Parmer County Enhanced Life Estate Deed Form

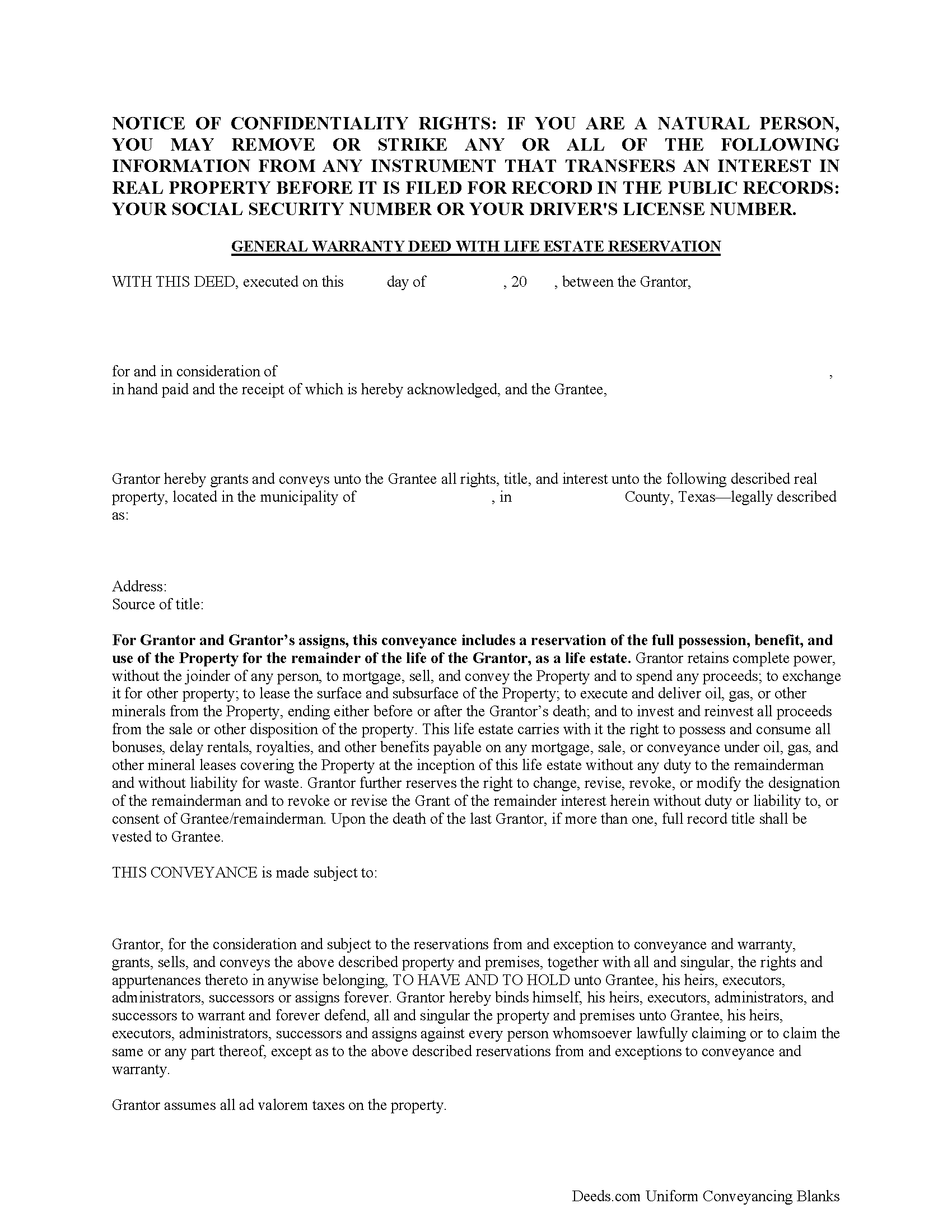

Parmer County Enhanced Life Estate Form

Fill in the blank form formatted to comply with all recording and content requirements.

