Jones County Special Warranty Deed Form

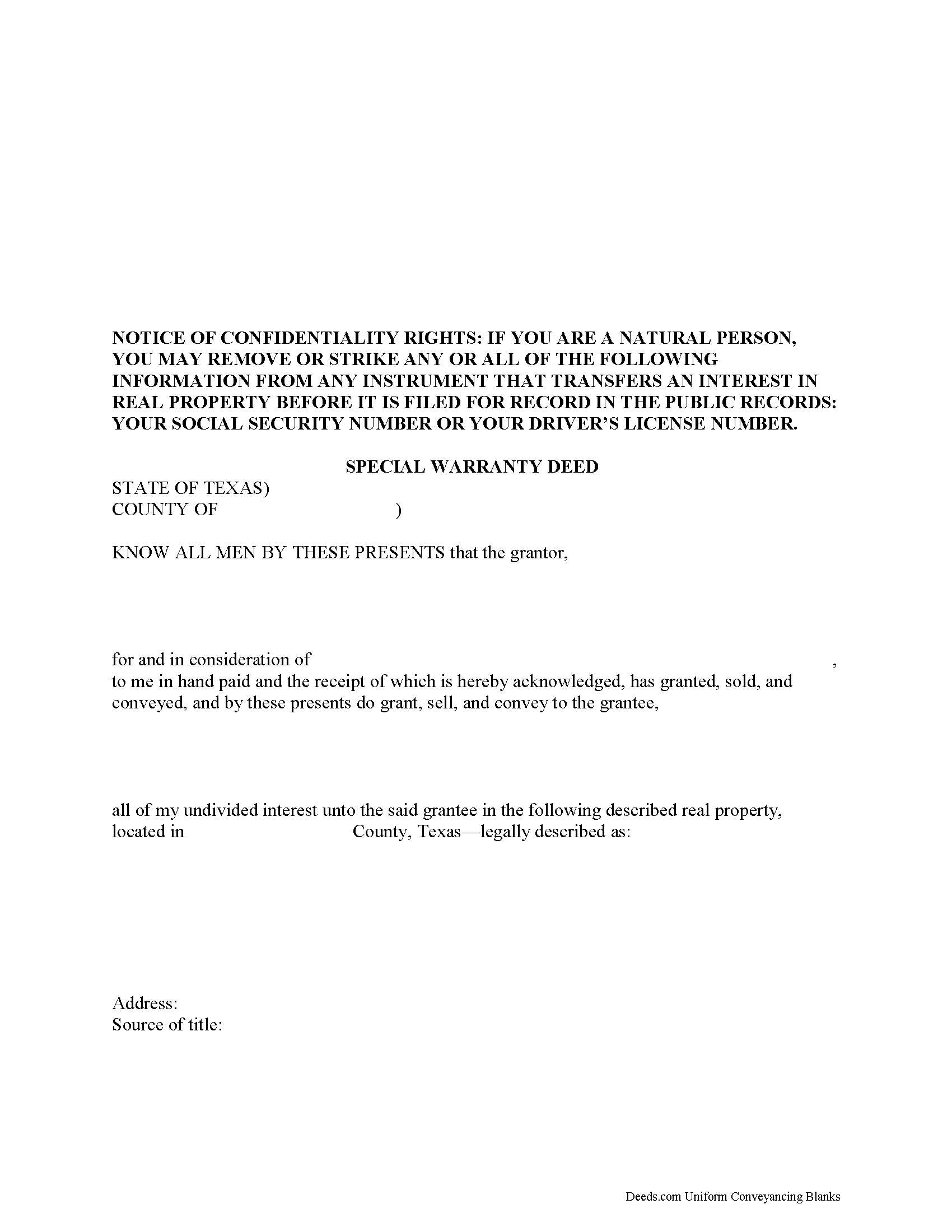

Jones County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

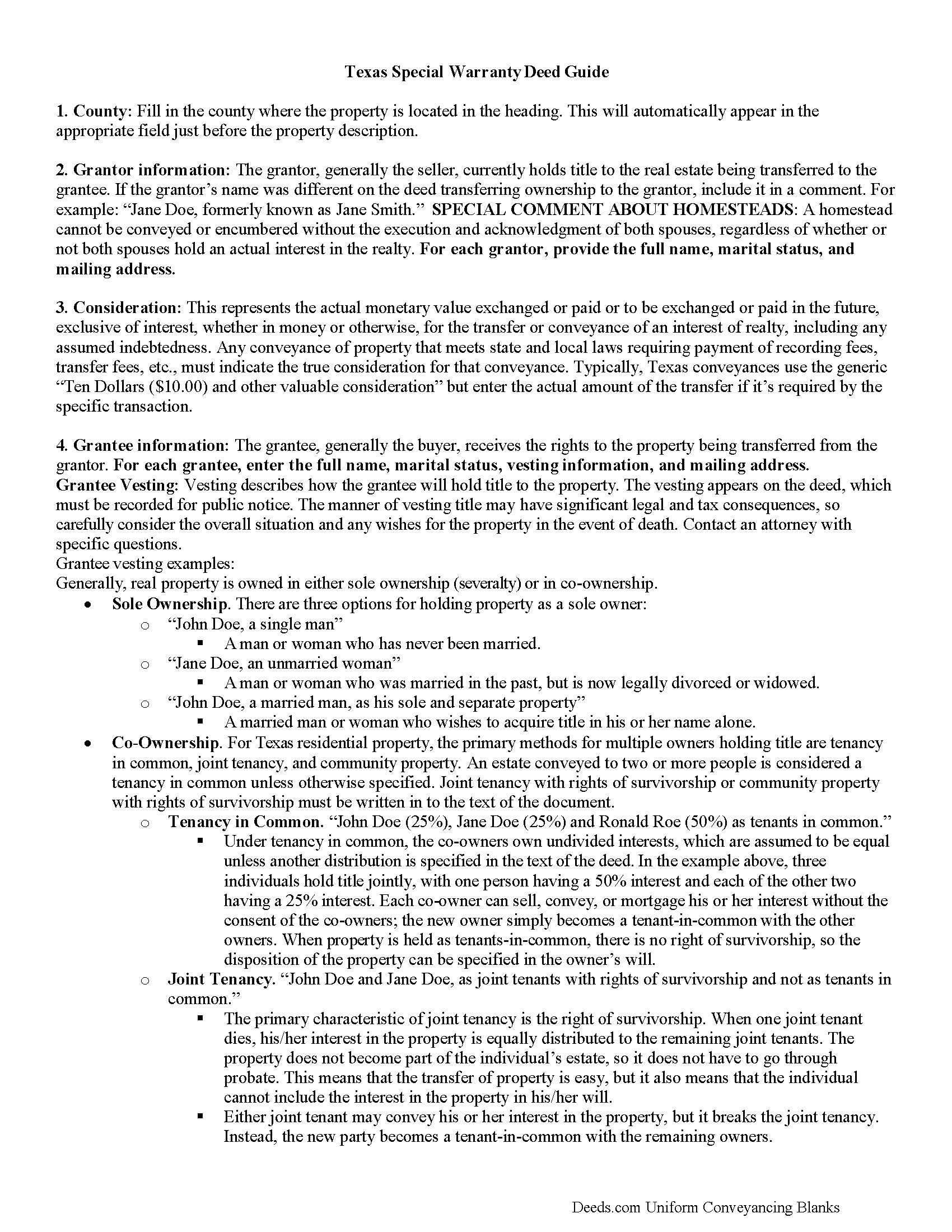

Jones County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

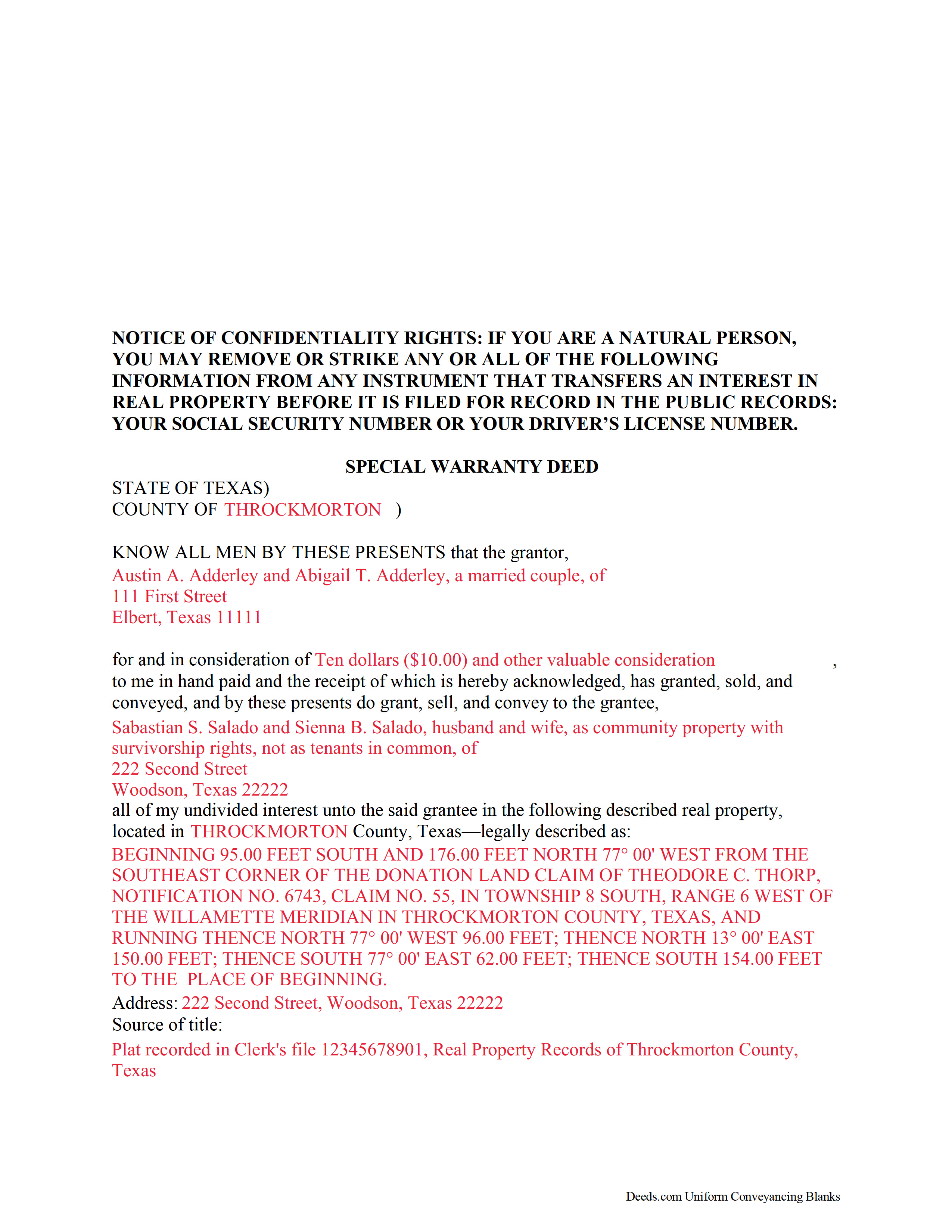

Jones County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Jones County documents included at no extra charge:

Where to Record Your Documents

Jones County Clerk

Anson, Texas 79501

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (325) 823-3762

Recording Tips for Jones County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Jones County

Properties in any of these areas use Jones County forms:

- Anson

- Avoca

- Hamlin

- Hawley

- Lueders

- Stamford

Hours, fees, requirements, and more for Jones County

How do I get my forms?

Forms are available for immediate download after payment. The Jones County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jones County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jones County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jones County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jones County?

Recording fees in Jones County vary. Contact the recorder's office at (325) 823-3762 for current fees.

Questions answered? Let's get started!

