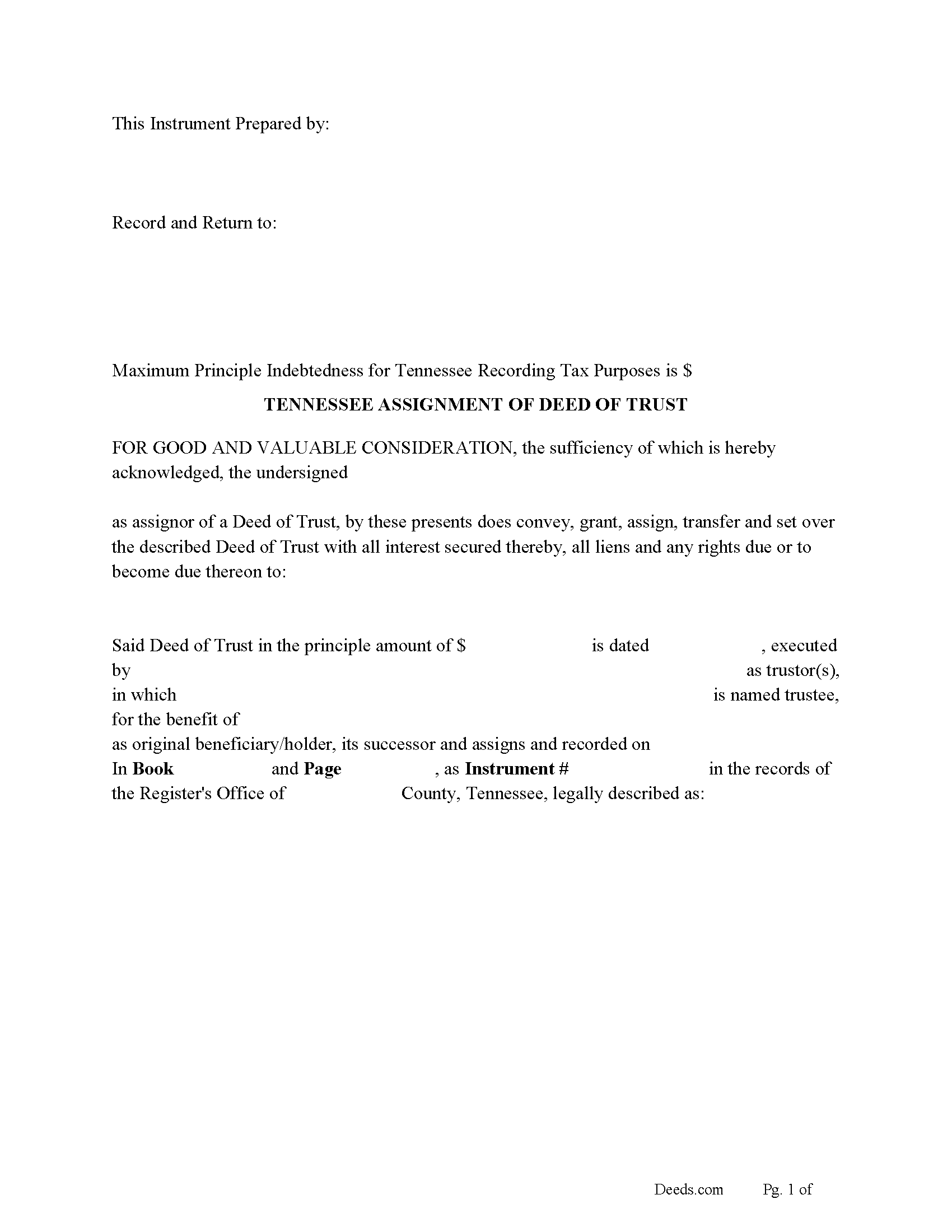

Anderson County Assignment of Deed of Trust Form

Anderson County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

