Palo Pinto County Release of Lien - by Deed of Trust and Note Form

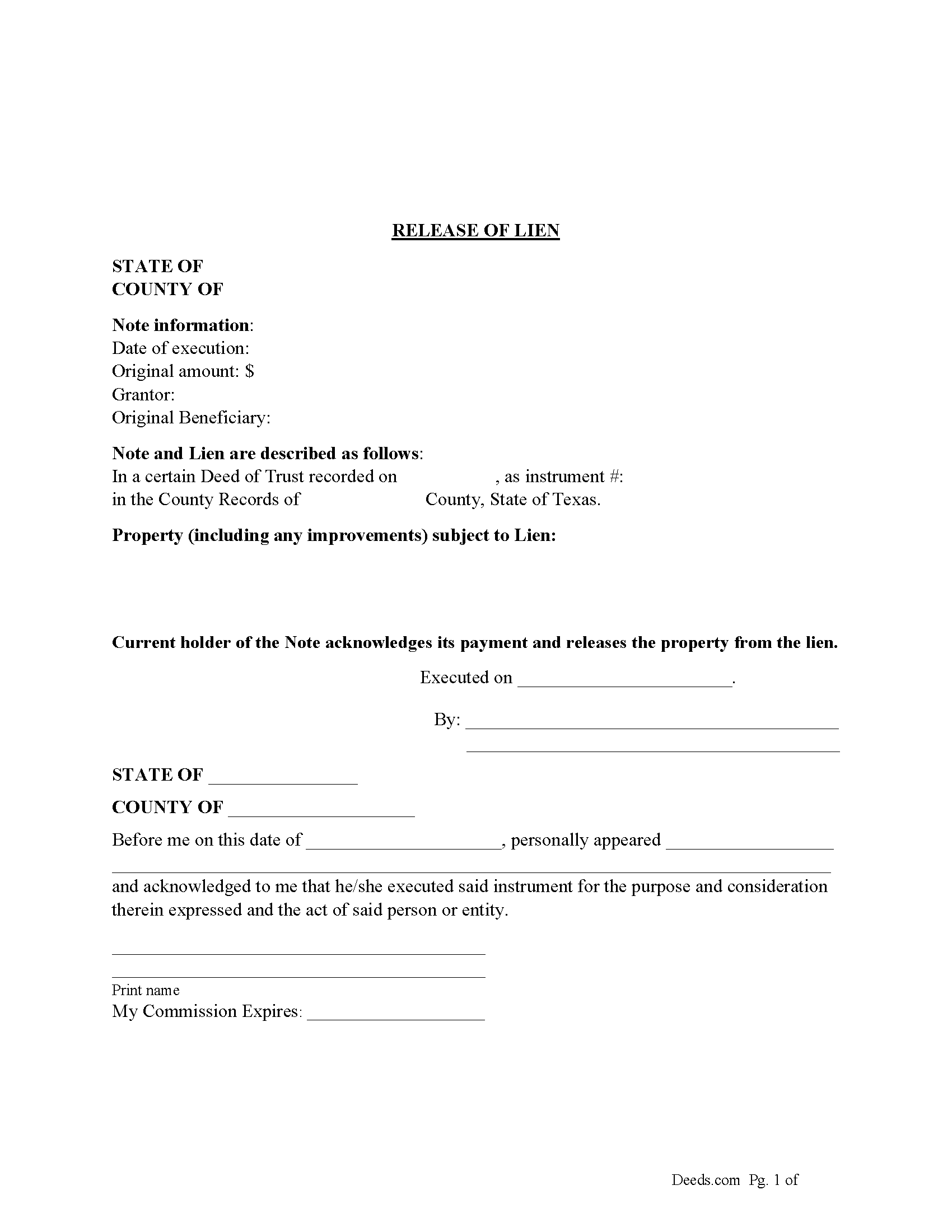

Palo Pinto County Release of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

