Dyer County Notice to Owner Form

Dyer County Notice to Owner Form

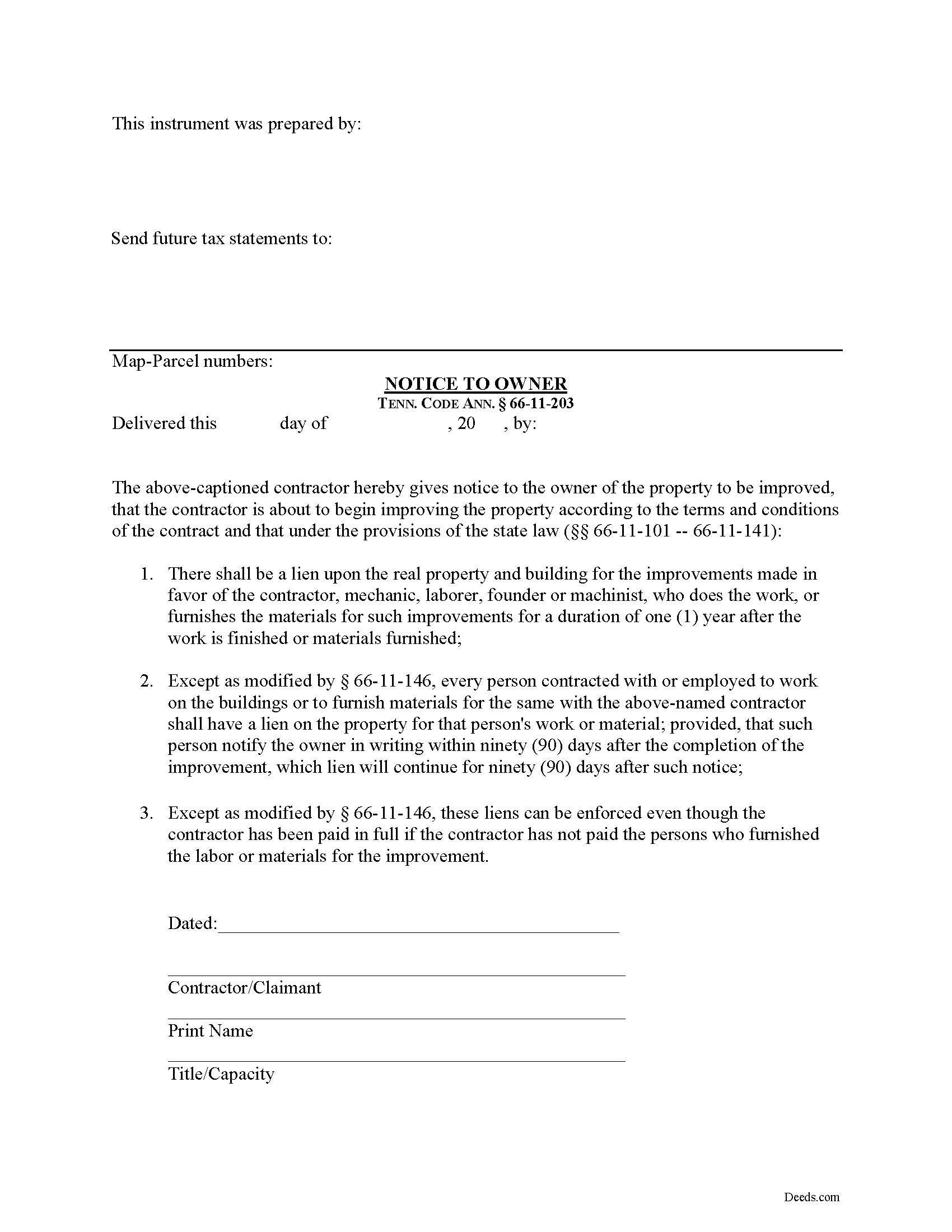

Fill in the blank Notice to Owner form formatted to comply with all Tennessee recording and content requirements.

