Comal County Mineral Deed Form

Comal County Mineral Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

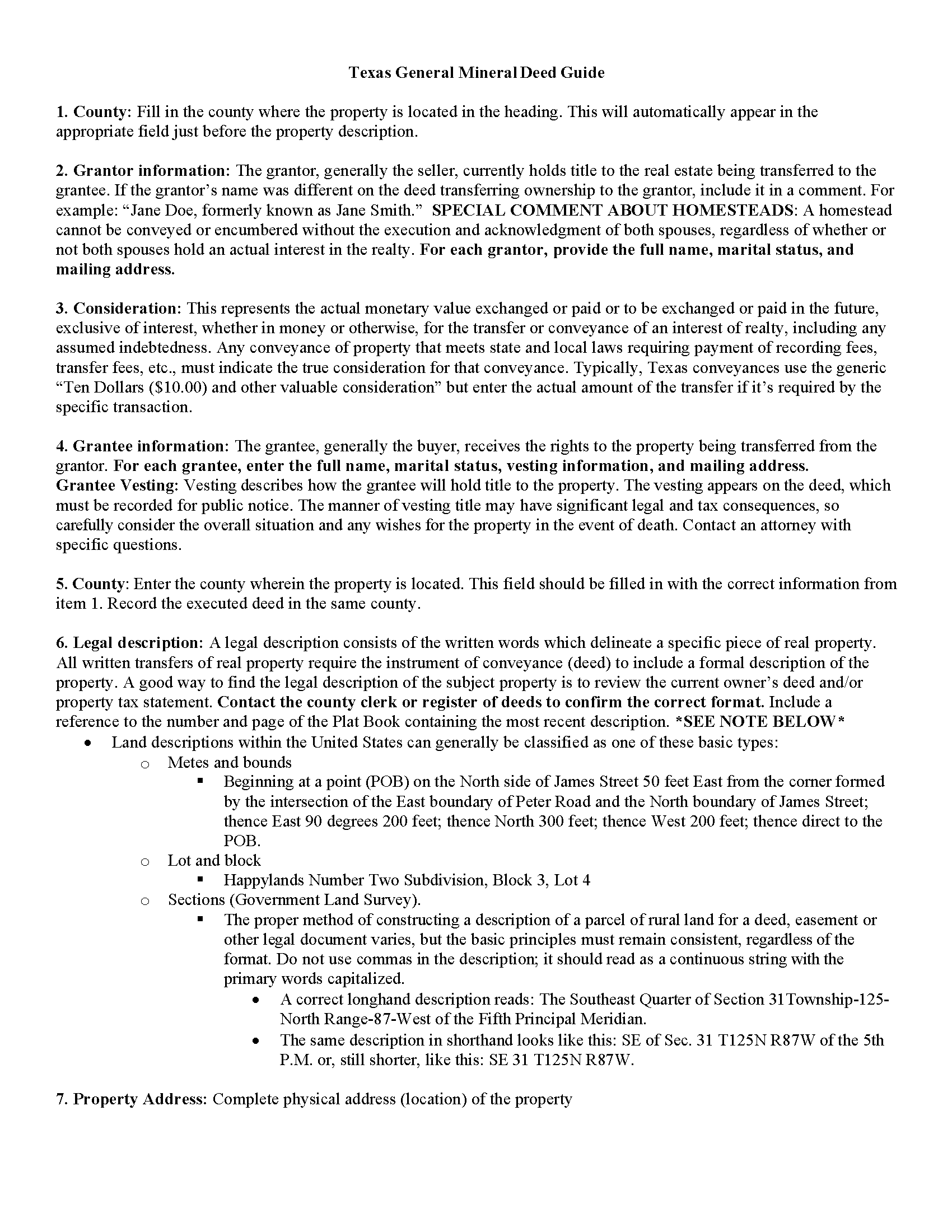

Comal County Mineral Deed Guide

Line by line guide explaining every blank on the form.