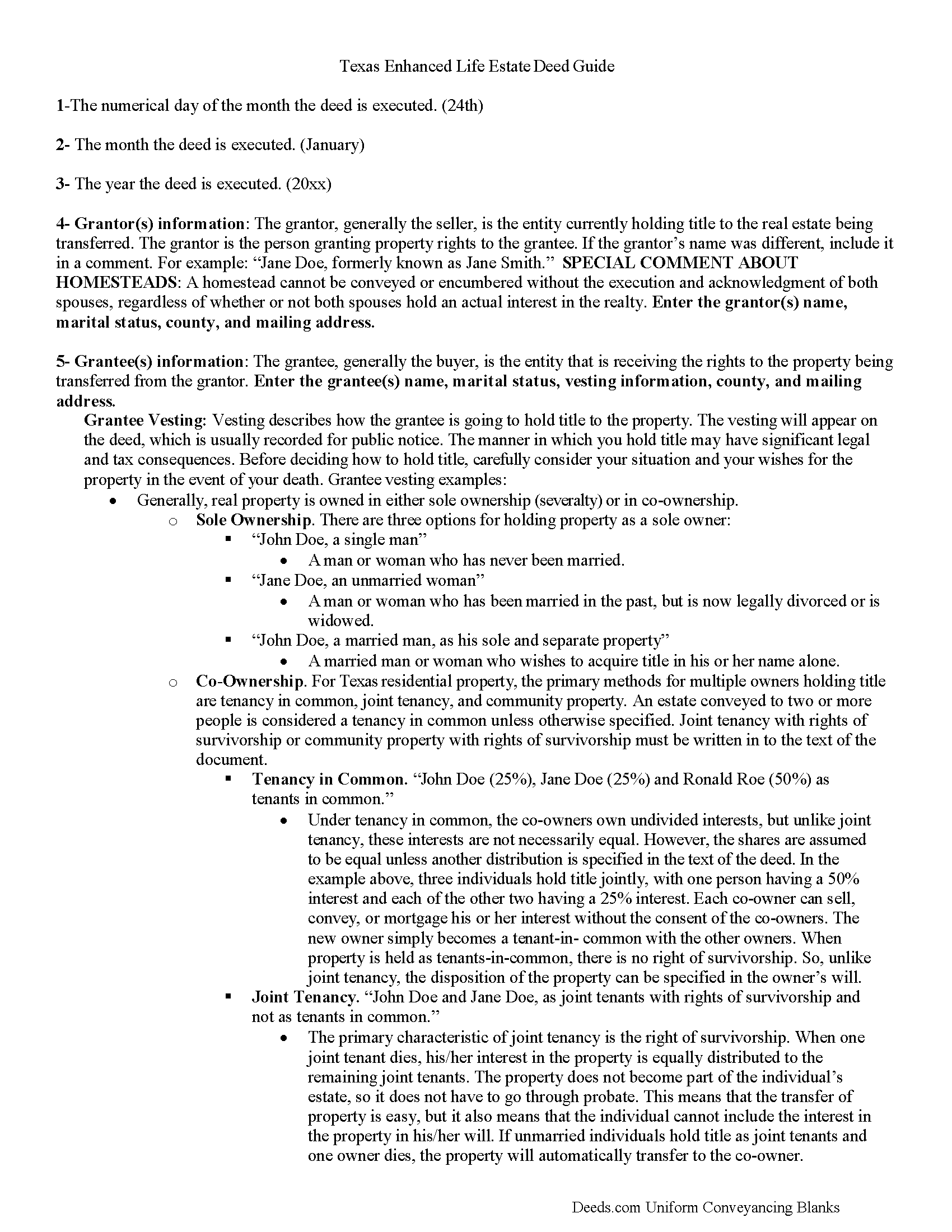

Parmer County Enhanced Life Estate Guide

Line by line guide explaining every blank on the form.

