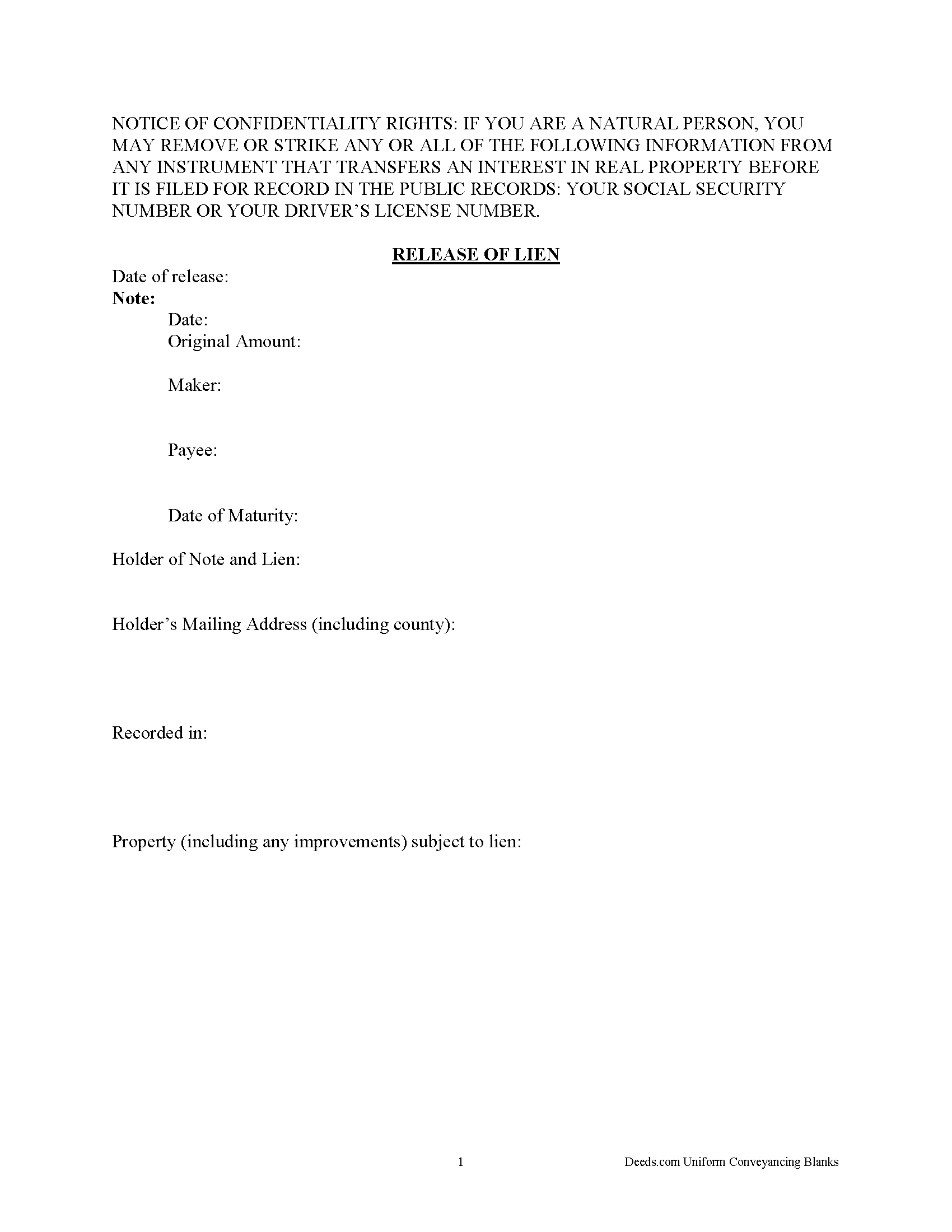

Terrell County Release of Lien Form

Terrell County Release of Lien Form

Fill in the blank Release of Lien form formatted to comply with all Texas recording and content requirements.