Comal County Completed Example of the Mineral Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Comal County documents included at no extra charge:

Where to Record Your Documents

Comal County Clerk

New Braunfels, Texas 78130

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (830) 221-1230

Recording Tips for Comal County:

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Comal County

Properties in any of these areas use Comal County forms:

- Bulverde

- Canyon Lake

- Fischer

- New Braunfels

- San Antonio

- Spring Branch

Hours, fees, requirements, and more for Comal County

How do I get my forms?

Forms are available for immediate download after payment. The Comal County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Comal County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Comal County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Comal County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Comal County?

Recording fees in Comal County vary. Contact the recorder's office at (830) 221-1230 for current fees.

Questions answered? Let's get started!

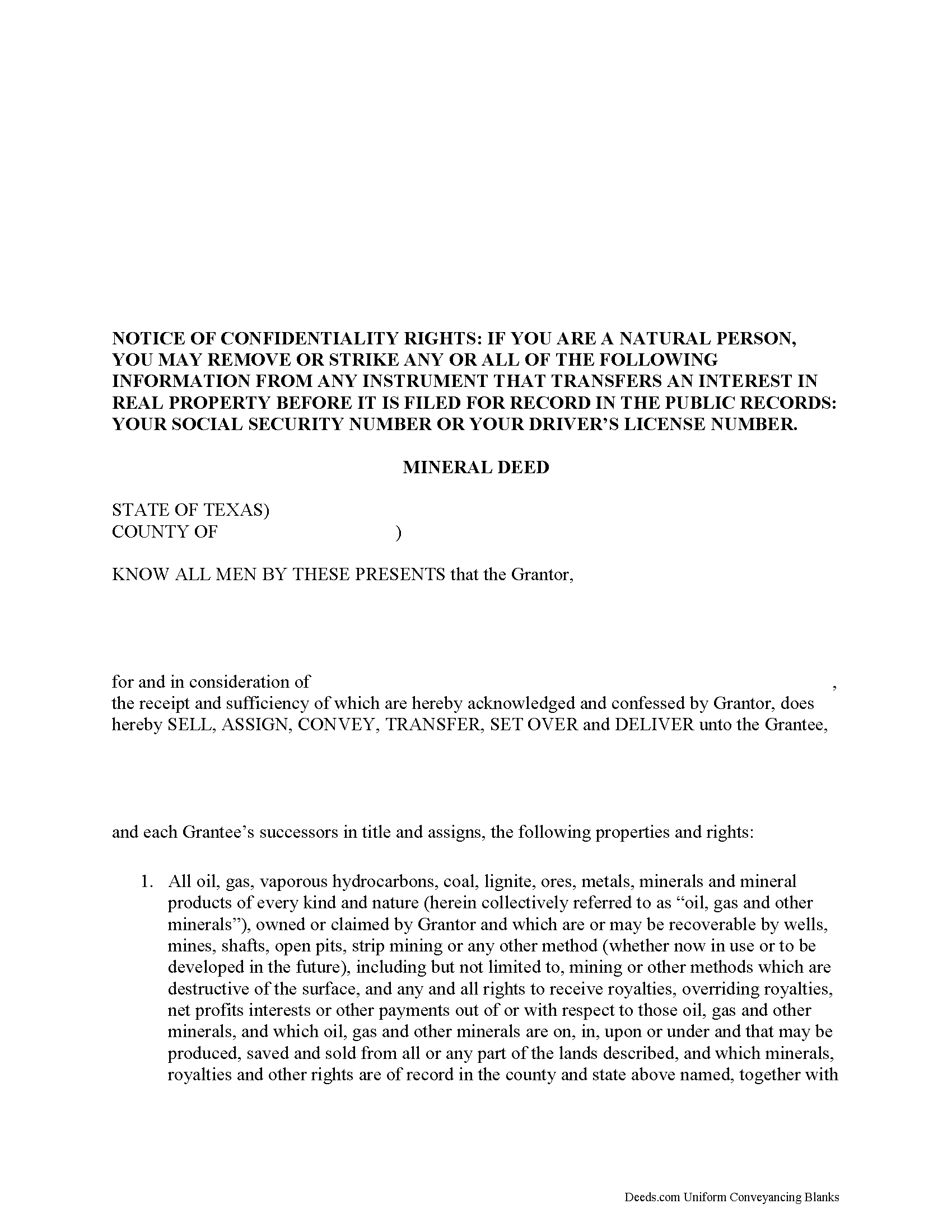

The General Mineral Deed in Texas transfers ALL oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes all oil, gas, vaporous hydrocarbons, coal, lignite, ores, metals, minerals and mineral products of every kind and nature. It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals.

This general mineral deed gives the grantee the right to extract by wells, mines, shafts, open pits, strip mining or any other method (whether now in use or to be developed in the future), including but not limited to, mining or other methods which are destructive of the surface.

Use of this document has a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Texas Mineral Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Comal County to use these forms. Documents should be recorded at the office below.

This Mineral Deed meets all recording requirements specific to Comal County.

Our Promise

The documents you receive here will meet, or exceed, the Comal County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Comal County Mineral Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Jayne B.

July 1st, 2020

This makes it so easy and I'm so glad I found you. I visited two other sites before I found this one. They were cumbersome to use to the point where I abandoned them and kept on looking. Then I found yours, and it was a breeze. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

FRANK O.

March 1st, 2019

Easy to download and use the forms, however two forms needed for my county recording were not included.

Thank you for your feedback Frank. We'll look into finding and including the additional supplemental documents. Sometimes supplemental documents have to be generated by the county's system, specific to the transaction.

