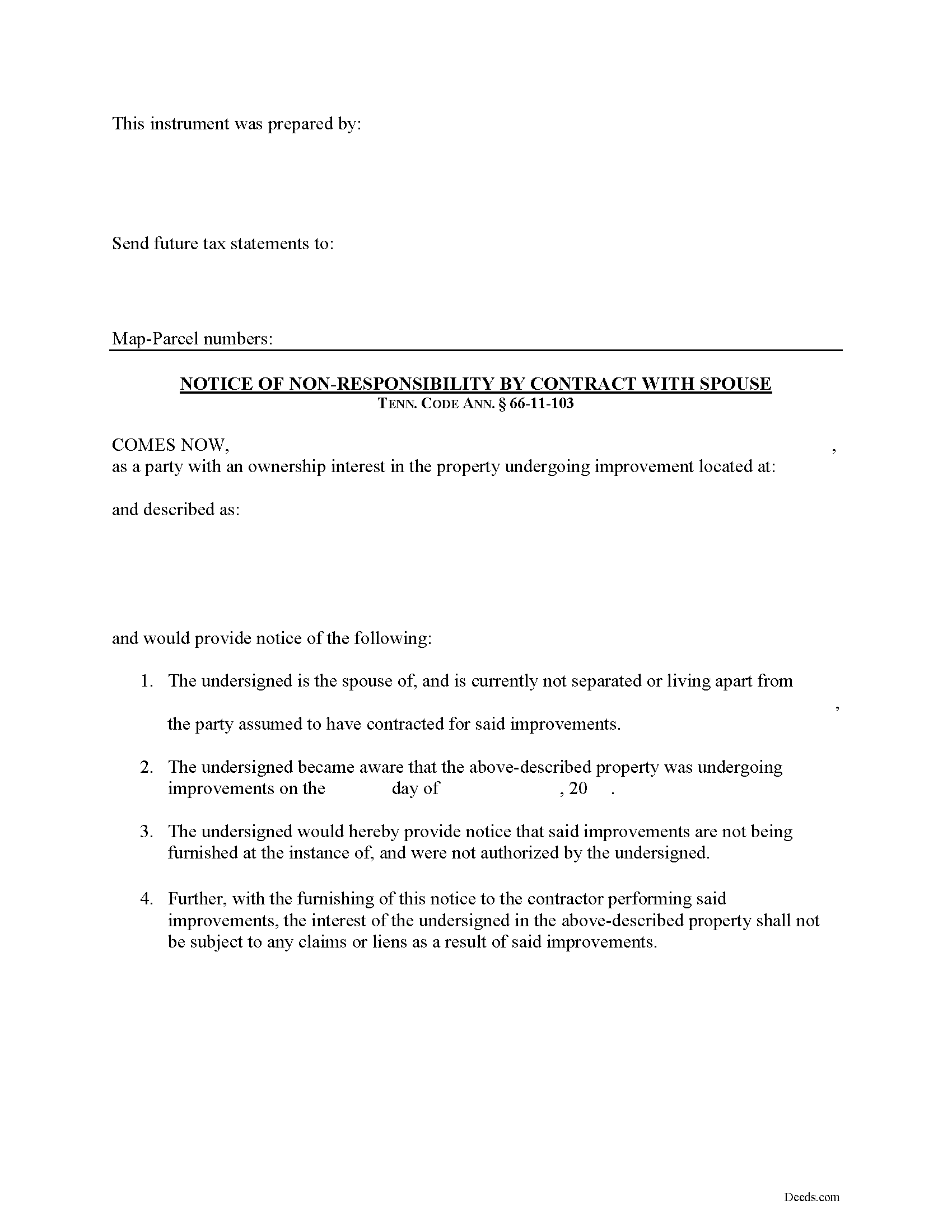

Bedford County Notice of Spousal Non-Responsibility Form

Bedford County Notice of Spousal Non-Responsibility Form

Fill in the blank Notice of Spousal Non-Responsibility form formatted to comply with all Tennessee recording and content requirements.

