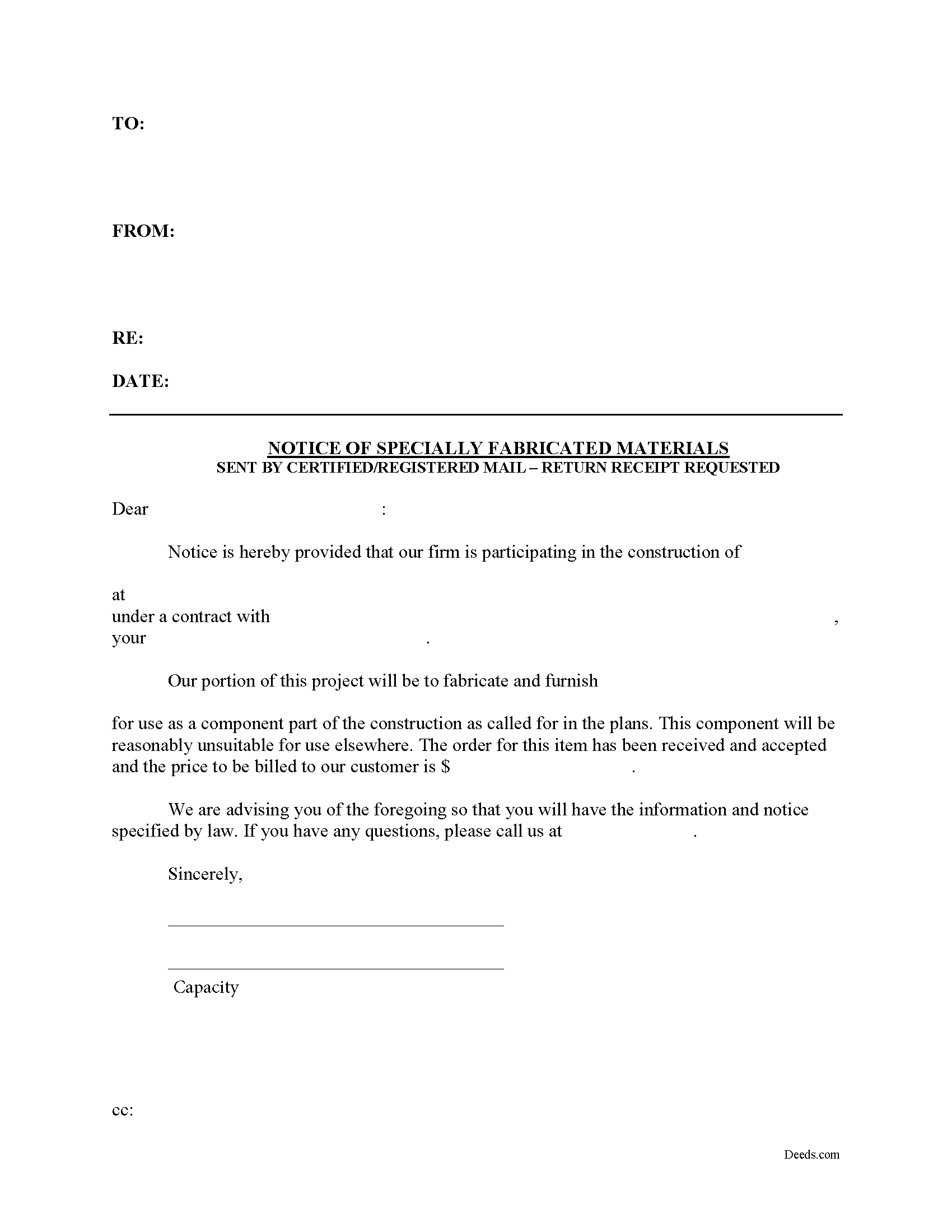

Parmer County Notice of Specially Manufactured Materials Form

Parmer County Notice of Specially Manufactured Materials Form

Fill in the blank Notice of Specially Manufactured Materials form formatted to comply with all Texas recording and content requirements.

