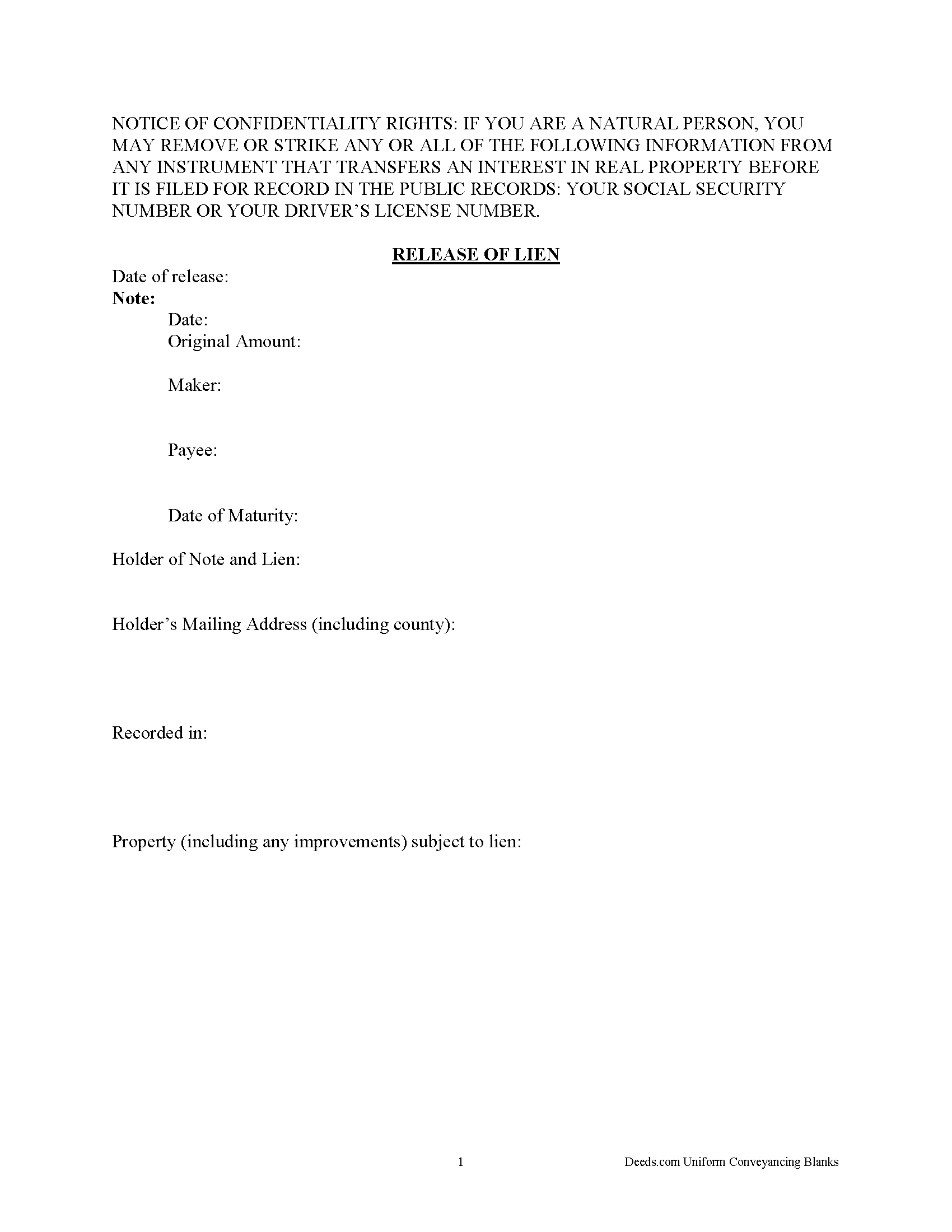

Kimble County Release of Lien Form

Kimble County Release of Lien Form

Fill in the blank Release of Lien form formatted to comply with all Texas recording and content requirements.

