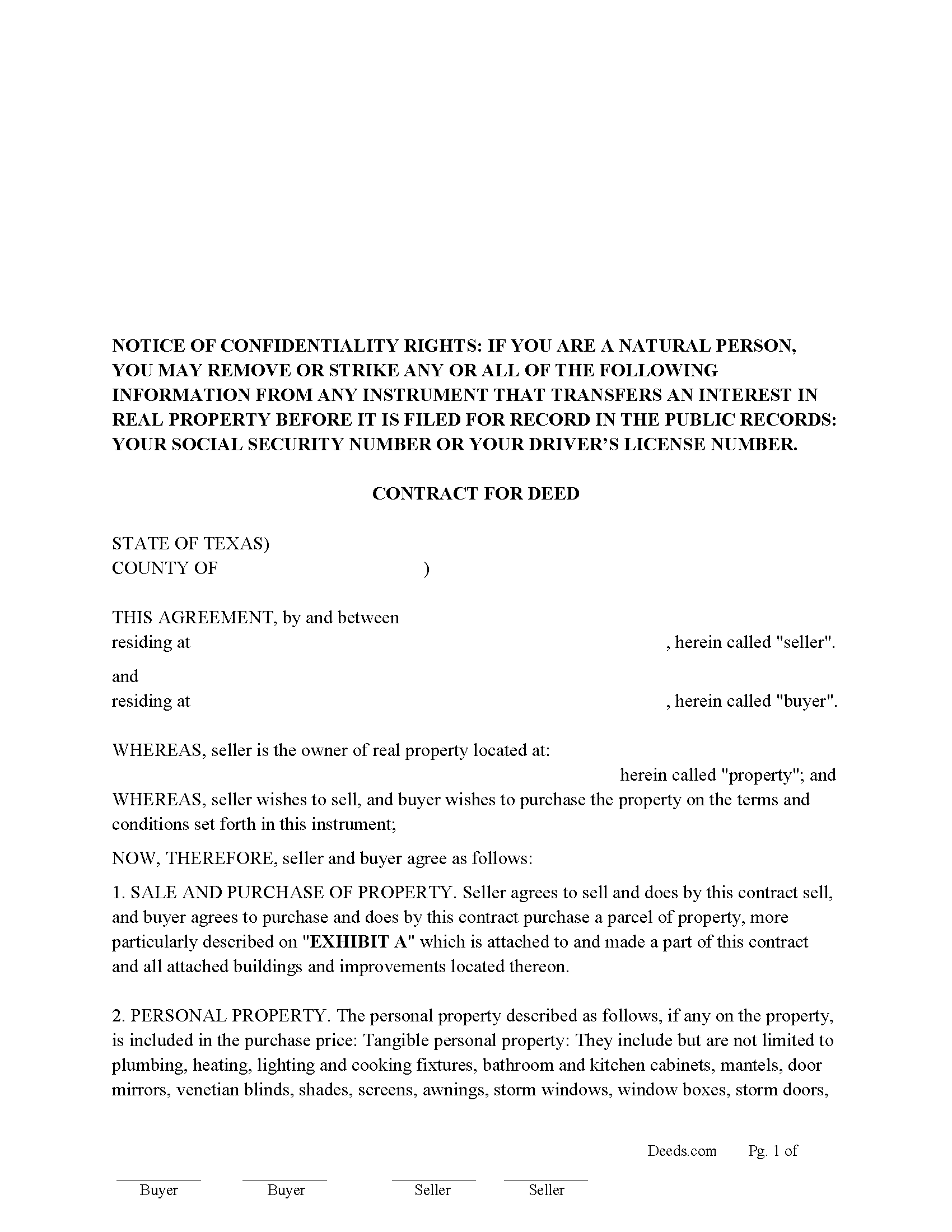

Duval County Contract for Deed Form

Duval County Contract for Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