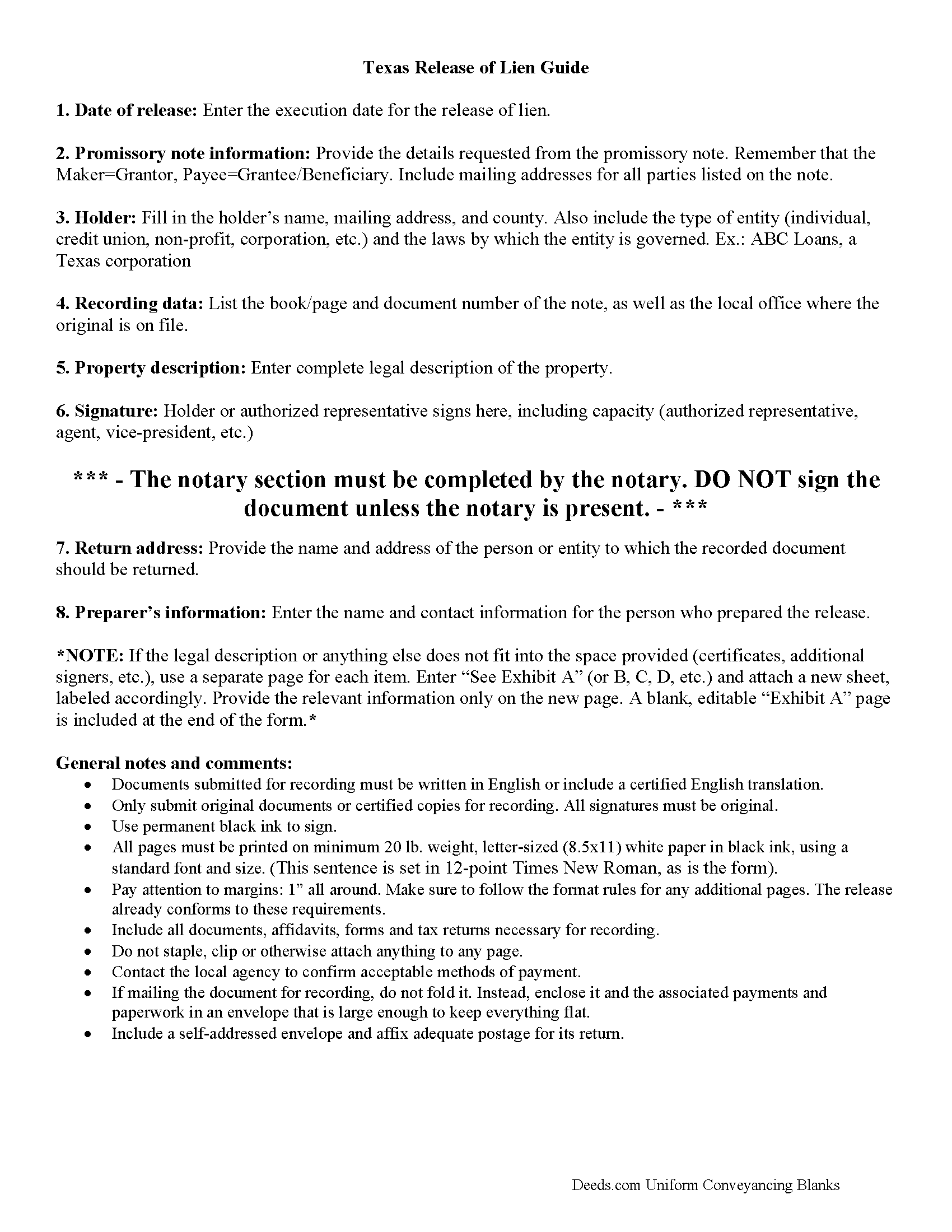

Terrell County Release of Lien Guide

Line by line guide explaining every blank on the form.