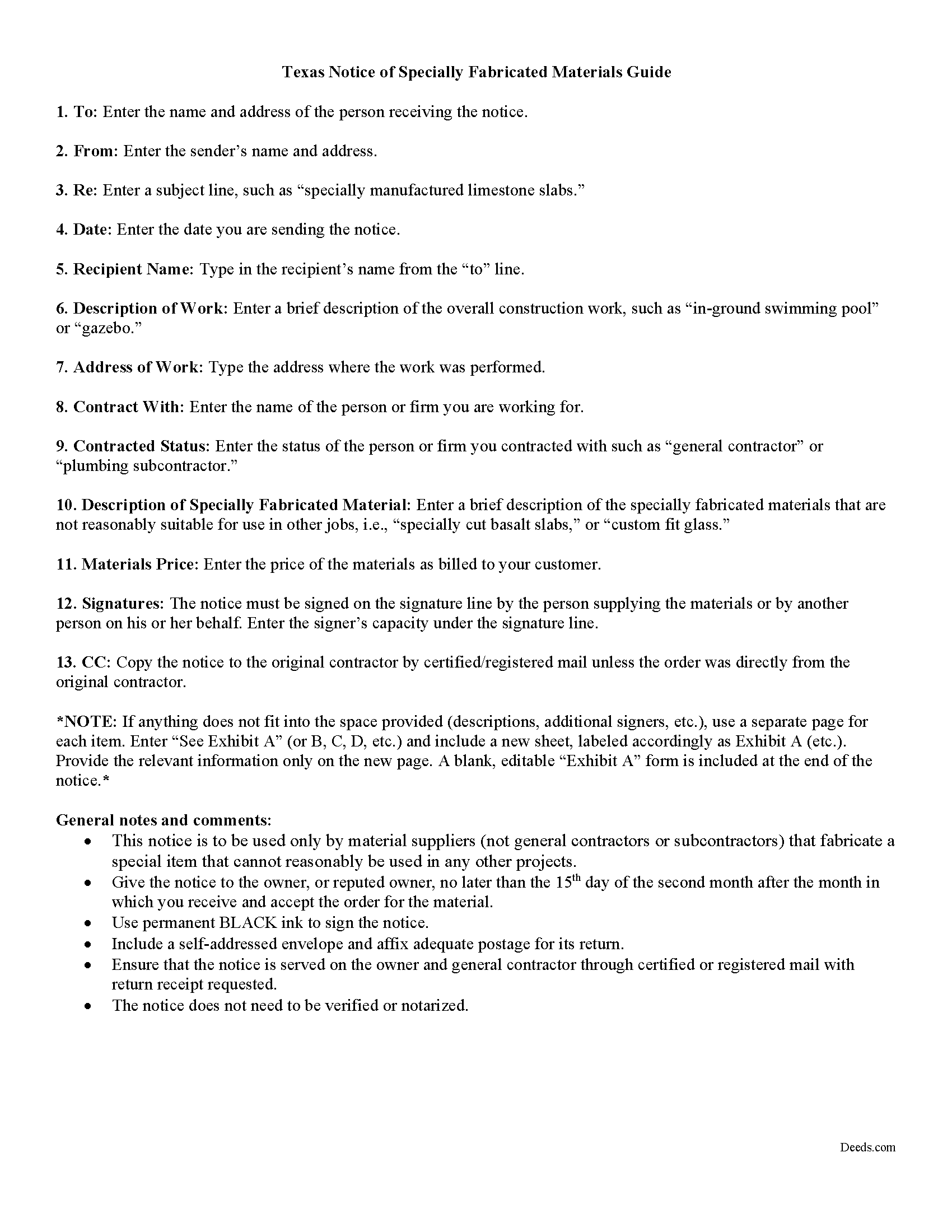

Parmer County Notice of Specially Manufactured Materials Guide

Line by line guide explaining every blank on the form.

