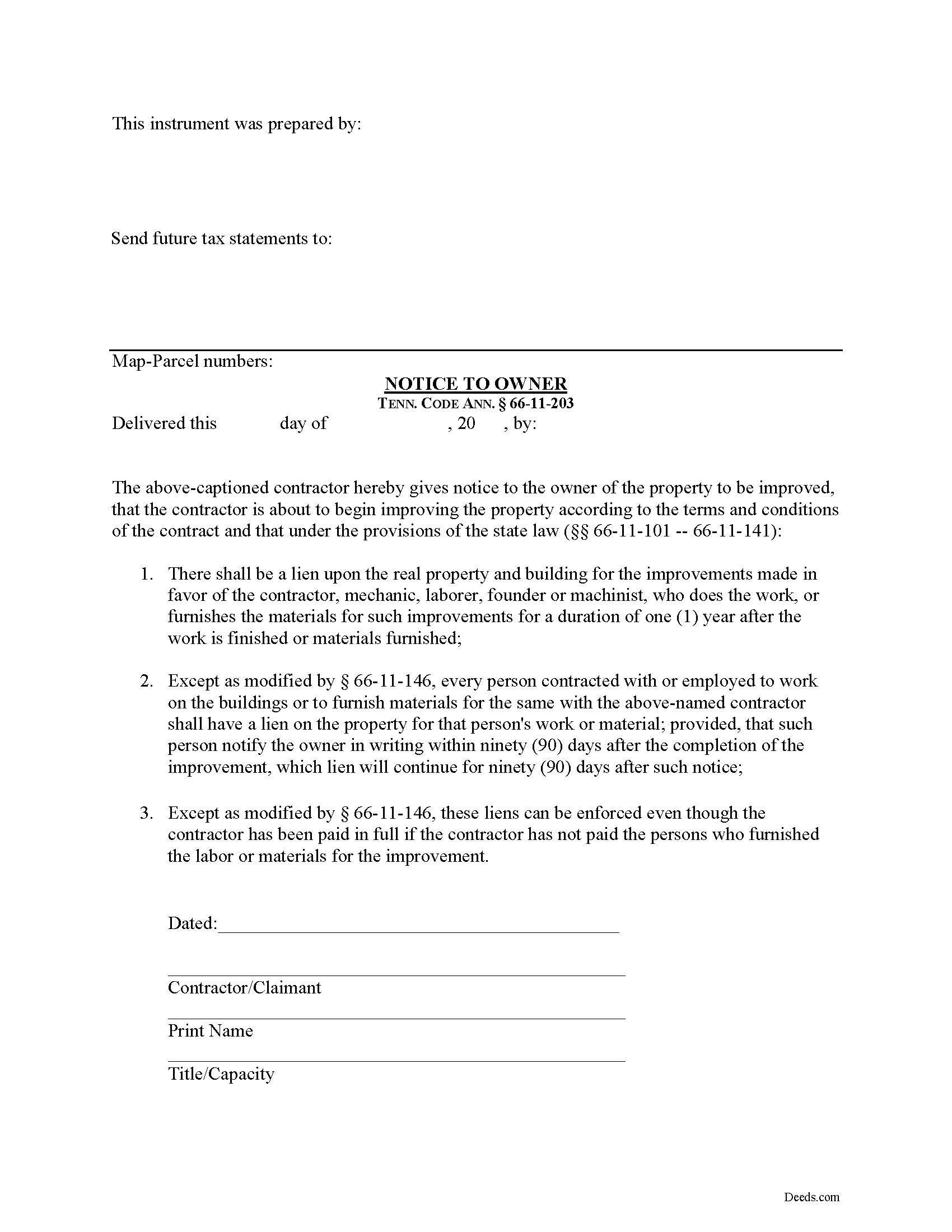

Johnson County Notice to Owner Form

Johnson County Notice to Owner Form

Fill in the blank Notice to Owner form formatted to comply with all Tennessee recording and content requirements.

