Motley County Correction Deed Form

Motley County Correction Deed Form

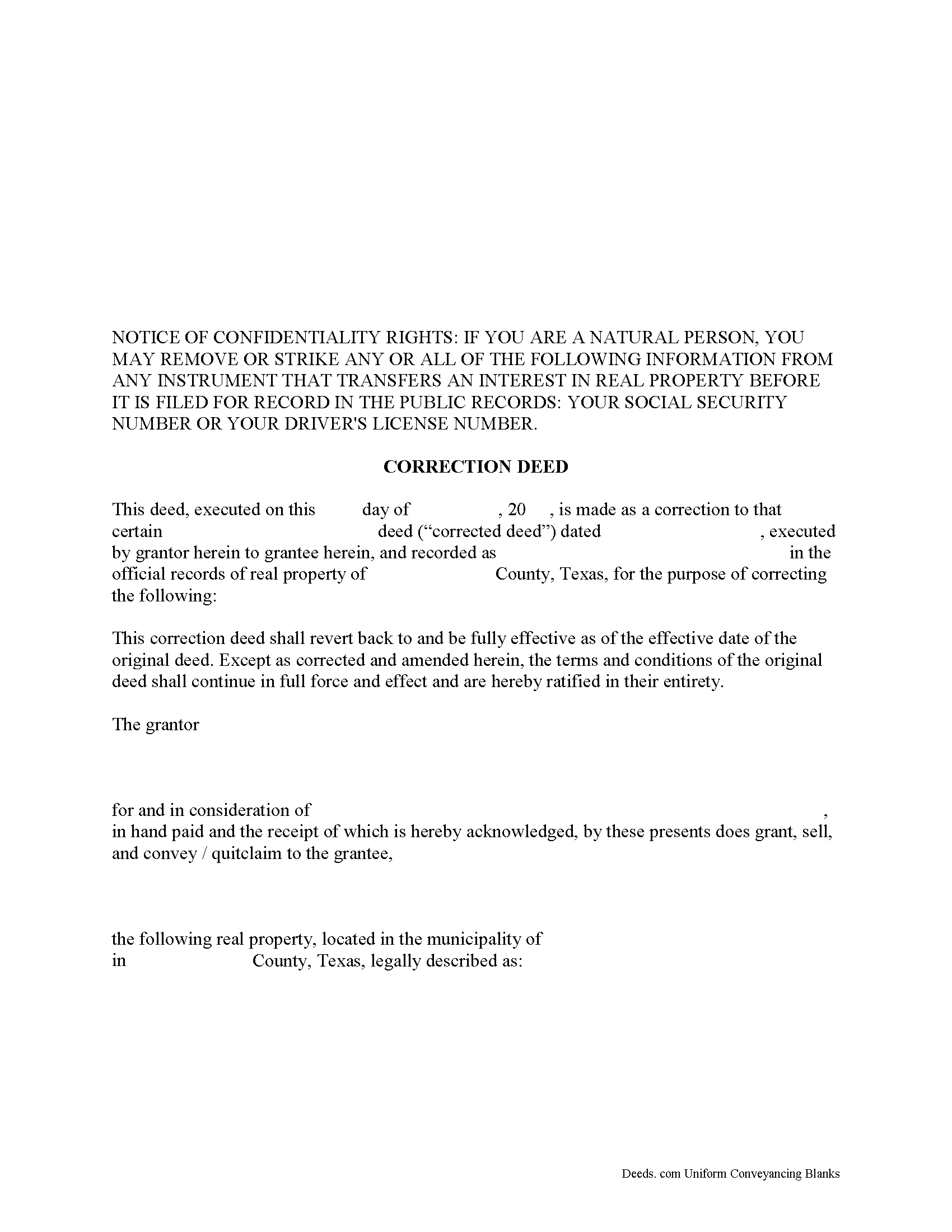

Fill in the blank form formatted to comply with all recording and content requirements.