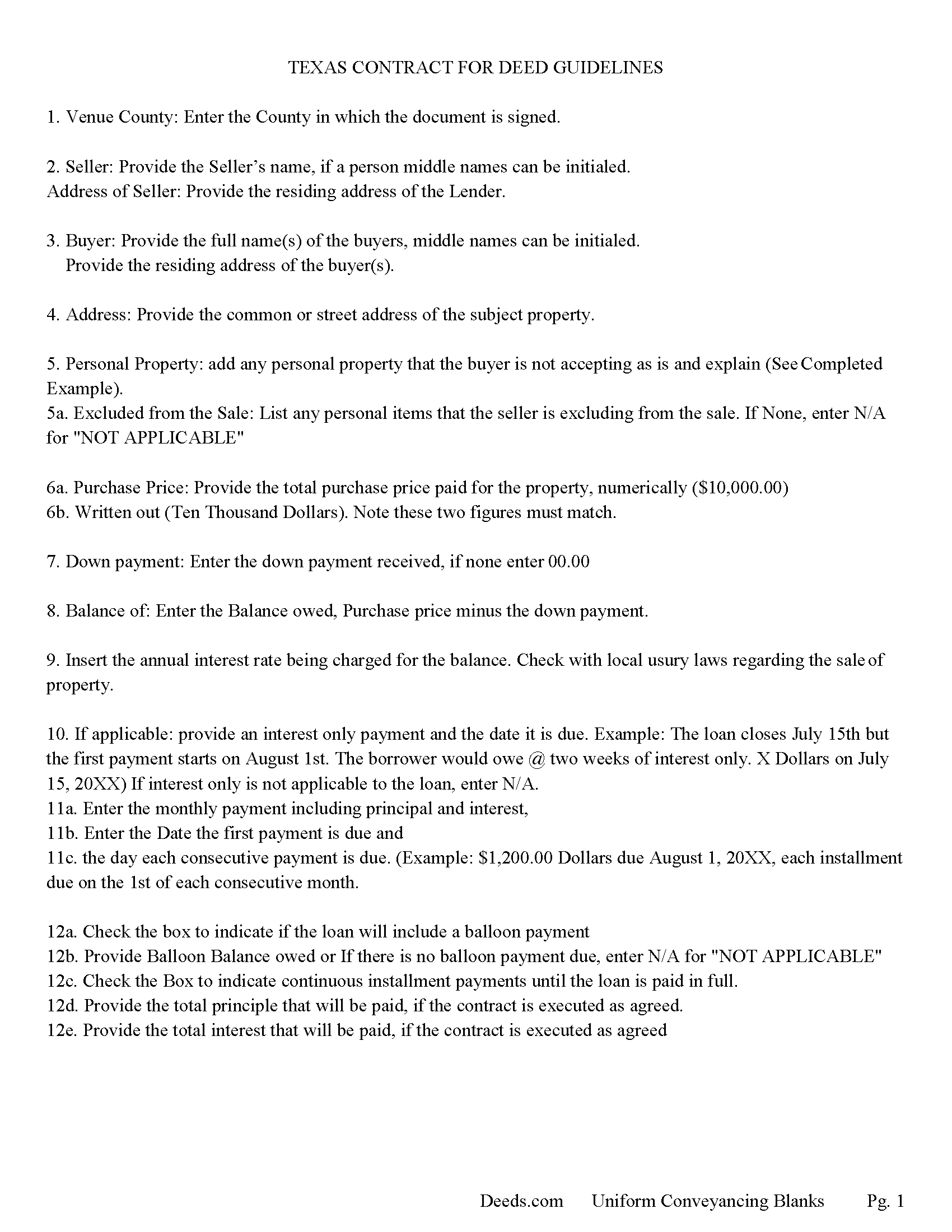

Duval County Contract for Deed Guidelines

Line by line guide explaining every blank on the form.