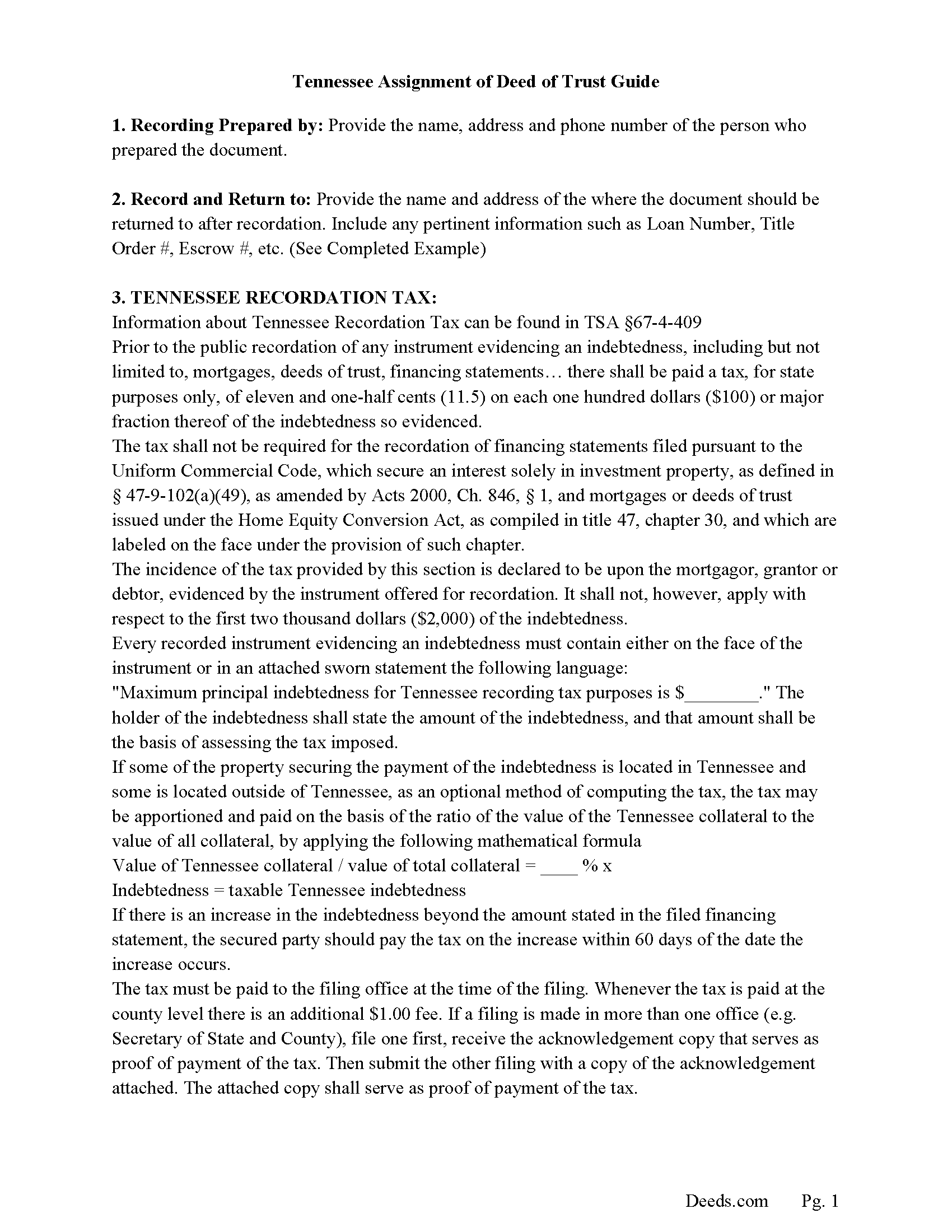

Anderson County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

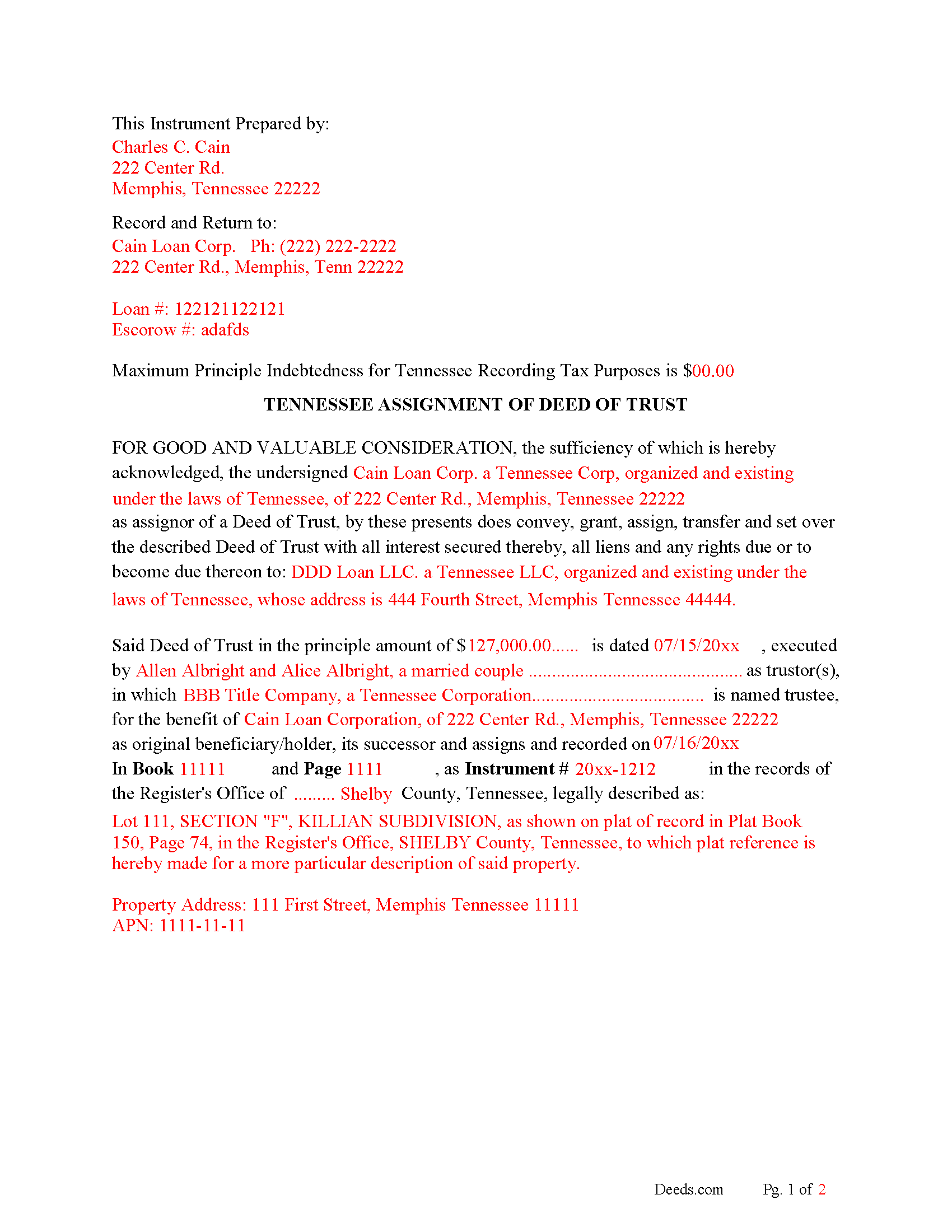

