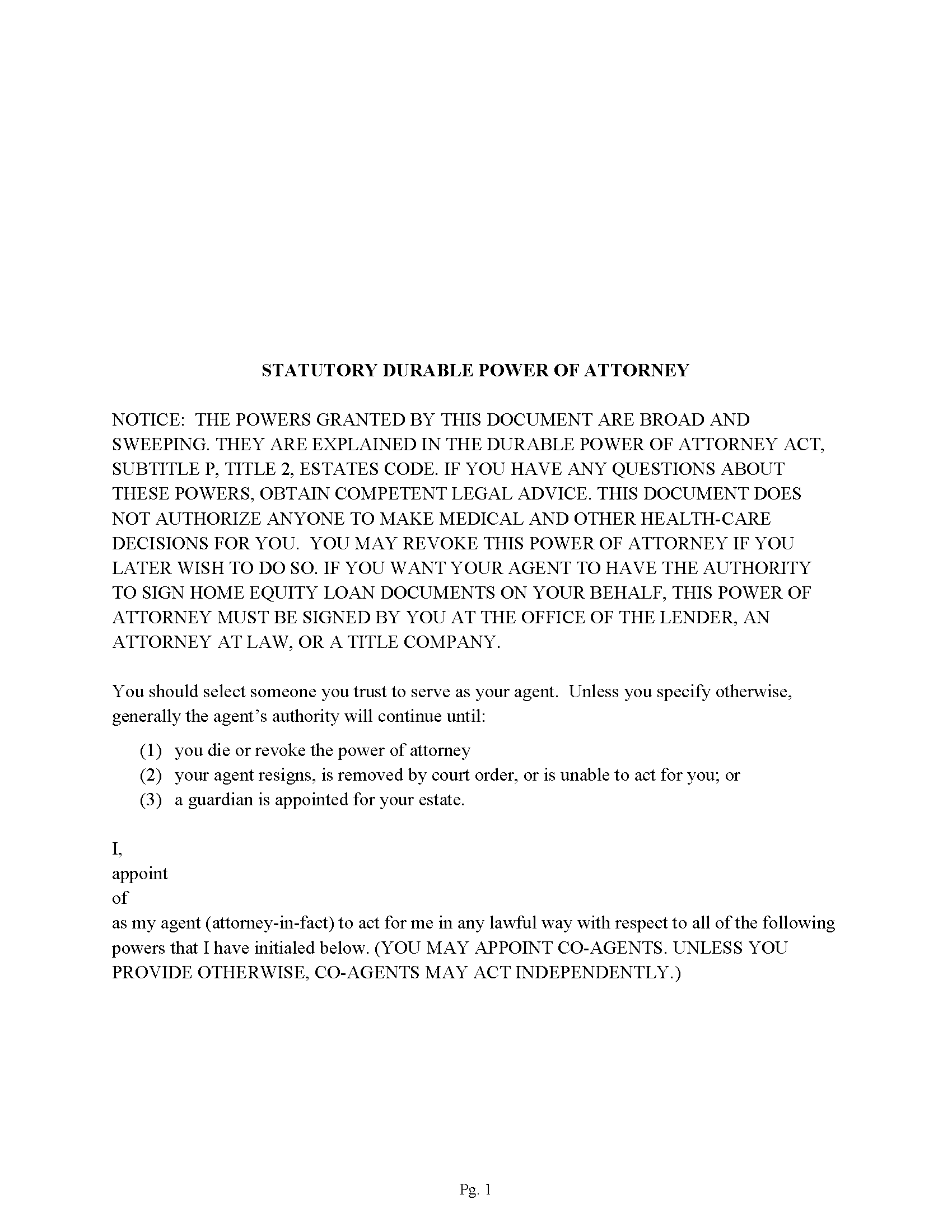

Martin County Statutory Durable Power of Attorney Form

Martin County Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

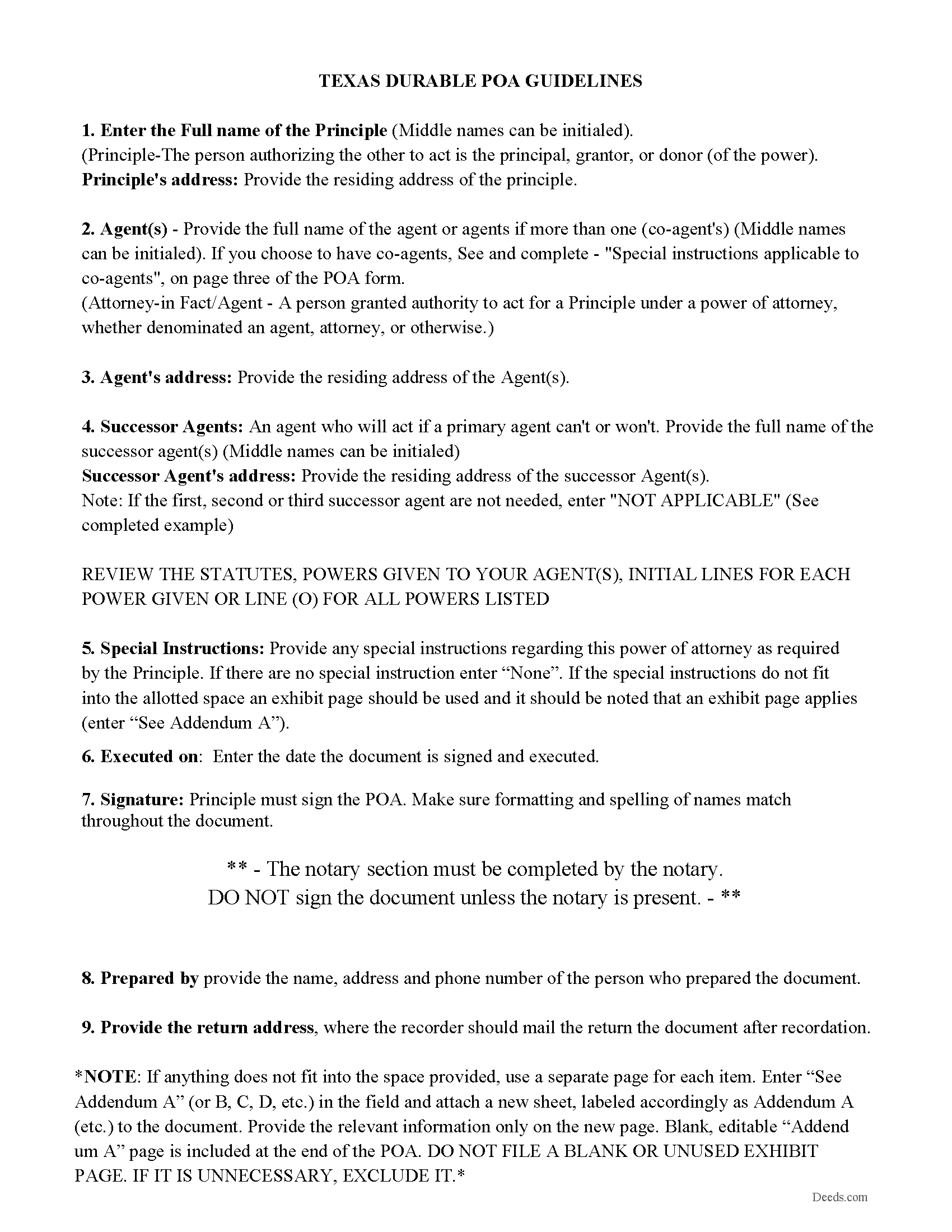

Martin County Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

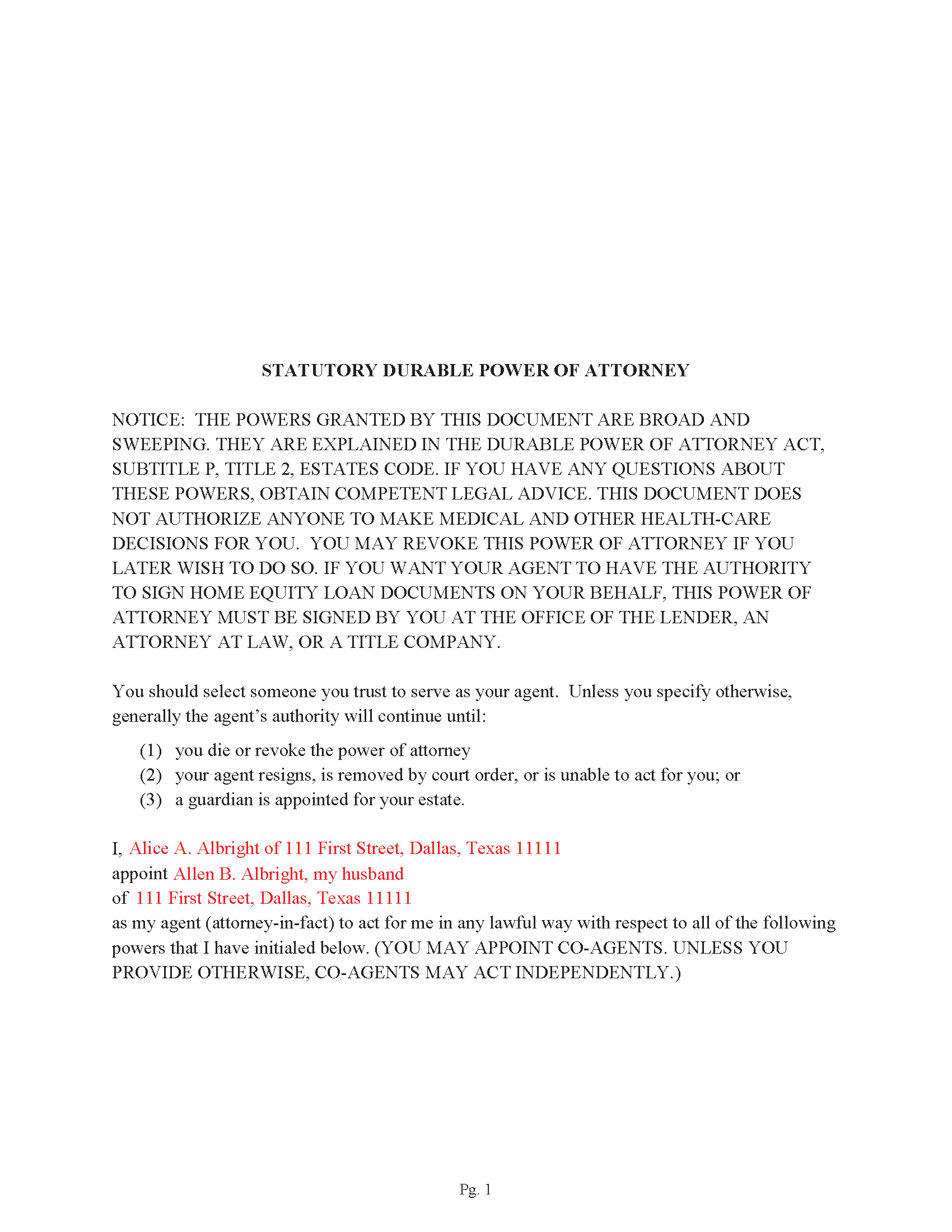

Martin County Completed Example of the Power of Attorney

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Martin County documents included at no extra charge:

Where to Record Your Documents

Martin County & District Clerk

Stanton, Texas 79782

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm

Phone: 432-756-3412

Recording Tips for Martin County:

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Martin County

Properties in any of these areas use Martin County forms:

- Ackerly

- Lenorah

- Stanton

- Tarzan

Hours, fees, requirements, and more for Martin County

How do I get my forms?

Forms are available for immediate download after payment. The Martin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Martin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Martin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Martin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Martin County?

Recording fees in Martin County vary. Contact the recorder's office at 432-756-3412 for current fees.

Questions answered? Let's get started!

This form allows for up to 3 Alternate/Successor Agents, formatted for County recording requirements in Texas.

Powers addressed:

(A) Real property transactions;

(B) Tangible personal property transactions;

(C) Stock and bond transactions;

(D) Commodity and option transactions;

(E) Banking and other financial institution transactions;

(F) Business operating transactions

(G) Insurance and annuity transactions;

