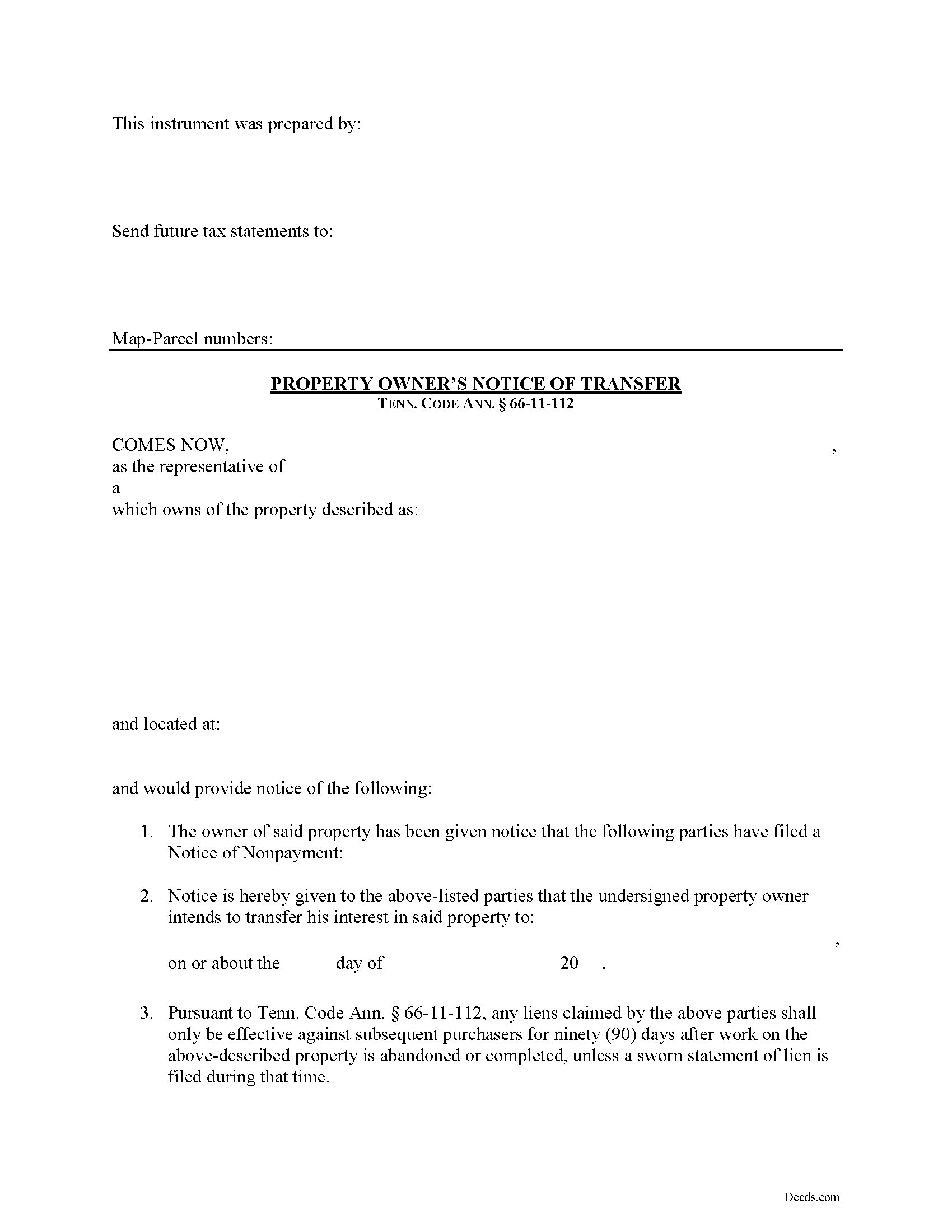

Carroll County Notice of Transfer Form

Carroll County Notice of Transfer Form

Fill in the blank Notice of Transfer form formatted to comply with all Tennessee recording and content requirements.