Anderson County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

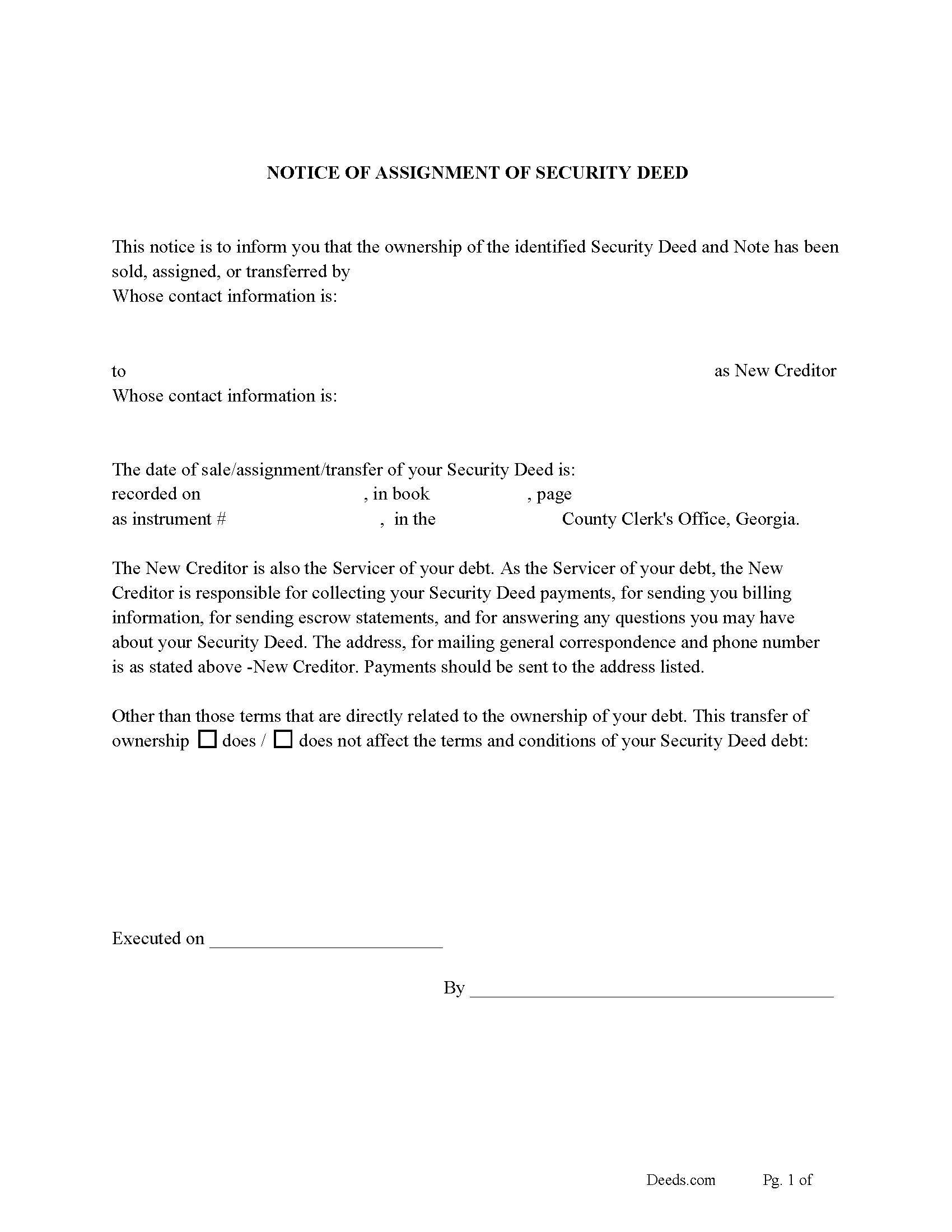

Anderson County