Bastrop County Notice of Contractual Retainage Form

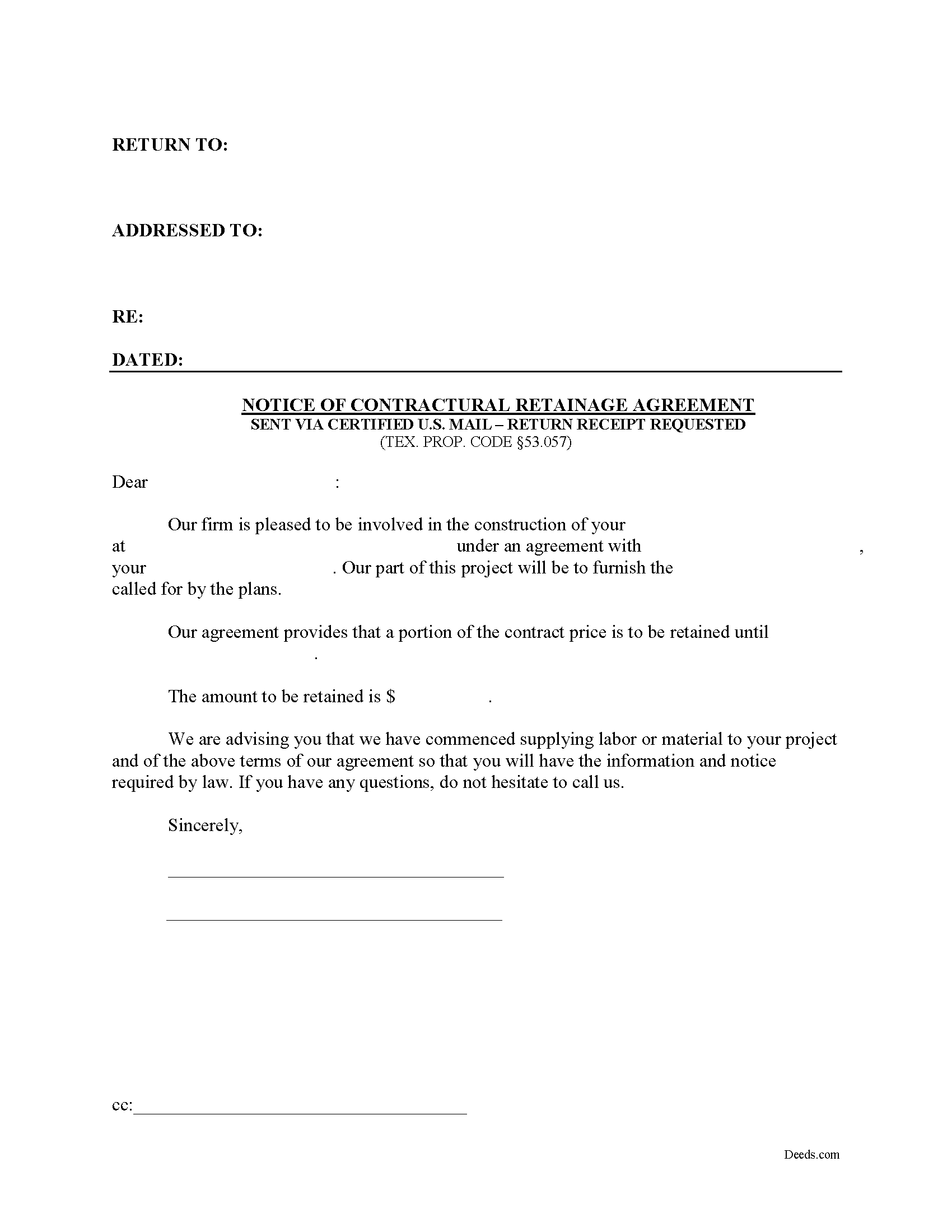

Bastrop County Notice of Contractual Retainage Form

Fill in the blank Notice of Contractual Retainage form formatted to comply with all Texas recording and content requirements.

