Overton County Notice to Owner Form

Overton County Notice to Owner Form

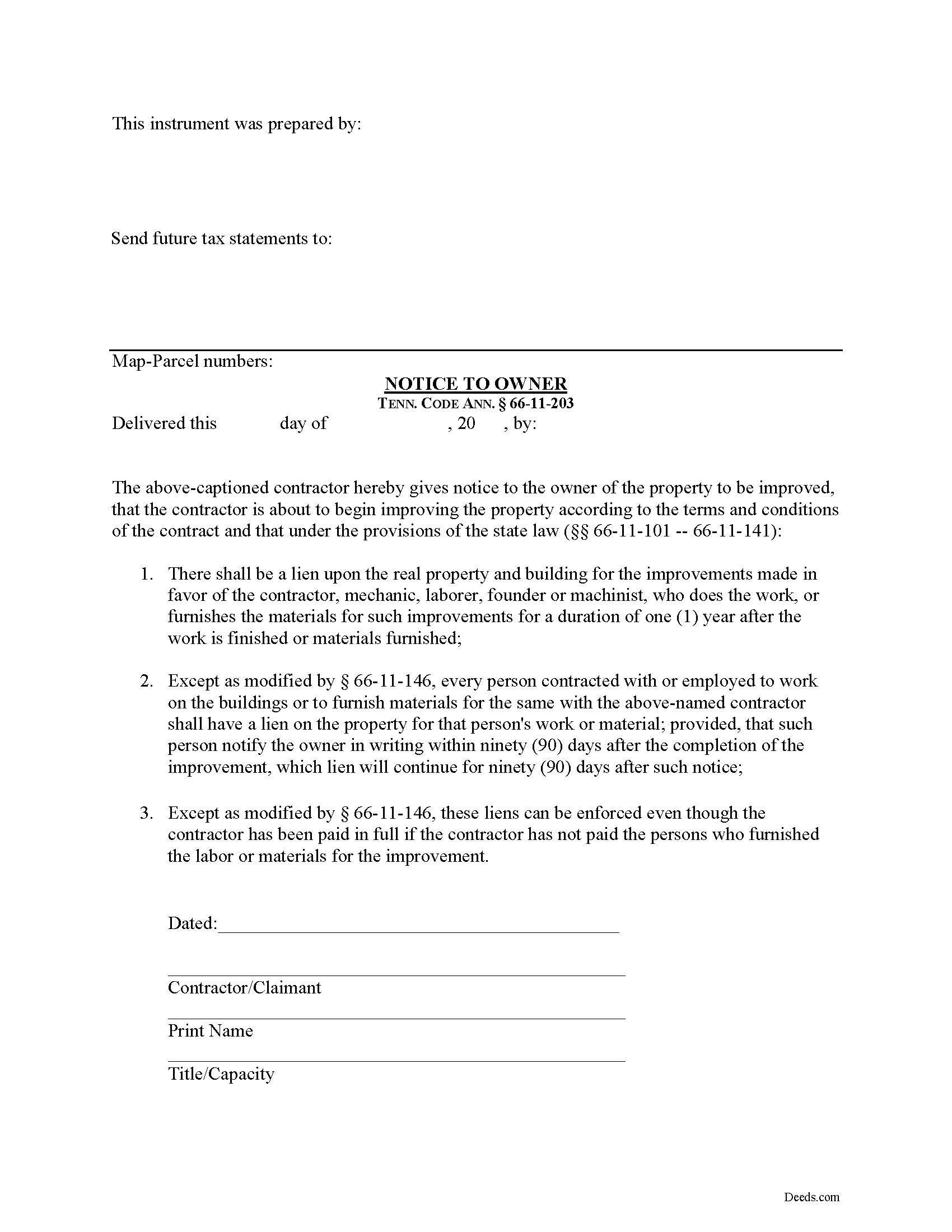

Fill in the blank Notice to Owner form formatted to comply with all Tennessee recording and content requirements.

