San Patricio County Quitclaim Deed Form

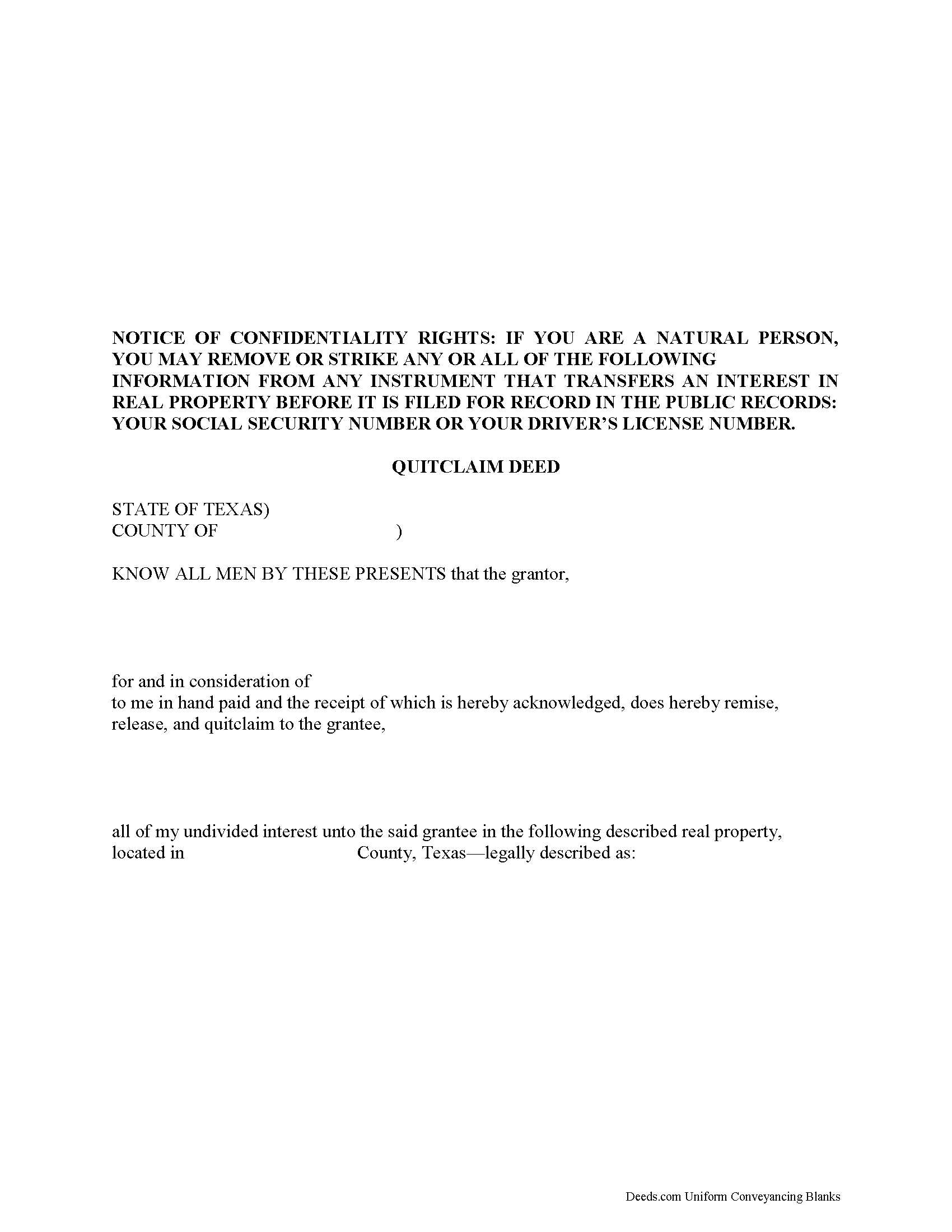

San Patricio County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Texas recording and content requirements.