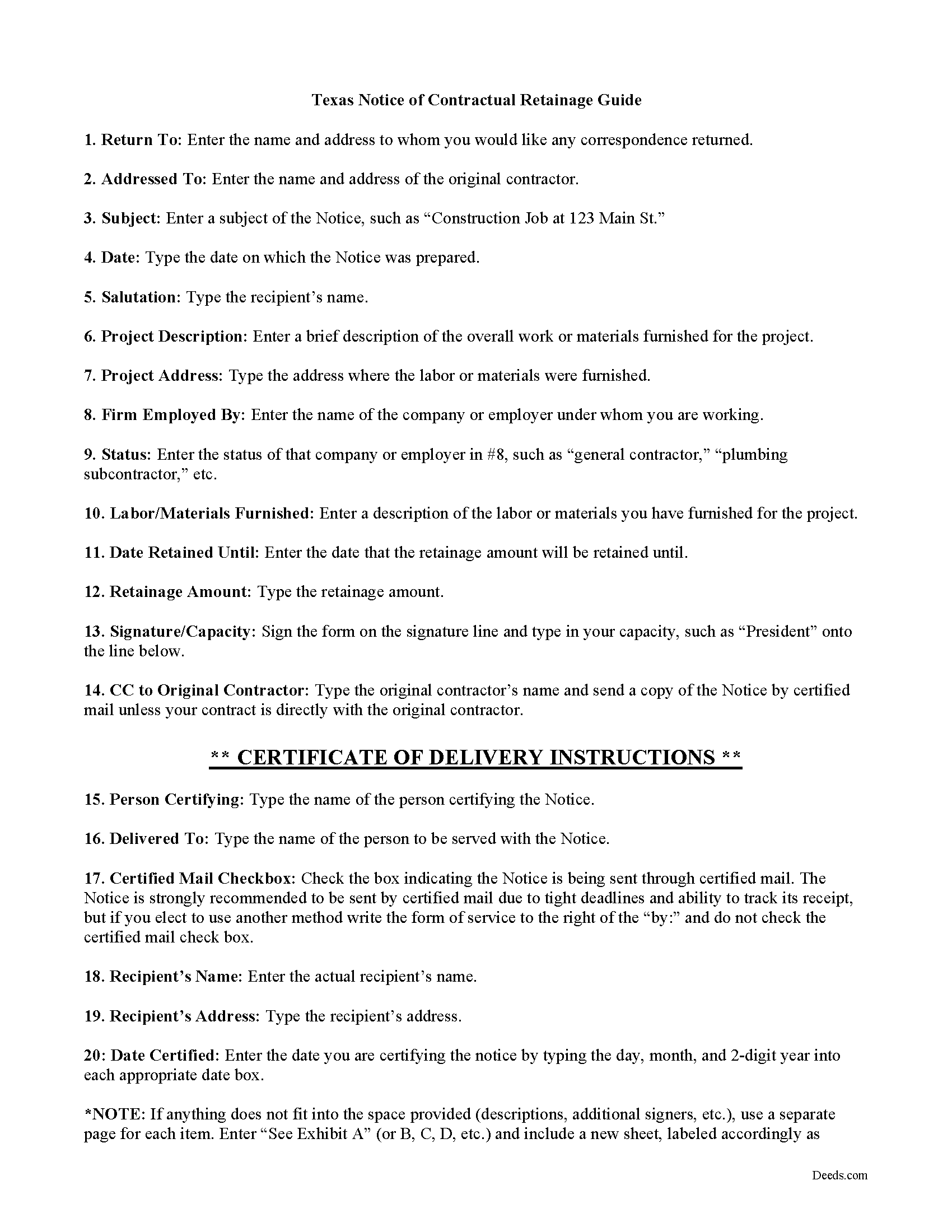

Bastrop County Notice of Contractual Retainage Guide

Line by line guide explaining every blank on the form.