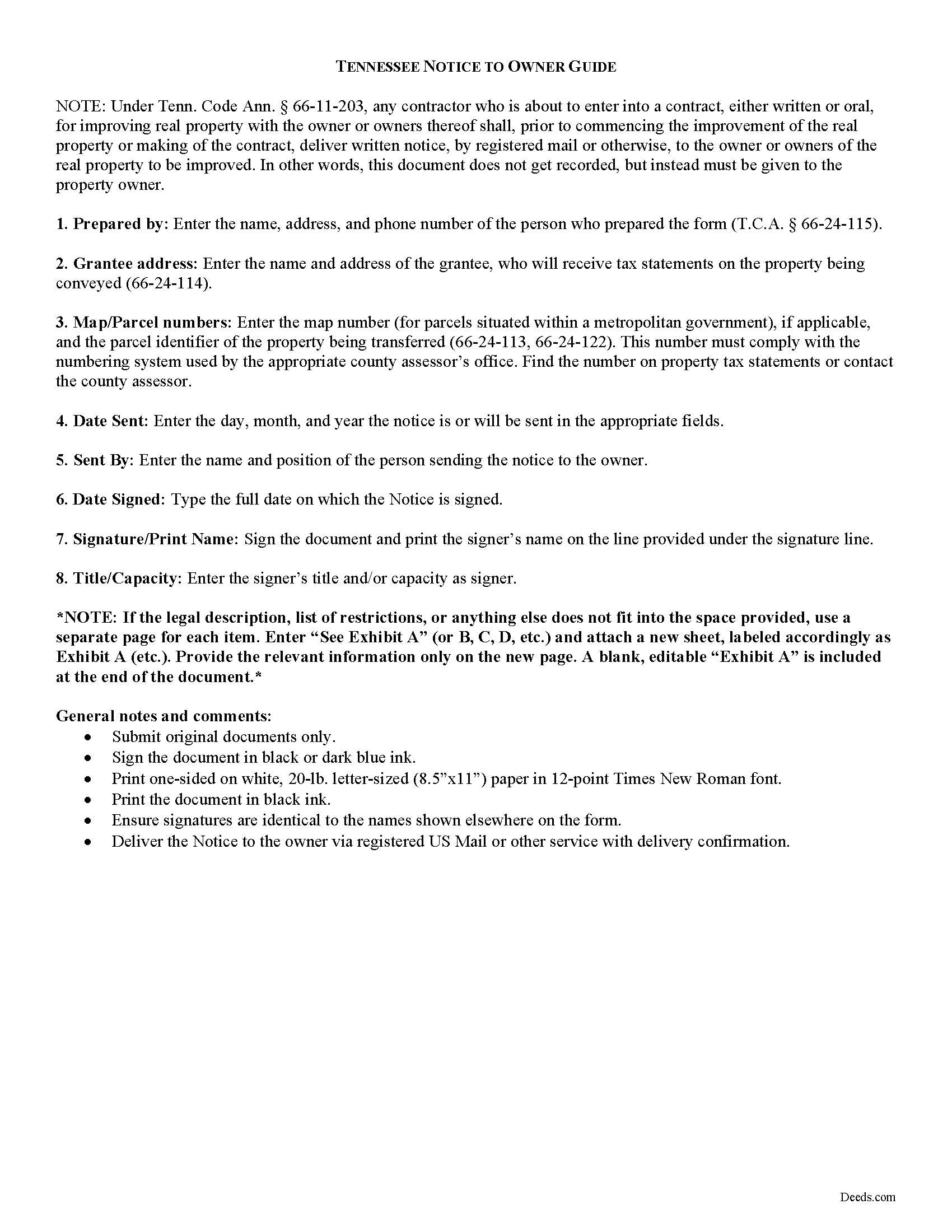

Overton County Notice to Owner Guide

Line by line guide explaining every blank on the form.

