Bradley County Demand for Enforcement Form

Bradley County Demand for Enforcement Form

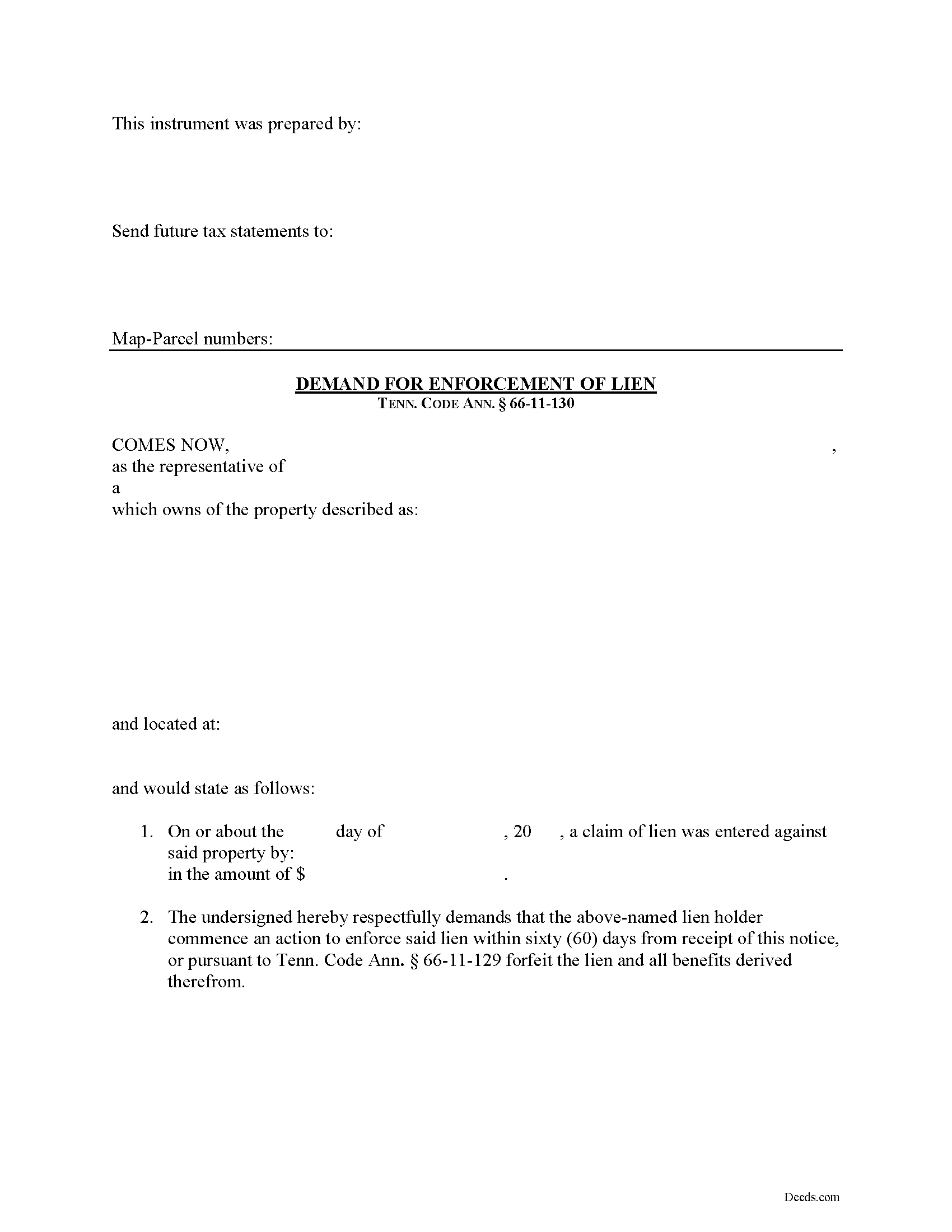

Fill in the blank Demand for Enforcement form formatted to comply with all Tennessee recording and content requirements.

