Howard County Enhanced Life Estate Deed Form

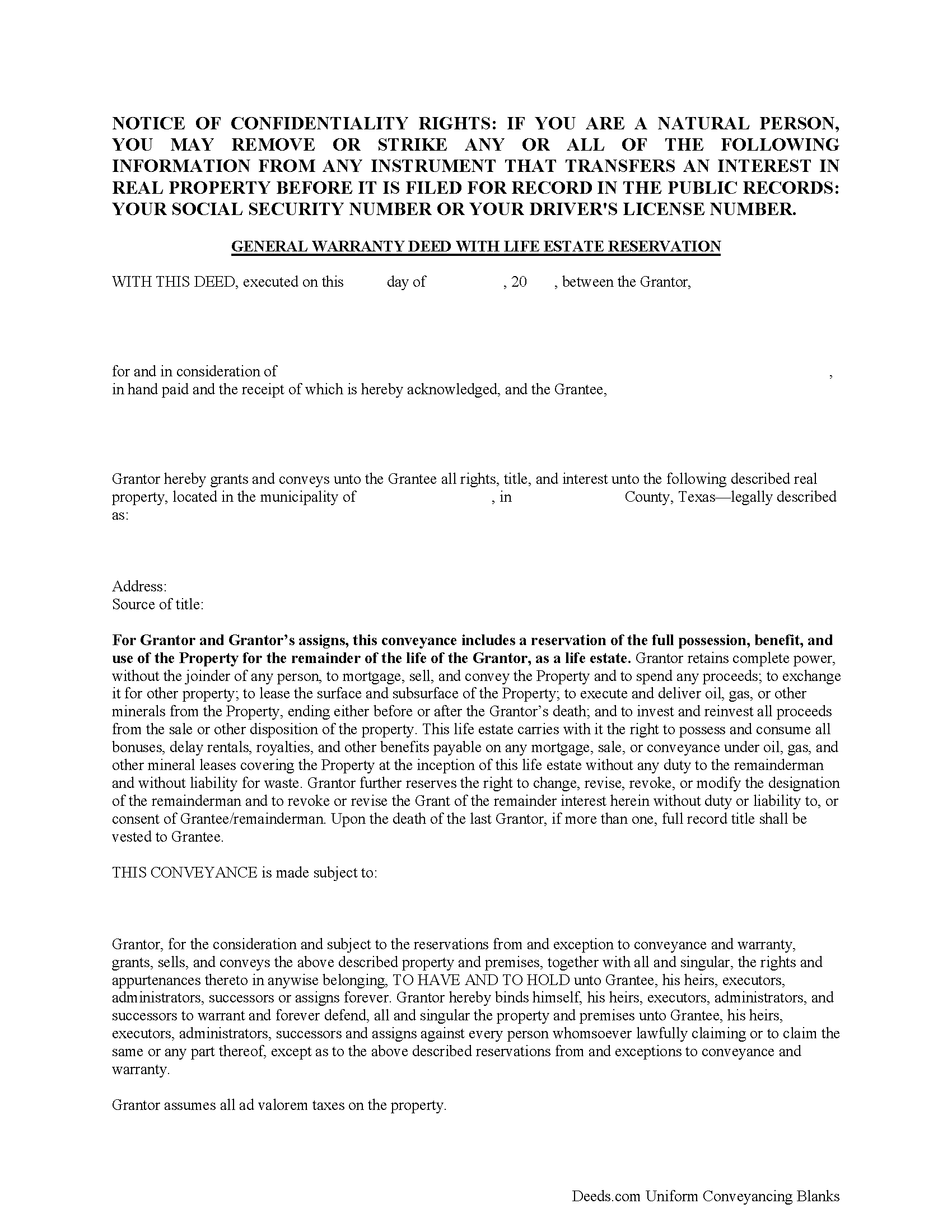

Howard County Enhanced Life Estate Form

Fill in the blank form formatted to comply with all recording and content requirements.