Motley County Correction Deed Guide

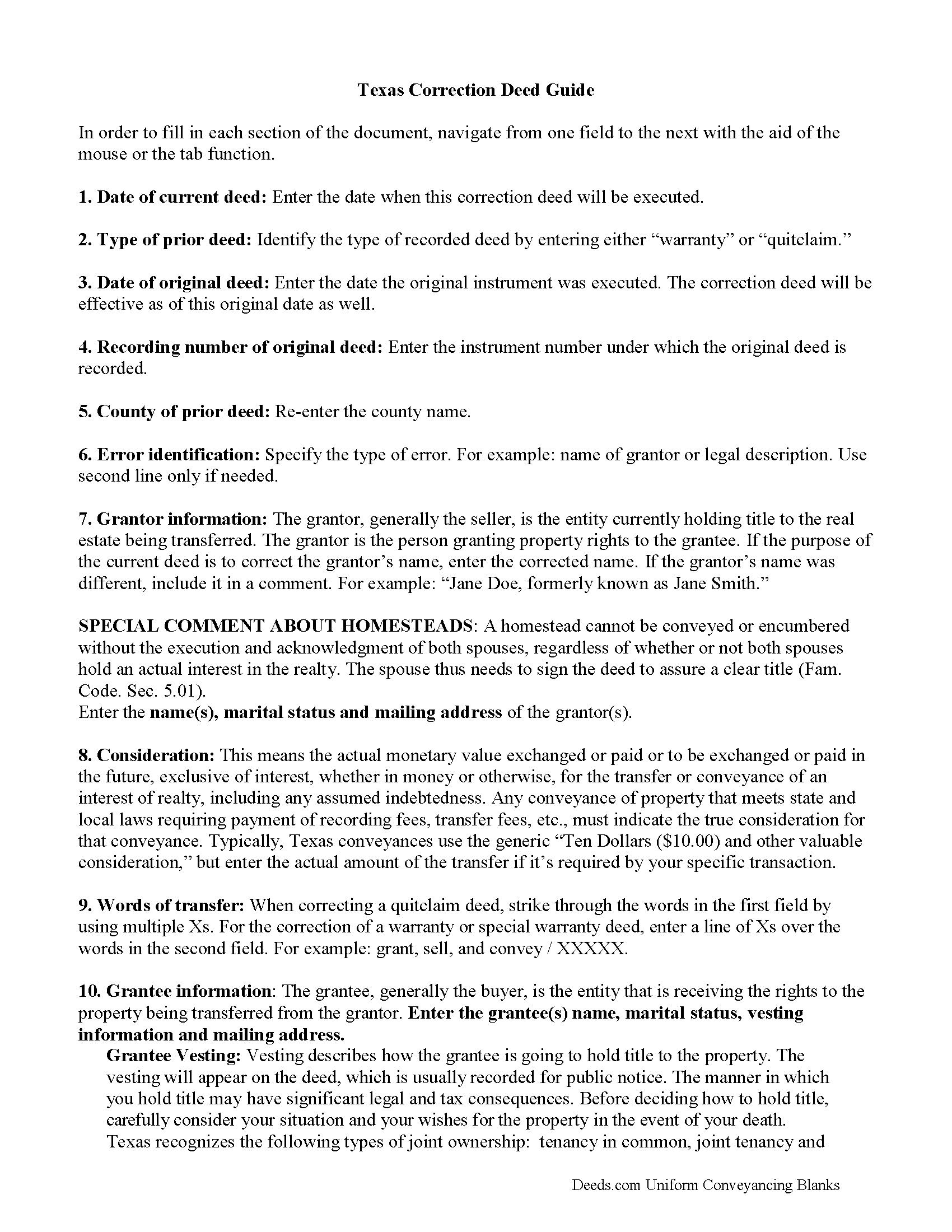

Line by line guide explaining every blank on the form.

