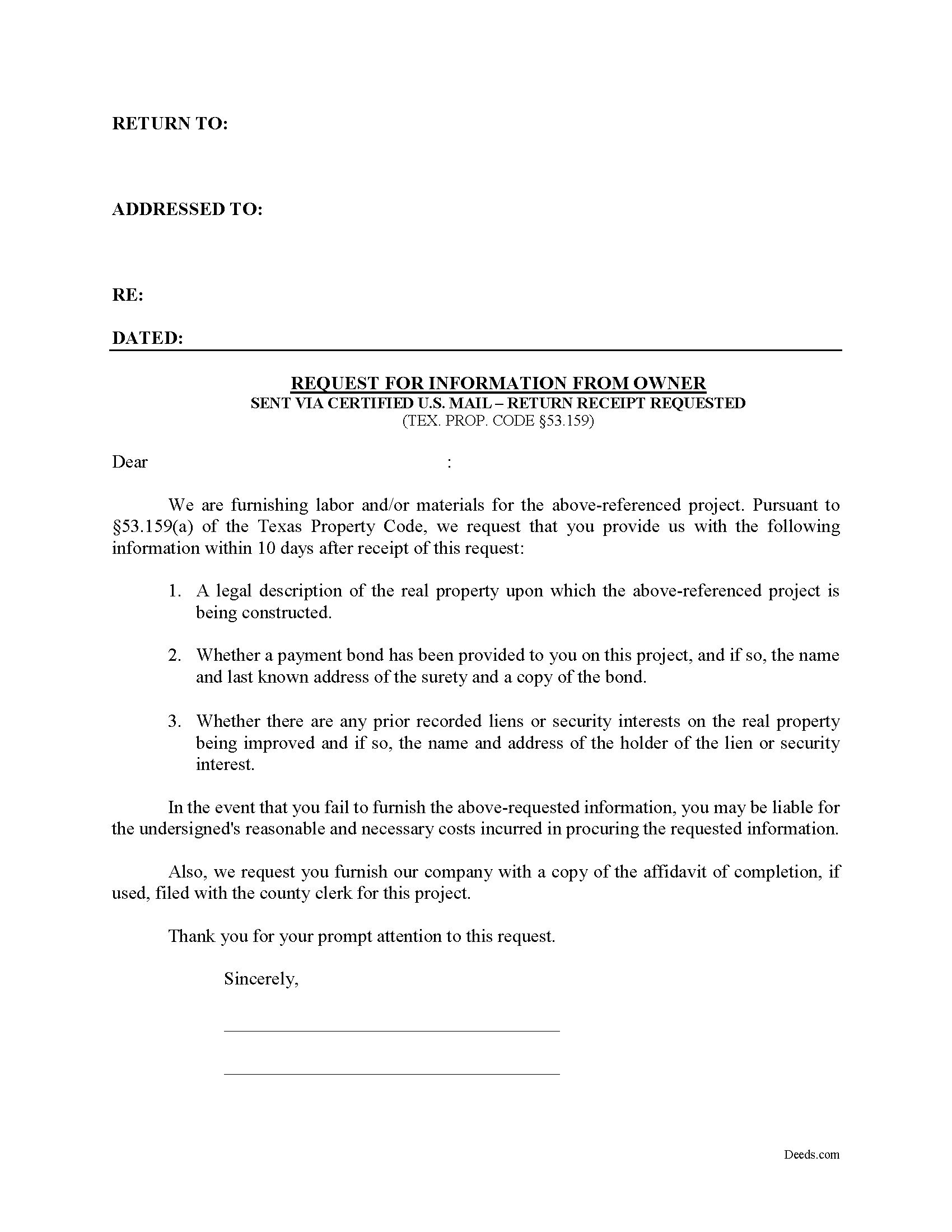

Leon County Request for Information from Owner Form

Leon County Request for Information from Owner Form

Fill in the blank Request for Information from Owner form formatted to comply with all Texas recording and content requirements.