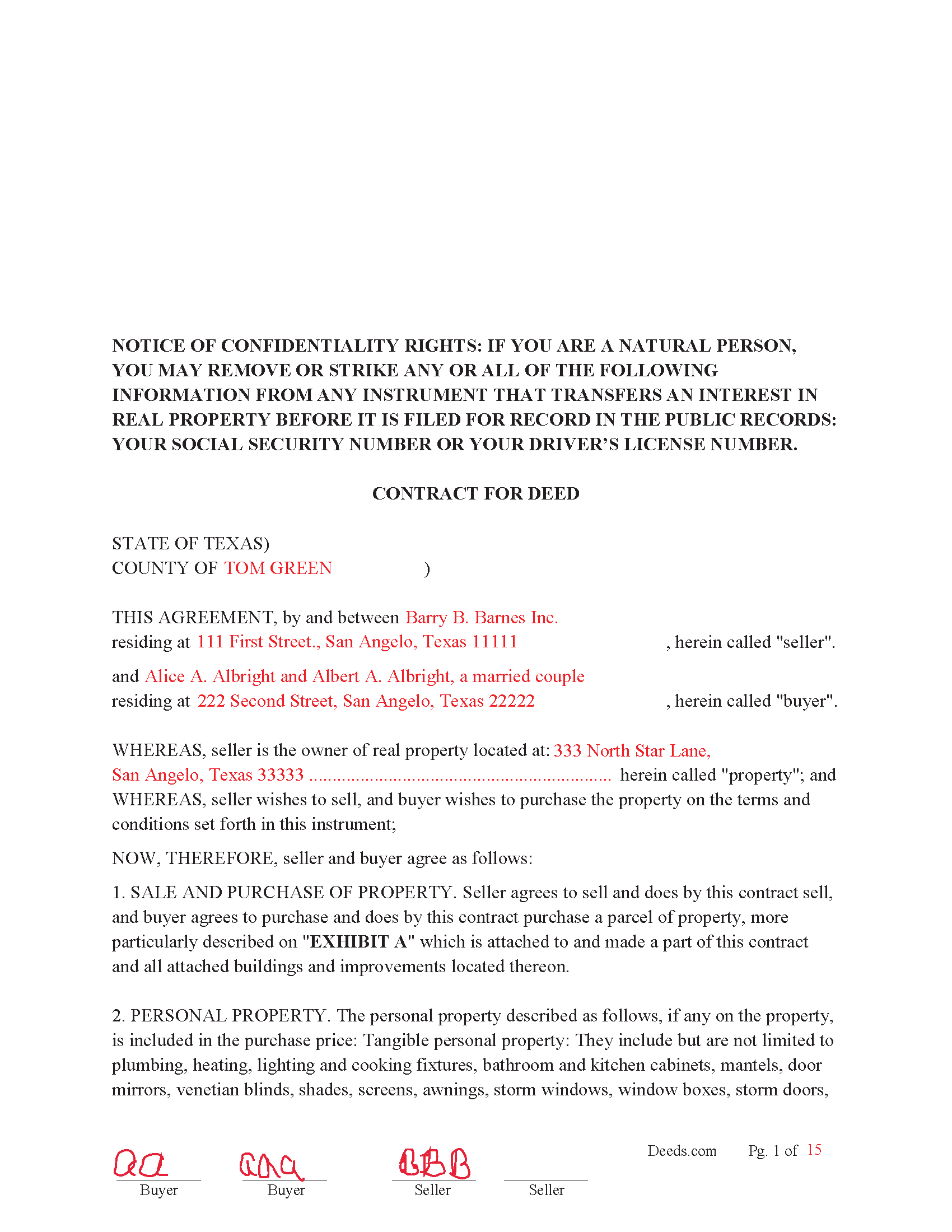

Duval County Completed Example of the Contract for Deed

Example of a properly completed form for reference.