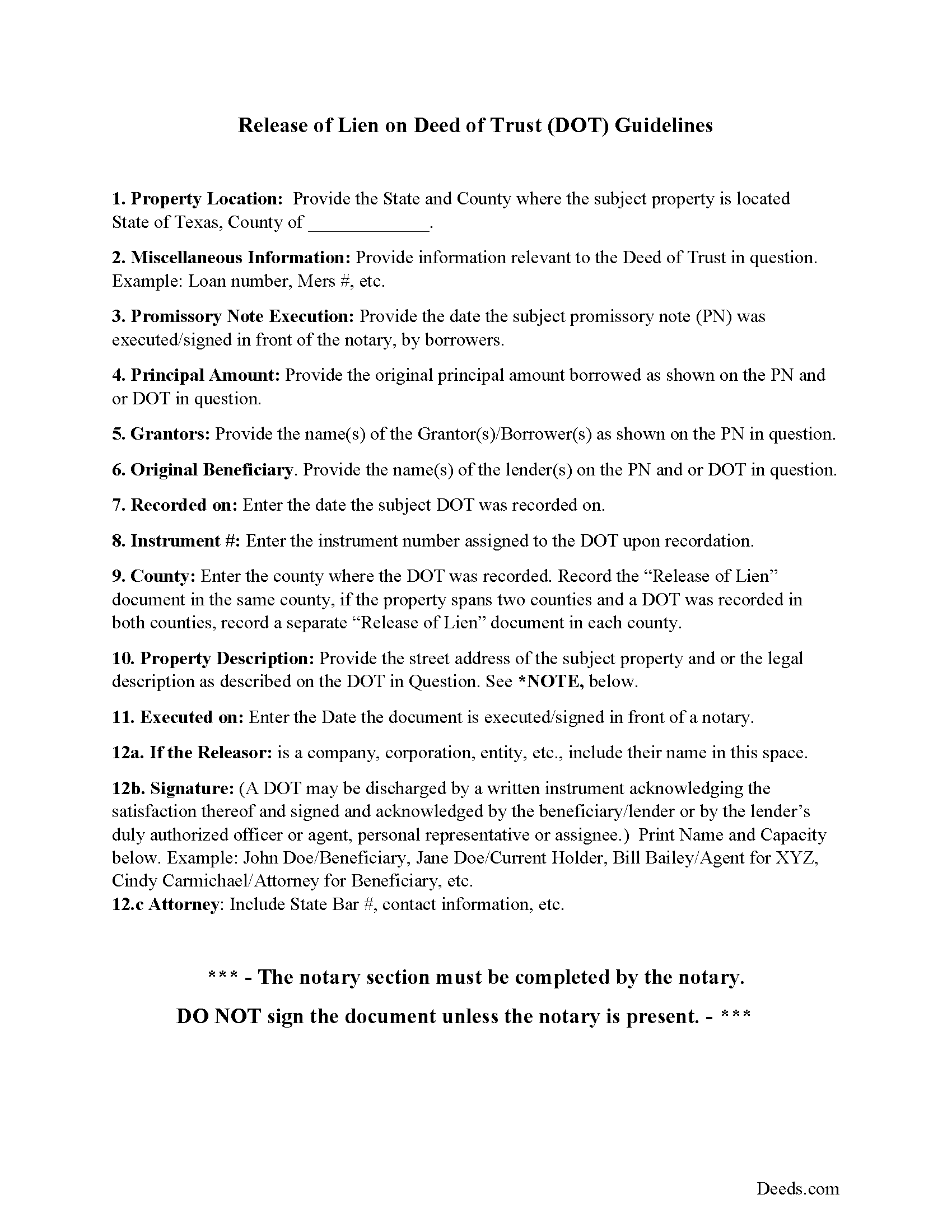

Palo Pinto County Guidelines for Release of Lien

Line by line guide explaining every blank on the form.