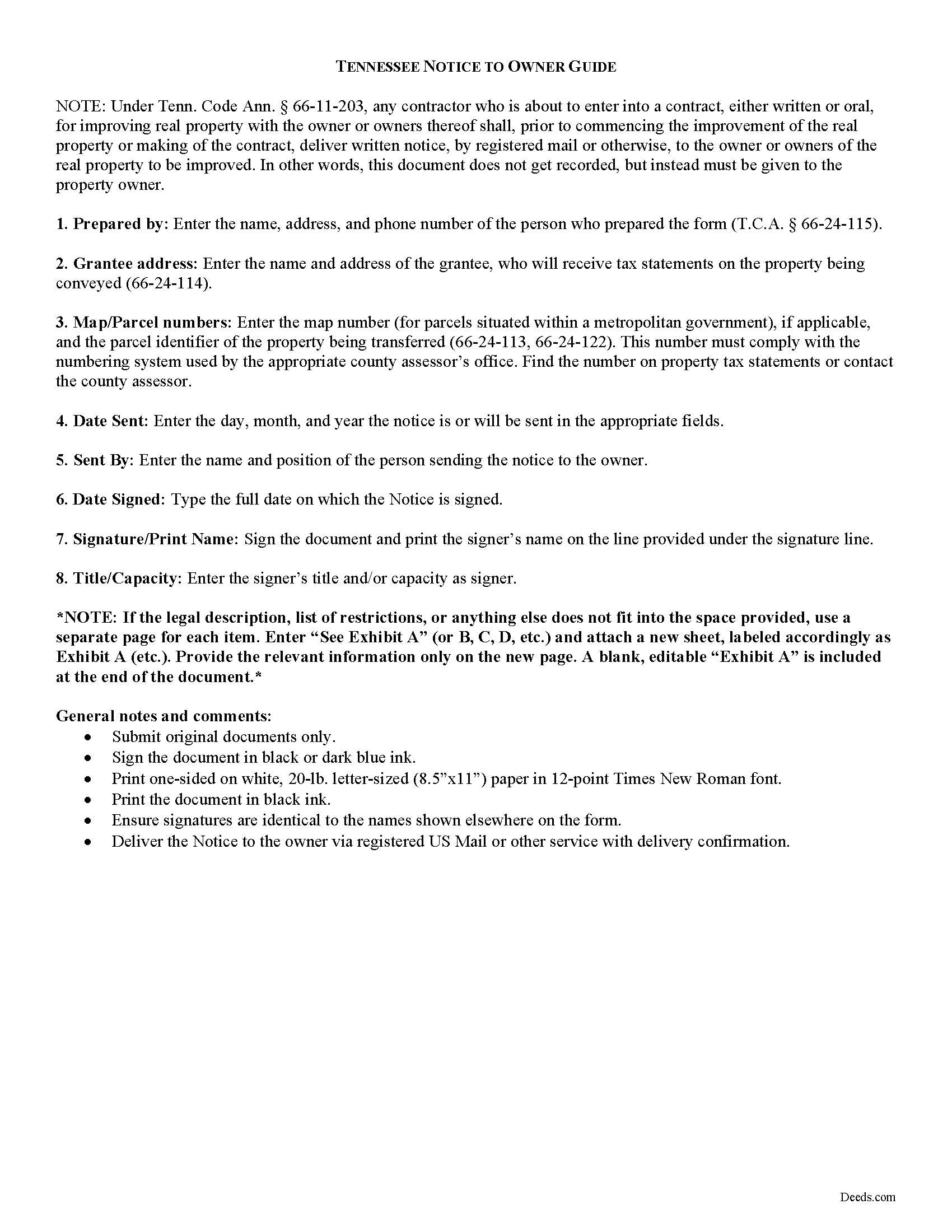

Johnson County Notice to Owner Guide

Line by line guide explaining every blank on the form.

