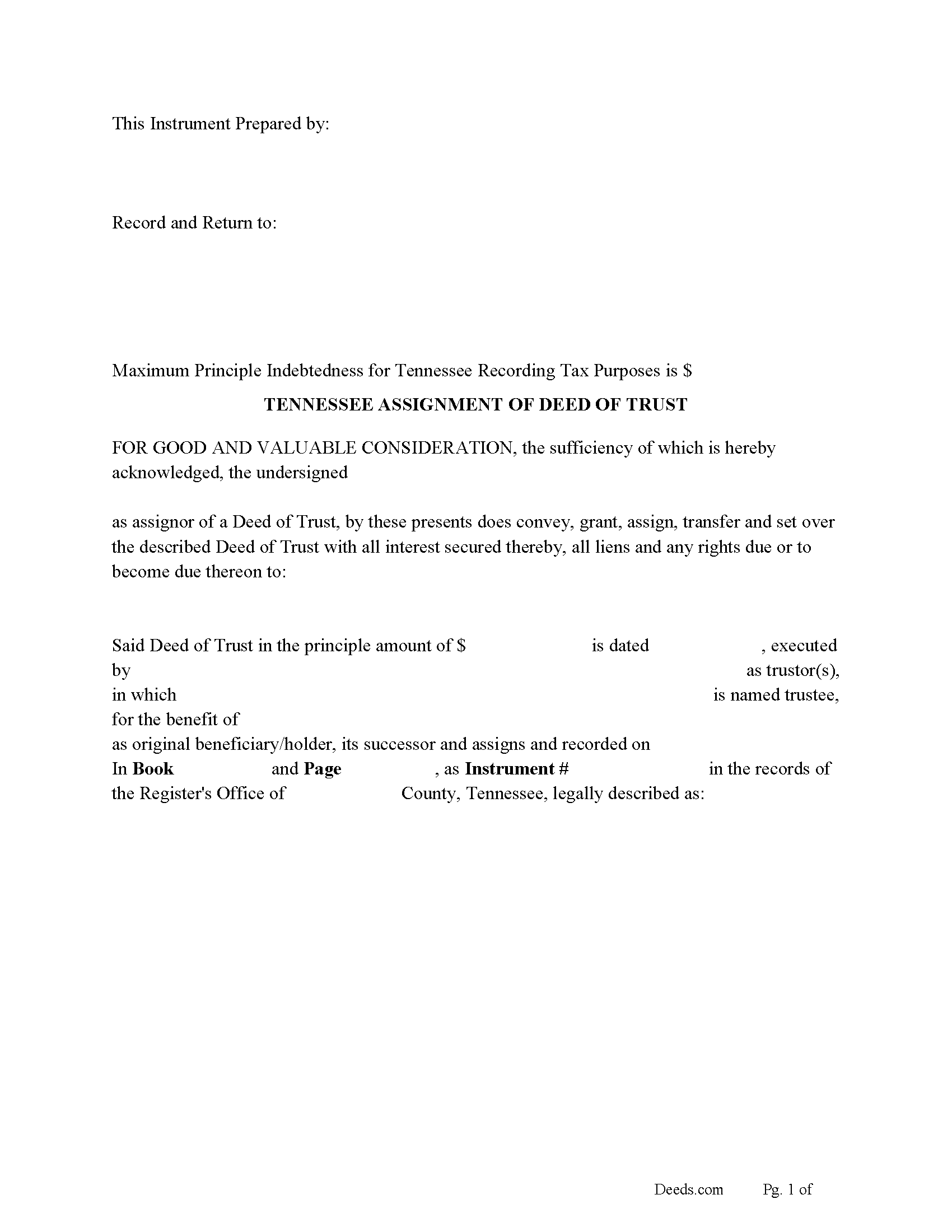

Henderson County Assignment of Deed of Trust Form

Henderson County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

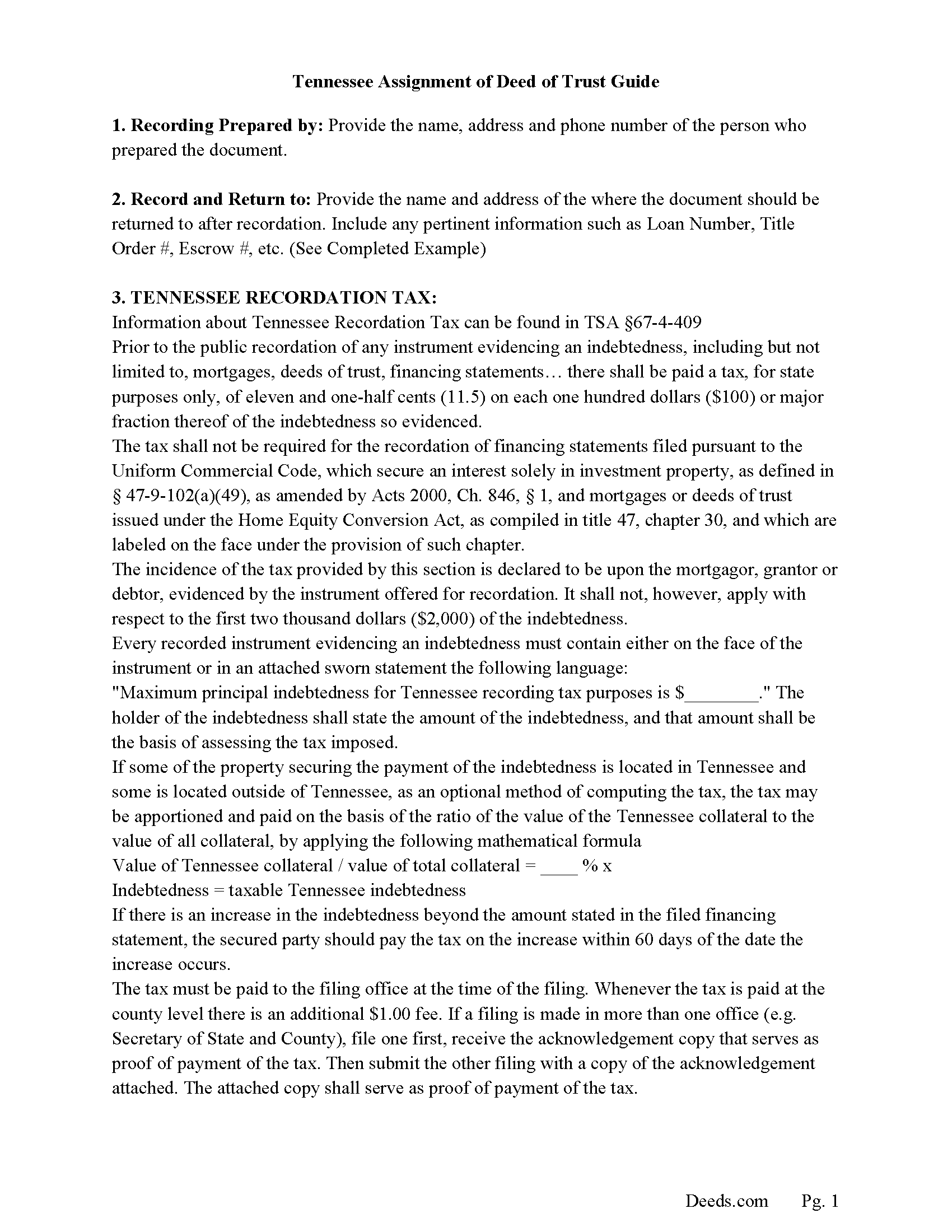

Henderson County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

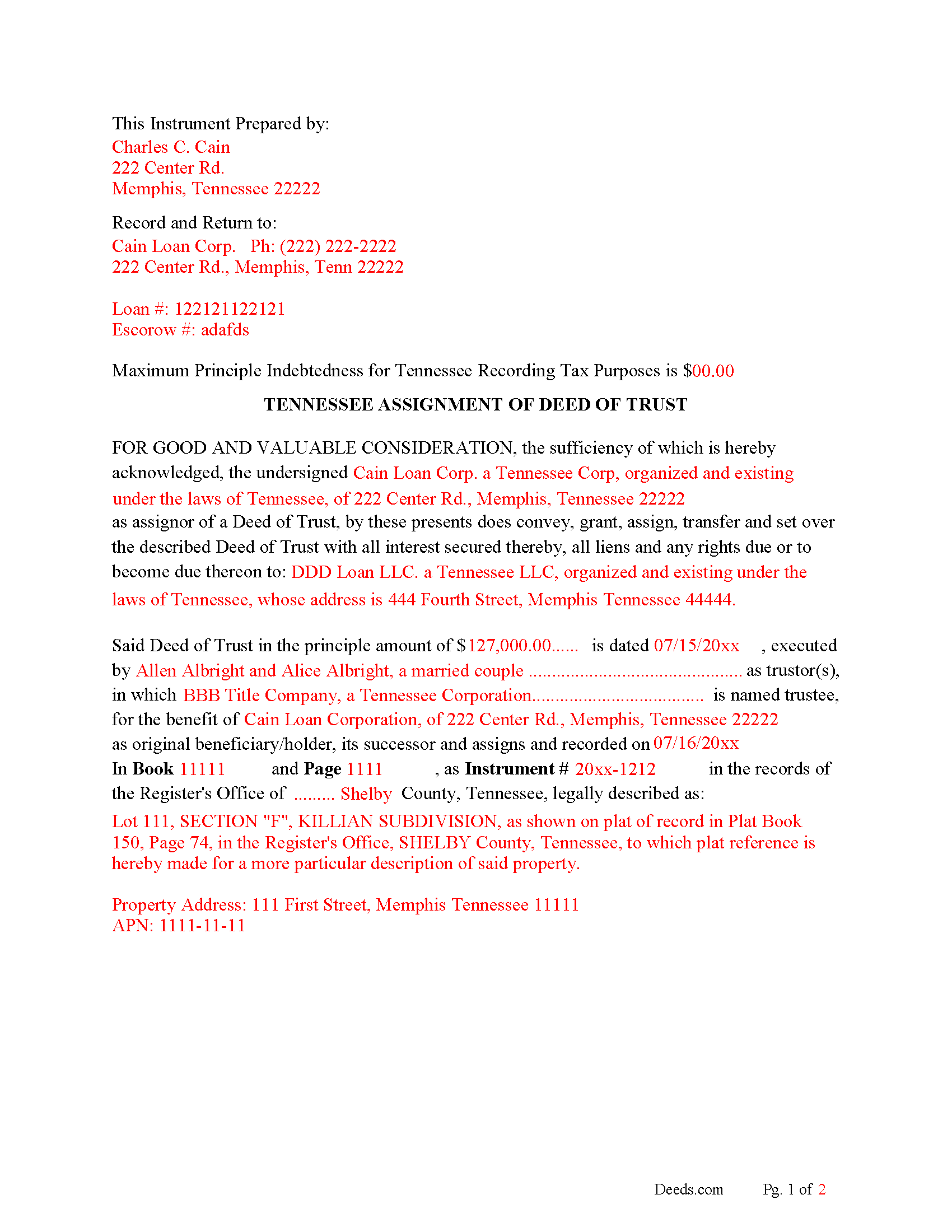

Henderson County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

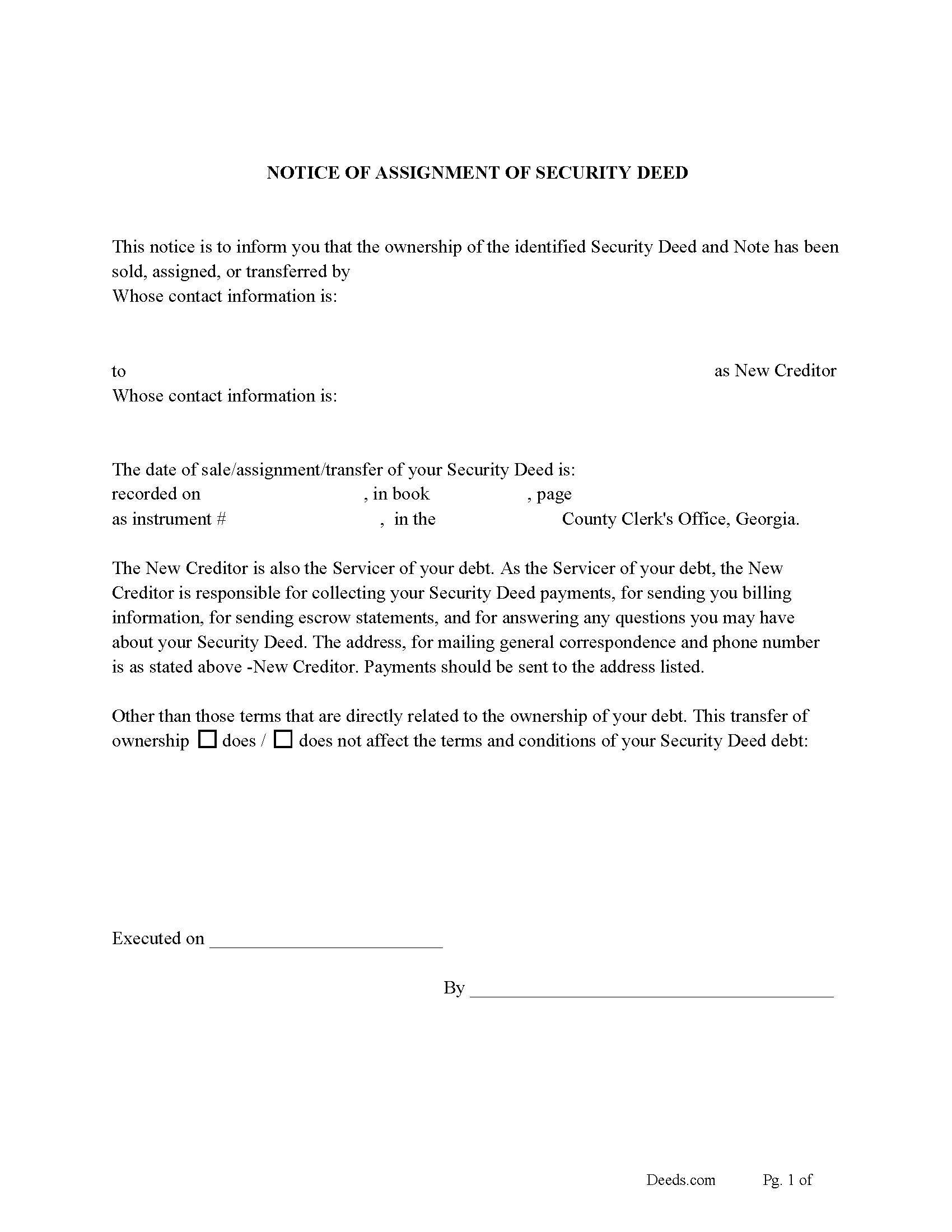

Henderson County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

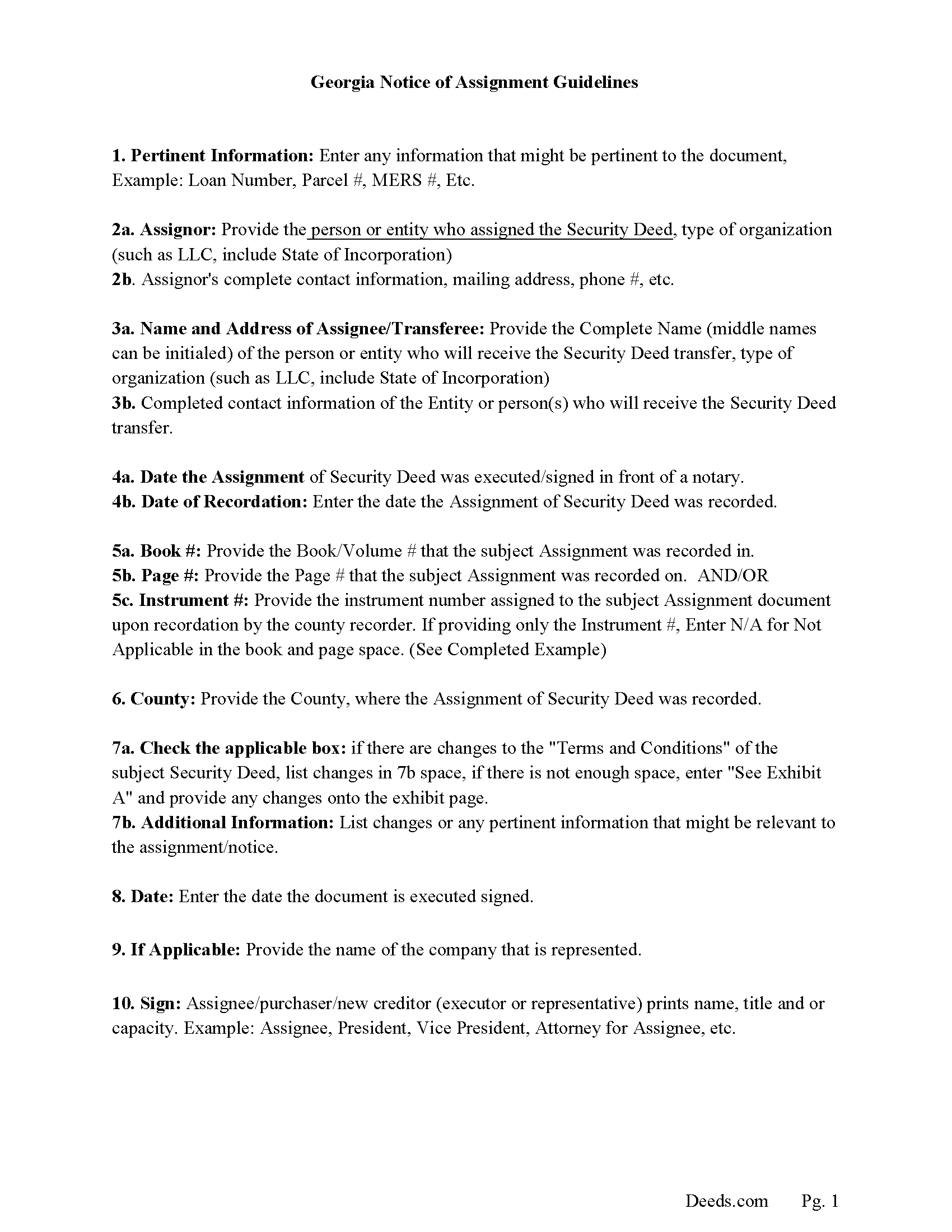

Henderson County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

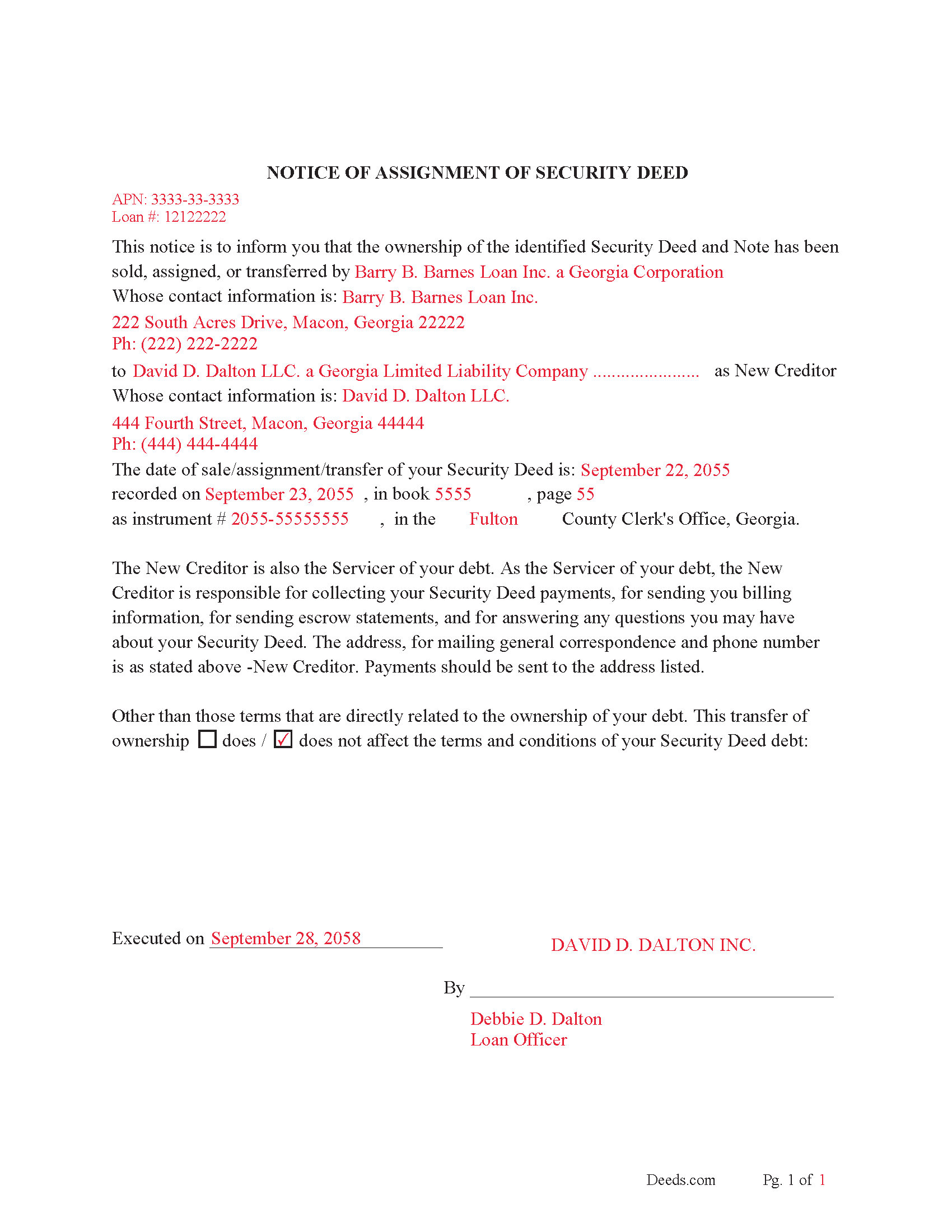

Henderson County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Henderson County documents included at no extra charge:

Where to Record Your Documents

Henderson County Register of Deeds

Lexington, Tennessee 38351

Hours: 8:00 to 4:30 Monday through Friday