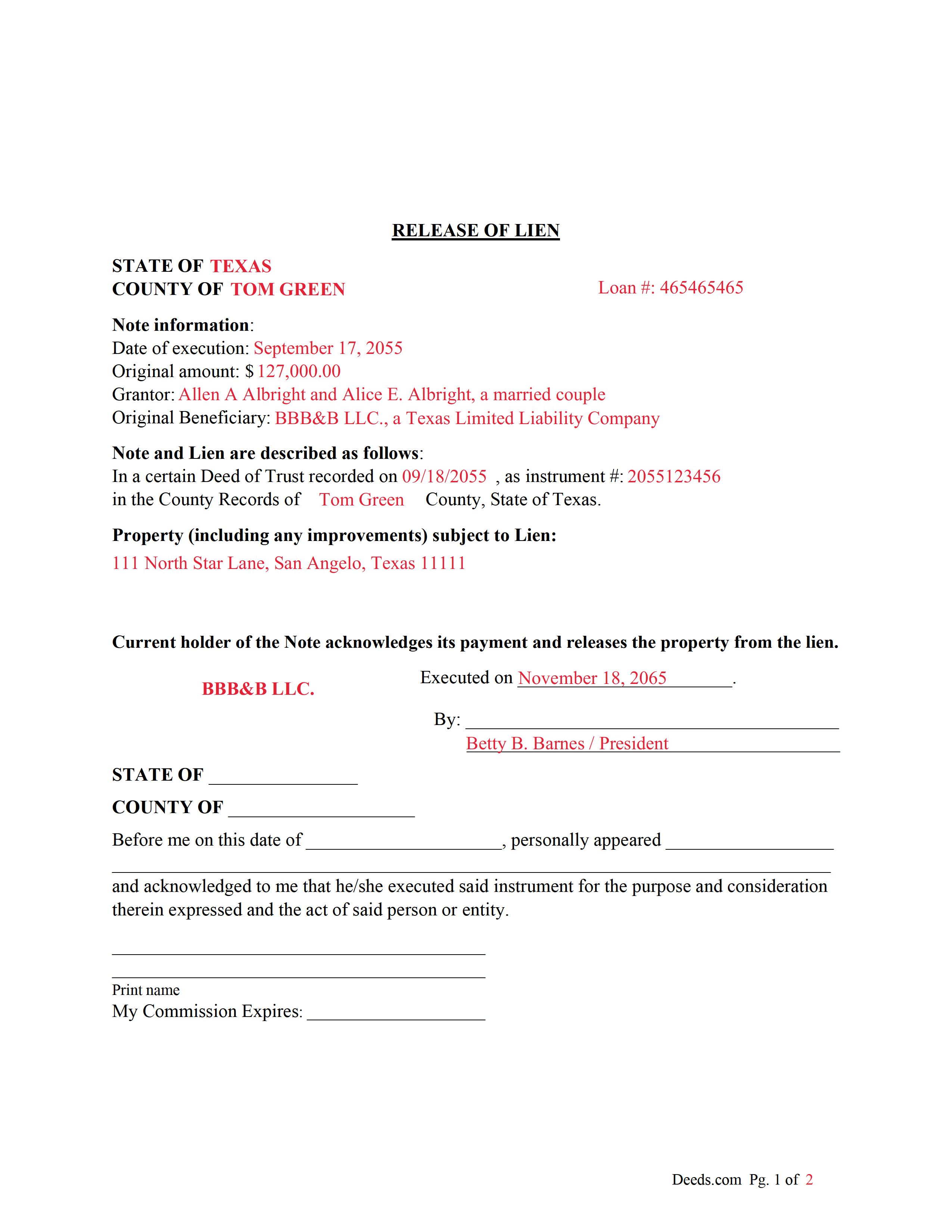

Palo Pinto County Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Palo Pinto County documents included at no extra charge:

Where to Record Your Documents

Palo Pinto County

Palo Pinto, Texas 76484

Hours: Monday - Friday 8:30 am - 4:30 pm

Phone: (940) 659-1277

Recording Tips for Palo Pinto County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Palo Pinto County

Properties in any of these areas use Palo Pinto County forms:

- Gordon

- Graford

- Mineral Wells

- Mingus

- Palo Pinto

- Santo

- Strawn

Hours, fees, requirements, and more for Palo Pinto County

How do I get my forms?