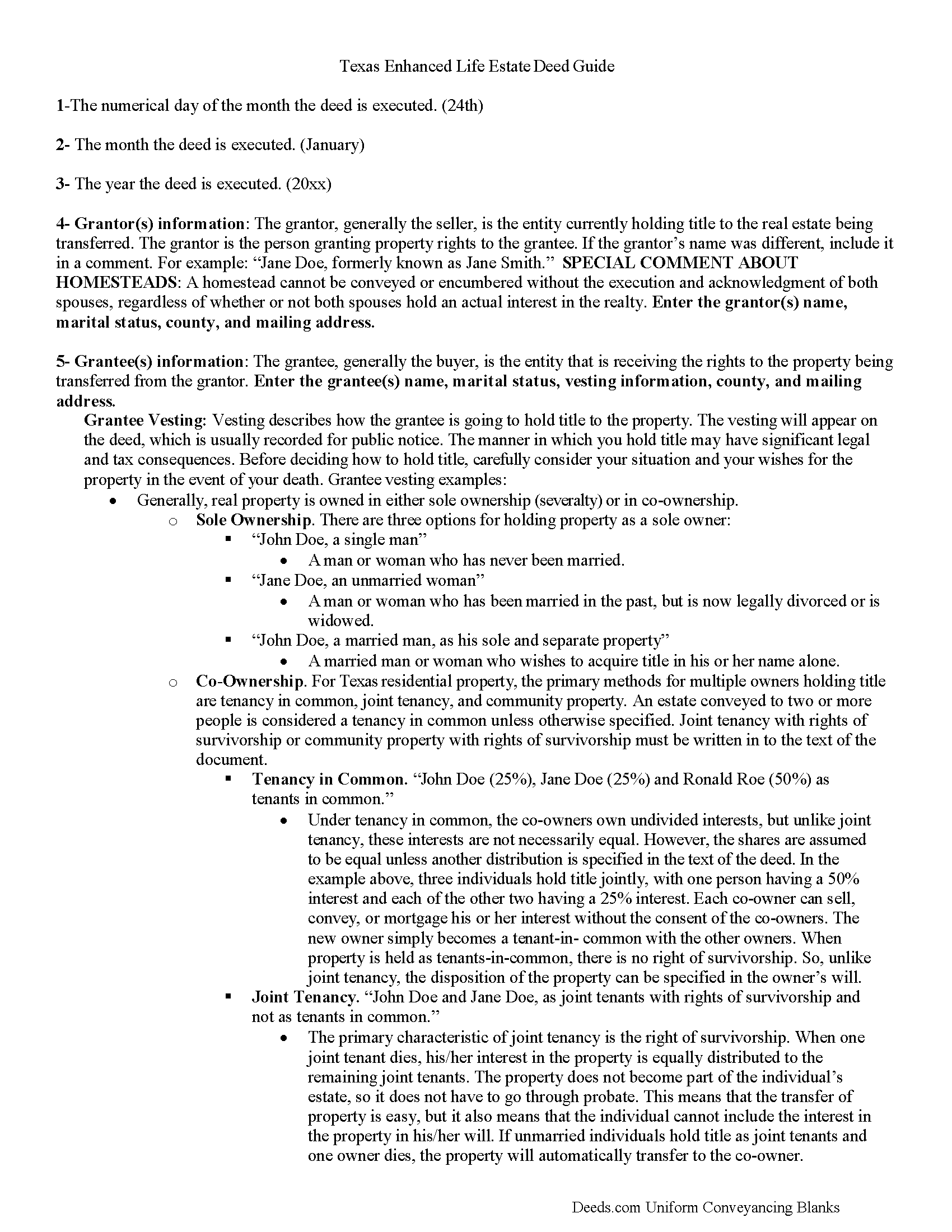

Howard County Enhanced Life Estate Guide

Line by line guide explaining every blank on the form.