Phone: (901) 968-2941

Recording Tips for Henderson County:

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Henderson County

Properties in any of these areas use Henderson County forms:

- Darden

- Huron

- Lexington

- Reagan

- Sardis

- Wildersville

Hours, fees, requirements, and more for Henderson County

How do I get my forms?

Forms are available for immediate download after payment. The Henderson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Henderson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Henderson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Henderson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Henderson County?

Recording fees in Henderson County vary. Contact the recorder's office at (901) 968-2941 for current fees.

Questions answered? Let's get started!

This form is used by the current lender/beneficiary to Assign/transfer a Deed of Trust and Promissory Note to another party, this is usually done when a note has been sold.

Recording requirements include:

- Assignor & assignee

- Debtor's name

- Reference original Volume & Page of assigned document

- Maximum Principal Indebtedness for Tennessee Recording Tax Purposes is $0 (If amount is listed taxes must be paid)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Tennessee Assignment of DOT Package includes form, guidelines, and completed example) For use in Tennessee only.

Important: Your property must be located in Henderson County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Henderson County.

Our Promise

The documents you receive here will meet, or exceed, the Henderson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Henderson County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Alex Q.

January 25th, 2022

10 STARS! Deeds.com never fails! Thank you so much!

Thank you!

William M.

February 27th, 2019

I got what I needed and did exactly what I needed. All legal and no hassle. Thanks Deeds.com, you made the job much easier.

Thank you!

MARY LACEY M.

April 11th, 2024

I am extremely impressed with the quality of this service. They are a pleasure to work with and I know I can rely on them.

Thank you for your feedback. We really appreciate it. Have a great day!

Susie k.

March 3rd, 2020

No complaints

Thank you!

Guadalupe G.

November 10th, 2022

Easy but why charge???

Thank you!

cora c.

December 30th, 2021

ALTHOUGH IT TOOK A LITTLE LONGER THAN EXPECTED TO RECEIVE AN INVOICE TO ALLOW ME TO PAY THE REQUIRED FEES AND HAVE MY DOCUMENT SUBMITTED FOR RECORDING, I REALLY APPRECIATED THE SERVICE AND PROMPT RESPONSES TO MY MESSAGES, SEEKING ASSISTANCE. THANK YOU SO MUCH!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kay C.

