You do have one typo on your form--you left out 'at'. It should read: "You should carefully read all information at the end of this form."

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela R.

April 8th, 2022

Thank you for this excellent website. Obtaining appropriate forms was very easy. Thank you!

Thank you!

bruce t.

May 16th, 2022

Much good information provided. Forms easy to use. Price is a bargain.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jackie C.

February 20th, 2022

Easy process!

Thank you!

Linda D.

July 17th, 2019

It was easy to download the form I wanted BUT there were 2 other options listed for "open/download." I didn't want to risk more charges for something I couldn't determine I needed so I passed them up. There were a few others listed with the option to "view" so I did that, without down-loading, and there were no additional charges. I would've liked that opportunity for 2 others that didn't offer "view" so maybe deeds.com missed a sale?

Thank you for your feedback Linda. All the documents available for download in your account are included with your payment, no additional charges.