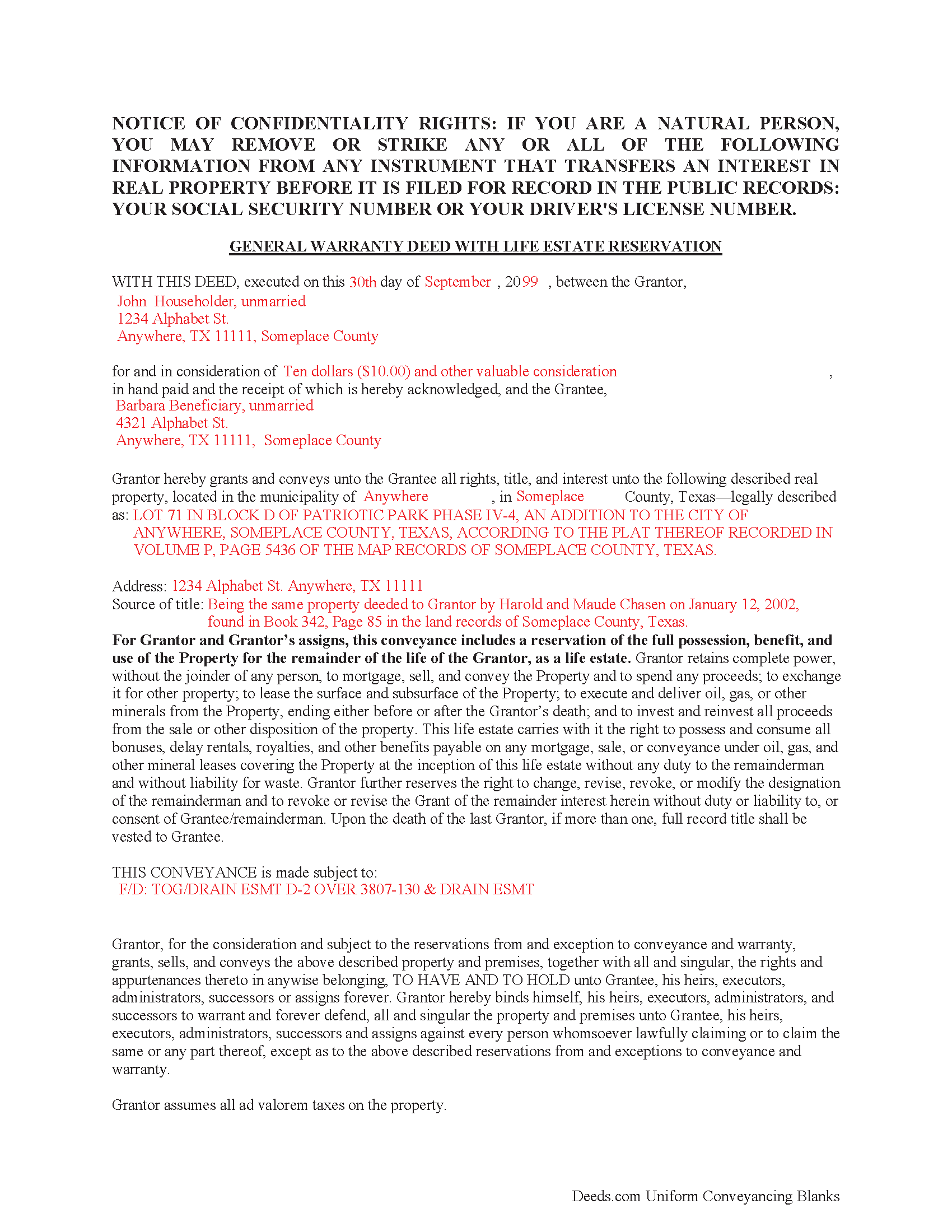

Parmer County Completed Example of the Enhanced Life Estate Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Parmer County documents included at no extra charge:

Where to Record Your Documents

Parmer County Clerk

Farwell, Texas 79325-4671

Hours: Monday - Friday 8:30am - 12:00 & 1:00 - 5:00pm

Phone: (806) 481-3691

Recording Tips for Parmer County:

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Parmer County

Properties in any of these areas use Parmer County forms:

- Bovina

- Farwell

- Friona

- Lazbuddie

Hours, fees, requirements, and more for Parmer County

How do I get my forms?

Forms are available for immediate download after payment. The Parmer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Parmer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Parmer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Parmer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Parmer County?

Recording fees in Parmer County vary. Contact the recorder's office at (806) 481-3691 for current fees.

Questions answered? Let's get started!

A Lady Bird deed, also called an enhanced life estate deed or reservation of a life estate with a general power of appointment, is a useful estate planning tool. When executed, the grantor conveys a life estate in real property to himself, with the remainder conveyed to the beneficiary of his choice, thereby avoiding the probate process. This type of deed enables the grantor to preserve homestead status (if claimed) as well as any deductions, protections, and tax exemptions associated with the real estate during his lifetime. In addition, he retains absolute control over the property, allowing for the option to change the beneficiary or even sell, convey, or mortgage the property before the transfer of ownership goes into effect upon the grantor's death.

(Texas Enhanced Life Estate Package includes form, guidelines, and completed example)

Important: Your property must be located in Parmer County to use these forms. Documents should be recorded at the office below.

This Enhanced Life Estate Deed meets all recording requirements specific to Parmer County.

Our Promise

The documents you receive here will meet, or exceed, the Parmer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Parmer County Enhanced Life Estate Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

raquel f.

July 28th, 2021

Wow!!! that was super easy to record a mechanic lien! I will definitely use your service again but I hope I won't have to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stuart P.

May 14th, 2021

Easy and fast. I'll use this service for all my recordings

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George S.

September 16th, 2021

Excellent product- very easy to use. Will use again...

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

January 18th, 2021

This was very easy to do. Great experience. These are the forms I needed. I would recommend these to anyone.

Thank you!

Robin G.

July 3rd, 2020

Very responsive and helpful.

Thank you!

Carol R.

February 19th, 2023

I found the site to be useful,informative and very accessable. Thank You

Thank you!

Morgan K.

August 24th, 2021

When I brought this deed to the county assessor, they were so impressed that I had done it correctly on my first try, and said they wished everyone would do such a good job on their paperwork.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn C.

April 6th, 2020

My document got recorded right away. Thank you! Will use again in the future when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James R.

November 14th, 2019

Really Easy site to navigate!

Thank you James, have a great day!

GAYNELL G.

August 9th, 2022

THANKS

Thank you!

Daniel M.

May 24th, 2023

It was quick and easy!! I recommend this site for your needs!!

Really appreciate you Daniel, thanks for the kind words.

DONALD L P.

January 15th, 2019

HAD WRONG PASSWORD; PROGRAM MADE CHANGE EASY.

Thank you!

Lana J.

March 4th, 2022

Very easy to use and the forms were perfectly formatted. Great value and service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN L.

November 17th, 2020

Not just good, very good. Very intuitive and very responsive. It just works!

Thank you for your feedback. We really appreciate it. Have a great day!