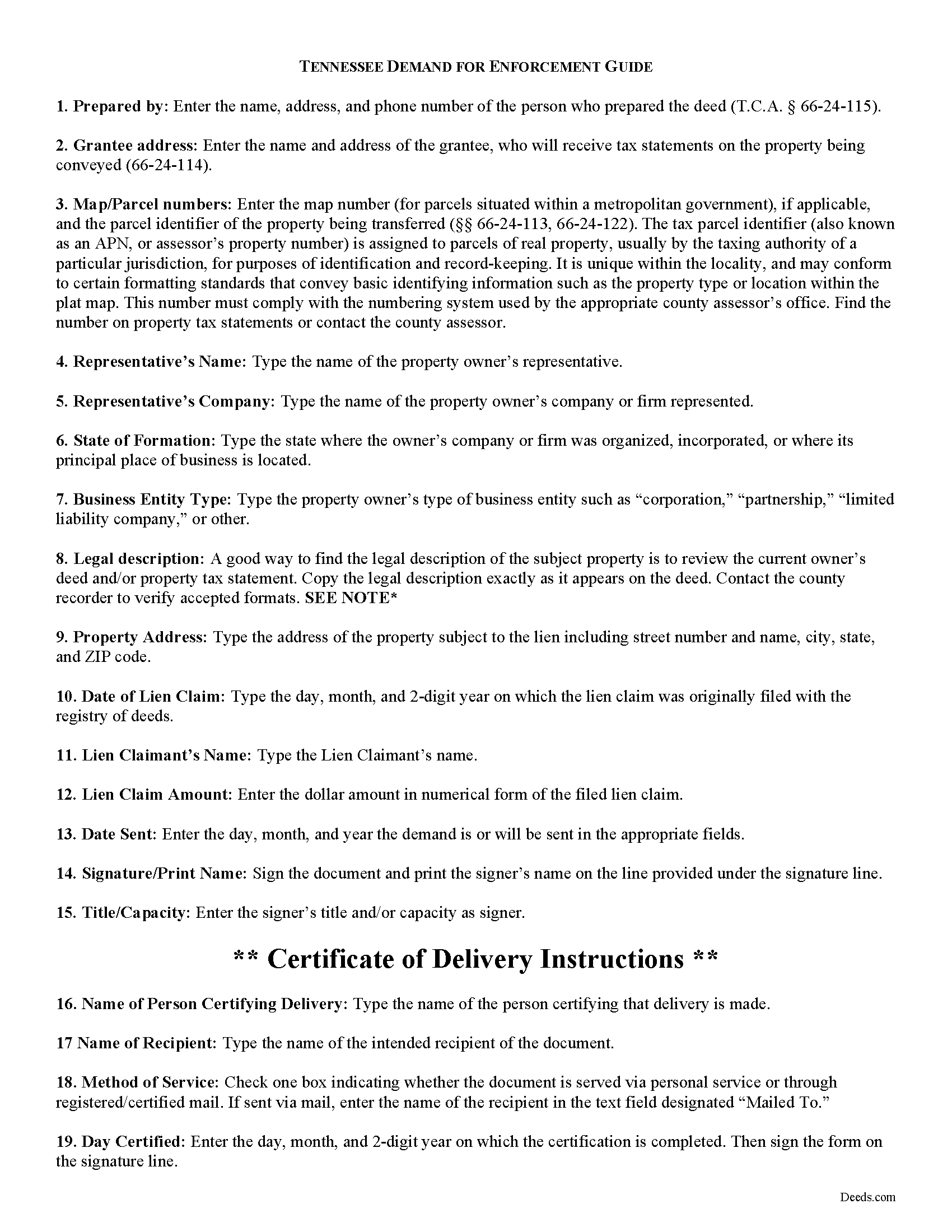

Bradley County Demand for Enforcement Guide

Line by line guide explaining every blank on the form.