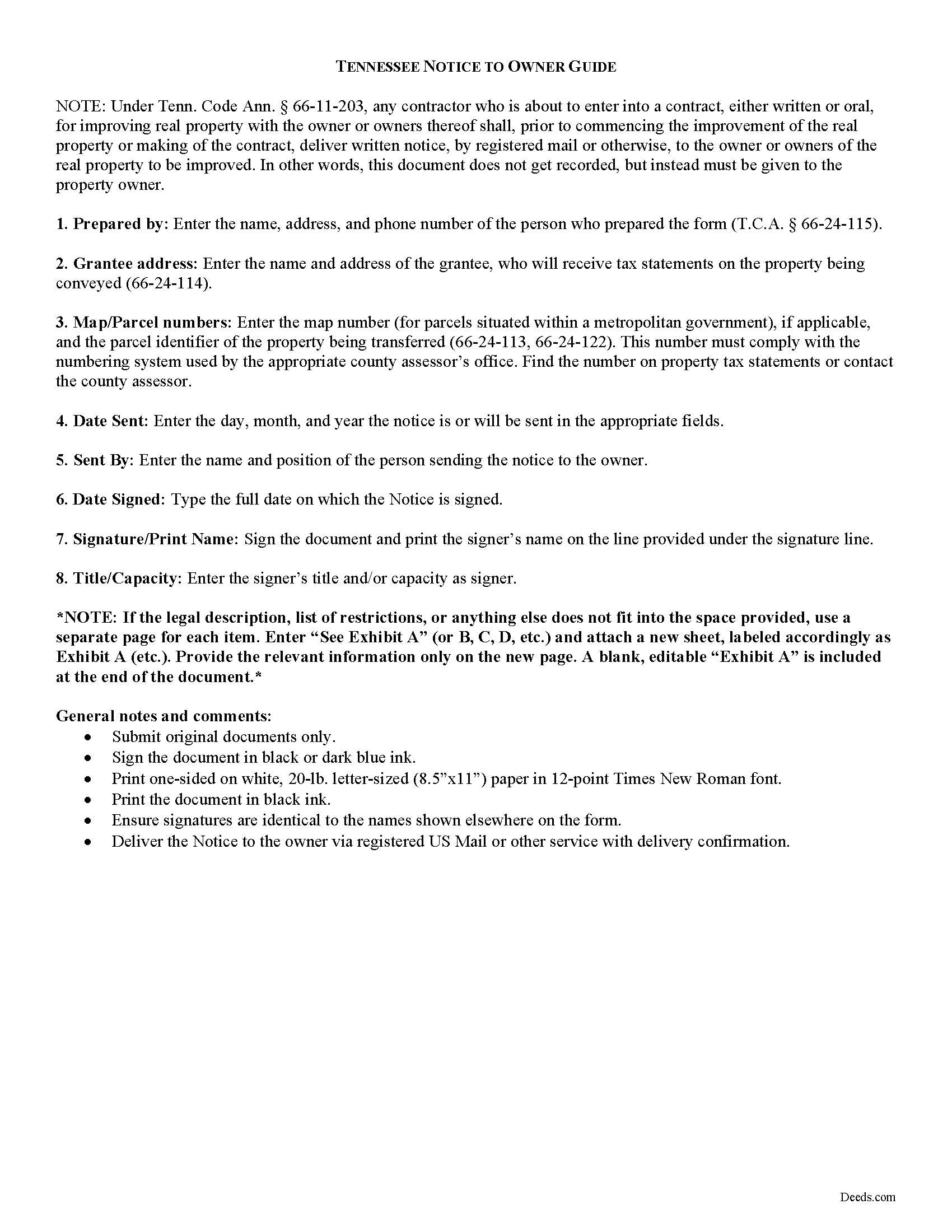

Dyer County Notice to Owner Guide

Line by line guide explaining every blank on the form.