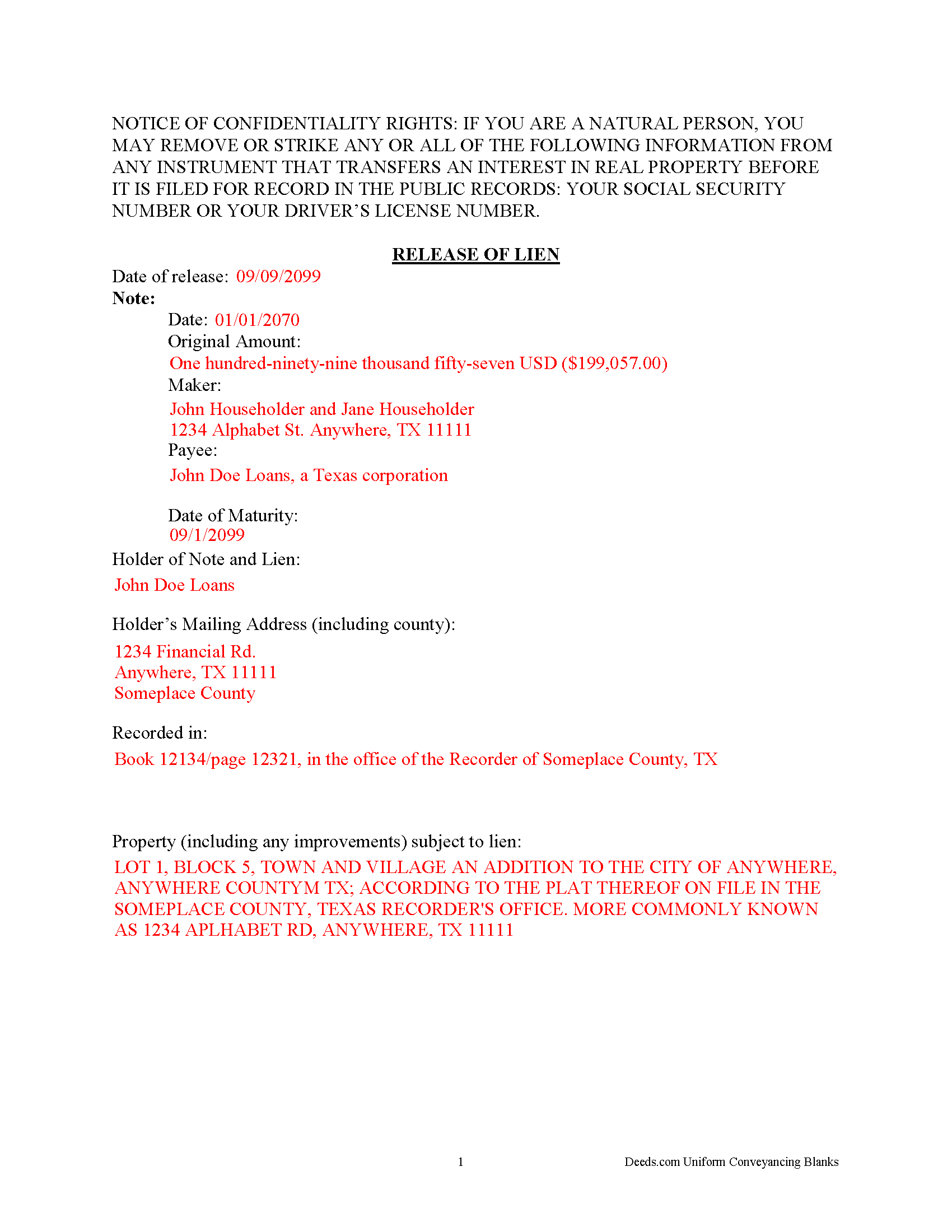

Terrell County Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Terrell County documents included at no extra charge:

Where to Record Your Documents

County Clerk - Terrell County Courthouse

Sanderson, Texas 79848

Hours: 8:00am to 12:00 & 1:00 to 5:00pm M-F

Phone: (432) 345-2391

Recording Tips for Terrell County:

- Bring your driver's license or state-issued photo ID

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Terrell County

Properties in any of these areas use Terrell County forms:

- Dryden

- Sanderson

Hours, fees, requirements, and more for Terrell County

How do I get my forms?

Forms are available for immediate download after payment. The Terrell County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Terrell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Terrell County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Terrell County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Terrell County?

Recording fees in Terrell County vary. Contact the recorder's office at (432) 345-2391 for current fees.

Questions answered? Let's get started!

After completing payments on the promissory note connected to a deed of trust, the lender completes this release of lien form. Promptly recording this document in the same county as the original deed of trust and promissory note serves to unencumber (free up) the title to the related real property. There is no need for any words of conveyance because the property rights were transferred when the borrower and lender signed the deed of trust.

Important: Your property must be located in Terrell County to use these forms. Documents should be recorded at the office below.

This Release of Lien meets all recording requirements specific to Terrell County.

Our Promise

The documents you receive here will meet, or exceed, the Terrell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Terrell County Release of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Teresa G.

May 11th, 2021

My first time using eRecording. Excellent user friendly service.

Thank you for your feedback. We really appreciate it. Have a great day!

Roger V.

April 26th, 2019

Very easy to use.

Thank you Roger, we appreciate your feedback.

Donnajean L.

October 9th, 2024

The site is user friendly and uncomplicated.

Thank you!

Lisa D.

May 2nd, 2023

Great service, would be nice if it provided an address to send this to once completed!

Thank you for your feedback. We really appreciate it. Have a great day!

Debby P.

April 2nd, 2020

First time user and the service was great.. I typically go to recording kiosk at the libraries. This was fast and easy.. I appreciate the great service

Thank you for your feedback. We really appreciate it. Have a great day!

QINGXIONG L.

January 1st, 2021

The major problem is too expensive, particularly sometime, only few words need to file correction deed which cost 20 dollars!!

Thank you for your feedback. We really appreciate it. Have a great day!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

ELOISA F.

May 27th, 2021

Once I had everything right;the recording was fast and easy. I was updated at every juncture and apprised of my mistakes in order to fix and record my deed. To improve service: I think that several different examples and scenarios would have helped. If you have different names from your children; birth certificates and marriage certificates are a requirement in Clark County, NV. If you want to add anyone to the deed in a Quit Claim Deed; you have to add yourself as a grantee even if you are the grantor along with the other grantees.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

July 30th, 2019

Found documents I needed quickly and at a reasonable price. MH

Thank you for your feedback. We really appreciate it. Have a great day!

Rose H.

March 22nd, 2021

I am so glad I found this resource! As the Executor of a family members estate I wanted to save money by bypassing a lawyer as it seemed pretty straight forward to tranfer a Life Estate to the remainderman. (I had original deeds). But talking with 3 different states and 4 different counties - none of which seemed to need the same documents, I was almost ready to dump this in a lawyer's lap. This resource makes it simple!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David D.

September 20th, 2022

Two thumbs up!

Thank you!

Ashley D.

March 4th, 2021

Was able to print my documents immediately. Documents included deed form, a guide, a sample document, etc. Very helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Terrance S.

April 6th, 2020

I'd say 5 stars. Thank you.

Thank you!

Sandra T.

May 4th, 2023

I hope this will address all I need to make sure my father is not being taken for granted by my siblings and a nephew and his wife. thank you

Thank you!