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

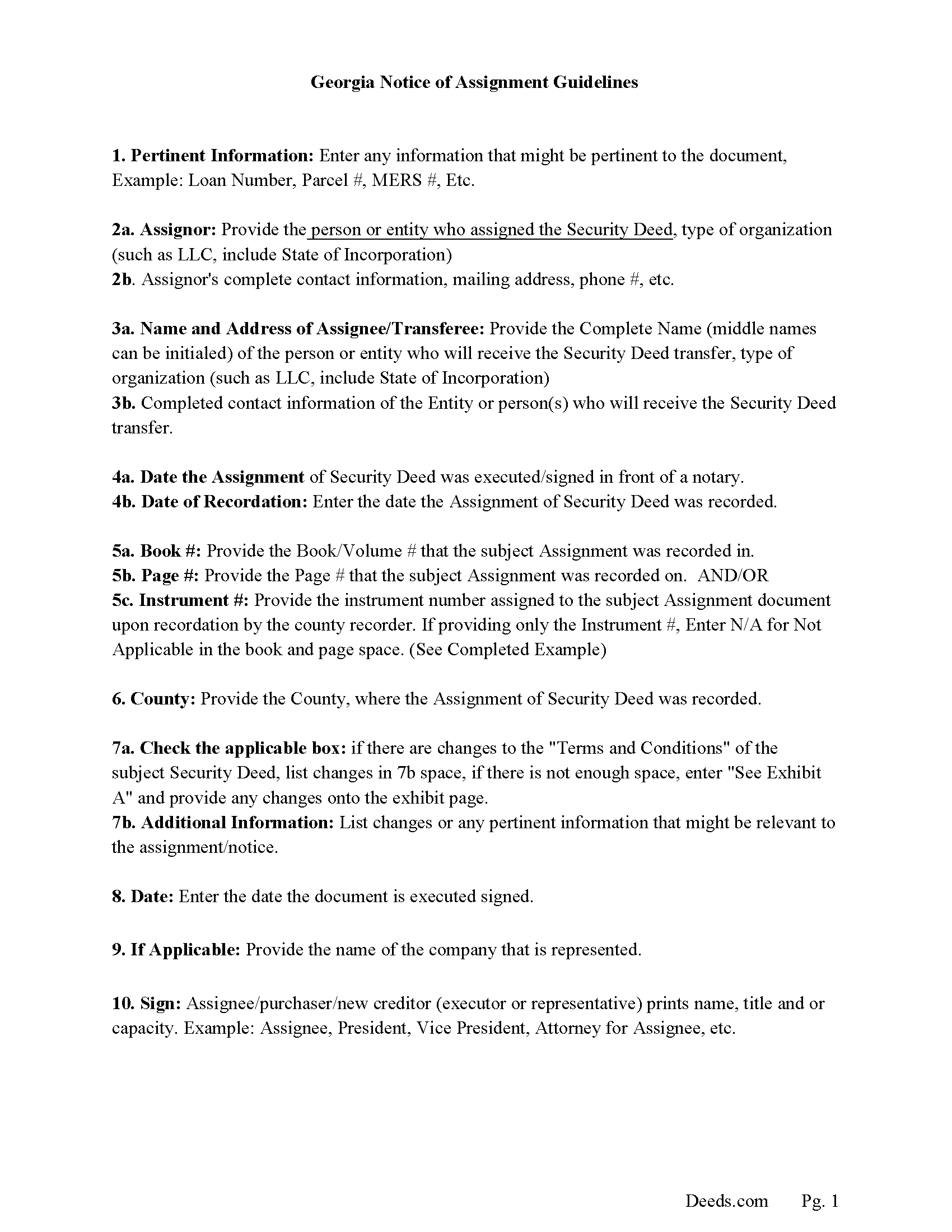

Anderson County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