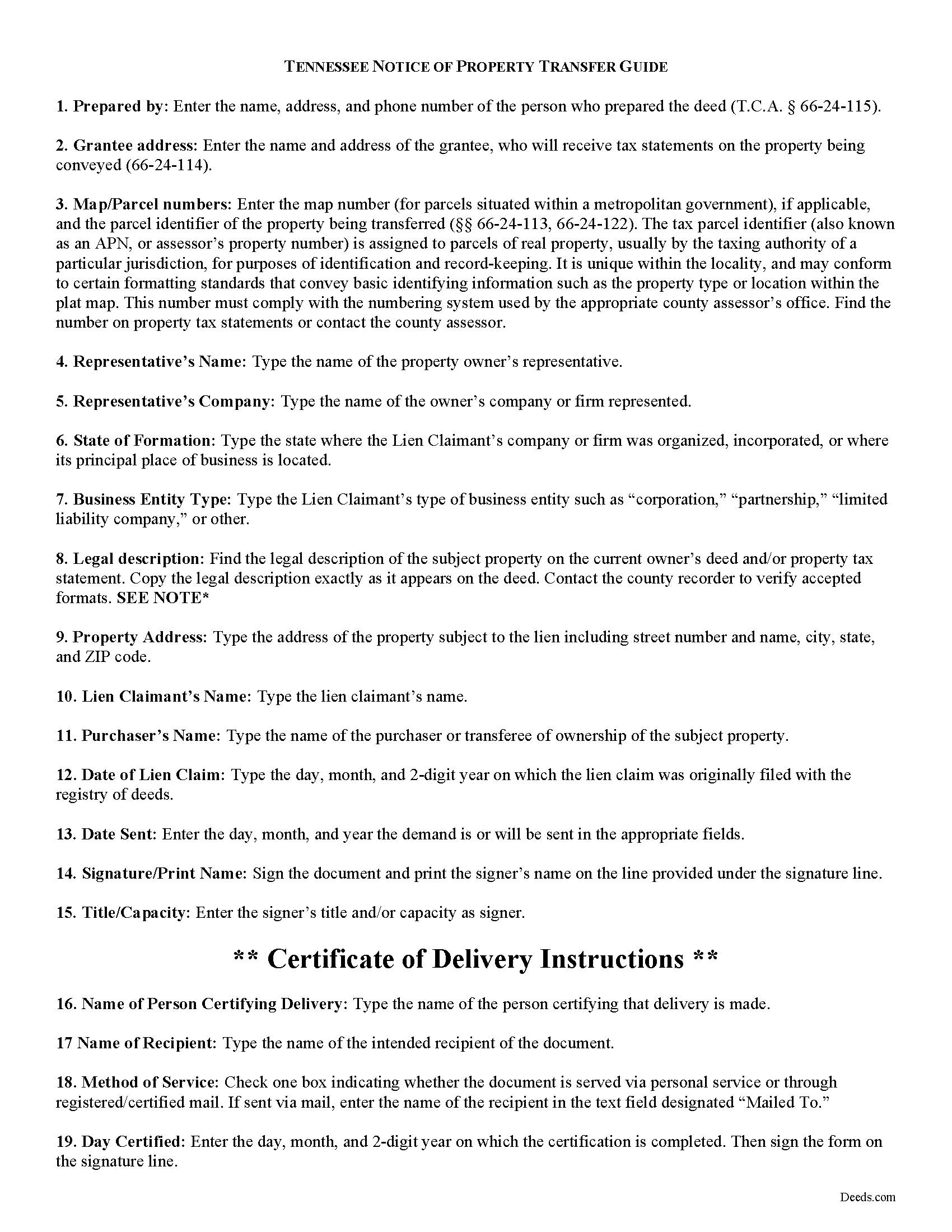

Carroll County Notice of Transfer Guide

Line by line guide explaining every blank on the form.