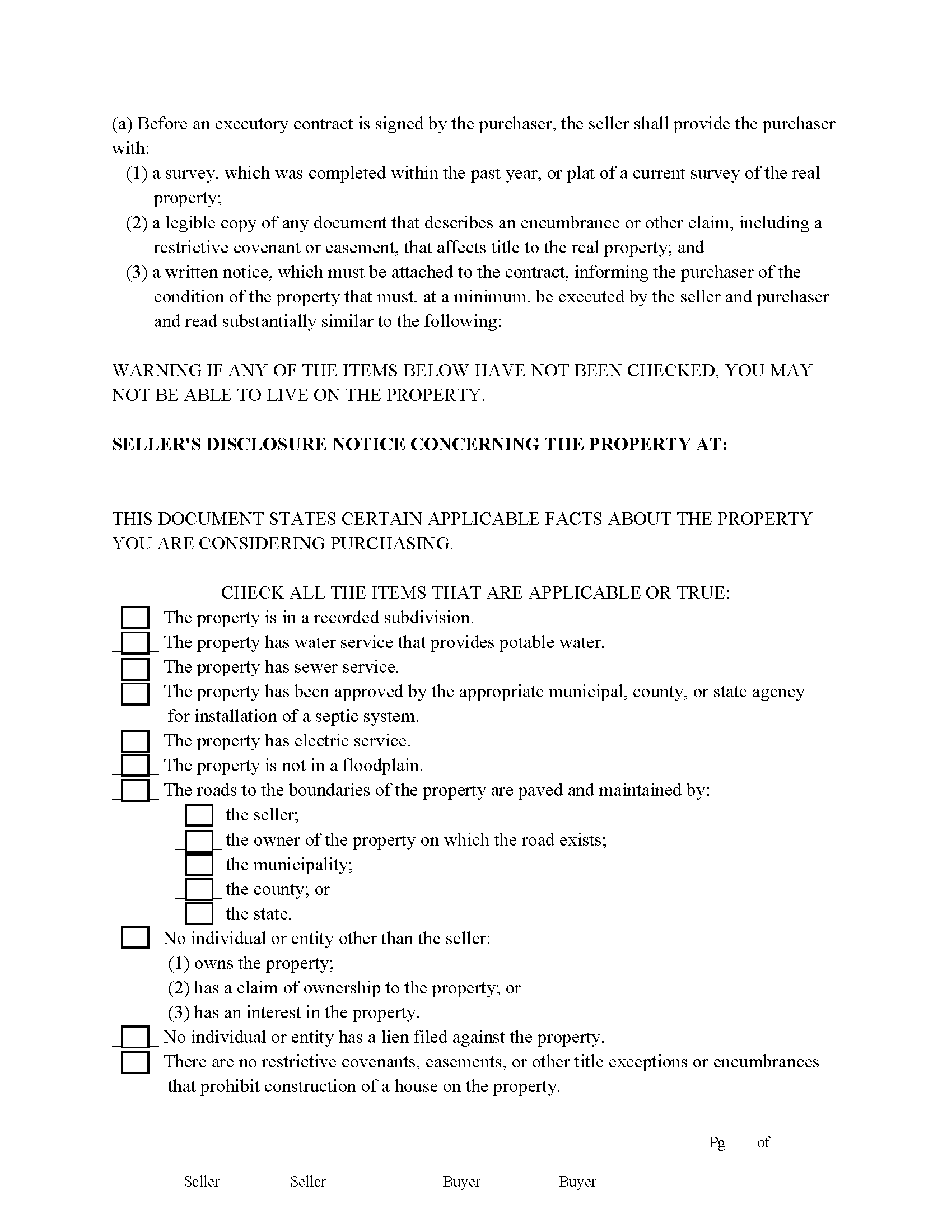

Duval County Property Disclosure Form

Fill in the blank form