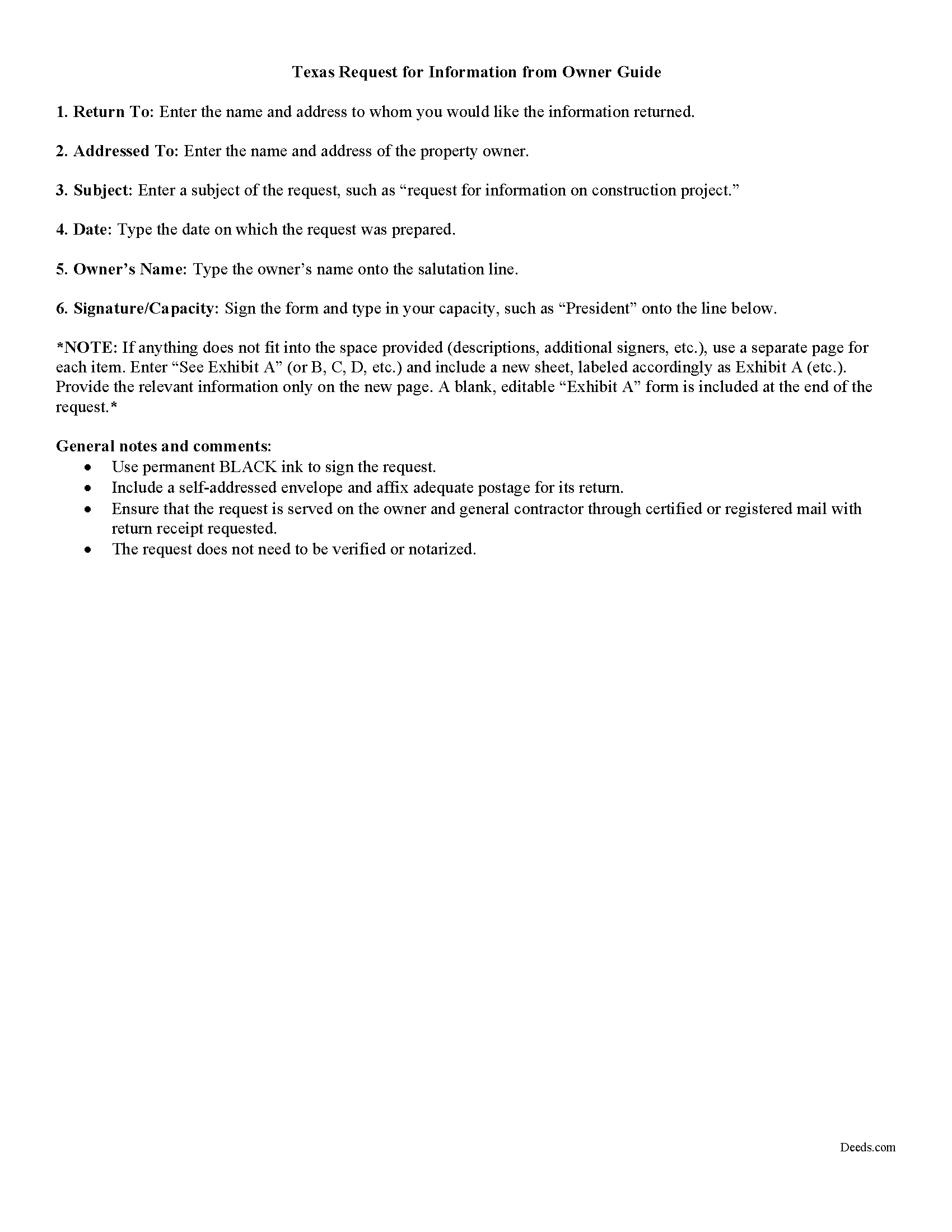

Leon County Request for Infomation from Owner Guide

Line by line guide explaining every blank on the form.