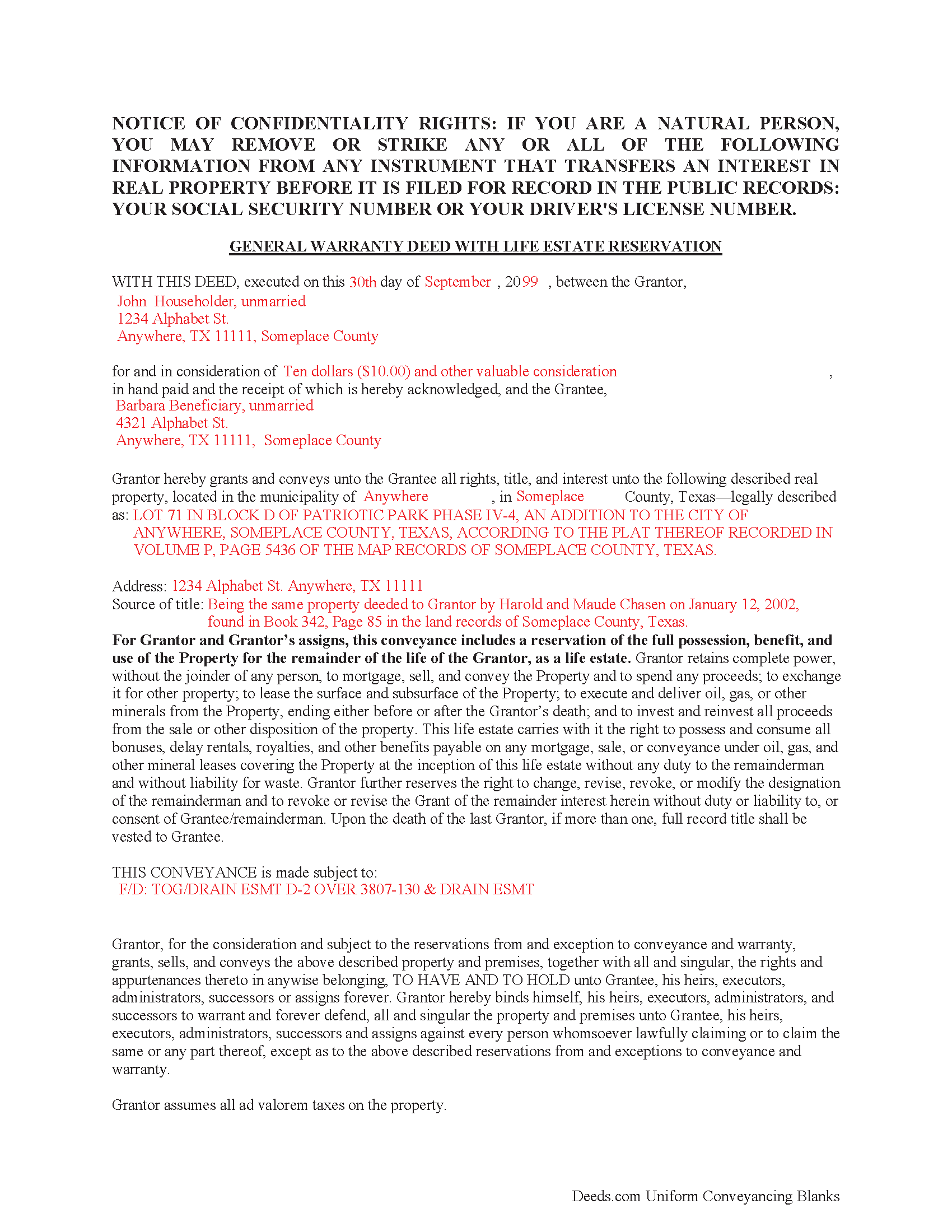

Howard County Completed Example of the Enhanced Life Estate Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Howard County documents included at no extra charge:

Where to Record Your Documents

Howard County Clerk

Big Spring, Texas 79721

Hours: Monday - Friday 8:00am - 5:00pm

Phone: 432-264-2213

Recording Tips for Howard County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Howard County

Properties in any of these areas use Howard County forms:

- Big Spring

- Coahoma

- Forsan

- Knott

Hours, fees, requirements, and more for Howard County

How do I get my forms?

Forms are available for immediate download after payment. The Howard County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Howard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Howard County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Howard County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Howard County?

Recording fees in Howard County vary. Contact the recorder's office at 432-264-2213 for current fees.

Questions answered? Let's get started!

A Lady Bird deed, also called an enhanced life estate deed or reservation of a life estate with a general power of appointment, is a useful estate planning tool. When executed, the grantor conveys a life estate in real property to himself, with the remainder conveyed to the beneficiary of his choice, thereby avoiding the probate process. This type of deed enables the grantor to preserve homestead status (if claimed) as well as any deductions, protections, and tax exemptions associated with the real estate during his lifetime. In addition, he retains absolute control over the property, allowing for the option to change the beneficiary or even sell, convey, or mortgage the property before the transfer of ownership goes into effect upon the grantor's death.

(Texas Enhanced Life Estate Package includes form, guidelines, and completed example)

Important: Your property must be located in Howard County to use these forms. Documents should be recorded at the office below.

This Enhanced Life Estate Deed meets all recording requirements specific to Howard County.

Our Promise

The documents you receive here will meet, or exceed, the Howard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Howard County Enhanced Life Estate Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Cathaleen P.

April 26th, 2021

Excellent service and very easy to process. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

ALFRED B.

September 4th, 2020

The product was just what I needed. Not being the sharpest computer user I stumbled a little but after reading more carefully I navigated the process and I am very satisfied with my experience. deeds certainly saved me a lot of time.

Thank you!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

James H.

December 7th, 2020

Clear and easy instructions. Prompt processing and confirmation. I am still in the middle of submitting my document for recording, but I am confident that the Deeds.com service will deliver as promised. Definitely a valuable tool with important legal doucments.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa D.

December 7th, 2022

Had the correct forms I needed with guides and examples to follow on filling them out. Very easy to use. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BARRY D.

March 24th, 2024

Could not have been easier. Instructions were clear. Guidelines and example were clearly written. Erecording worked fast and let me skip a dreaded trip downtown to be ignored by government employees who hate their jobs.

Thank you for your positive words! We’re thrilled to hear about your experience.

Emili C.

October 14th, 2020

Thank you! I received my forms promptly and they are easy to follow along for filling out. The examples gave me confidence that they were done correctly.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia R.

October 26th, 2022

Very quick to respond with the obvious answers. I asked what form to use when adding my daughter to deed. Answer: talk to an attorney duh.

Thank you!

John U.

April 24th, 2020

It's too early for me to tell because I just uploaded the document today and it hasn't been recorded yet. However, I will say that the website is very user friendly so assuming that everything goes as planned, this is a great service.

Thank you!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

ROBERT K.

April 12th, 2021

It was so easy to obtain the necessary documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela B.

September 19th, 2020

Great forms! Quick, easy, and to the point. The completed document, when printed out, looks really professional.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roy T.

April 3rd, 2020

Thank you for an easy to use system. I was able to find all the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!