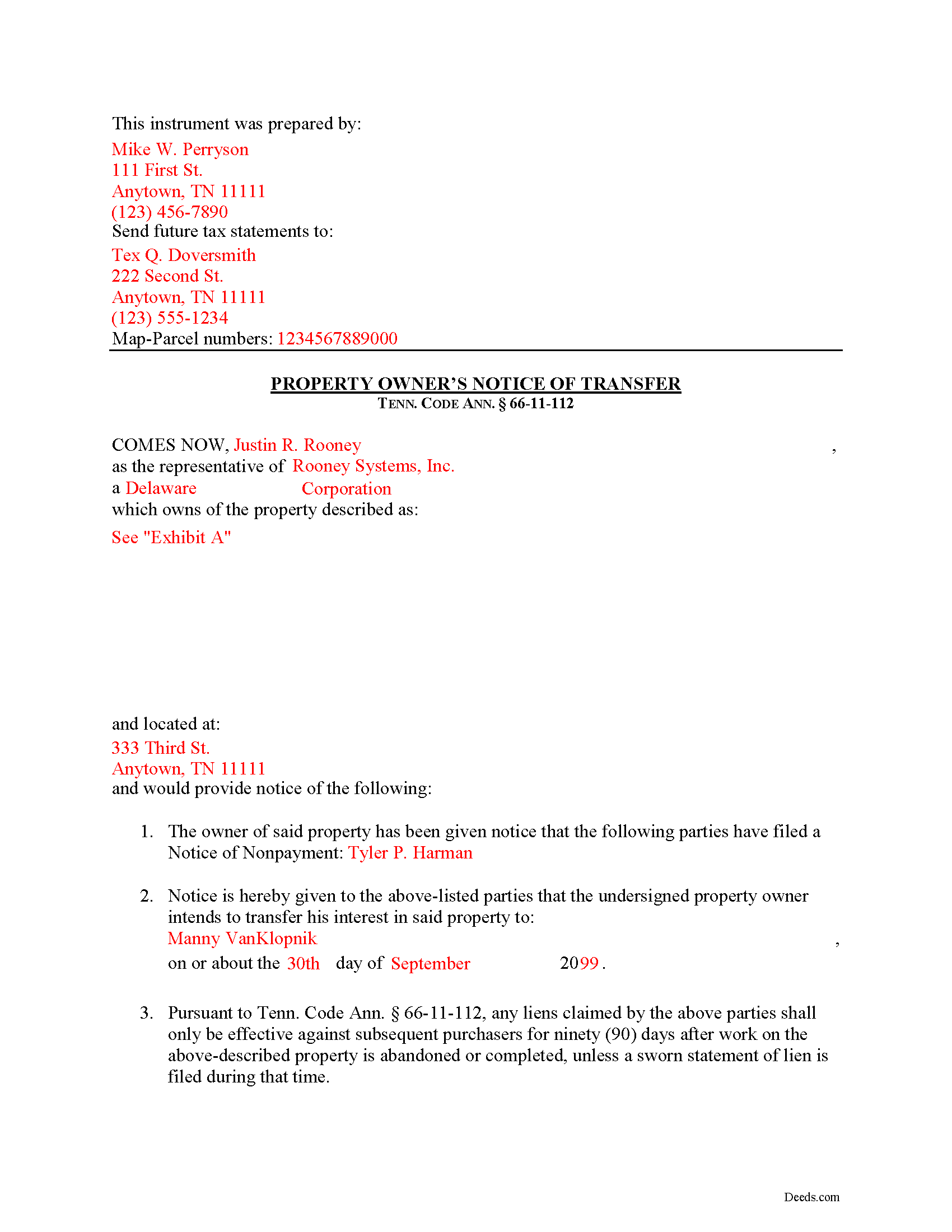

Carroll County Completed Example of the Notice of Transfer Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Carroll County documents included at no extra charge:

Where to Record Your Documents

Carroll County Register Of Deeds

Huntingdon, Tennessee 38344

Hours: 8:00am to 4:00pm M-F

Phone: (731) 986-1952

Recording Tips for Carroll County:

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Carroll County

Properties in any of these areas use Carroll County forms:

- Atwood

- Bruceton

- Buena Vista

- Cedar Grove

- Clarksburg

- Hollow Rock

- Huntingdon

- Lavinia

- Mc Kenzie

- Mc Lemoresville

- Trezevant

- Westport

- Yuma

Hours, fees, requirements, and more for Carroll County

How do I get my forms?

Forms are available for immediate download after payment. The Carroll County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carroll County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carroll County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carroll County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carroll County?

Recording fees in Carroll County vary. Contact the recorder's office at (731) 986-1952 for current fees.

Questions answered? Let's get started!

