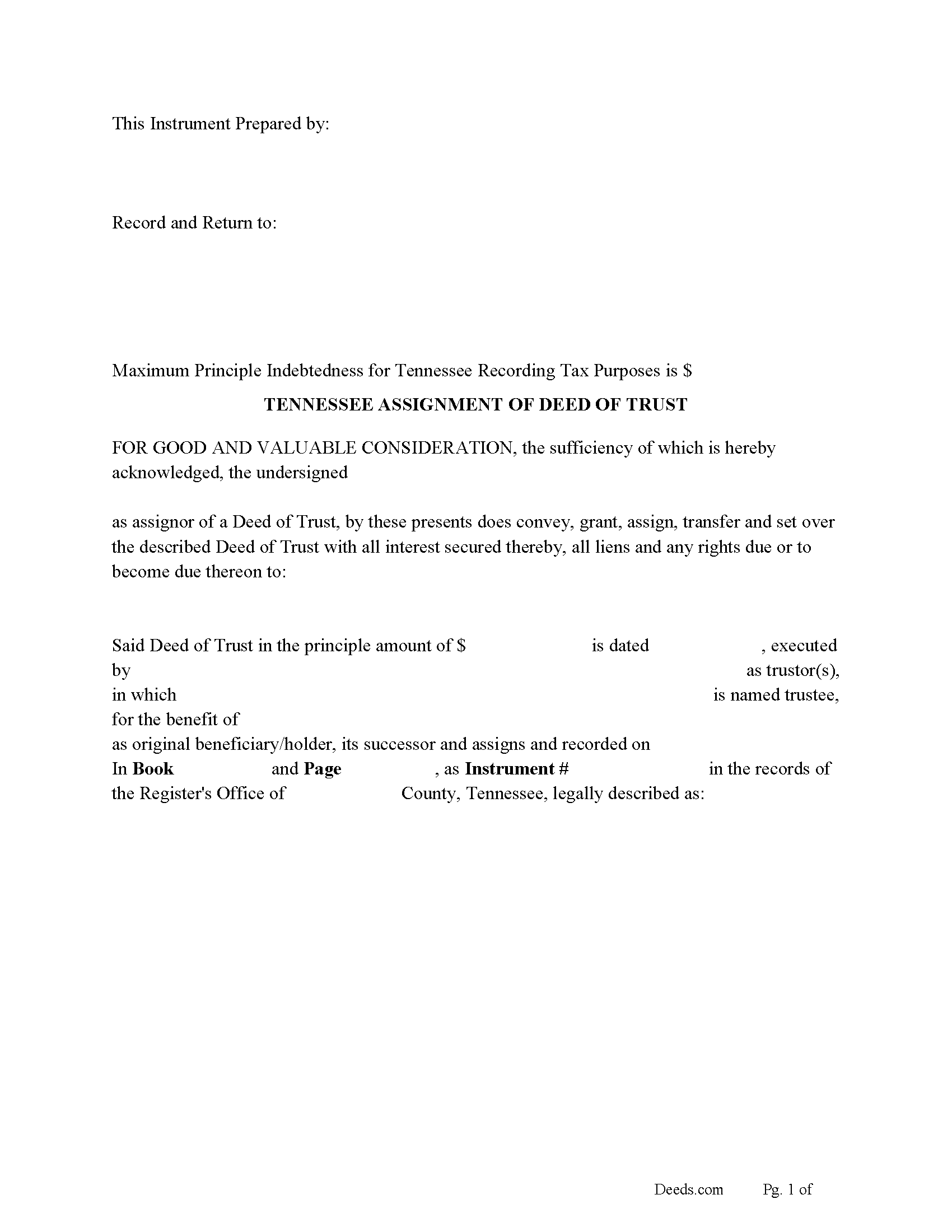

Carroll County Assignment of Deed of Trust Form

Carroll County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

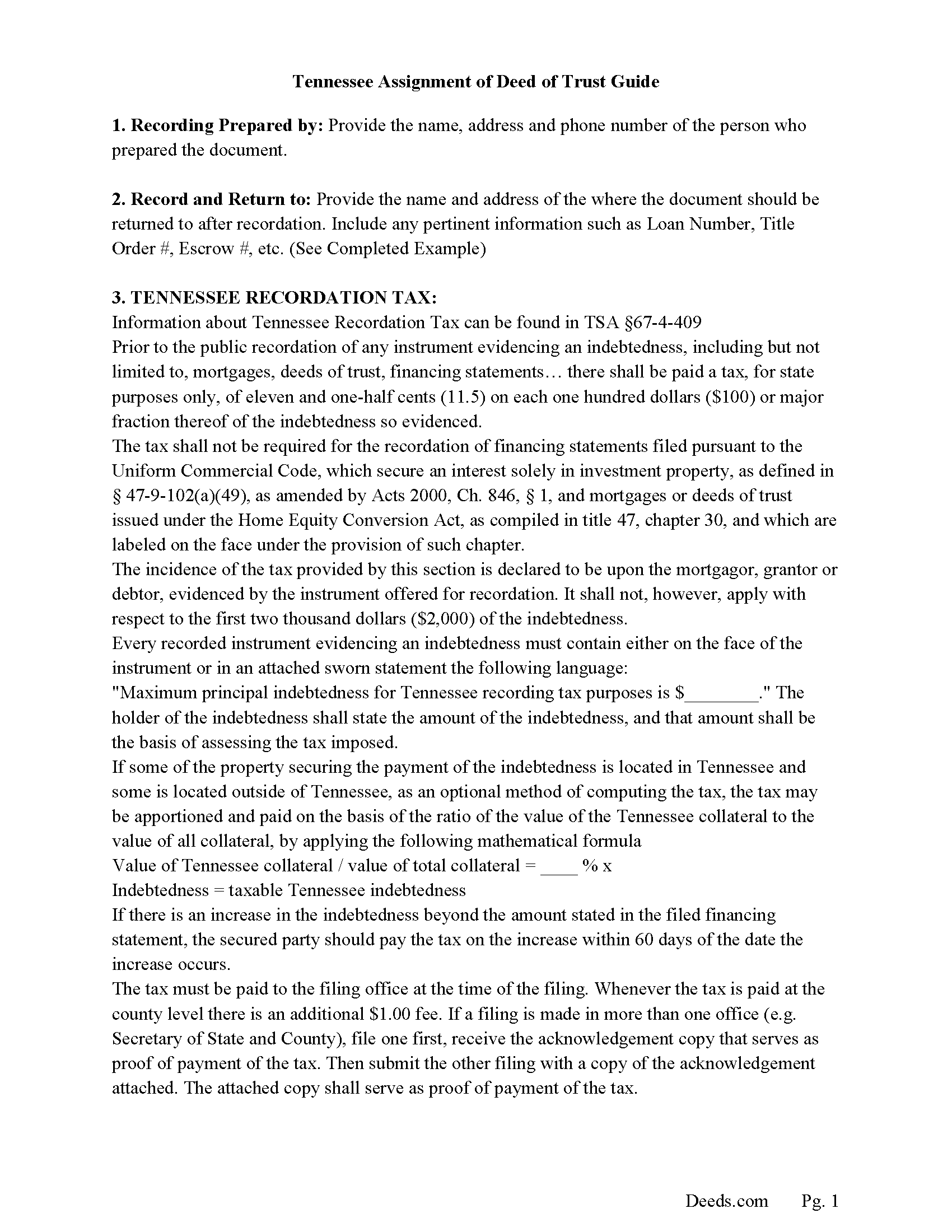

