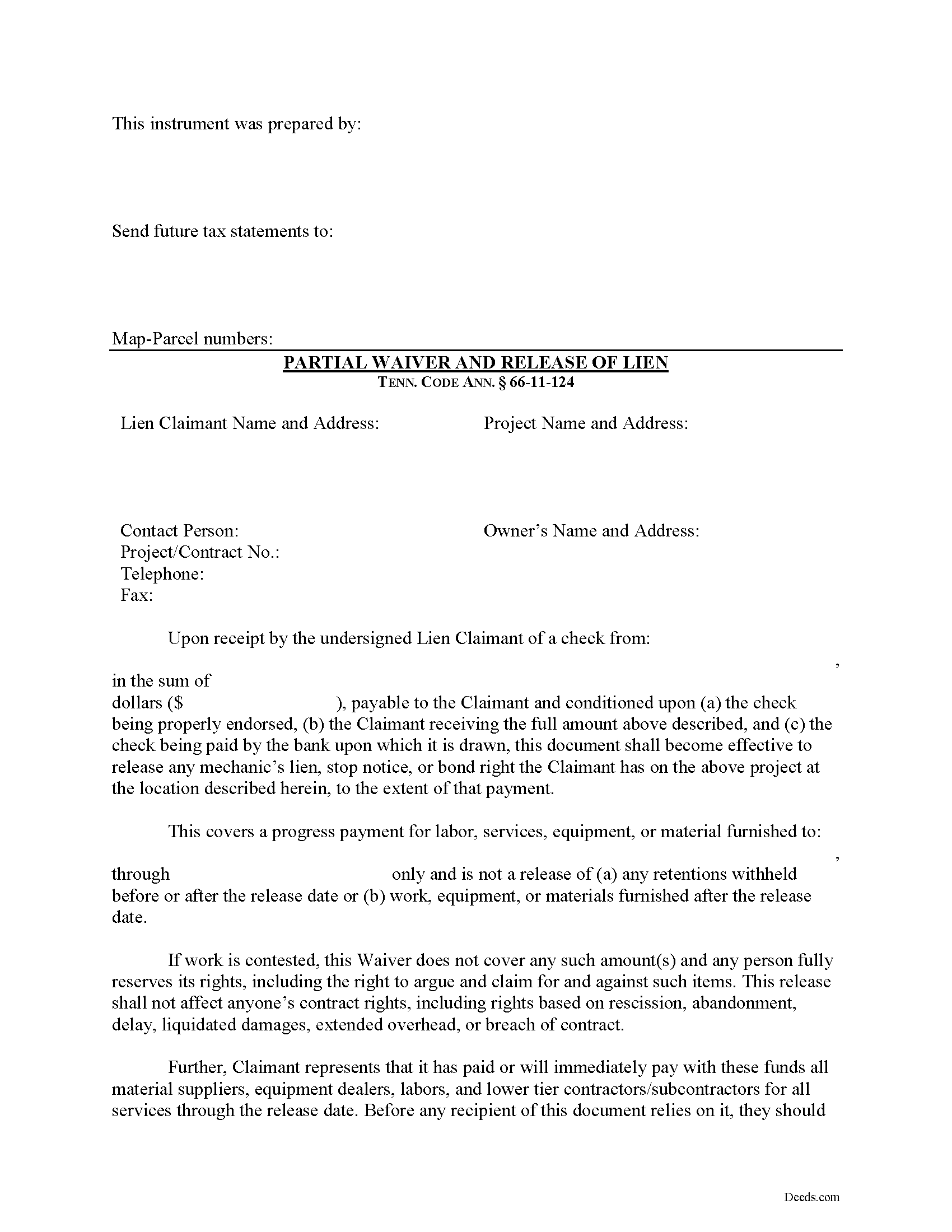

Bradley County Partial Lien Waivers Form

Bradley County Partial Lien Waivers Form

Fill in the blank Partial Lien Waivers form formatted to comply with all Tennessee recording and content requirements.