Forms are available for immediate download after payment. The Palo Pinto County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Palo Pinto County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Palo Pinto County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Palo Pinto County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Palo Pinto County?

Recording fees in Palo Pinto County vary. Contact the recorder's office at (940) 659-1277 for current fees.

Questions answered? Let's get started!

This form used to release a lien placed on real property by a previously recorded Deed of Trust. The current holder/lender or representative signs the Release of Lien document, acknowledging payment and release of the lien.

(Texas Release of Lien Package includes form, guidelines, and completed example) For use in Texas only.

Important: Your property must be located in Palo Pinto County to use these forms. Documents should be recorded at the office below.

This Release of Lien - by Deed of Trust and Note meets all recording requirements specific to Palo Pinto County.

Our Promise

The documents you receive here will meet, or exceed, the Palo Pinto County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Palo Pinto County Release of Lien - by Deed of Trust and Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Earle T.

January 23rd, 2021

This is an excellent service. And very easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rico J.

November 3rd, 2021

Plenty of great information.

Thank you!

David G.

September 2nd, 2020

Fill in the blanks portions are so limited, it makes it almost impossible to use.

Sorry to hear that David. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere.

Robert S.

December 21st, 2018

Were unable to help me because of the recorders office but credited my account promptly

Thank you for your feedback. We really appreciate it. Have a great day!

Karen F.

July 29th, 2022

Very easy to understand instructions. I was able to order, download and print.

Thank you for your feedback. We really appreciate it. Have a great day!

DIANE S.

June 6th, 2020

I received my report pretty quick! Had info that I needed. Thank you!

Thank you!

Sara D.

September 25th, 2019

Would have been beneficial to have more information about the previous sale history of the property. The report was received in a very timely manner.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

June 10th, 2022

Thank you! You are so awesome. Its amazing to be able to get everything together in a download packet. You make it so easy for the user.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda S.

August 9th, 2019

I had no problem signing up to Deeds.com. It was easy and effective. I was able to retrieve my records.

Thank you!

Camesha Y.

January 10th, 2019

Was working with a notary client that need to do a deed. We got on this site, ordered the blank forms, he filled them out and we printed them so he could sign. Really clean forms, easy to understand and complete in a hurry. I will be letting all my clients know about this site.

That's terrific Camesha, glad to hear. Have a great day!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Steve W.

February 3rd, 2023

Simple and easy transaction

Thank you for your feedback. We really appreciate it. Have a great day!

Kasie K.

May 15th, 2020

This was such an easy transaction and quicker than if I went to the recording office. During this time of COVID19 and not being able to record documents in person it helped us to get what we needed and quickly. Thank you!

Thank you!

JUDITH-DIAN W.

June 28th, 2023

I didn't have any problem downloading and filling out the form on my computer and printing it yesterday. I didn't know what to put for "Source of Title". I called the county recording office; they didn't know either and said to leave it blank. I got the form notarized at my bank and took it in to the recording office. They checked it, accepted it, I paid a fee, and it's done. So easy. My children will appreciate that I've done this. Added note: You do have one typo on your form--you left out 'at'. It should read: "You should carefully read all information at the end of this form."

Thank you for your feedback. We really appreciate it. Have a great day!

Michael B.

June 5th, 2020

Amazing! I was able to submit my documentation and it was on record within one hour! Highly Recommend.

Thank you for your feedback. We really appreciate it. Have a great day!