Carroll County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

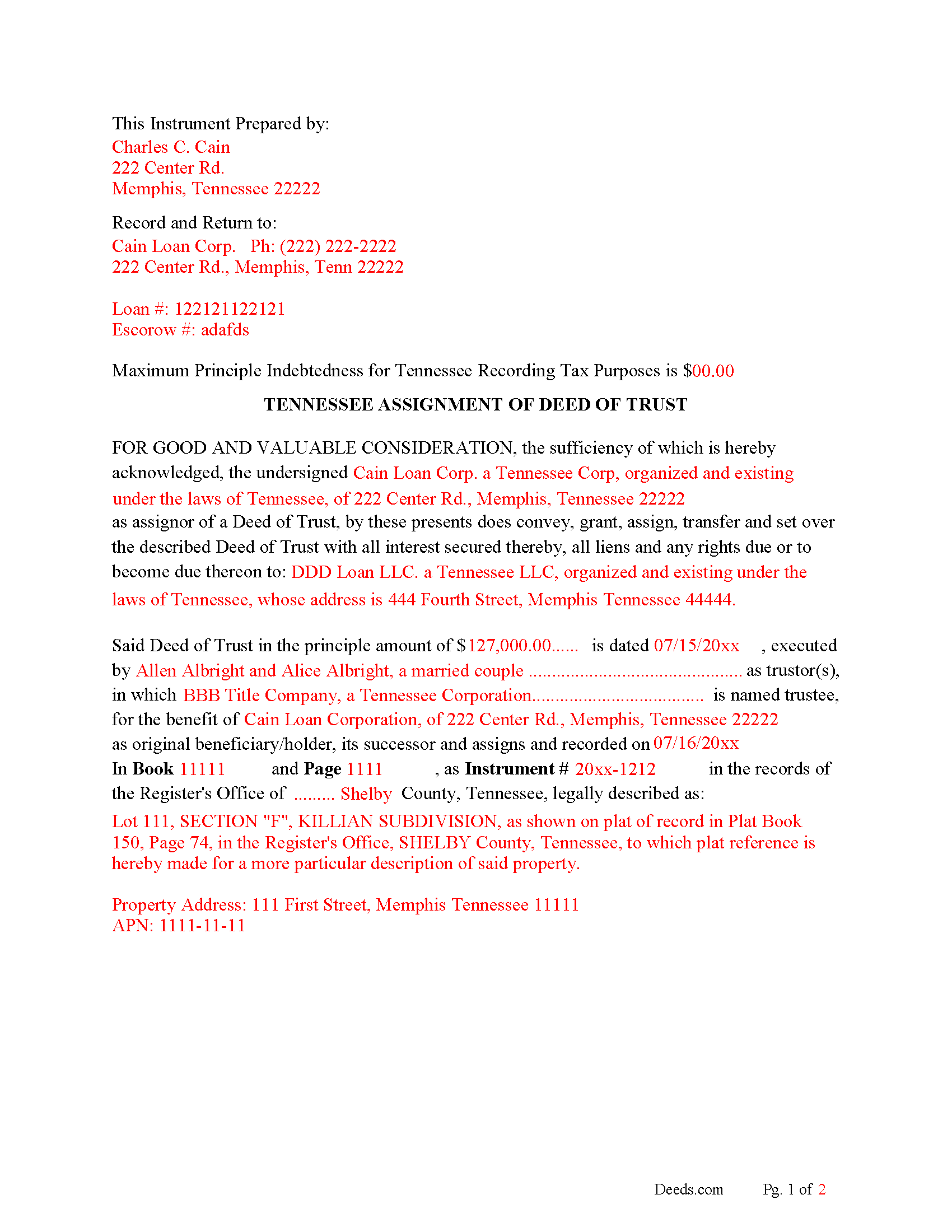

Carroll County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

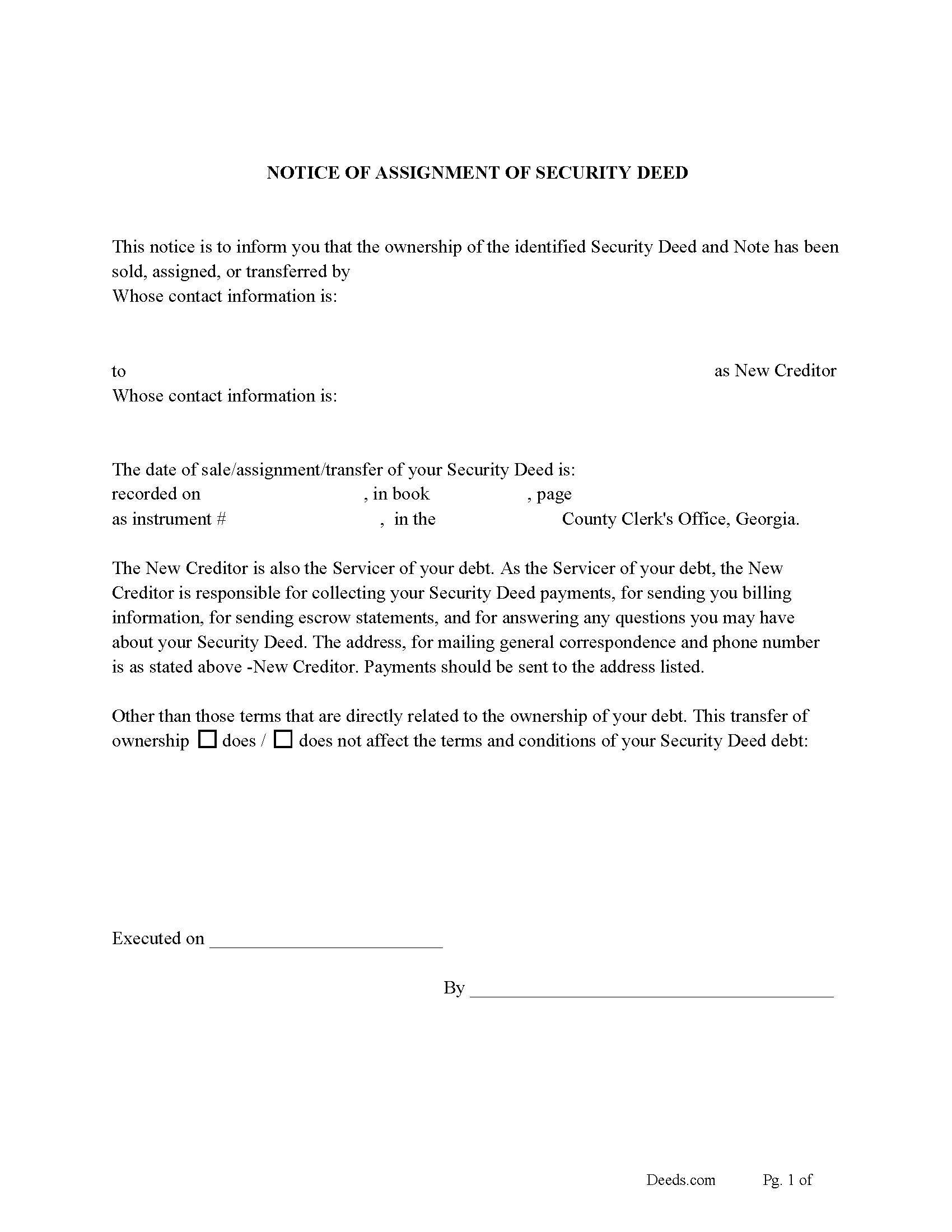