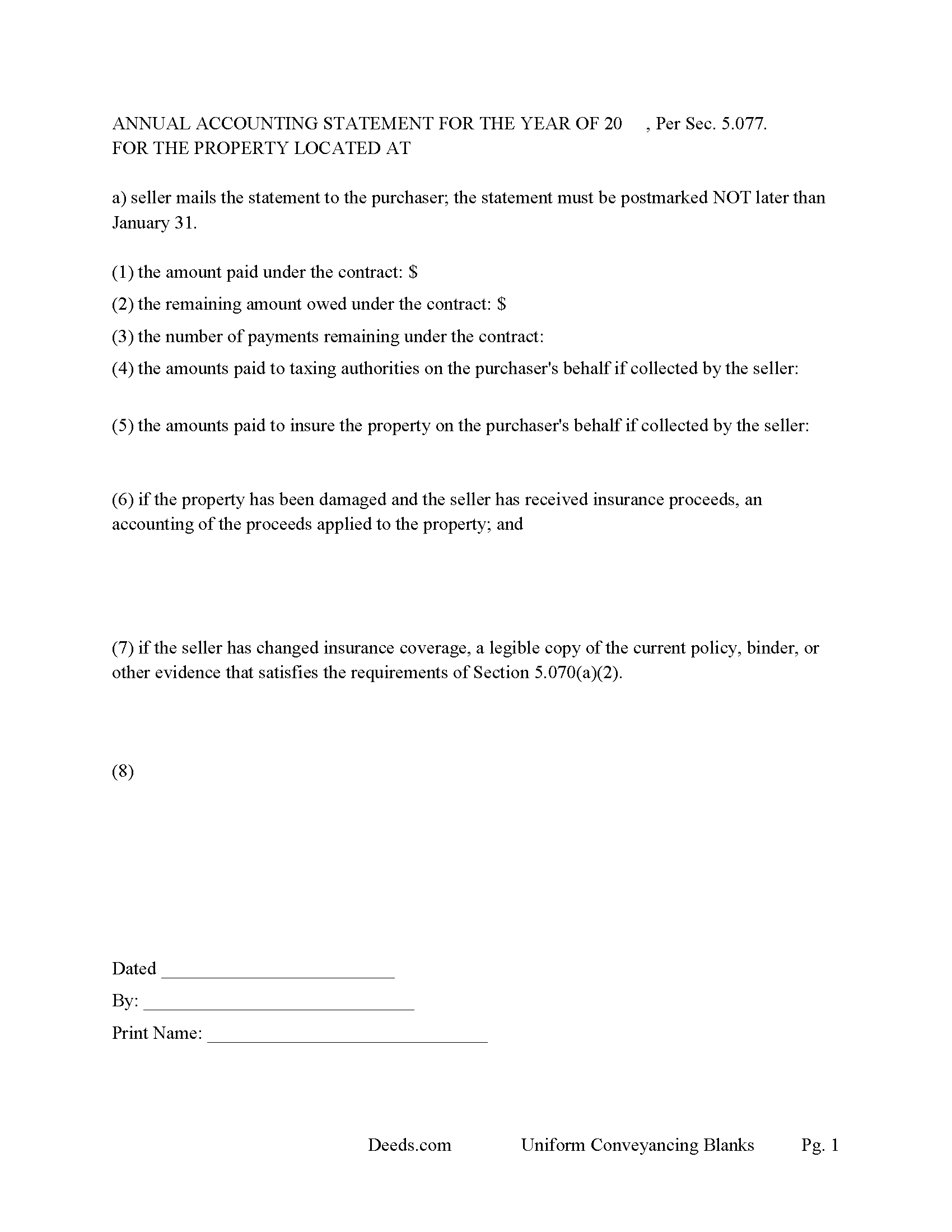

Duval County Annual Accounting Statement Form

As required by Texas Property Code.