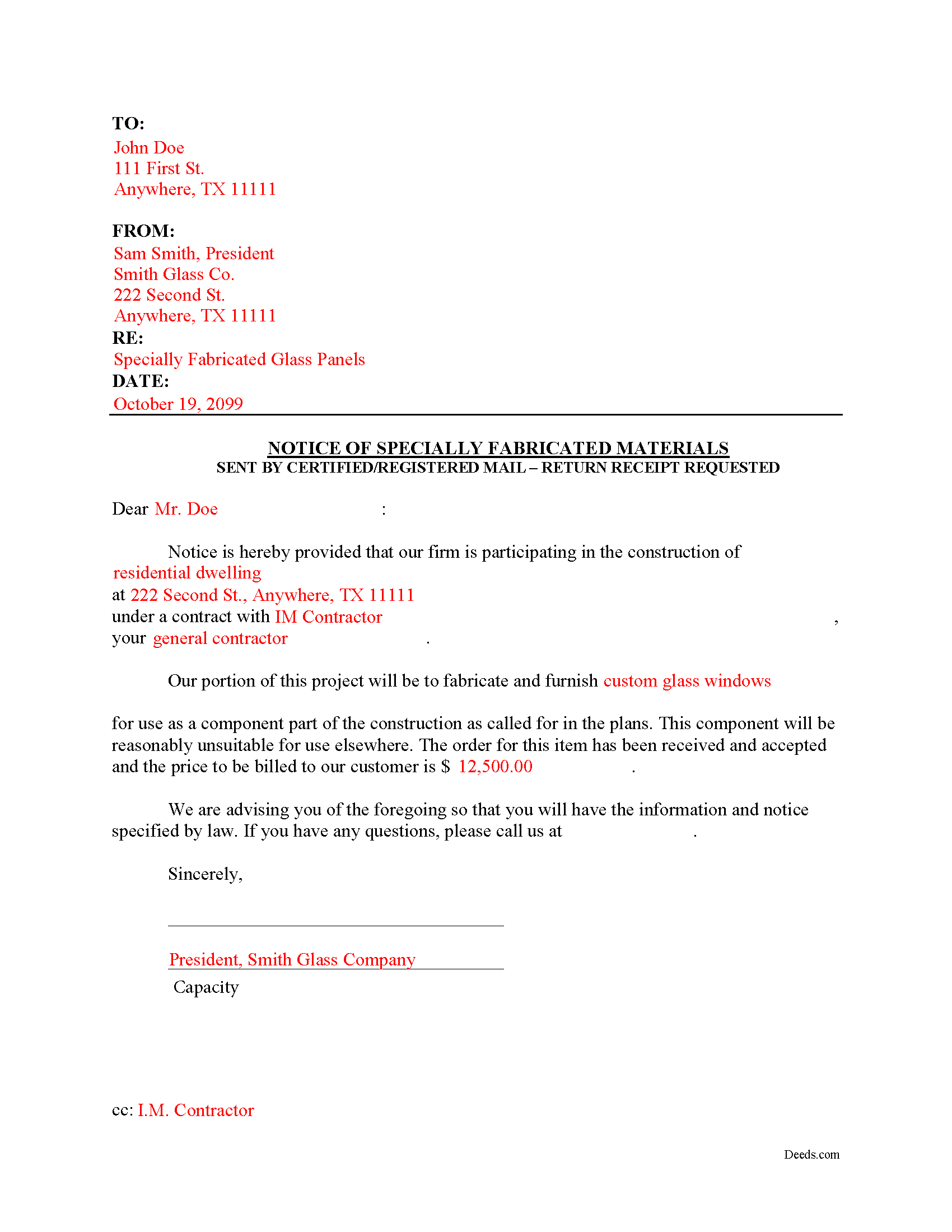

Parmer County Completed Example of the Notice of Specially Manufactured Materials Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Parmer County documents included at no extra charge:

Where to Record Your Documents

Parmer County Clerk

Farwell, Texas 79325-4671

Hours: Monday - Friday 8:30am - 12:00 & 1:00 - 5:00pm

Phone: (806) 481-3691

Recording Tips for Parmer County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Parmer County

Properties in any of these areas use Parmer County forms:

- Bovina

- Farwell

- Friona

- Lazbuddie

Hours, fees, requirements, and more for Parmer County

How do I get my forms?