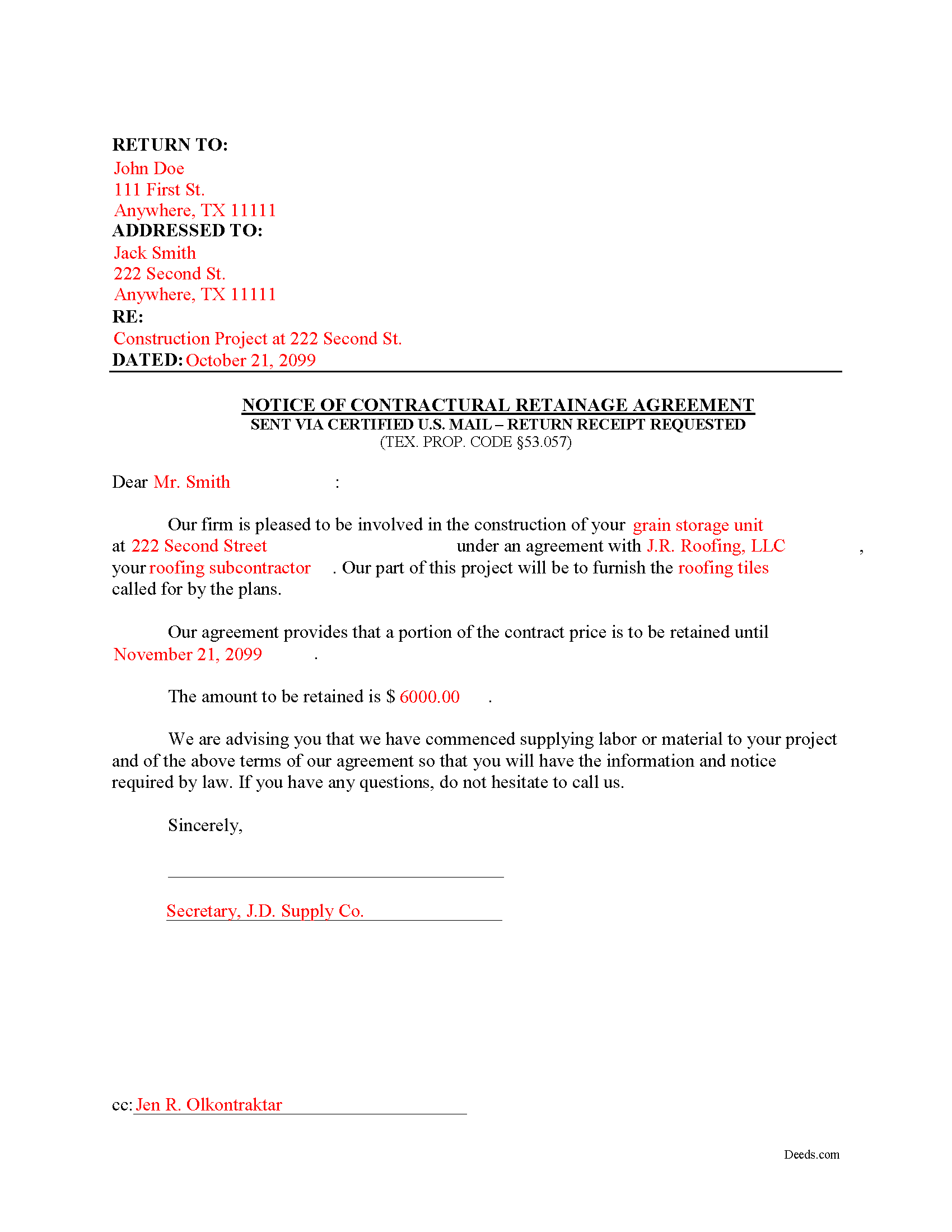

Bastrop County Completed Example of the Notice of Contractual Retainage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Bastrop County documents included at no extra charge:

Where to Record Your Documents

Bastrop County Clerk

Bastrop, Texas 78602

Hours: 8:00 a.m. - 5:00 p.m. Monday - Friday

Phone: (512) 332-7234 / Austin Metro: (512) 581-7134

Recording Tips for Bastrop County:

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Bastrop County

Properties in any of these areas use Bastrop County forms:

- Bastrop

- Cedar Creek

- Elgin

- Mc Dade

- Paige

- Red Rock

- Rosanky

- Smithville

Hours, fees, requirements, and more for Bastrop County

How do I get my forms?

Forms are available for immediate download after payment. The Bastrop County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bastrop County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bastrop County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bastrop County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bastrop County?

Recording fees in Bastrop County vary. Contact the recorder's office at (512) 332-7234 / Austin Metro: (512) 581-7134 for current fees.

Questions answered? Let's get started!

As a contractor, it's important to send out early notice forms shortly after beginning work on a construction job. By putting all interested parties on notice, claimants can help protect their lien rights. One important early notice form is called a Notice of Contractual Retainage, as defined at Sec. 53.057 of the Texas Property Code.