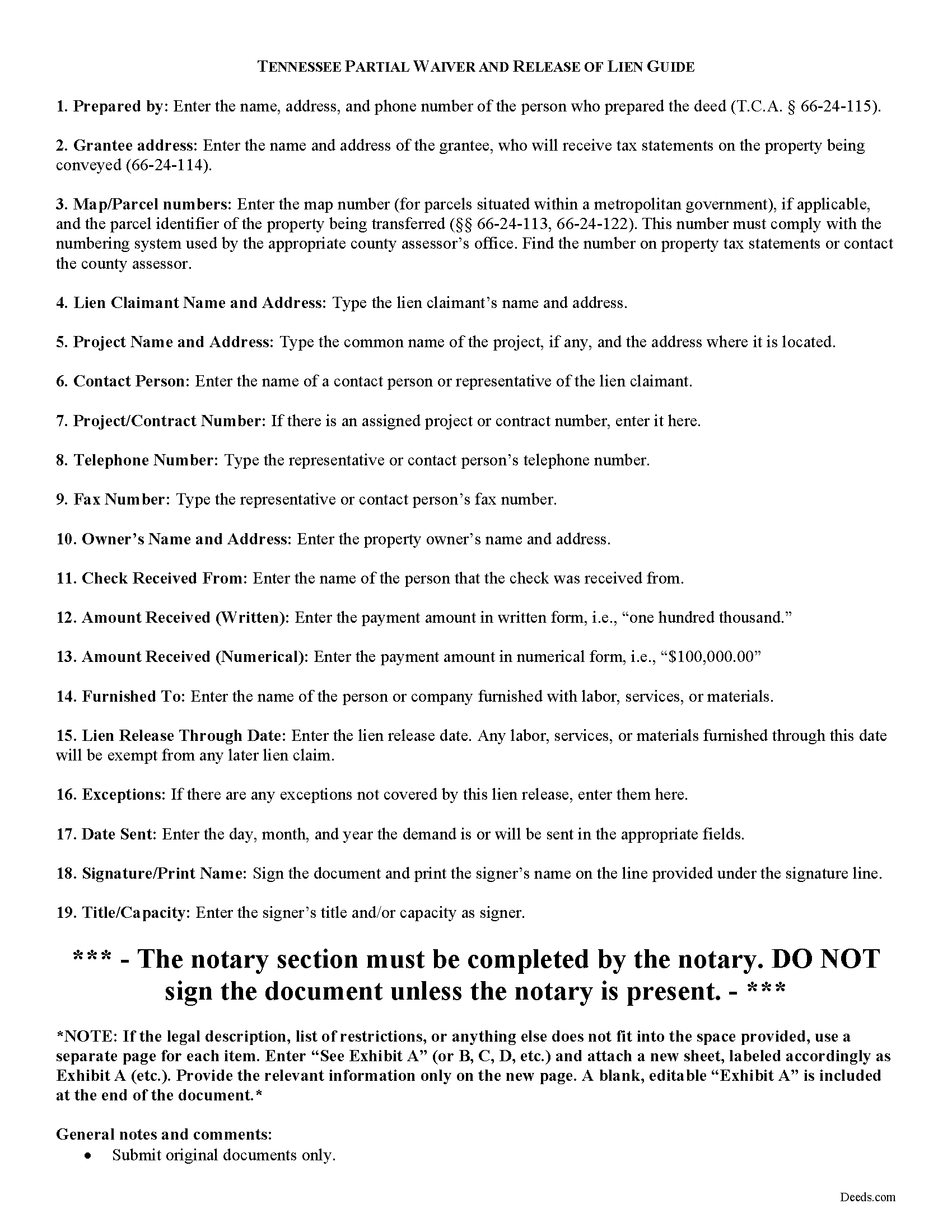

Bradley County Partial Lien Waiver Guide

Line by line guide explaining every blank on the form.