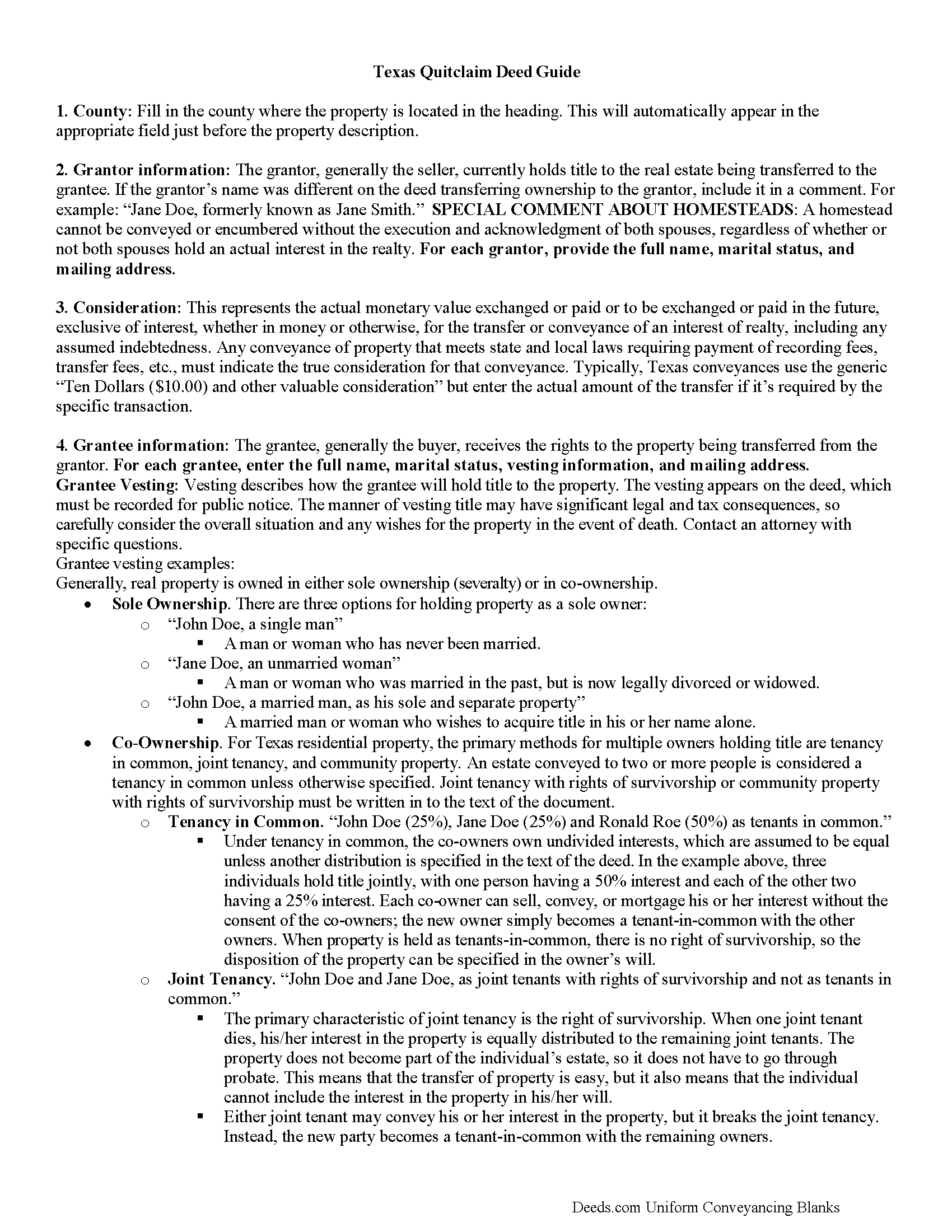

San Patricio County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

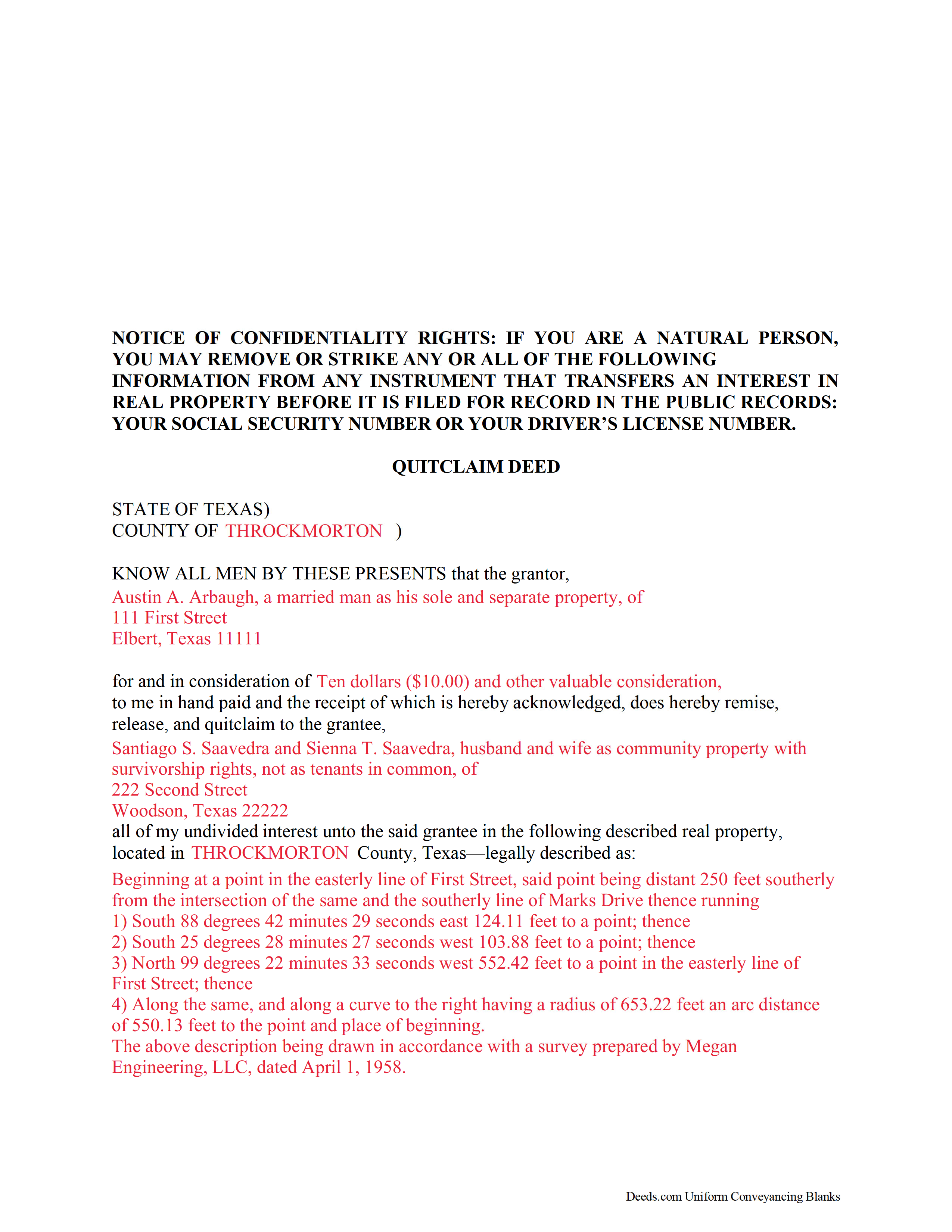

San Patricio County Completed Example of the Quitclaim Deed Document

Example of a properly completed Texas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and San Patricio County documents included at no extra charge:

Where to Record Your Documents

San Patricio County Clerk

Sinton, Texas 78387

Hours: 8:00am to 5:00pm M-F

Phone: (361) 364-9350

Recording Tips for San Patricio County:

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

- Have the property address and parcel number ready

Cities and Jurisdictions in San Patricio County

Properties in any of these areas use San Patricio County forms:

- Aransas Pass

- Edroy

- Gregory

- Ingleside

- Mathis

- Odem

- Portland

- Sinton

- Taft

Hours, fees, requirements, and more for San Patricio County

How do I get my forms?