Carroll County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

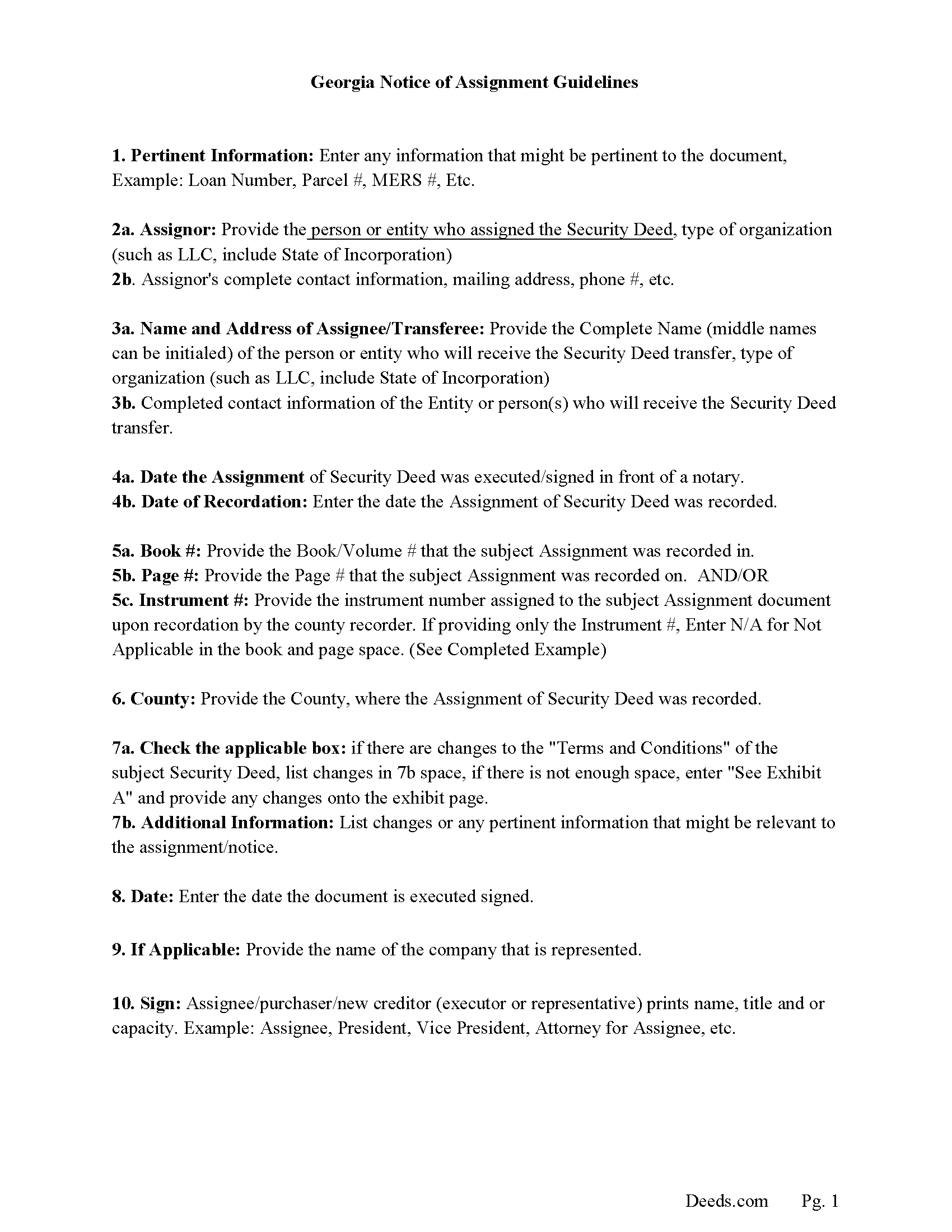

Carroll County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

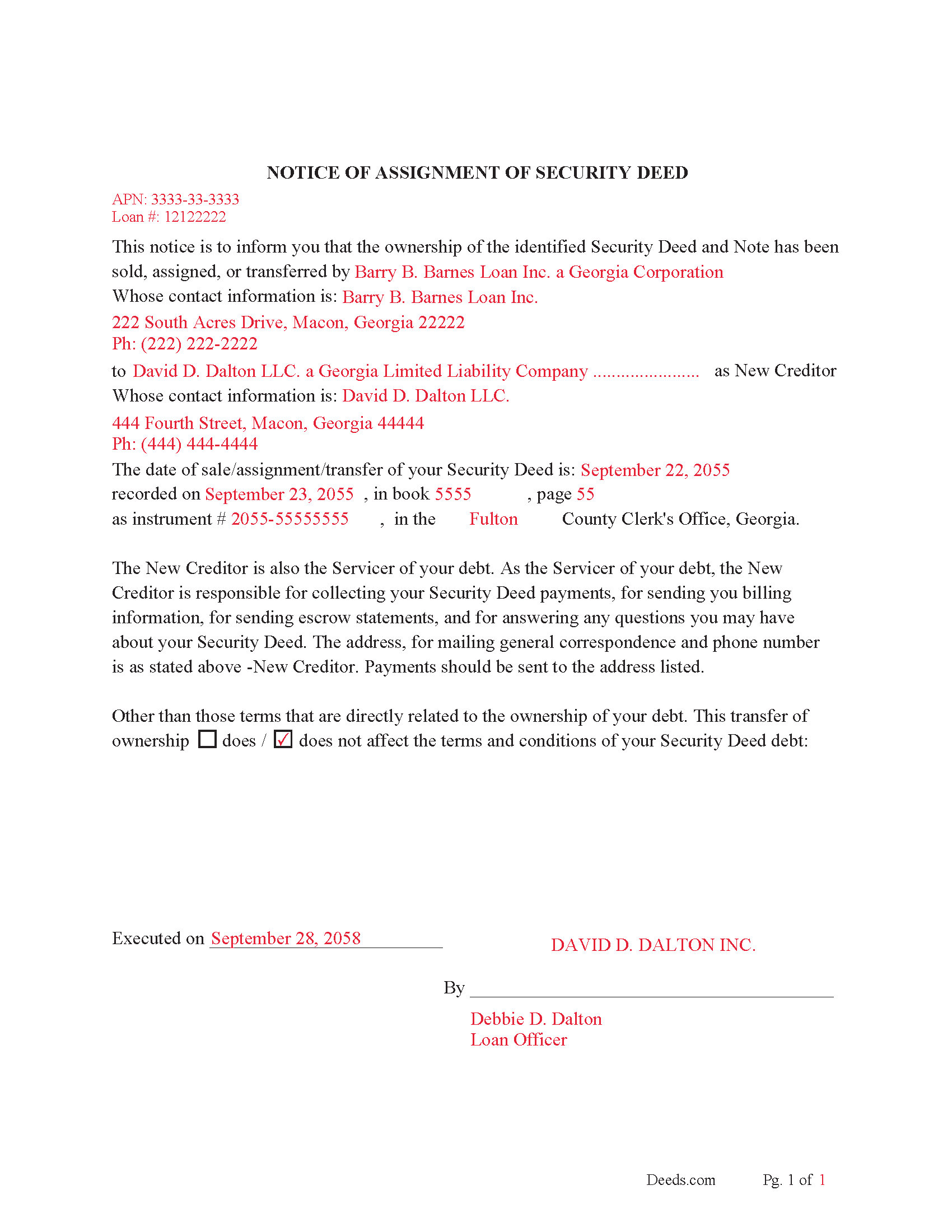

Carroll County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Carroll County documents included at no extra charge:

Where to Record Your Documents

Carroll County Register Of Deeds

Huntingdon, Tennessee 38344

Hours: 8:00am to 4:00pm M-F

Phone: (731) 986-1952

Recording Tips for Carroll County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Carroll County

Properties in any of these areas use Carroll County forms:

- Atwood

- Bruceton

- Buena Vista

- Cedar Grove

- Clarksburg

- Hollow Rock

- Huntingdon

- Lavinia

- Mc Kenzie

- Mc Lemoresville

- Trezevant

- Westport

- Yuma

Hours, fees, requirements, and more for Carroll County

How do I get my forms?