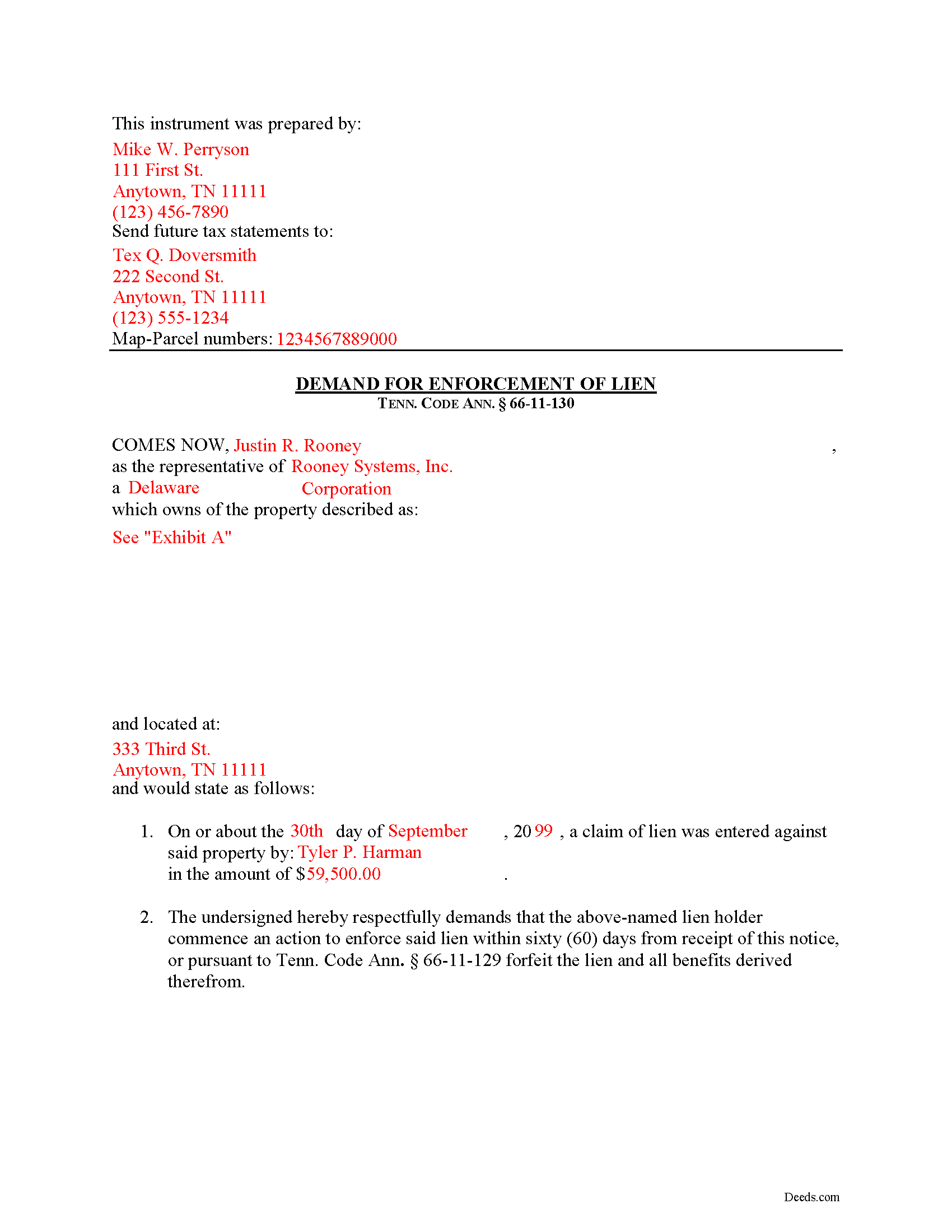

Bradley County Completed Example of the Demand for Enforcement Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Bradley County documents included at no extra charge:

Where to Record Your Documents

Bradley County Register of Deeds

Cleveland, Tennessee 37311

Hours: Mon - Thur 8:30am to 4:30pm; Fri 8:30am to 5:00pm

Phone: (423) 728-7240

Recording Tips for Bradley County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Bradley County

Properties in any of these areas use Bradley County forms:

- Charleston

- Cleveland

- Mc Donald

Hours, fees, requirements, and more for Bradley County

How do I get my forms?