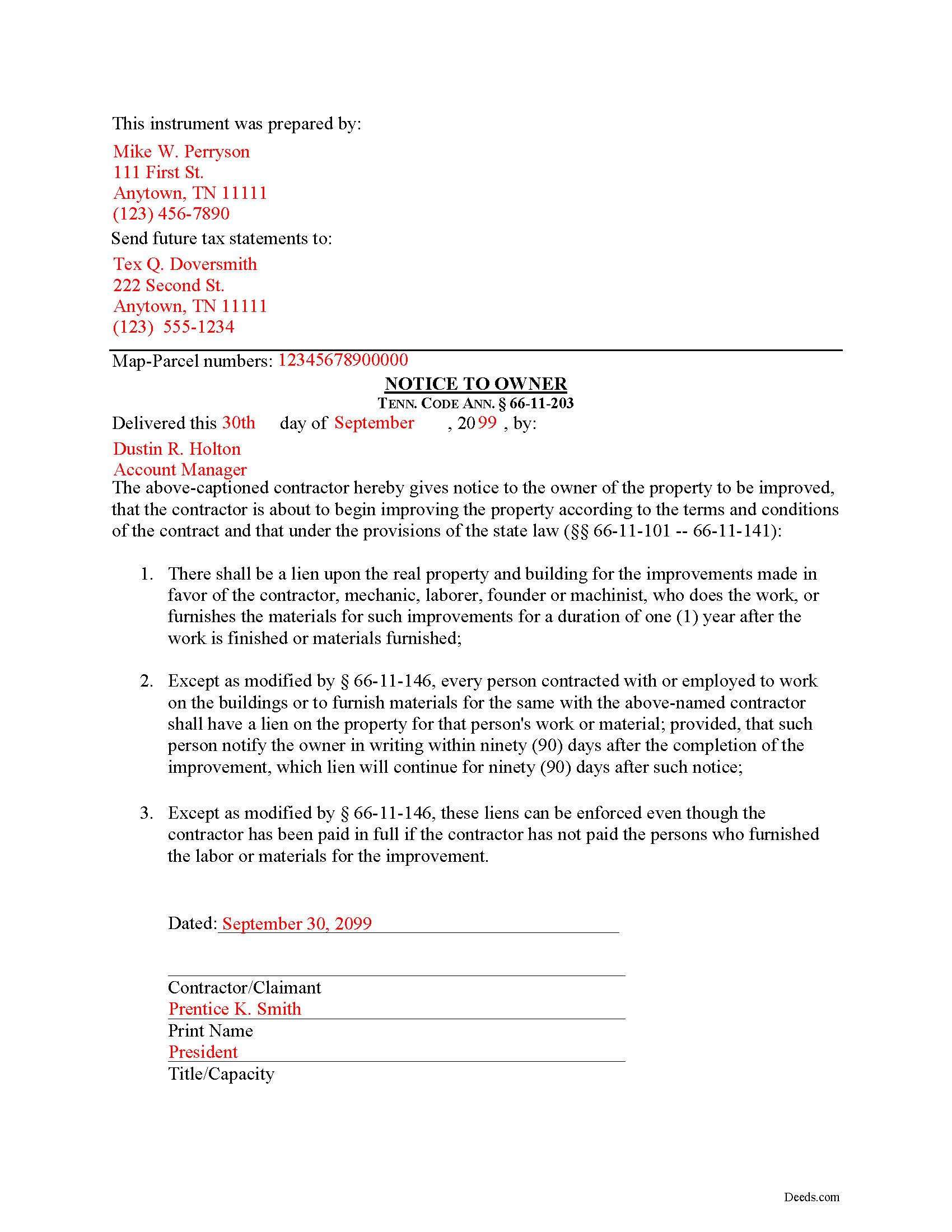

Dyer County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Dyer County documents included at no extra charge:

Where to Record Your Documents

Dyer County Register of Deeds

Dyersburg, Tennessee 38024

Hours: 8:30am to 4:30pm M-F

Phone: (731) 286-7806

Recording Tips for Dyer County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Dyer County

Properties in any of these areas use Dyer County forms:

- Bogota

- Dyersburg

- Finley

- Lenox

- Newbern

- Tigrett

- Trimble

Hours, fees, requirements, and more for Dyer County

How do I get my forms?