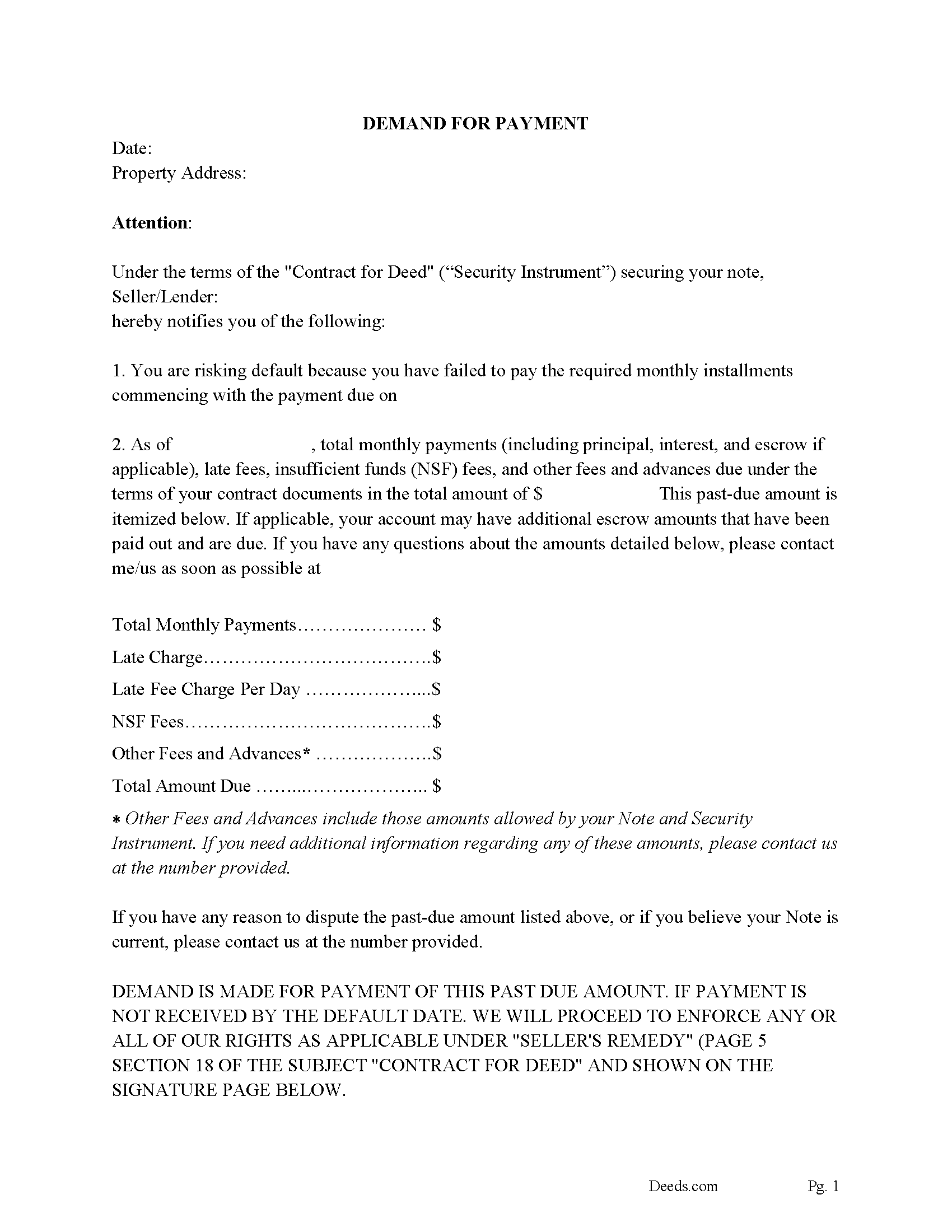

Duval County Demand for Payment

Use for payments past due, if needed.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Duval County documents included at no extra charge:

Where to Record Your Documents

Duval County Clerk

San Diego, Texas 78384

Hours: Monday-Friday 8am-5pm

Phone: (361) 279-6272 or 6249

Recording Tips for Duval County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Avoid the last business day of the month when possible

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Duval County

Properties in any of these areas use Duval County forms:

- Benavides

- Concepcion

- Freer

- Realitos

- San Diego

Hours, fees, requirements, and more for Duval County

How do I get my forms?

Forms are available for immediate download after payment. The Duval County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Duval County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Duval County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Duval County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Duval County?

Recording fees in Duval County vary. Contact the recorder's office at (361) 279-6272 or 6249 for current fees.

Questions answered? Let's get started!

Contract for Deed also known as a Land Contract

Use for Seller financing of a home, condominium, rental property (up to 4 units), planned unit development, and land.

Financing can be conventional installment payments or installments followed by a balloon payment. This is often used with owner financing. 3 years of payments followed by a balloon payment. This gives the buyer time to build equity and credit. Buyer has the right to prepay any additional sums to reduce the principal at any time without penalty.

This form includes the following as per [Texas Code 5.071-Seller's Disclosure of Financing Terms]

[(1) the purchase price of the property;

(2) the interest rate charged under the contract;

(3) the dollar amount, or an estimate of the dollar amount if the interest rate is variable, of the interest charged for the term of the contract;

(4) the total amount of principal and interest to be paid under the contract;

(5) the late charge, if any, that may be assessed under the contract; and

(6) the fact that the seller may not charge a prepayment penalty or any similar fee if the purchaser elects to pay the entire amount due under the contract before the scheduled payment date under the contract.]

Oral Agreements Prohibited.

(d) The seller shall include in a separate document or in a provision of the contract a statement printed in 14-point boldfaced type or 14-point uppercase typewritten letters that reads substantially similar to the following:

THIS EXECUTORY CONTRACT REPRESENTS THE FINAL AGREEMENT BETWEEN THE SELLER AND PURCHASER AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES. (Texas Property Code 5.072)

This form can also be used if there are one or more existing liens on the property, includes the warning statement:

WARNING: ONE OR MORE RECORDED LIENS HAVE BEEN FILED THAT MAKE A CLAIM AGAINST THIS PROPERTY AS LISTED BELOW. IF A LIEN IS NOT RELEASED AND THE PROPERTY IS CONVEYED WITHOUT THE CONSENT OF THE LIENHOLDER, IT IS POSSIBLE THE LIENHOLDER COULD DEMAND FULL PAYMENT OF THE OUTSTANDING BALANCE OF THE LIEN IMMEDIATELY. YOU MAY WISH TO CONTACT EACH LIENHOLDER FOR FURTHER INFORMATION AND DISCUSS THIS MATTER WITH AN ATTORNEY. (Texas Statute 5.016)

A purchaser has the right to cancel a contract without cause within 14 days after execution. This form contains this clause and the "Cancellation Notice" form.