Forms are available for immediate download after payment. The Bradley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bradley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bradley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bradley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bradley County?

Recording fees in Bradley County vary. Contact the recorder's office at (423) 728-7240 for current fees.

Questions answered? Let's get started!

Demand for Enforcement of a Mechanic's Lien in Tennessee

Liens can be trouble when placed on your property, especially if you're trying to sell or refinance. Regardless of the reason for the lien, there are steps an owner can take to speed up the time that the lien can be effective. In Tennessee, filing a Demand for Enforcement of a filed lien will accelerate the lien action, requiring the lien claimant to enforce the lien or forfeit it.

Upon written demand of the owner, the owner's agent, or prime contractor, served on the lienor, requiring the lienor to commence action to enforce the lienor's lien, and describing the real property in the demand, the action shall be commenced, or the claim filed in a creditors' or foreclosure proceeding, within sixty (60) days after service, or the lien shall be forfeited. Tenn. Prop. Code 66-11-130.

The Demand for Enforcement contains the following: 1) the lien claimant's name (including business name and entity type), 2) a description of the property bound under the lien, 3) date of the lien claim, and 4) amount of the claim. The person sending the document must complete a certificate of delivery that specifies the method of service and to whom it is directed. Serving the document to the lien claimant is effective to demand he or she enforce the lien within 60 days.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Demand for Enforcement or for any other issues regarding mechanic's liens.

Important: Your property must be located in Bradley County to use these forms. Documents should be recorded at the office below.

This Demand for Enforcement meets all recording requirements specific to Bradley County.

Our Promise

The documents you receive here will meet, or exceed, the Bradley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bradley County Demand for Enforcement form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

James A.

March 9th, 2021

Thanks for you help to get me out of a quick problem. Downloads were great. I recommend this service for the arcane situations of legal angst.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stanley P.

February 14th, 2019

Fast accurate service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela S.

April 29th, 2021

Very easy process and efficient. Made my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

William H.

August 4th, 2025

Was easy to find forms I needed and download was quick.

Thank you for your positive words! We’re thrilled to hear about your experience.

Erik N.

May 31st, 2025

I liked it, very much.

Thank you!

Susan J.

June 6th, 2023

I was pleased that I could send the documents this way rather than having to mail it or take time out of my day to go down to the records office.

Thank you for taking the time to leave your feedback Susan, we really appreciate you. Have an amazing day.

william l H.

June 26th, 2021

Just downloaded package , fast and quick and all the info i will need to complete my deed. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

Diane W.

January 3rd, 2020

The forms were immediately available for download, which was nice. However, I was not impressed by the lack of several features: 1) there was no way to edit set text in the form, such as where it says you should consult an attorney. That is not necessary for recording the deed and I wanted to deleted it, but could not. 2) Also, under the "Notes" section, there is a limited area to write; I tried adding a fuller explanation of something, but the form would not accept or include it when I printed the final document. The form may do the job, but it's not very sophisticated or elegant.

Thank you for your feedback. We really appreciate it. Have a great day!

Cathy W.

December 18th, 2021

Easy to use and fee is reasonable.

Thank you!

James W.

January 20th, 2019

Easy access to forms saving lots of time researching reqmts from a State/Municipal Govt website. I saved 400-500 in lawyer fees but getting these forms, and coordinating with the Property recorders office in another state. Will use you again.

Thank you James. We really appreciate your feedback.

Eppie G.

October 19th, 2021

Perfect

Thank you!

Joanne K.

July 16th, 2021

I haven't used the forms yet, but was at the county recorders office and they looked at it and said it looked fine. The instructions were easy to read and the forms easy to complete and save for a next time, if there is need.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald L.

January 21st, 2021

There is not enough room on the form to describe my property which was taken directly from the previous deed. Other than that worked as expected.

Thank you for your feedback. We really appreciate it. Have a great day!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!