Forms are available for immediate download after payment. The Dyer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dyer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dyer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dyer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dyer County?

Recording fees in Dyer County vary. Contact the recorder's office at (731) 286-7806 for current fees.

Questions answered? Let's get started!

Most states require contractors and other workers to provide a written notice to a property owner that lets he or she know that a project is about to commence. Sending the notice is necessary to protect any later mechanic's lien rights. In Tennessee, the form of notice is called a "Notice to Owner."

Any contractor who is about to enter into a contract, either written or oral, for improving real property with the owner or owners thereof shall, prior to commencing the improvement of the real property or making of the contract, deliver, by registered mail or otherwise, to the owner or owners of the real property to be improved a written notice. Tenn. Prop. Code 66-11-203.

The purpose of the Notice is to identify who the contractor is and inform the owner that the contractor is about to commence work and will have a right to claim a lien under State law. Id.

The notice identifies the parties, the delivery date, and the intended location and start date for the work or improvement. It must be sent before the work begins or else the person sending the notice may only be able to claim a lien for work arising after the notice is sent (if sent late). This document does not need to be recorded, but the potential claimant should either deliver it by hand or via USPS Registered mail or another delivery service that offers confirmation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens or sending notice to an owner.

Important: Your property must be located in Dyer County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Dyer County.

Our Promise

The documents you receive here will meet, or exceed, the Dyer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dyer County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Rose C.

September 12th, 2020

easy breezy *****

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry L.

September 18th, 2023

Easy, quick and responsive for recording purposes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles B.

December 14th, 2019

Excellent andeasy to navigate website for non-lawyers. Needed some forms for a specific county in a specific state, and Deeds.com took me right there, where I downloaded the forms and a guide on how to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine B.

April 16th, 2021

The site was easy to navigate.

Thank you!

Biagio V.

July 16th, 2022

Process was quick , through and completed with no problems. Excellent service for the price involved.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard G.

March 17th, 2023

Easy to use. I was able to find out what I needed quickly and was able to download the information necessary.

Thank you!

David H.

March 25th, 2022

It was great

Thank you!

alex b.

February 16th, 2021

I appreciate the very quick response that I received and I am very impressed with the access that you provide to records. I'm still in the process of trying to find out what's there but that will take a bit of time. All in all, you are to be commended for a first class operation.

Thank you!

Michael R.

August 25th, 2025

A suggestion: Include instructions on how to add your spouse to the deed, rather than transferring completely to a third party

Thank you for your thoughtful feedback. Adding a spouse to a deed is a common need, and suggestions like yours help us identify where additional guidance would be useful. We’ll take this into consideration as we continue improving our resources.

Amber H.

January 31st, 2019

after typing in the information, the printing is not in alignment - looks disorganized on the page and hard to read

Thank you for your feedback. We will flag the document for review.

Arthur L.

October 31st, 2020

The directions were clear, I typed the deed out and it was successfully recorded and mailed back to me in less than a week.

Thank you for your feedback. We really appreciate it. Have a great day!

Annette H.

April 7th, 2022

Clear directions. Giving a sample filled-in set of forms was great! Economical cost. Will refer others & use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen H.

July 21st, 2020

Very disappointed that the Recording Information section did not state where to get the information required.

Sorry to hear that we failed you Kathleen.

Janet M.

May 4th, 2021

Was fairly easy to complete but my situation wasn't covered so I had to make a call to get help. Will see if it gets filed successfully.

Thank you!

Michael H.

April 8th, 2020

Very responsive and thorough. Glad to have found such a great company for our recording needs.

Thank you!