Transferring Property Subject to Lien Claims in Tennessee

Lots of things can happen with a property that can cause the owner to sell or otherwise transfer ownership while a lien is pending. Luckily, in Tennessee offers a procedure for accelerating the time to enforce a lien when transferring property to a purchaser. Drafting and recording a Notice of Transfer will effectively limit the time that the lien claimant can enforce any lien against a subsequent purchaser.

Under Tenn. Prop. Code 66-11-112(a), any liens claimed only remain effective against subsequent purchasers for ninety (90) days after work on the above-described property is abandoned or completed, unless a sworn statement of lien is filed during that time.

The notice identifies the parties, the location of the work or improvement, intended date of the transfer, and any other information relevant to the specific situation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Transfer or for any other issues regarding mechanic's liens.

Important: Your property must be located in Carroll County to use these forms. Documents should be recorded at the office below.

This Notice of Transfer meets all recording requirements specific to Carroll County.

Our Promise

The documents you receive here will meet, or exceed, the Carroll County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carroll County Notice of Transfer form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Lori B.

June 8th, 2023

Great service. Very easy to follow instructions and examples. I would use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig P.

August 19th, 2019

Good

Thank you!

Frank S.

March 28th, 2025

ALL THE DEED DOCUMENTS ARE ALL EXCELLENT AND ADDITIONAL DOCUMENTS REGARDING COMPLETING THE DOCUMENTS!!! EXCELLENT!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

fran g.

April 25th, 2021

To hard for me. But with that being said it's a great option for most people.

Thank you!

Ethan N.

January 11th, 2021

Quick, responsive service always!! Preferred way to record documents. Thanks Deeds.com!!

Thank you!

David C.

January 17th, 2020

Very fast service

Thank you!

Frank W.

January 19th, 2023

Everything worked smoothly

Thank you!

mary s.

July 30th, 2021

It would help if pages of a document indicated 1 of 3 etc. When I downloaded the TOD guide I got a 4th page though it only showed 3 on the screen.

Thank you for your feedback. We really appreciate it. Have a great day!

Julia C.

May 18th, 2025

Deeds.com was such a blessing in order for me to get something done that my lawyers could not get done. Transferring a mineral right from my deceased parents to me and my husband. The mineral company person I worked with went above and beyond helping me fill the paperwork out perfectly so that it had “right of survivorship” (and other things phrased properly) so that either my husband or I won’t have the issue I have had. Had it not been for deeds.com I don’t think I would have been able to complete this process. I hope anyone that ever needs something such as this learns about I deeds.com.

Thank you, Julia, for your kind and thoughtful review. We're truly honored to have played a role in helping you and your husband secure your mineral rights — especially after such a frustrating experience elsewhere. It’s great to hear that our team and resources were able to guide you through the process with clarity and care. Your words mean a lot to us, and we hope others in similar situations find the support they need through Deeds.com, just like you did. Wishing you continued peace of mind and security with your property.

Ming Z.

September 28th, 2022

Definitely 5 Stars !

Thank you!

Kimberly F.

April 22nd, 2020

Ordered and received the quitclaim form. Exactly what I expected, perfect.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy C.

January 19th, 2022

Excellent service. Pay your fee, download the form and fill out according to specific instructions. Then, again according to instructions, take it to the county clerk's office and have it recorded. It could not be easier.

Thank you!

Timmy S.

December 18th, 2019

The form gave me a perfect place to start. I was looking for something regarding time-shares, so the form was not perfect, but the register of deeds worked with me to get it right. I would not have even been able to start without the form from deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria J.

July 23rd, 2021

I needed a Missouri Notice of Intent to Sell without a named designated buyer. Mo Statutes require notice be notarized and filed 45 days before any closing to protect buyer from liens. You do not have that document. We are flipping a house so it must be filed. Our lawyer was on vacation. Cannot find one anywhere on net. Finally got a template from our title company.

Thank you for your feedback Gloria.

CYNTHIA W.

April 12th, 2023

My deed has now been recorded. Thank you so very much. I saved about $120.00 by doing this with your document service. Thankfully, I heard about you from a friend and did not go with my Title Company that wanted a fee that seems outrageous because of how simple it was to do. I will definitely "advertise" this service to others.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!