(H) Estate, trust, and other beneficiary transactions;

(I) Claims and litigation;

(K) Benefits from social security, Medicare, Medicaid, or other governmental programs or civil or military service;

(L) Retirement plan transactions;

(M) Tax matters;

(N) Digital assets and the content of an electronic communication;

(Texas Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Martin County to use these forms. Documents should be recorded at the office below.

This Statutory Durable Power of Attorney meets all recording requirements specific to Martin County.

Our Promise

The documents you receive here will meet, or exceed, the Martin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Martin County Statutory Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Sallie S.

January 24th, 2019

Great speedy service with access to areas beyond my reach.

Thank you Sallie, have a great day!

Robert H.

March 17th, 2021

Just what I needed to file in Orange County. East to use and reasonably priced. Will use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leroy B.

February 7th, 2020

I have a Timeshare in Florida and started looking to sell it. Just finally downloaded this site, it looks fairly simple. I will start getting more serious soon. Looking forward to working with Deeds.com.

Thank you!

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita L.

January 22nd, 2020

Found this site very easy to navigate and customer service very supportive and quickly answers any questions you have regarding forms. Best of all you can get the forms you need and only pay for those forms, not tied to some ongoing fee that you must cancel if you have no further need beyond forms you've already purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna F.

March 4th, 2019