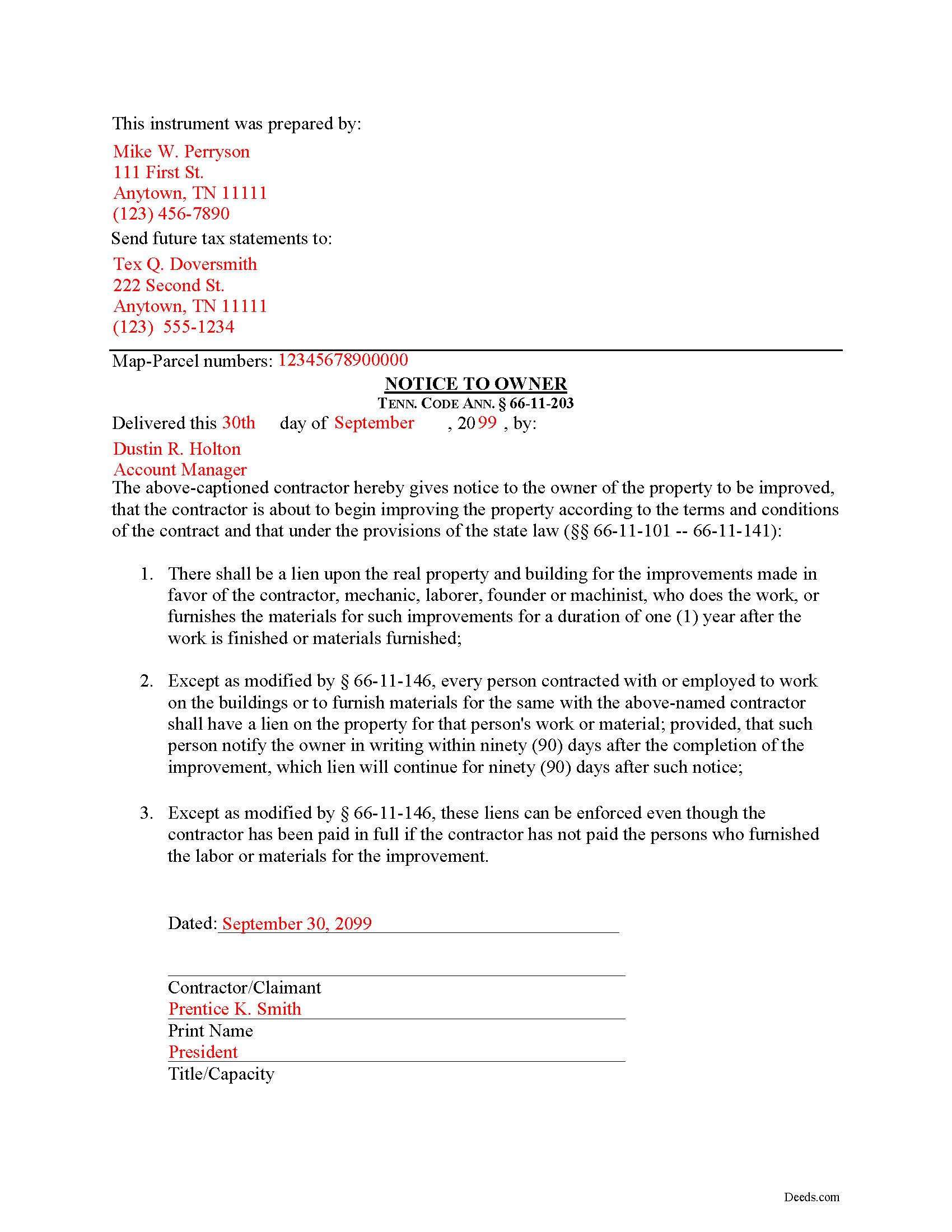

Overton County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Overton County documents included at no extra charge:

Where to Record Your Documents

Overton County Register of Deeds

Livingston, Tennessee 38570

Hours: 8:00am to 4:30pm M-F

Phone: (931) 823-4011

Recording Tips for Overton County:

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Overton County

Properties in any of these areas use Overton County forms:

- Allons

- Allred

- Alpine

- Crawford

- Hilham

- Livingston

- Monroe

- Rickman

- Wilder

Hours, fees, requirements, and more for Overton County

How do I get my forms?

Forms are available for immediate download after payment. The Overton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Overton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Overton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Overton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Overton County?

Recording fees in Overton County vary. Contact the recorder's office at (931) 823-4011 for current fees.

Questions answered? Let's get started!

Most states require contractors and other workers to provide a written notice to a property owner that lets he or she know that a project is about to commence. Sending the notice is necessary to protect any later mechanic's lien rights. In Tennessee, the form of notice is called a "Notice to Owner."

Any contractor who is about to enter into a contract, either written or oral, for improving real property with the owner or owners thereof shall, prior to commencing the improvement of the real property or making of the contract, deliver, by registered mail or otherwise, to the owner or owners of the real property to be improved a written notice. Tenn. Prop. Code 66-11-203.

The purpose of the Notice is to identify who the contractor is and inform the owner that the contractor is about to commence work and will have a right to claim a lien under State law. Id.

The notice identifies the parties, the delivery date, and the intended location and start date for the work or improvement. It must be sent before the work begins or else the person sending the notice may only be able to claim a lien for work arising after the notice is sent (if sent late). This document does not need to be recorded, but the potential claimant should either deliver it by hand or via USPS Registered mail or another delivery service that offers confirmation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens or sending notice to an owner.

Important: Your property must be located in Overton County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Overton County.

Our Promise

The documents you receive here will meet, or exceed, the Overton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Overton County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Jane N.

February 17th, 2022

Good morning, It seems to be easy to navigate and print out the form I needed. Great!!! Jane

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Edward B.

May 13th, 2020

Thank you for the rapid response. I shall persevere in my search using other public records. I shall keep your website handy for other such searches in the future.

Thank you!

Todd B.

October 9th, 2020

very quick and easy

Thank you!

Lacina B.

July 25th, 2020

Forms were appropriately priced, easy to download

Thank you for your feedback. We really appreciate it. Have a great day!

Sheryl C.

July 28th, 2021

Very Very helpful easy to navigate the guides and examples were great and informative. Great to have will be using for future transactions.

Thank you for your feedback. We really appreciate it. Have a great day!

ruth l.

January 6th, 2021

I found this sight very helpful. All the information that one needs to file a quit claim deed. thank you so much.

Thank you!

Ernest K.

July 27th, 2020

Im an out of state realtor, but couldnt believe how quick and easy the process was. Recieved my deed within 15 min of submission. I will be referring clients to this service.

Thank you!

Linda W.

January 16th, 2019

Got the forms, very straight forward. No problems completing them.

Thanks Linda!

Allan S.

September 19th, 2024

Using this sofftware was a piece of cake! Donload was fast and simple. Using the guide supplied I did the Beneficiary Deed in no time. Would certainly use this service again without hesitation.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

RICK M.

February 20th, 2020

great

Thank you!

Heidi S.

August 5th, 2021

I had prompt service thank you

Thank you!

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shantu S.

December 1st, 2022

Easy to follow directions and complete the Deed.

Thank you!

John M.

March 17th, 2021

Very satisfied with your service. Considering how complicated real estate titles are, this could not have been simpler. Your website worked perfectly.

Thank you!

Maura M.

January 15th, 2020

Easy user friendly website

Thank you!