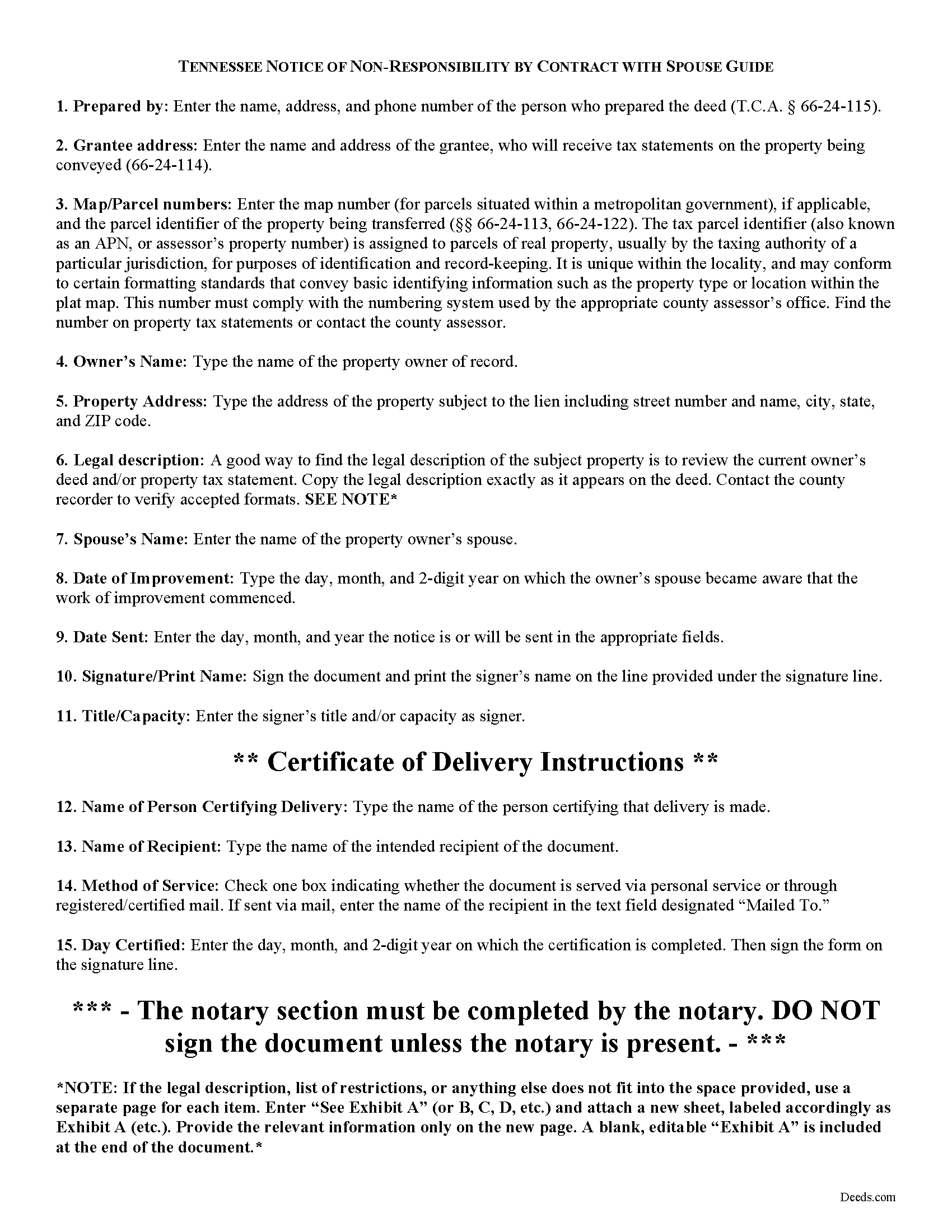

Bedford County Notice of Non-Responsibility Guide

Line by line guide explaining every blank on the form.