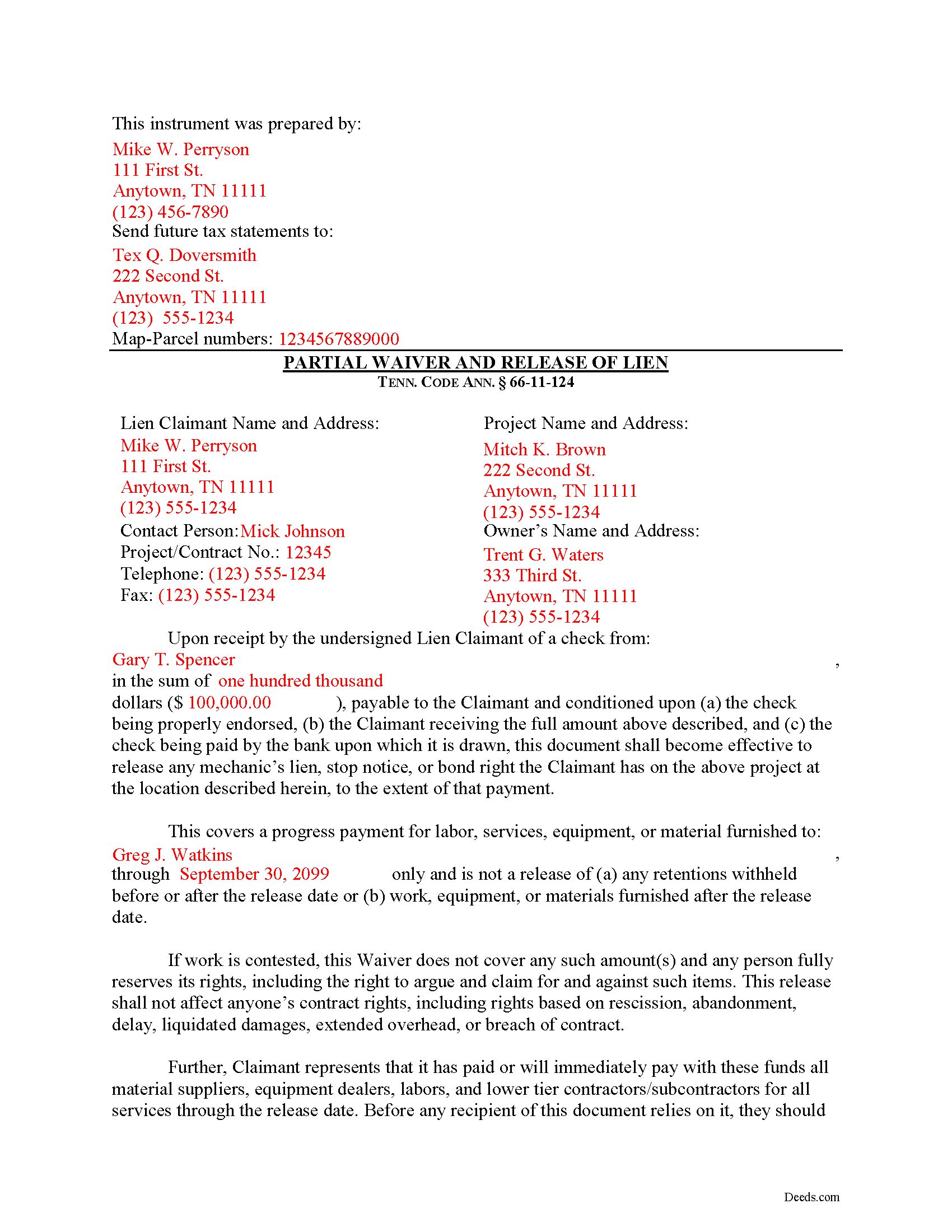

Bradley County Completed Example of the Partial Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Bradley County documents included at no extra charge:

Where to Record Your Documents

Bradley County Register of Deeds

Cleveland, Tennessee 37311

Hours: Mon - Thur 8:30am to 4:30pm; Fri 8:30am to 5:00pm

Phone: (423) 728-7240

Recording Tips for Bradley County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Bradley County

Properties in any of these areas use Bradley County forms:

- Charleston

- Cleveland

- Mc Donald

Hours, fees, requirements, and more for Bradley County

How do I get my forms?

Forms are available for immediate download after payment. The Bradley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bradley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bradley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bradley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bradley County?

Recording fees in Bradley County vary. Contact the recorder's office at (423) 728-7240 for current fees.

Questions answered? Let's get started!