Forms are available for immediate download after payment. The San Patricio County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in San Patricio County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Patricio County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in San Patricio County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in San Patricio County?

Recording fees in San Patricio County vary. Contact the recorder's office at (361) 364-9350 for current fees.

Questions answered? Let's get started!

A quitclaim deed in Texas is recordable once it has been acknowledged, sworn to with a proper jurat, or proved according to law. The grantor to the quitclaim deed must sign and acknowledge the instrument. If the grantee's address is not included in the deed, the recording party may face penalty fees. There may also be formatting standards and specific guidelines as to the type of information that should be included in a quitclaim deed presented for recording in Texas.

An unrecorded quitclaim deed is binding only to the parties involved, the party's heirs, and a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Tex. Prop. Code Ann. 13.001 b). The recording act in Texas states that any conveyance or interest in real property (i.e. a quitclaim deed) is void against creditors and subsequent purchasers for valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed for record according to law. A quitclaim deed that is properly recorded in the proper county in Texas will provide notice to the public of the existence of the instrument and will also be subject to public inspection (Tex. Prop. Code Ann. 13.002).

(Texas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in San Patricio County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to San Patricio County.

Our Promise

The documents you receive here will meet, or exceed, the San Patricio County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Patricio County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Deb F.

July 16th, 2022

The county clerk accepted your mineral deed. It was a blessing finding your deed and instructions for filling it out online. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

TAMMIE M.

November 20th, 2020

The site worked well for me.

Thank you!

Kristine S.

July 9th, 2020

Thank you! You made the process of filing something unusual very easy and efficiently. I will definitely recommend you and be back for my future recording needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James A.

March 9th, 2021

Thanks for you help to get me out of a quick problem. Downloads were great. I recommend this service for the arcane situations of legal angst.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael O.

January 9th, 2023

Great experience. Pre-printed forms, line explanations and samples - solve a lot of problems, eliminate many headaches and research. Thank You!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheri L.

July 9th, 2019

Very helpful even though what I'm looking for hasnt updated yet. I'll use you again.

Thank you!

Jina N.

January 29th, 2019

Awesome site!! You guys really make it simple to understand and access any Deeds that I need. I know you keep very up to date forms, as my county is hard core when it comes to the smallest of details, even compared to every other county across the state. Yet you made it simple and quick, and I never had to redo anything. Even the clerk was impressed that I had it filled out correctly the first time, as that usually never happened. Even the size of type/font and the margins were perfect. That saved a lot of time, money and most of all, frustration. I've recommended you to relatives, friends and co-workers. Thanks to the staff at deeds dot com !! I truly appreciate you. j

Thank you!

Philip C.

July 2nd, 2019

The product I purchased looks great and I added Adobe to be able to copy it, but for some reason I can't,so I will delete Adobe and then try again to copy what i paid for. I have all the PDFS' and my computer and printer are fairly new (windows 10),I should have tried to copy it first, I'll get it! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin M.

December 3rd, 2021

My first time using Deeds.com and I am impressed how much you offer and how easy it is to use this site. Had the real-estate forms I needed plus a bonus of how to fill them out. Best value on the internet for real-estate forms and information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Michelle D.

March 4th, 2019

Very professional service, they were timely and proficient with answers and sending in the documents that I requested. Will work with them again in the future

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dan M.

November 8th, 2024

Quick ... Easy ... Great Instructions ... Easy Peasy ...

We are grateful for your feedback and looking forward to serving you again. Thank you!

William N.

July 16th, 2019

Every thing worked perfectly.

Thank you!

Beverly J. A.

April 24th, 2022

Thank you for the paperwork. It was so much easier to do at home than go out and have to have people miss work.

Thank you!

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!