Motley County Completed Example of the Correction Deed Document

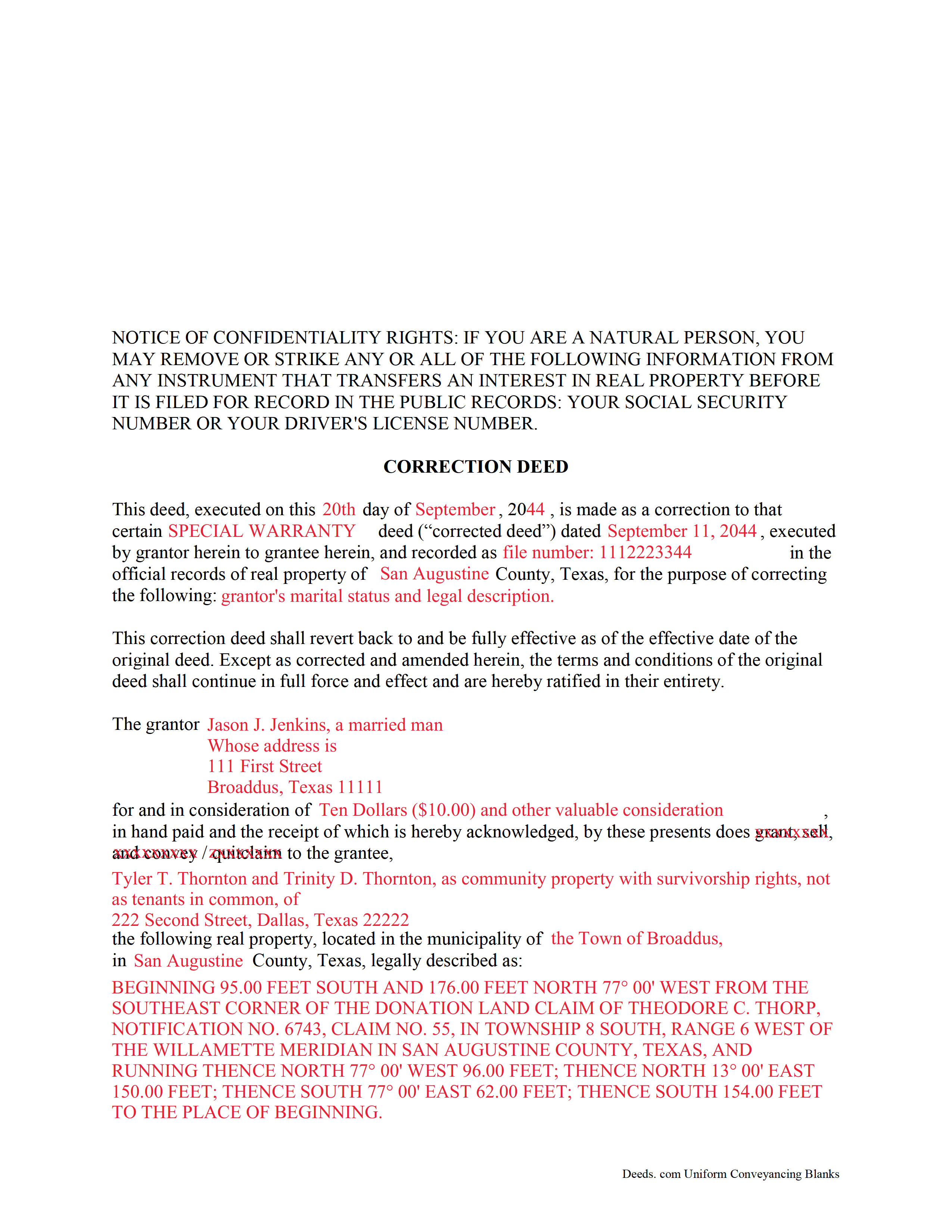

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Motley County documents included at no extra charge:

Where to Record Your Documents

Motley County Clerks Office

Matador, Texas 79244

Hours: Monday - Friday 9:00am-12:00, 1:00-5:00 pm

Phone: (806) 347-2621

Recording Tips for Motley County:

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Leave recording info boxes blank - the office fills these

- Recording early in the week helps ensure same-week processing

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Motley County

Properties in any of these areas use Motley County forms:

- Flomot

- Matador

- Roaring Springs

Hours, fees, requirements, and more for Motley County

How do I get my forms?