Forms are available for immediate download after payment. The Carroll County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carroll County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carroll County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carroll County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carroll County?

Recording fees in Carroll County vary. Contact the recorder's office at (731) 986-1952 for current fees.

Questions answered? Let's get started!

This form is used by the current lender/beneficiary to Assign/transfer a Deed of Trust and Promissory Note to another party, this is usually done when a note has been sold.

Recording requirements include:

- Assignor & assignee

- Debtor's name

- Reference original Volume & Page of assigned document

- Maximum Principal Indebtedness for Tennessee Recording Tax Purposes is $0 (If amount is listed taxes must be paid)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Tennessee Assignment of DOT Package includes form, guidelines, and completed example) For use in Tennessee only.

Important: Your property must be located in Carroll County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Carroll County.

Our Promise

The documents you receive here will meet, or exceed, the Carroll County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carroll County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

D F.

March 3rd, 2020

Find what i was looking for, and got the answers to my questions!! Thank you

Thank you!

HEATHER M.

September 27th, 2024

The guide I needed was very easy to understand and the template was easy to complete. I had a property attorney review the deed before I had it registered and she was impressed. She said she couldn't have written it better herself! Definitely worth the money instead of paying high dollar attorney fees for a simple task.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Karen D.

July 17th, 2020

Awesome,thorough, and fast.

Thank you!

Sandra C.

December 30th, 2020

Quick and easy. Would recommend this site to everyone. Deed was sent to the site and recorded at my local county within 24 hours. Website could be set up better. Not labeled well for us that is not computer savvy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sara R.

June 19th, 2019

Worked well for me to create a deed for a house I inherited. It was very thorough and easy to use. I have no experience with the law so I just googled terms I didn't understand and was fine. I also called land records a lot and ended up not needing a lot of the material included, but it was still good to have it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane C.

April 19th, 2020

Website is very user friendly and provided a variety of forms to download for use

Thank you!

Sally Ann C.

November 16th, 2019

Thank you for your service. It seems to have worked, I printed a document purporting to be the Deed I needed. I was somewhat disappointed though - I was expecting something as impressive as the Title Search, which goes back to 1828 and includes Millard Fillmore, admittedly not one of our most celebrated Presidents. But I am happy to have what I have, and thank you again! peace - SAVC

Thank you for your feedback. We really appreciate it. Have a great day!

Michael T.

October 17th, 2019

Good site. Two things to note. 1. The Documentary Transfer Tax Exemption sheet, the word "computer" is used when I think it should be "computed" Error in state form? 2. The California Trust Guide could have a watermark which is less distracting. Kind of hard to read the print with the DEEDS.COM logo so prominent.

Thank you for your feedback. We really appreciate it. Have a great day!

DONALD L P.

January 15th, 2019

HAD WRONG PASSWORD; PROGRAM MADE CHANGE EASY.

Thank you!

scott m.

February 21st, 2021

thanks- easy as pie.

Thank you!

Susan Z.

February 1st, 2019

Helpful website. Couldn't use the forms for my situation and area

Thank you for your feedback Susan. We don't want you to have to pay for something you didn't use, we've gone ahead and canceled your order and payment. Have a great day!

silvia m.

November 5th, 2019

Used the forms for a quitclaim deed. Worked great! Also, big bonus to have the extra forms available, needed a couple of them. Highly recommend...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William M.

February 27th, 2019

I got what I needed and did exactly what I needed. All legal and no hassle. Thanks Deeds.com, you made the job much easier.

Thank you!

LISA B.

December 5th, 2019

GOT WHAT I NEEDED FORMS WORKED FINE.

Thank you!

Clint J.

March 23rd, 2021

Deeds.com is a great way for people that are unfamiliar with legal documents to get things done. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!