Forms are available for immediate download after payment. The Parmer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Parmer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Parmer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Parmer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Parmer County?

Recording fees in Parmer County vary. Contact the recorder's office at (806) 481-3691 for current fees.

Questions answered? Let's get started!

Construction projects often demand custom materials that are only suitable for that specific job, due to unique dimensions of the materials or other customized aspects as specified by the customer. These materials are not suitable for use in other projects, except as possible salvage or scrap with a greatly diminished value.

Suppliers of specially manufactured items that are not reasonably suitable for other jobs may serve the Notice of Specially Manufactured Items as set out at Sec. 53.058 of the Texas Property Code. This notice is not required, but under 53.023(2), a person who creates such job-specific materials is entitled to lien, even if the materials were never delivered to the job site.

These claimants must also serve the Notice of Contractual Retainage, along with either a Second Month Notice or a Third Month Notice, warning the contractor and owner about the outstanding debt.

The document identifies the parties and the project, describes the materials, and lists the relevant dates, fees, and payments, if any. The Notice of Specially Manufactured Materials is not recorded in a county public records office and does not need to be verified or notarized. Simply fill out the required fields and send it via U.S. certified or registered mail with a return receipt requested.

Texas lien laws are complex and require strict adherence. Each case involving specially manufactured items is unique, so contact an attorney for complex situations, with specific questions about the Notice of Specially Fabricated Materials, or any other issues related to mechanic's liens.

Important: Your property must be located in Parmer County to use these forms. Documents should be recorded at the office below.

This Notice of Specially Manufactured Materials meets all recording requirements specific to Parmer County.

Our Promise

The documents you receive here will meet, or exceed, the Parmer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Parmer County Notice of Specially Manufactured Materials form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Cedric W.

January 2nd, 2021

This process was very easy to go through, from beginning to end. It was fast, precise and got the job done without me having to leave my computer. If opportunities arise, I will definitely use deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Tullea S.

October 15th, 2024

Although I didn't get what I needed, the customer service is outstanding. I got a text asking if I needed any help. He canceled my subscription right away and was very helpful. He responded quickly each time.

We are delighted to have been of service. Thank you for the positive review!

Emanuel W.

December 16th, 2021

Excellent service! We surely use again

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah D.

June 1st, 2023

What I thought was gonna be a long drawn out tedious process was literally 10min tops... The help was quick and a load off. Thanks y'all.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

Jo Anne C.

February 1st, 2021

Excellent documentation. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

JIM H.

July 21st, 2022

Excellent service Always find the documents in minutes. Supporting docs is a super plus!

Thank you!

Desiree D.

April 10th, 2024

This service is so good, quick, reasonably priced! I would use Deeds.com again!

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Jan H.

October 15th, 2020

This is a great service. It was easy to find and the instructions were complete and easy to follow.

Thank you!

Annette H.

September 8th, 2022

Deeds.com has done a wonderful job! They are quick to get back to me either with the Deed or reason why there is no Deed. You have saved me so much time using your services that I hope to keep using them for years to come! Thank you!

Thank you!

Evelyn T.

March 26th, 2025

Easy to follow; user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

April 28th, 2020

Hi Please do not take time to respond to my previous inquiry - - - I figured it out. Deeds.com is a great tool for those of us who have occasional need for your type of services. Thanks ! Chuck

Thank you!

David J.

March 27th, 2020

Very easy to use and saved a lot of time

Thank you!

Sol B.

February 13th, 2020

Got me all the info I was looking for Thanks you deeds.com

Thank you!

Mary-Ann K.

November 23rd, 2021

Very pleasantly pleased so far. Hope to hear from the town registrar Transfer On Death Deed accepted. Wish all legal proceedings were so simple . . .

Thank you for your feedback. We really appreciate it. Have a great day!