Wharton County Statutory Durable Power of Attorney Form

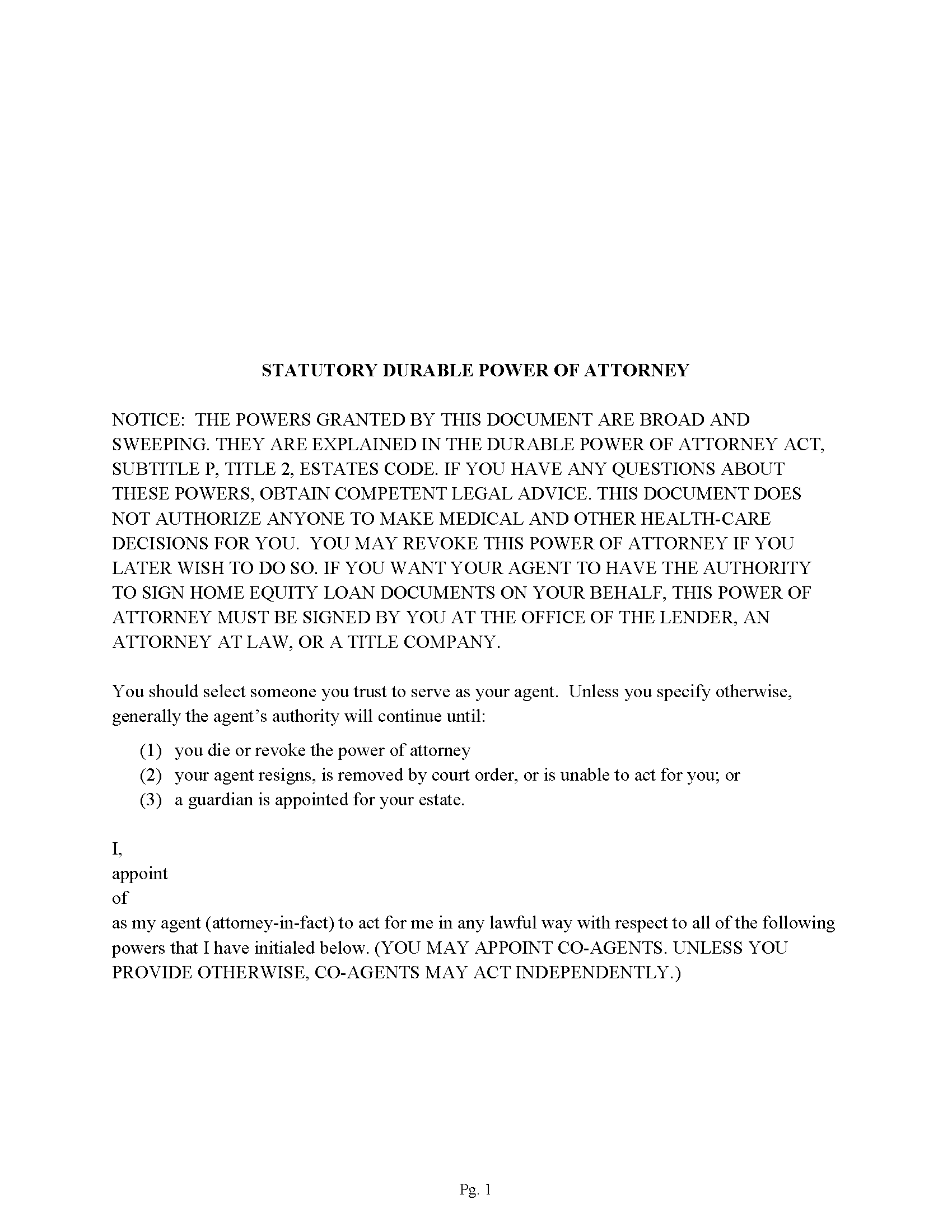

Wharton County Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

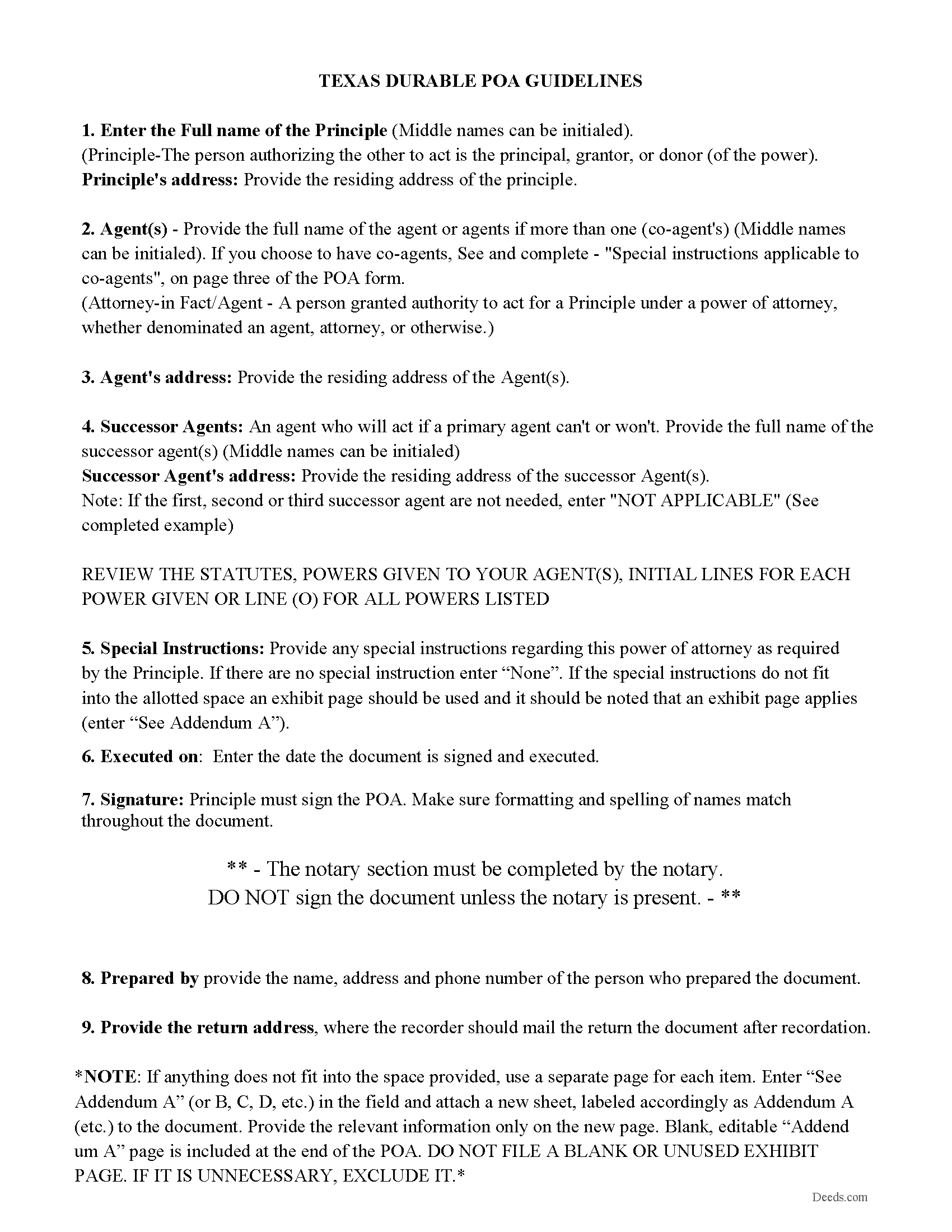

Wharton County Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

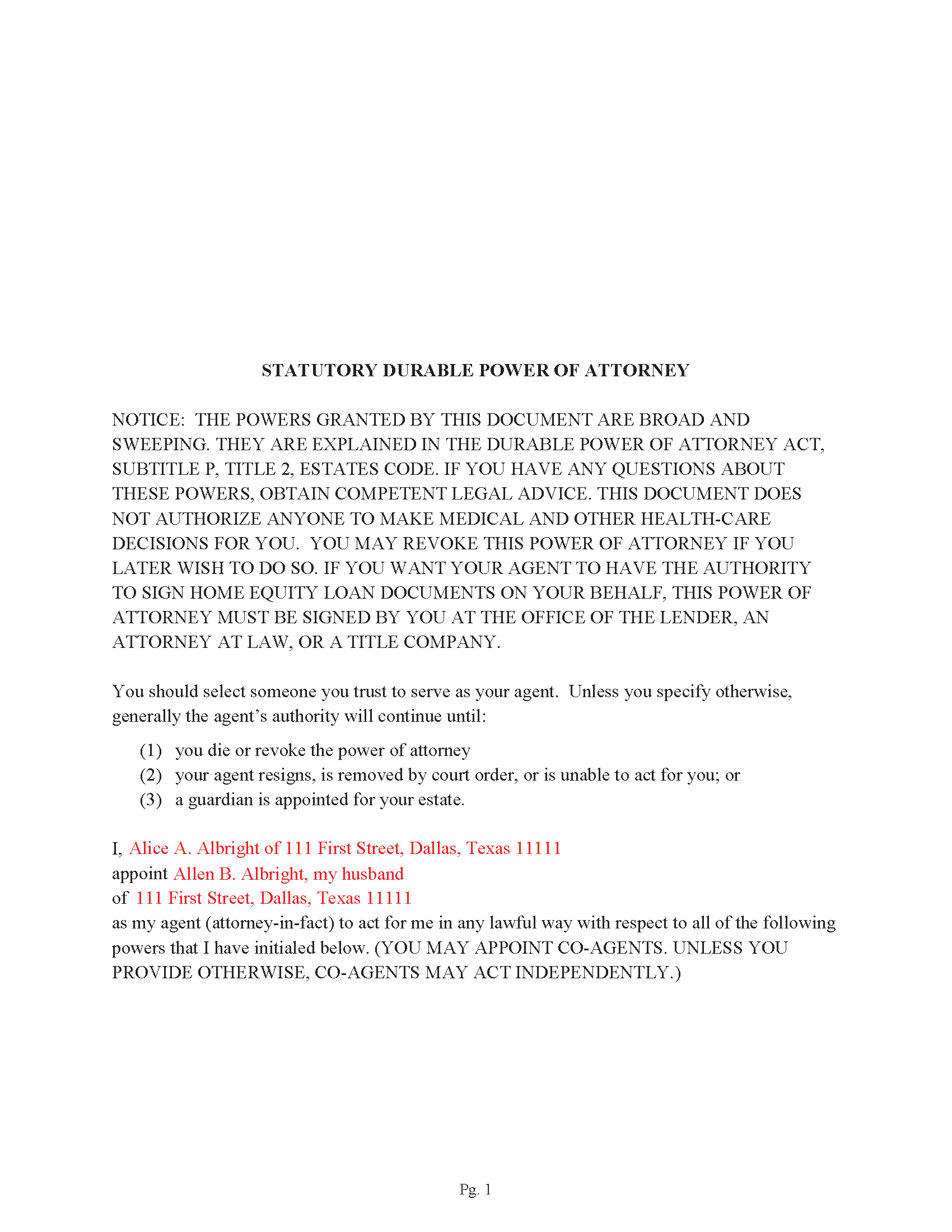

Wharton County Completed Example of the Power of Attorney

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Wharton County documents included at no extra charge:

Where to Record Your Documents

Wharton County Clerk

Wharton, Texas 77488

Hours: Monday - Friday 8:00am - 4:30pm / Calls until 5:00pm

Phone: (979) 532-2381

Recording Tips for Wharton County:

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Wharton County

Properties in any of these areas use Wharton County forms:

- Boling

- Danevang

- East Bernard

- Egypt

- El Campo

- Glen Flora

- Hungerford

- Lane City

- Lissie

- Louise

- Pierce

- Wharton

Hours, fees, requirements, and more for Wharton County

How do I get my forms?

Forms are available for immediate download after payment. The Wharton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wharton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wharton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wharton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wharton County?

Recording fees in Wharton County vary. Contact the recorder's office at (979) 532-2381 for current fees.

Questions answered? Let's get started!