Meredith B.

January 5th, 2021

Clean and easy process. Super attentive and helpful.

Thank you!

Mark W.

December 19th, 2022

Great form and easy to complete. Sending a sample and instructions was very helpful. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bridgit L.

May 20th, 2020

I must admit I was a bit hesitant to record a document online, but I am impressed by how quickly the process took from the initial sign-on, uploading and recording! I will definitely use your services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Francis L.

February 8th, 2023

You have duplicate documents in your listing of documents. please clean up.

Thank you!

Harley N.

August 25th, 2022

Well thought out and user friendly website. The forms were easily fillable as well.

Thank you for your feedback. We really appreciate it. Have a great day!

Rafael R.

May 9th, 2019

This was my first time using Deed.com. It was easier than I expected. The service is more convenient than filing documents in person or by mail. The response from Deeds.com upon the submission of my order was almost instantaneous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

annie m.

February 13th, 2023

recently joined Deeds.com. still exploring the site. has been very helpful in providing local information for recording, such as fees and requirements. i am working to correct mistakes made within a deed. it is amazing how these municipalities operate outside the scope of Article 1, Section 8, Clause 17; to claim land is "in" the "State of ____. when the land is actually not ceded to the United States of America as for use for needful buildings. beware of the fraud perpetrated by Attorneys in the recording of your Deeds. Registration as "RESIDENTIAL" puts your private-use land on the TAX rolls with the use of that one word. i recommend this site as it appears there is information for each state and each county office. will update my review once i place an order.

Thank you!

Jeremy C.

May 13th, 2021

Really impressed with the speed and professionalism of the service. I would recommend putting a grey background on the form field inputs as I had trouble seeing them in the user interface, but otherwise I was really impressed and would happily return as a customer.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet P.

July 30th, 2021

Extremely easy to use. The guide and sample were a great source of reference.

Thank you for your feedback. We really appreciate it. Have a great day!

Harry C.

February 11th, 2019

I got the wrong state and now they want to charge me again for the proper state. My fault, BUT!!!!

Sorry to hear that Harry. We've gone ahead and canceled the order you made in error. Have a wonderful day.