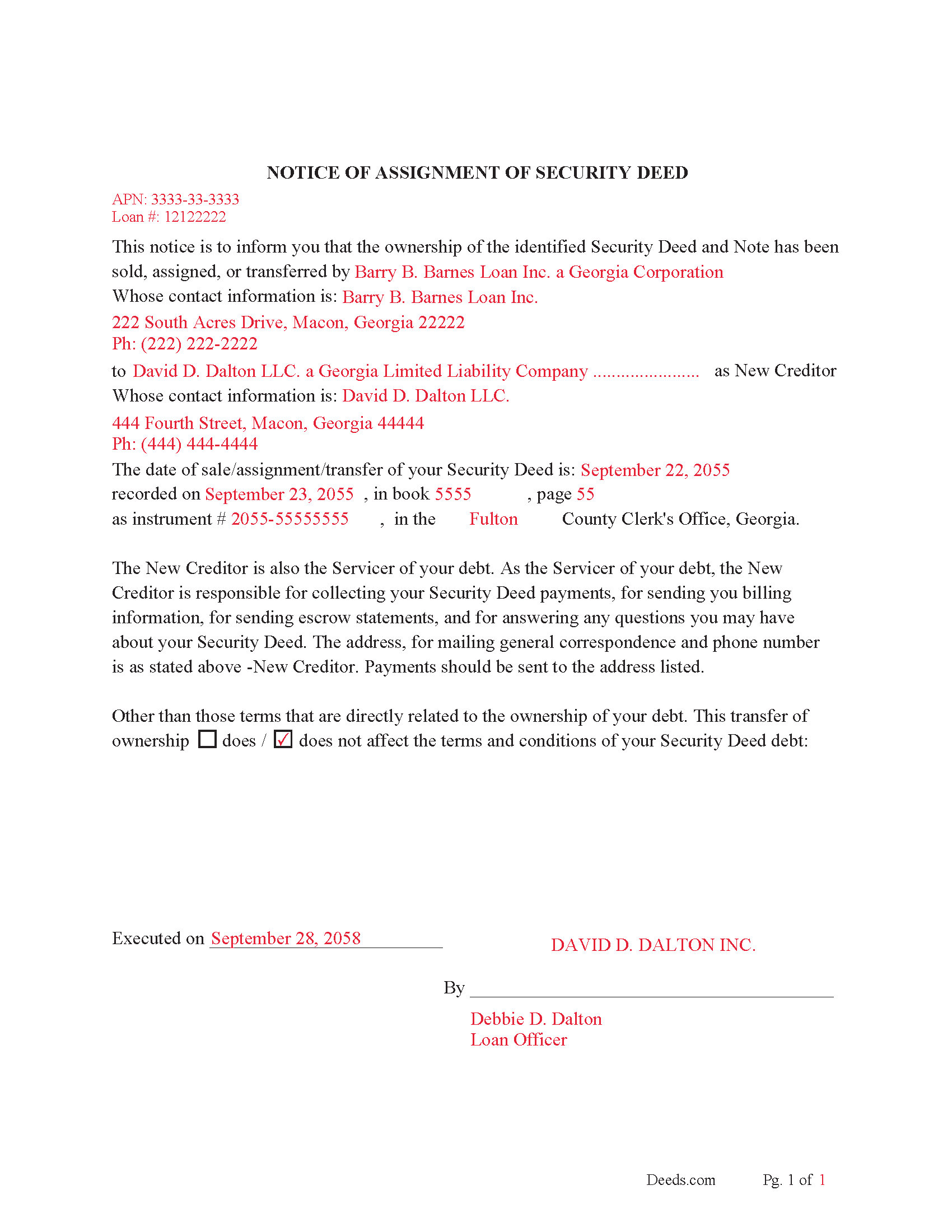

Anderson County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Anderson County documents included at no extra charge:

Where to Record Your Documents

Anderson County Register of Deeds

Clinton, Tennessee 37716

Hours: 8:00 to 5:00 M-F

Phone: (865) 457-6236

Recording Tips for Anderson County:

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Anderson County

Properties in any of these areas use Anderson County forms:

- Andersonville

- Briceville

- Clinton

- Lake City

- Norris

- Oak Ridge

Hours, fees, requirements, and more for Anderson County

How do I get my forms?

Forms are available for immediate download after payment. The Anderson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Anderson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Anderson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Anderson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Anderson County?

Recording fees in Anderson County vary. Contact the recorder's office at (865) 457-6236 for current fees.

Questions answered? Let's get started!

This form is used by the current lender/beneficiary to Assign/transfer a Deed of Trust and Promissory Note to another party, this is usually done when a note has been sold.

Recording requirements include:

- Assignor & assignee

- Debtor's name

- Reference original Volume & Page of assigned document

- Maximum Principal Indebtedness for Tennessee Recording Tax Purposes is $0 (If amount is listed taxes must be paid)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Tennessee Assignment of DOT Package includes form, guidelines, and completed example) For use in Tennessee only.

Important: Your property must be located in Anderson County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Anderson County.

Our Promise

The documents you receive here will meet, or exceed, the Anderson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Anderson County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Joan B.

March 27th, 2023

So quick and easy! No searching for a parking place or waiting in line. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jan K.

August 21st, 2019

Very simple and easy, quick!

Thank you for your feedback. We really appreciate it. Have a great day!

Kyle E.

November 8th, 2023

Works great thank you for saving us driving time!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary G.

March 7th, 2021

Deeds.com was a fast and easy site to use the staff answered my questions online efficiently

Thank you!

Janice S.

August 31st, 2022

All instructions and forms are very easy to read and fill-out. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Erik H.

July 16th, 2020

tl;dr - Bookmarked and anticipating using this site for years to come. My justification for rating 5/5 1. Provide intuitive method for requesting property records. 2. Cost for records *seems reasonable. 3. They clearly state that interested parties could gather these records at more affordable costs through the county (which was more confusing for an inexperienced person such as myself). I mean, I appreciate and respect this level of honesty. *I didn't shop around too much because it was difficult for me to find other services that could deliver CA property records.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth R.

May 26th, 2023

Easy to use and saves money.

Thank you!

Diana M.

October 18th, 2020

Awesome service. Quick and easy. Complete directions on how to complete the forms with examples for further assistance.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ben F.

April 14th, 2019

My initial review during download and before reading the guide and forms looks promising.

Thank you!

Pamela P.

April 10th, 2021

Access to all the necessary forms was easy. The detailed guide very helpful for ensuring a customer can fill out the documents accurately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard M.

January 9th, 2020

Needed some help at the beginning but once I was into the program it was smooth sailing.

Thank you!

Tiffany P.

May 7th, 2019

Very quick and gave me exactly what I needed! I would have had to go down to the courts and take off work to get this info otherwise.

Thank you for your feedback. We really appreciate it. Have a great day!

Jenifer L.

January 2nd, 2019

I'm an attorney. I see youve mixed up the terms "grantor" and "grantee" and their respective rights in this version. Anyone using it like this might have title troubles down the line.

Thank you for your feedback Jenifer, we have flagged the document for review.

Robert F.

July 11th, 2023

This service is excellent. I submitted a Quickclaim Deed so my home would be in the name of a Living Trust I had just created. This was my first attempted at any of this and the staff person, KVH, who reviewed my Deed was extremely helpful and quick to respond to any questions I had and to make sure the Deed had the correct information before submittal to the county for recording. I started the process one afternoon and by the next day, the Deed was submitted to, and recorded in, my county. I will use them again whenever needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott M.

August 8th, 2024

Very straightforward. Only issue was it took a few times for the mineral deed form to show up. The first few times it instead showed a mineral rights transfer between operators.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!