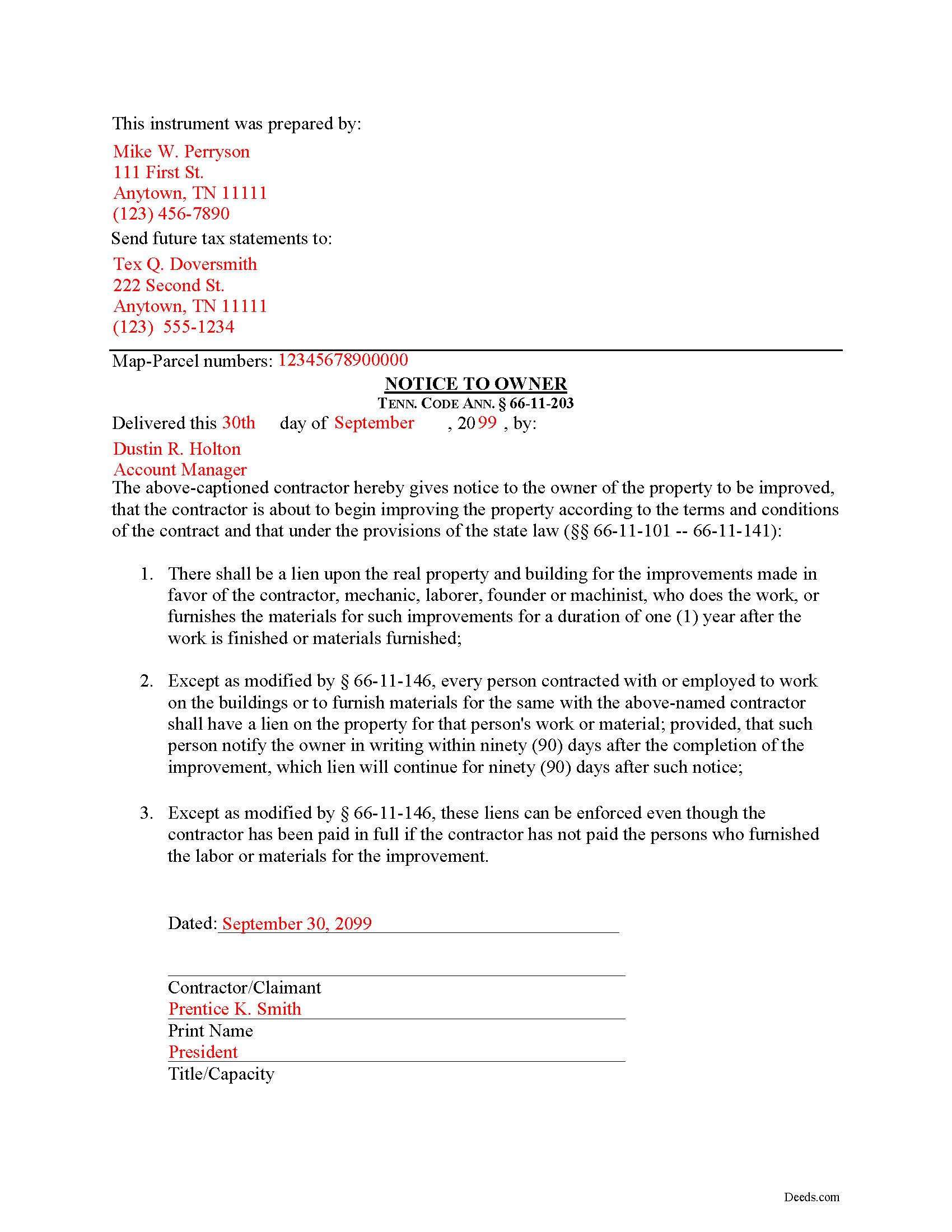

Johnson County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Register of Deeds

Mountain City, Tennessee 37683

Hours: 8:00 to 4:00 Monday through Friday

Phone: (423) 727-7841

Recording Tips for Johnson County:

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Butler

- Laurel Bloomery

- Mountain City

- Shady Valley

- Trade

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (423) 727-7841 for current fees.