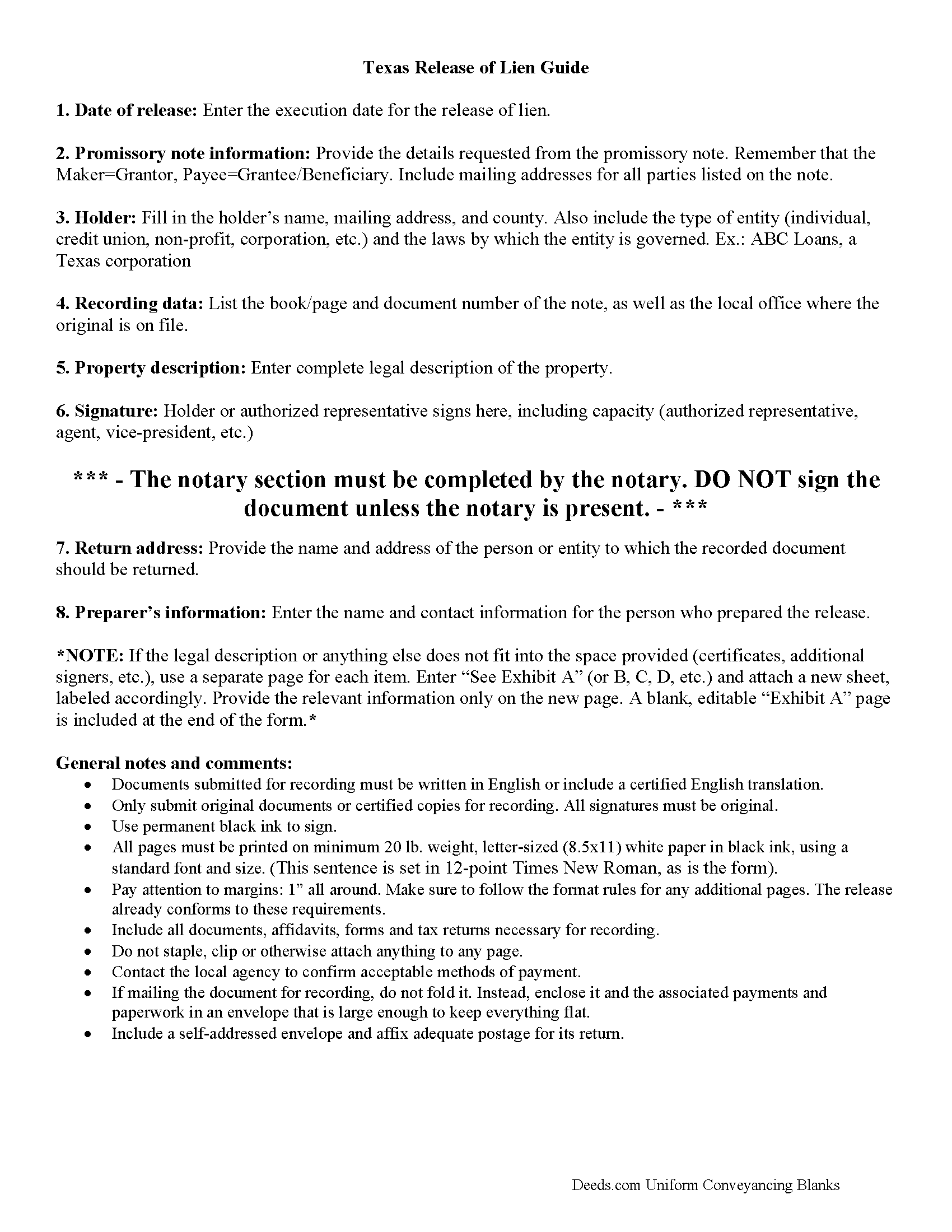

Kimble County Release of Lien Guide

Line by line guide explaining every blank on the form.