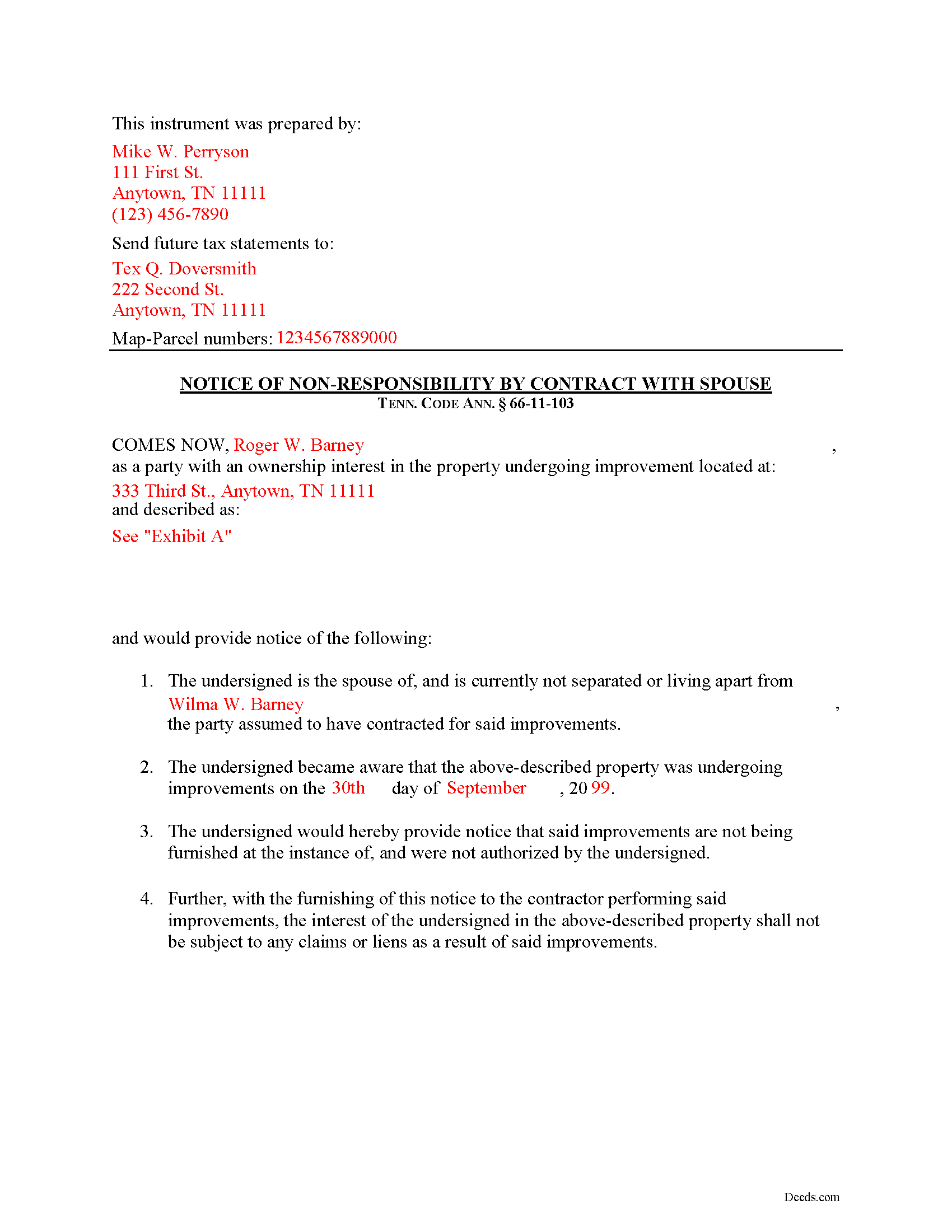

Bedford County Completed Example of the Notice of Non-Responsibility Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Bedford County documents included at no extra charge:

Where to Record Your Documents

Bedford County Register of Deeds

Shelbyville, Tennessee 37160

Hours: 8:00 to 4:00 M-F

Phone: (931) 684-5719

Recording Tips for Bedford County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Bedford County

Properties in any of these areas use Bedford County forms:

- Bell Buckle

- Normandy

- Shelbyville

- Unionville

- Wartrace

Hours, fees, requirements, and more for Bedford County

How do I get my forms?