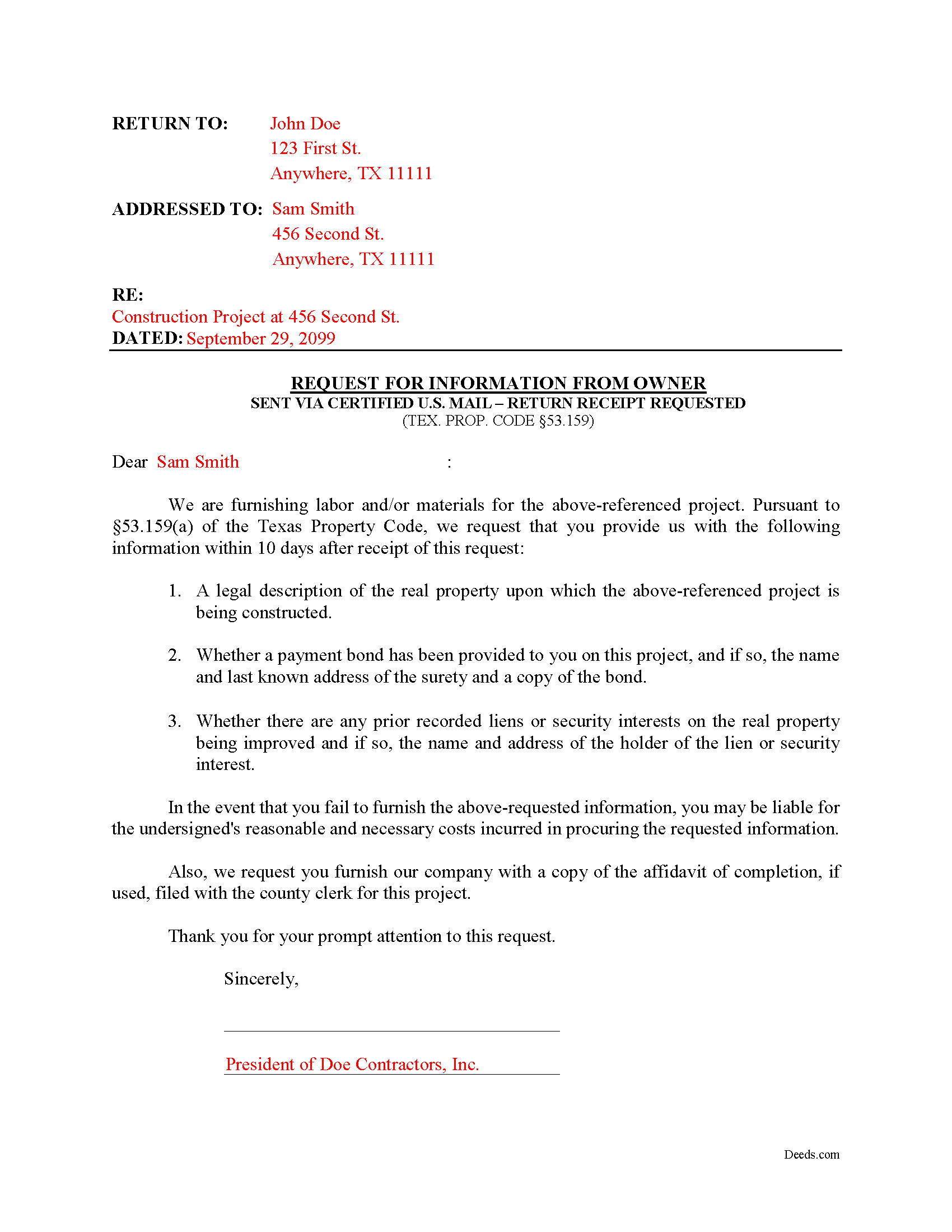

Leon County Completed Example of the Request for Information from Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Leon County documents included at no extra charge:

Where to Record Your Documents

Leon County Clerk

Centerville, Texas 75833

Hours: Monday - Friday 8:00am - 5:00pm / Recording until 4:00pm

Phone: (903) 536-2352

Recording Tips for Leon County:

- Ensure all signatures are in blue or black ink

- Recorded documents become public record - avoid including SSNs

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Leon County

Properties in any of these areas use Leon County forms:

- Buffalo

- Centerville

- Concord

- Flynn

- Jewett

- Leona

- Marquez

- Normangee

- Oakwood

Hours, fees, requirements, and more for Leon County

How do I get my forms?