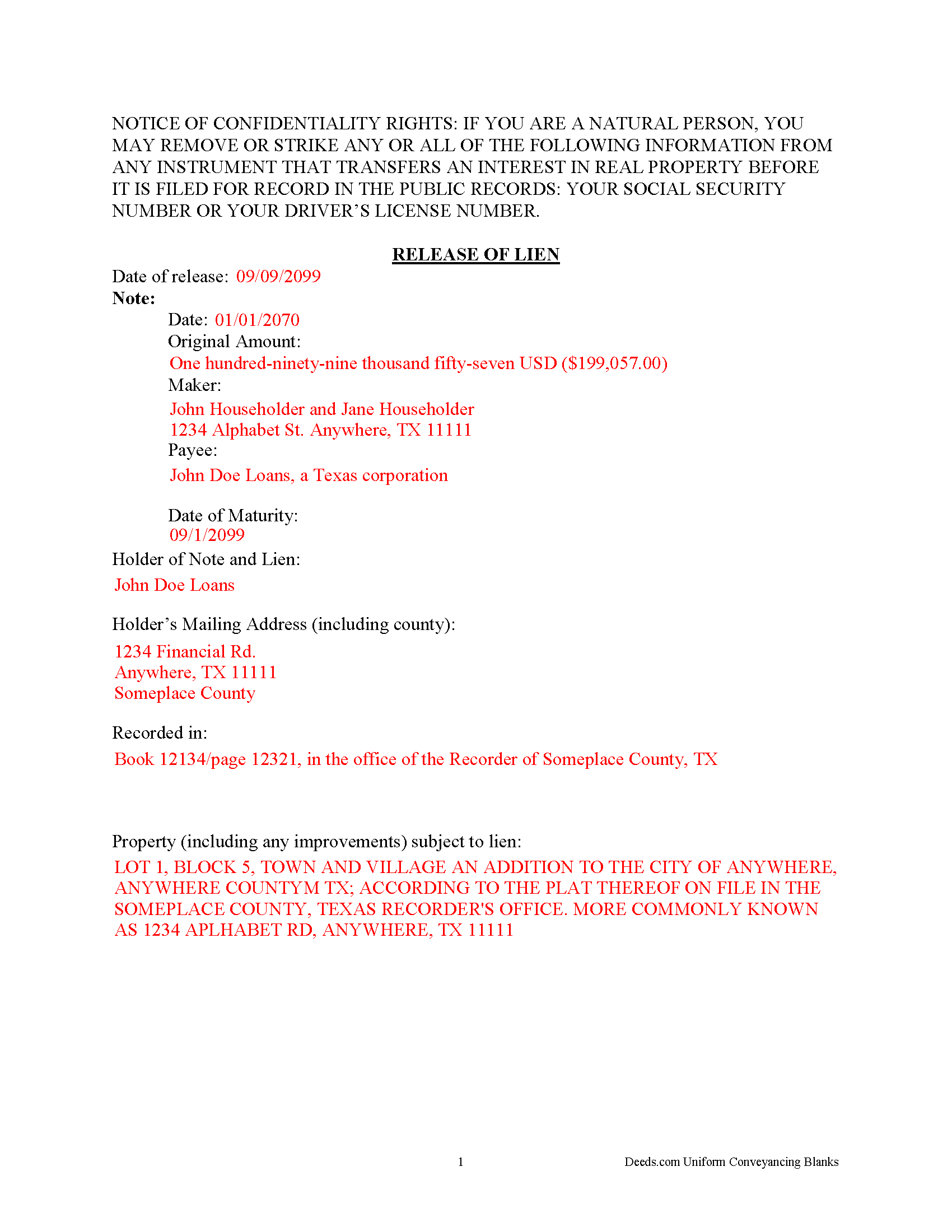

Kimble County Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Kimble County documents included at no extra charge:

Where to Record Your Documents

Kimble County Clerk

Junction, Texas 76849

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm / Until 3:00pm day before holiday

Phone: (325) 446-3353

Recording Tips for Kimble County:

- Bring your driver's license or state-issued photo ID

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Kimble County

Properties in any of these areas use Kimble County forms:

- Junction

- London

- Roosevelt

Hours, fees, requirements, and more for Kimble County

How do I get my forms?

Forms are available for immediate download after payment. The Kimble County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kimble County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kimble County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kimble County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kimble County?

Recording fees in Kimble County vary. Contact the recorder's office at (325) 446-3353 for current fees.

Questions answered? Let's get started!

After completing payments on the promissory note connected to a deed of trust, the lender completes this release of lien form. Promptly recording this document in the same county as the original deed of trust and promissory note serves to unencumber (free up) the title to the related real property. There is no need for any words of conveyance because the property rights were transferred when the borrower and lender signed the deed of trust.

Important: Your property must be located in Kimble County to use these forms. Documents should be recorded at the office below.

This Release of Lien meets all recording requirements specific to Kimble County.

Our Promise

The documents you receive here will meet, or exceed, the Kimble County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kimble County Release of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Carolyn G.

January 15th, 2023

This information was extremely helpful and needed. The price is so worth it also.

Thank you!

Michael B.

November 17th, 2020

I'm very pleased with the service provided by Deeds.com. After a format issue caused my scanner, it was a very smooth and speedy process. Highly recommended.

Thank you for your feedback. We really appreciate it. Have a great day!

tom s.

May 13th, 2021

Easier than I had expected. Was looking for the 'I have to get information that I don't understand' part which never appeared. Thank you

Thank you!

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!

James E.

December 1st, 2020

Forms were available for immediate download. Examples were helpful in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John H.

October 13th, 2019

works nice

Thank you!

Elliot B.

January 31st, 2022

Outstanding forms and the recording service made a short day of what I needed to do. Will be back for the next one, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Cindy H.

October 22nd, 2021

Very easy to use and organized. When I needed the form I needed it immediately. I didn't want to get locked into a monthly subscription. Deeds.com met that need. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DAVID K.

May 15th, 2020

You are definitely the place to go for forms and other things which I need to solve my problems. Thanks for your help.

Thank you!

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!

Louise M.

August 31st, 2023

Amazing fast service. From the U.K. I was unable to get a check in U.S. dollars. This solved my problem as I was able to make payment with a card. So much faster than sending the documents from the U.K. via the postal service. Easy to use site, very quickly processed. Highly recommend

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra H.

April 1st, 2020

I did not receive the information in a timely fashion as stated on the website. I would not recommend this service.

Thank you for your feedback Sandra. In reviewing your order I see that it did take our staff 11 minutes to respond to your order. That is significantly longer than the 10 minute average listed on our website. Even in these unprecedented times of quarantines and staff shortages our failure is unacceptable. We have fully refunded your account and we do hope that you found something more suitable to your needs elsewhere.

Guy G.

March 22nd, 2023

Deeds.com was easy to use and their easement deed was exactly what I was looking for. I knew I didn't need to spend hundreds of dollars talking to an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Freddy S.

August 2nd, 2019

great job

Thank you!