(YOU, THE PURCHASER, MAY CANCEL THIS CONTRACT AT ANY TIME DURING THE NEXT TWO WEEKS. THE DEADLINE FOR CANCELING THE CONTRACT IS (date). THE ATTACHED NOTICE OF CANCELLATION EXPLAINS THIS RIGHT.) (Statute 5.074 Purchaser's Right to Cancel Contract Without Cause)

SELLER'S DISCLOSURE OF PROPERTY CONDITION form provided as per Texas Property Code Statute Sec. 5.069.

a written notice, which must be attached to the contract, informing the purchaser of the condition of the property that must, at a minimum, be executed by the seller and purchaser and read substantially similar to the following: (See Statute 5.069)

Annual Accounting Statement Form included

Yearly no later than January 31, seller must provide an accounting statement that includes

[(1) the amount paid under the contract;

(2) the remaining amount owed under the contract;

(3) the number of payments remaining under the contract;

(4) the amounts paid to taxing authorities on the purchaser's behalf if collected by the seller;

(5) the amounts paid to insure the property on the purchaser's behalf if collected by the seller;

(6) if the property has been damaged and the seller has received insurance proceeds, an accounting of the proceeds applied to the property; and

(7) if the seller has changed insurance coverage, a legible copy of the current policy, binder, or other evidence that satisfies the requirements of Section 5.070(a)(2)]. [Statute5.077 Annual Accounting Statement]

Oral Agreements Prohibited, this form includes the following clause as per statute.

(THIS EXECUTORY CONTRACT REPRESENTS THE FINAL AGREEMENT BETWEEN THE SELLER AND PURCHASER AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.) (Texas Property Code Statute 5.072)

Demand for Payment Form included.

This form itemizes all payments, fees, late charges due upon delinquency.

DEMAND IS MADE FOR PAYMENT OF THIS PAST DUE AMOUNT. IF PAYMENT IS NOT RECEIVED BY THE DEFAULT DATE. WE WILL PROCEED TO ENFORCE ANY OR ALL OF OUR RIGHTS AS APPLICABLE UNDER "SELLER'S REMEDY" (PAGE 5 SECTION 18 OF THE SUBJECT "CONTRACT FOR DEED" AND SHOWN ON THE SIGNATURE PAGE BELOW.

(Texas Contract for Deed Package includes forms, guidelines, and completed example)

Important: Your property must be located in Duval County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Duval County.

Our Promise

The documents you receive here will meet, or exceed, the Duval County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Duval County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Charles F.

November 20th, 2020

Fantastic service. I purchased the form one day, had it filled out, notarized and e-filed the next day. The following day I received the recorded document back. It was really overnight service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Boyd B.

June 16th, 2025

I had an issue because of what I was doing, thanks to these guys. I received an email and lickety-split done no more problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle G.

April 26th, 2021

EXCEPTIONAL CUSTOMER SERIVCE!!! THANK YOU!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael D.

February 7th, 2019

I did not like the size of the Warranty Deed form which took 2 pages to print. It should be no larger than 8 1/2 by 14 inches. I did not like that I could not reformat it to be smaller, could not eliminate unused lines, could not delete the excessive 4 signature lines, could not copy or paste into text editor. Very unsatisfactory rating.

Thank you for your feedback Michael. Unfortunately we don't make the requirements, we only make the documents to be compliant with the requirements. Have a great day!

David K.

March 25th, 2019

Worked Great! First time go at the courthouse

Thank you!

Joseph P.

April 28th, 2023

I purchased the Affidavit of Surviving Joint Tenant document and found the whole package of documents to be useful and practical. Successfully recorded!!! While the fillable PDF files are good enough, I personally prefer a Word document as it is easier to modify font or spacing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darlene D.

June 21st, 2019

A little confusing to try to save your docouments and how to process them but once figured out easy to do.

Thank you!

Cyrus A.

July 18th, 2024

Easy site to work with.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Christopher Shawn S.

November 4th, 2020

Swift and Concise Process!!! I would recommend, as well as, use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

leila m.

January 30th, 2021

Very good service, friendly customer service I absolutely will use the service again

Thank you!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

catherine f.

May 28th, 2019

Easy! 5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bryan C.

September 5th, 2021

Your service is sweet. It is self-explanatory and easy to download. I am excited about finding your website.

Thank you!

reed w.

February 26th, 2022

Great service that saved me a lot of time for under 30 bucks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wanda C.

August 20th, 2020

Site is very well laid out and easy to use. My only issue is that it wouldn't allow me to change my password, so I'm stuck with the "temporary" one. Not a big deal, but I would have preferred to change it.

Thank you for your feedback. We really appreciate it. Have a great day!