Retainage means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. TEX. PROP. CODE 53.001(11). Simply put, it is a portion of the agreed upon contract price that is deliberately withheld until the work reaches substantial completion to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. If the job is not up to par, the retainage amount is used to make any changes or fixes.

Give this notice to all other interested parties to make them aware that the person who hired you is withholding a retainage amount from you under your contract. Therefore, once provided with the notice, the other parties above you can withhold a matching retainage amount. If you are an original contractor on the job, the notice is not required since the owner already has such notice of any retainage agreement.

Use this form if you do not have a direct contract with the owner or the original contractor. Thus, you need to provide this notice to these parties to make them aware of the existing retainage agreement. The claimant must give the owner or reputed owner the notice of contractual retainage no later than the earlier of: (a) the 30th day after the date the claimant's agreement providing for retainage is completed, terminated, or abandoned; or (b) the 30th day after the date the original contract is terminated or abandoned. TEX. PROP. CODE 53.057(b).

The Notice of Contractual Retainage does not need to be notarized or recorded. Instead, deliver it to relevant parties via certified or registered US mail, with return receipt requested.

Each case is unique, and the Texas lien law is complicated. Contact an attorney for complex situations, with specific questions about sending a notice of contractual retainage, or any other issue about mechanic's liens.

Important: Your property must be located in Bastrop County to use these forms. Documents should be recorded at the office below.

This Notice of Contractual Retainage meets all recording requirements specific to Bastrop County.

Our Promise

The documents you receive here will meet, or exceed, the Bastrop County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bastrop County Notice of Contractual Retainage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Norma O.

March 10th, 2020

good

Thank you!

Phoenix D.

August 17th, 2020

I was looking for the proper quit claim deed for my state. I found it on deeds.com along with instructions and a sample. I couldn't have filed without them.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen E.

May 6th, 2020

Thank you for your great response on my needs. In less than 24 hours I had my documents in hand as needed. Looking forward to working with Deeds.com again. Steve Esler

Thank you for your feedback Steve, glad we could help.

Michael M.

April 30th, 2019

Easy to follow directions and instructions to properly and legally fill-in the Deed that I requested. It was also very easy and convenient. If I was going to employ an Attorney or Legal Documents Preparer, they would easily charge me between $150 to $225 a Deed! For the cost of $19.97, anyone would pursue this price! Thank you, Deeds.com for a wonderful and terrific experience! I'm going to need you again to change Titles for my other Investment Properties.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen T.

March 25th, 2020

Perfect in every way, the guide was a big help in a few areas that I had questions on. Overall the average person should have no issues with the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tiffany Dawn J.

September 28th, 2019

Would be nice to have a better description on how to complete the forms if it is separated couple and one is signing the deed over to the other. I am still unsure how it should be worded. Disappointed that the guide didn't have better explanations.

Thank you for your feedback. We really appreciate it. Have a great day!

Heather M.

January 9th, 2019

Great service, convenient, fast and easy to use. Thumbs Up!!!!w

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rex M.

February 21st, 2019

fulfilled all NC requirements

Thank you!

Boyd B.

June 16th, 2025

I had an issue because of what I was doing, thanks to these guys. I received an email and lickety-split done no more problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Traci R.

November 21st, 2019

I was disappointed in the form received. The language was not clear and for the price, one would think we would receive a Word version rather than a PDF.

Sorry to hear of your struggle Traci. We have canceled your order and payment. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Clint E.

September 3rd, 2020

Good value. I like not only getting the forms, but also the instructions and examples the forms came with

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca C.

January 26th, 2021

Great service ! Hawaii is not a "forms state" so unfortunately the public has no way to get templates on our local gov site but deeds.com to the rescue. The template was affordable and easy to use and successfully recorded. Great to use when you don't need to involve title or attorneys for simple deed changes, thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Ben F.

April 14th, 2019

My initial review during download and before reading the guide and forms looks promising.

Thank you!

Richard B.

May 27th, 2022

Had trouble filling in the forms not very user friendly. The text always had to be manipulated to look in the best place. Could not easily move existing text to look more professional with the text being inserted.

Thank you for your feedback. We really appreciate it. Have a great day!

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!