Forms are available for immediate download after payment. The Motley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Motley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Motley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Motley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Motley County?

Recording fees in Motley County vary. Contact the recorder's office at (806) 347-2621 for current fees.

Questions answered? Let's get started!

In Texas, a correction deed is the deed issued to make changes to an erroneous deed, referred to as the corrected deed. These two instruments are closely linked, and all corrections are effective as of the date of the original recorded instrument (Property Code Sec. 5.030).

Texas Property Code distinguishes between material and non-material corrections, giving specific examples in each category. Non-material changes are generally clerical in nature and include additions to or corrections of: party names and marital status; elements of the property description, such as, an error in a metes and bounds description or incorrect acreage; the recording date or reference data to an earlier instrument; a missing or defective acknowledgement. All these corrections can be made by persons other than the parties of the original instrument, as long as reasons for the correction and knowledge of the facts corrected are stated and evidence of notification of the original parties or their heirs is provided (Property Code Sec. 5.028).

Material corrections, on the other hand, can only be made by the original parties or their heirs and must be executed by all of parties involved. Such changes include the addition or removal of land, disclaimers, a mortgagee's consent or subordination to a recorded instrument, and changes of lot or unit number (Property Code Sec. 5.029). A Texas Supreme Court decision from 2009 also specified the addition or removal of mineral rights as among the material changes that can only be made by the original parties.

In some areas of Texas, it has been common practice for the attorney who made the error to correct it through a scrivener's affidavit when the parties are not available and the error is only minor in nature. This type of correction is ineffective when a title company employee makes it or when it is made to a certified copy of the original instrument. Only when the parties initial the changes and sign a statement why they are being made is the correction of a certified copy acceptable for recording, but even then, can it be only made for the types of errors specified in the statutes (see above). It is always advisable to check with the local county recorder.

(Texas Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Motley County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Motley County.

Our Promise

The documents you receive here will meet, or exceed, the Motley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Motley County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Frank H.

April 26th, 2021

All the forms downloaded are very comprehensive of Quit Claim transfers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly M.

January 5th, 2019

GREAT FORMS. THANK YOU.

Thank you!

John B.

December 23rd, 2020

Thorough. Thanks!

Thank you!

Jane B.

December 20th, 2020

Easy to use,thanks

Thank you!

Agnes I H.

January 28th, 2019

Good knowing the price right up front...and not a FREE one you pay at the end....

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Muhamed H.

February 3rd, 2022

Nice!

Thank you!

Brian R.

January 15th, 2022

A waste of my time

We do hope that you found something more suitable to your needs elsewhere Brian. Have a wonderful day.

Kermit S.

October 12th, 2020

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

MARCO G.

May 9th, 2019

Very easy to use. Got the emailed documents within minutes.

We appreciate your feedback Marco, thank you.

Kirsten Z.

March 31st, 2021

Thank you! Including the Guide and completed example was especially helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Chad N.

March 16th, 2021

Thank you for taking care of a recording very quickly. I am very impressed by your service an would recommend to anyone. Easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

A Rod P.

May 25th, 2019

The website was short and to the point. And I receive three responses quite quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Grace O.

November 4th, 2020

I was happy to find a way to file my title without having to send original. Although I found it hard to naigste, my daughter came to my rescue and we were successful. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jean T.

January 3rd, 2024

It's wonderful that these forms are easily accessible!

Thank you for your feedback. We really appreciate it. Have a great day!

Melody P.

May 4th, 2021

Great service as always, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!