Forms are available for immediate download after payment. The Leon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Leon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Leon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Leon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Leon County?

Recording fees in Leon County vary. Contact the recorder's office at (903) 536-2352 for current fees.

Questions answered? Let's get started!

What information must the owner provide on a Texas construction project?

The Request for Information from Owner is a form letter used to obtain information from the property owner on a construction job. The required information from the owner includes a description of the real property, details of any surety bond posted, whether there are prior recorded liens or security interests on the property, and the date on which the original contract for the project was executed.

Under TEX. PROP. CODE 53.159(a), upon a written request, the property owner must provide the information within a reasonable time to anyone who furnished labor or materials. The owner must respond no later than the 10th day after the date the request is received.

If the requester is not in direct contractual relationship with the owner on the project, the owner may require payment of the actual costs in producing the information which cannot exceed $25.00. TEX. PROP. CODE 53.159(e). Therefore, some people choose to enclose a check with the request form, up to $25.00, to cover any costs.

If the owner fails to furnish the required information, he or she may be liable for reasonable and necessary costs incurred in procuring the requested information. TEX. PROP. CODE 53.159(f).

Each case is unique, and the Texas lien law is complex. Contact an attorney with specific questions about requesting information about a construction project from the property owner, or any other issues related to mechanic's liens.

Important: Your property must be located in Leon County to use these forms. Documents should be recorded at the office below.

This Request for Information from Owner meets all recording requirements specific to Leon County.

Our Promise

The documents you receive here will meet, or exceed, the Leon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Leon County Request for Information from Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Fernando V.

February 28th, 2023

Excellent!

Thank you!

Pamela G.

November 18th, 2020

I have an apple phone. I could not fill in the form to pay because apple phones do not have a dash that can be used when the field requires a phone number with a dash. I had to borrow an android phone in which the telephone keypad had a dash that could be used. It was easy to pay using an android phone but impossible to pay using an apple phone. Remove the requirement for dashes to allow apple phones to use this service.

Thank you!

Trina P.

February 22nd, 2023

Deeds.com is a quick and effective way at finding property deeds. I had the results I needed in a couple hours without having to miss work to get to the clerks office, which is well worth the price of the service.

Thank you for your feedback. We really appreciate it. Have a great day!

Regina G.

May 18th, 2022

Very good customer service. Would recommend them highly.

Thank you!

john t.

November 1st, 2019

it worked well and printed out well.

Thank you!

Teri B.

January 7th, 2019

Glad to have all of the helpful extra information, even though they don't answer all questions for all situations. So, I accessed public records and asked questions at the auditor's office. Also, on my Mac computer, filling out the actual deed form is a challenge because the screen jumps to the last page everytime I try to type a few letters or hit the return key, so I'm rollling back up to the first 2 pages after most keystrokes. A bit annoying. Overall, happy to have these form options are available! There is really no need to wait and pay for an attorney when all the information needed is available via public records. Fill in the blanks!

Thanks so much for the feedback Teri. There are known issues between Adobe and Mac, we try to work around them as much as possible. Have a wonderful day!

Robert K.

September 6th, 2022

Easy site to use. Well worth the time spent to complete the form.

Thank you!

Michael K.

April 2nd, 2021

I haven't used them yet. So far so good.

Thank you!

Rosa D.

June 18th, 2019

Obtaining a quick claim deed from this website was easy and friendly I must say. Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

CHARLES V.

June 4th, 2019

Legit. Reasonable prices.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT H.

September 13th, 2020

Quick and easy. A very good value even without COVID complications. Since we DO have COVID complications this is perfect.

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

March 10th, 2021

Was a lot easier than driving to the County Building and faster than expected. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margaret D.

October 7th, 2020

They deliver!

Thank you!

Noble Mikhail F.

October 2nd, 2020

The system is wonderful, and makes recording and searching simple, thanks a lot

Thank you!

Debra C.

March 27th, 2020

Excellent service. Love the site.

Thank you for your feedback. We really appreciate it. Have a great day!