Questions answered? Let's get started!

Most states require contractors and other workers to provide a written notice to a property owner that lets he or she know that a project is about to commence. Sending the notice is necessary to protect any later mechanic's lien rights. In Tennessee, the form of notice is called a "Notice to Owner."

Any contractor who is about to enter into a contract, either written or oral, for improving real property with the owner or owners thereof shall, prior to commencing the improvement of the real property or making of the contract, deliver, by registered mail or otherwise, to the owner or owners of the real property to be improved a written notice. Tenn. Prop. Code 66-11-203.

The purpose of the Notice is to identify who the contractor is and inform the owner that the contractor is about to commence work and will have a right to claim a lien under State law. Id.

The notice identifies the parties, the delivery date, and the intended location and start date for the work or improvement. It must be sent before the work begins or else the person sending the notice may only be able to claim a lien for work arising after the notice is sent (if sent late). This document does not need to be recorded, but the potential claimant should either deliver it by hand or via USPS Registered mail or another delivery service that offers confirmation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens or sending notice to an owner.

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Sara Beth M B.

August 14th, 2020

great service!!!!! wish this service was listed on the Washoe County Recorder website so people who aren't companies could find it.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael D.

February 7th, 2019

I did not like the size of the Warranty Deed form which took 2 pages to print. It should be no larger than 8 1/2 by 14 inches. I did not like that I could not reformat it to be smaller, could not eliminate unused lines, could not delete the excessive 4 signature lines, could not copy or paste into text editor. Very unsatisfactory rating.

Thank you for your feedback Michael. Unfortunately we don't make the requirements, we only make the documents to be compliant with the requirements. Have a great day!

WALTER L.

June 19th, 2019

GREAT SITE, HAD ALL THE FORMS I NEEDED AND INSTRUCTIONS WITH ILLUSTRATIONS.

Thank you!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra W.

January 13th, 2021

I was trying to get a lien released for the last 3 month with Maricopa County and once I utilized your system it was complete within 24 hours of my filing. Great company and customer service, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Robin B.

November 6th, 2020

Nice and easy

Thank you!

Michael B.

June 5th, 2020

Amazing! I was able to submit my documentation and it was on record within one hour! Highly Recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly L.

June 27th, 2020

Great to have online resources! I will most definitely refer others! Best regards,

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger S.

August 19th, 2020

status was canceled. said i needed to record directly. would be 5 stars if it worked.

Sorry for the inconvenience Roger. Unfortunately, not all jurisdictions in the country have progressed to the point of being able to accept all document types for e-recording.

James N.

December 14th, 2018

The purchasing process was very slick and my credit card was charged IMMEDIATELY. The deliver went well as the link was provided immediately. However I asked a question via the "Contact Us" link and days later I get a survey but no reply. I may have been directed to the wrong forms via my County and I wanted to confirm that...but still no answer. What would that deserve as a rating???

Also, your history on our site shows no messages sent via our contact us page.

BARBARA T.

July 16th, 2019

Love this site! So easy to use and very economical

Thank you!

Willie P.

May 13th, 2020

Your service was excellent

Thank you for your feedback. We really appreciate it. Have a great day!

Tracie R.

December 24th, 2019

Great company and very fast at getting deeds to me. :)5 star!!

Thank you!

Thomas Z.

November 10th, 2021

Excellent site! Very informative and easy to navigate. I would highly recommend to anyone requiring documents in a quick and through fashion.

Thank you for your feedback. We really appreciate it. Have a great day!

Francisco C.

January 25th, 2023

well first time my company is using and this what can say. excellent service im very happy, you guys did my job very professional and quickly so congratulations... i will recommend to every one.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!