Forms are available for immediate download after payment. The Bedford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bedford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bedford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bedford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bedford County?

Recording fees in Bedford County vary. Contact the recorder's office at (931) 684-5719 for current fees.

Questions answered? Let's get started!

Tennessee Notice of Non-Responsibility by Contract with Spouse

Under Tennessee Property Code section 66-11-103, spouses are awarded certain protections from mechanic's lien if a notice of objection to the contract is timely filed. The form of the notice is called a "Notice of Non-Responsibility by Contract with Spouse."

When the contract for improving real property is made with a husband or a wife who is not separated and living apart from that person's spouse, and the property is owned by the other spouse or by both spouses, the spouse who is the contracting party shall be deemed to be the agent of the other spouse unless the other spouse serves the prime contractor with written notice of that spouse's objection to the contract within ten (10) days after learning of the contract. Tenn. Prop. Code 66-11-103.

This document identifies the parties, the location and starting date of the project, and specifically states that the filing spouse accepts no obligations related to the improvement. If the notice is filed within the required ten-day period after learning of the contract, it can be a powerful tool to avoid any lien being placed on the spouse's property interest.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Non-Responsibility or for any other issues regarding mechanic's liens.

Important: Your property must be located in Bedford County to use these forms. Documents should be recorded at the office below.

This Notice of Spousal Non-Responsibility meets all recording requirements specific to Bedford County.

Our Promise

The documents you receive here will meet, or exceed, the Bedford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bedford County Notice of Spousal Non-Responsibility form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

CINDY P.

July 30th, 2019

Such any easy process! Thank you!

Thank you Cindy, we appreciate your feedback.

Michael W.

August 27th, 2021

This was really easy and very helpful. Thanks,

Thank you!

Robert E.

June 14th, 2022

The deed forms seem to be what I need but I am unable to save anything that I do with them. I ask for some assistance in this matter but did not get any.

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqui G.

April 8th, 2020

Excellent system and serviced!

Thank you!

Ronald L.

January 21st, 2021

There is not enough room on the form to describe my property which was taken directly from the previous deed. Other than that worked as expected.

Thank you for your feedback. We really appreciate it. Have a great day!

Filomena G.

March 8th, 2025

very helpful

Thank you!

Laura M.

November 12th, 2023

Very easy and I appreciate that when you hover over the blank, directions pop up and tell you what to put in that blank. I also appreciated that when I lost the original password, I sent an email and Deeds.com cancelled my order, refunded my account, so that I could start over.

It was a pleasure serving you. Thank you for the positive feedback!

Jill M.

January 12th, 2019

This service gave me the information and guide I needed to file a Quitclaim Deed. I went through the process with no problems at all.

Thank you Jill, we appreciate your feedback.

Jeffrey S.

February 1st, 2024

Web site was clear to understand and easy to use. Found what I needed quickly and crossed it off my to do list. Thanks, JS

We are grateful for your feedback and looking forward to serving you again. Thank you!

Jeffrey W.

October 20th, 2021

You should add a button to cancel a package. I uploaded a document for e-recording, but wanted to cancel because I got a more clear copy.

Thank you!

Barbara J.

October 7th, 2023

Process was simple and fast. Awaiting response form agency. I’m happy to have found deeds.com for a speedy service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lora N.

April 11th, 2023

Excellent, easy to use! Awesome system. Loved it.

Thank you!

Cynthia B.

July 21st, 2023

So simple to e-record my two documents. The communication was fast and very helpful. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Karen R.

June 9th, 2023

Easy to access and reasonable pricing, thank you deeds.com!

Thank you!