December 22nd, 2021

Thank you for your patience and help with filing the documents needed. You were helpful, prompt, courteous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ivory J.

August 1st, 2020

Haven't processed any deed documents so far. I do agree that Deed.com website browsing tool will be helpful.

Thank you!

Bonnee G.

January 16th, 2020

Arrived at your site from my county's government site. Saw that all the forms I think I need were included in one package deal, hopefully its the correct package. I Although I've not looked into other aspects of the site, retrieving the forms was pretty easy. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Grace O.

November 4th, 2020

I was happy to find a way to file my title without having to send original. Although I found it hard to naigste, my daughter came to my rescue and we were successful. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Suzanne A.

February 25th, 2024

The purchase and download from Deeds.com were pleasantly straightforward. The actual of filing not so obvious in our case.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Michael W.

November 16th, 2021

So far the web site and the tools are a pleasure to use. The price is reasonable. If only getting rid of this timeshare in Mashpee Massachusetts (that I have owned for over thirty years) was this easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly H.

February 13th, 2019

Thanks!!

Thank you!

JOHN S.

October 16th, 2021

They had everything for a living trust but the form to transfer your house into the living trust

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura S.

April 21st, 2025

Easy to utilize database and instructions!

We are grateful for your feedback and looking forward to serving you again. Thank you!