A special warranty deed can be used in Texas to convey title to real property. Special warranty deeds in this state will contain both express and implied warranties. A special warranty deed in Texas only warrants against defects, liens, and encumbrances arising by, through, or under the grantor. Even if a conveyance does not have express covenants of warranty, the words "grant" and "convey" will imply only the following covenants from the grantor: (a) That prior to the execution of the conveyance, the grantor has not conveyed the estate or any interest in the estate to any person other than the grantee and (b) that at the time of execution of the conveyance, the estate is free from any encumbrances (5.023).

A real property instrument, such as a special warranty deed can be recorded if it has been acknowledged, sworn to with a proper jurat, or proved according to law (12.001). Original signatures are required. The failure of a notary public to attach an official seal to an acknowledgment or other proof taken in a state other than Texas will render the acknowledgment invalid only if the jurisdiction in which the acknowledgement is taken requires the notary public to attach a seal (12.001d).To be effectively recorded, an instrument relating to real property must be eligible for recording and must be recorded in the county where the property, or a part of the property, is located (11.001).

Recording an instrument is necessary to provide constructive notice. When a special warranty deed has been properly recorded in the county where the property is located, the instrument is deemed to impart constructive notice of the contents to all persons. Additionally, the instrument will be part of the public records and is open to inspection (Sec. 13.002). A special warranty deed will be void as to a creditor or subsequent purchaser for a valuable consideration without notice unless the deed has been acknowledged, sworn to, or proved and filed for record (Sec. 13.001). Unrecorded special warranty deeds are binding on the parties to the instrument, on the parties' heirs, and on a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Sec. 13.001c).

(Texas Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Jones County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Jones County.

Our Promise

The documents you receive here will meet, or exceed, the Jones County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jones County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Michael W.

October 21st, 2022

Easy to use and fast

Thank you!

Salvatore R.

January 18th, 2023

It was fast and easy to find.

Thank you!

Christine A.

December 28th, 2018

So far do good. Don't understand the billing procedure yet and have just sent a request for information. Awaiting reply. Thank you, Christine Alvarez

Thanks for the feedback. Looks like your E-recording invoice is available. It takes a few minutes for our staff to prepare documents for recording and generate the invoice.

Suzanne W.

July 10th, 2020

Excellent service, knowledgeable, and quick responses. I'll be using this service again for any future filing needs. WAY better than going to the filing office in person!

Thank you so much for the kind words Suzanne, glad we could help.

Lori G.

May 21st, 2020

thank you for all your help and patience. I would highly recommend Deeds.com to everyone. Sincerely, Lori G.

Thank you!

Donald C.

January 7th, 2020

The service was VERY quick, simple and, easy. I would definetly use this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sawnie A.

July 29th, 2020

the deeds and related materials themselves are excellent but the PDF application is awful plus there is no way to customize the documents for specific purposes, so I had to type them from scratch in each instance.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet J.

December 15th, 2022

These forms were very easy to both download and print, as well as fill out on the site and then print. The instructions are clear and concise. We have not yet been to the County to file them, but we are expecting no issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donnajean L.

October 9th, 2024

The site is user friendly and uncomplicated.

Thank you!

Lillian B.

October 27th, 2022

Easy peasy

Thank you!

Joe S.

July 6th, 2020

Easy to use, reasonable price and excellent customer service! I would not hesitate to use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David L.

December 29th, 2020

It was a very easy to use application. I can only give it four stars because I have yet to receive confirmation from the county that my application was acceptable, ie., format, font, etc. I believe it will be fine.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina D.

March 31st, 2025

The papers allowed me to get done what I needed. But for the price I would expect a spell check. There were spelling errors when there should not have been any. Please proof read

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Mark & Linda W.

December 18th, 2020

Quite simple and easy. Only one critique: It would be easier if the names of the PDF would reflect the name of the deed/form such as 'Controlling tax return' rather than '1579101185SF56863.pdf'. However I love downloading forms rather than mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Kelli W.

October 5th, 2022

Fantastic documents! Easy to complete, looked great after I filled them in and printed them. No problems with the notary or recorder (recorder clerk actually said they see deeds.com documents all the time and they love em cause it makes their job easier). Highly recommend!!

Thank you for your feedback. We really appreciate it. Have a great day!