Straight forward easy to understand completing my document. The guide readily explained filing all portions of the document.

Thank you Donna, we appreciate your feedback.

joab k.

May 20th, 2021

Usable mediocre average stuff. functional but not extraordinary but the price and service is quite good

Thank you for your feedback. We really appreciate it. Have a great day!

George Y.

June 24th, 2021

Thought it was great, no issues. Very convenient especially dealing with difficult municipalities and a post COVID world. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Kenia B.

August 31st, 2020

Very convenient and efficient. I will recommend it, definitely.

Thank you!

Adam W.

October 6th, 2021

Great stuff

Thank you!

Christine L.

April 18th, 2019

I would like the ability to edit the document.

Thank you for your feedback Christine.

MARIZON M.

November 4th, 2020

This site/service is amazing! The response is almost real-time and the fees are super reasonable. I will be using this again in the future should I need to file any other documents with the county and will also recommend it to others! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

R Rodney H.

January 29th, 2019

Excellent service--I got just the information I needed quickly and reasonably priced. I am glad to know of this service for future needs, as an individual, in this sector. Cheers, RRH

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dorothea B.

October 2nd, 2019

The Affidavit- Death of Joint Tenant form you provided is not the same form as showed on the Los Angeles County property tax website. It appears that the LA county form requires entering additional info that is not included in your form.

Thank you!

Carol F.

May 22nd, 2019

Instructions were easy to follow and it was reasonable

Thank you for your feedback. We really appreciate it. Have a great day!