"Waiver" is a legal term which means giving up a right. A waiver can be written or oral. It can also be expressed by a formal agreement or implied through conduct of the parties. When discussing mechanic's liens, a waiver refers to a written document granted by a lien claimant to a property owner. This document usually confirms a partial or final payment and states that the lien claimant is waiving a right to claim a lien for the partial or full amount. Waivers help ease feelings of distrust between parties dealing at arms-length and give peace of mind for the laborer that he or she will get paid and for the property owner that his or her property won't be burdened by any mechanic's liens.

In Tennessee, lien waivers are governed under 66-11-124 of the Tennessee Property Code. Lien waivers in Tennessee must be explicit and are never implied. The acceptance by the lienor of a note or notes for all or any part of the amount of the lienor's claim shall not constitute a waiver of the lienor's lien, unless expressly so agreed in writing, nor shall it in any way affect the period for serving or recording the notice of lien under this chapter. Tenn. Prop. Code 66-11-124(a). Further, any contract term that purports to waive any right of lien under this chapter is void and unenforceable as against the public policy of the state. Tenn. Prop. Code 66-11-124(b). In fact, if a contractor solicits any person to sign a contract requiring the person to waive a right of lien, the person shall notify the state board for licensing contractors of that fact. Tenn. Prop. Code 66-11-124(b)(2)(A). Upon receiving the information, the executive director of the board shall notify the contractor within a reasonable time after receiving the information that the contract is against the public policy of this state and in violation of this section.

Use a partial lien waiver when a progress payment is made in exchange for the release of a portion of the contractor's lien rights. For instance, it the entire contract is for $100,000 and the owner makes a $10,000 progress payment, a partial waiver is appropriate. This allows the responsible party pay down an outstanding balance while the contractor retains some protection on the remainder.

A valid waiver is in the form of an affidavit (sworn statement). It identifies the parties, the location of the work, relevant dates and amounts paid, and any other information necessary for the specific situation. Record the completed and notarized document in the records of the county where the property is situated.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Important: Your property must be located in Bradley County to use these forms. Documents should be recorded at the office below.

This Partial Lien Waivers meets all recording requirements specific to Bradley County.

Our Promise

The documents you receive here will meet, or exceed, the Bradley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bradley County Partial Lien Waivers form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Susan S.

November 26th, 2021

What a delight to find this Website. Professionally done and easy to work with.

Thank you for your feedback. We really appreciate it. Have a great day!

Kay C.

December 22nd, 2021

Thank you for your patience and help with filing the documents needed. You were helpful, prompt, courteous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane W.

December 12th, 2019

Easy to download and print. Came with good instructions. Would use deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott W.

September 21st, 2021

World class forms and service! Wish I had known about this site years ago, woulda saved me lots of headaches. Thank you.

Thanks for the kinds words Scott, have an amazing day!

bruce t.

May 16th, 2022

Much good information provided. Forms easy to use. Price is a bargain.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary Ann H V.

May 4th, 2021

I'm very happy with your service! It saved me, at least, hundreds of dollars vs. going through a lawyer in a different state.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann B.

December 27th, 2019

Works perfect. Saved money hiring someone to do this work.

Thank you!

Kevin C.

August 22nd, 2021

Easy to use but the quit claim deep looked old and dated. The example of how to fill out should have asterisks stating what is need and what can be skipped

Thank you for your feedback. We really appreciate it. Have a great day!

Karen H.

April 6th, 2024

Saves a trip to the Recorders Office!

It was a pleasure serving you. Thank you for the positive feedback!

Laura H.

August 25th, 2020

I was very impressed with how quickly I was provided the data.

Thank you!

Lisa P.

February 18th, 2025

It was easy to find and download the documents that I needed.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Stefan L.

May 5th, 2022

Great templates and very efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas C.

July 31st, 2021

This platform made electronic filing of a lien easy and quick. I was able to accomplish everything from my laptop and phone, and the fees were reasonable. I would recommend deeds.com for efiling property related documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wilfrid J.

June 7th, 2021

It was fast and easy but it's really official

Thank you!

STEVEN J.

October 18th, 2019

Great , easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!