This form allows for up to 3 Alternate/Successor Agents, formatted for County recording requirements in Texas.

Powers addressed:

(A) Real property transactions;

(B) Tangible personal property transactions;

(C) Stock and bond transactions;

(D) Commodity and option transactions;

(E) Banking and other financial institution transactions;

(F) Business operating transactions

(G) Insurance and annuity transactions;

(H) Estate, trust, and other beneficiary transactions;

(I) Claims and litigation;

(K) Benefits from social security, Medicare, Medicaid, or other governmental programs or civil or military service;

(L) Retirement plan transactions;

(M) Tax matters;

(N) Digital assets and the content of an electronic communication;

(Texas Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Wharton County to use these forms. Documents should be recorded at the office below.

This Statutory Durable Power of Attorney meets all recording requirements specific to Wharton County.

Our Promise

The documents you receive here will meet, or exceed, the Wharton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wharton County Statutory Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Ronald W.

July 23rd, 2021

Easy to use and very helpful

Thank you!

Julie C.

July 21st, 2020

The process worked great! It's a great solution for recording documents at the county during the pandemic and in the future if you don't want to leave home!!

Thank you!

anthony r.

November 19th, 2020

Fast and easy

Thank you!

Sara R.

June 19th, 2019

Worked well for me to create a deed for a house I inherited. It was very thorough and easy to use. I have no experience with the law so I just googled terms I didn't understand and was fine. I also called land records a lot and ended up not needing a lot of the material included, but it was still good to have it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tyrone L.

April 24th, 2025

Great time saver fast service

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Taylor W.

February 2nd, 2021

This was the quickest NOC recording i have ever done. I will definitely be using deeds.com from here on out for recordings!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David N.

August 29th, 2020

It worked well for me. Now I need the actual lien form

Thank you!

Frank S.

March 28th, 2025

ALL THE DEED DOCUMENTS ARE ALL EXCELLENT AND ADDITIONAL DOCUMENTS REGARDING COMPLETING THE DOCUMENTS!!! EXCELLENT!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Darrell C.

March 26th, 2022

Excellent Service

Thank you!

Jennifer D.

March 9th, 2022

I was skeptical; but, so thankful I went with them. They were beyond helpful through the entire process and very patient with me. I could not have done my quit deed form without them. Thank you for all of your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Angela W.

February 16th, 2022

All went well.

Thank you for your feedback. We really appreciate it. Have a great day!

Jimmy W.

February 15th, 2022

The forms where easy to get to and I hope that they will be as easy to fill out.

Thank you!

Jack S.

March 5th, 2019

Excellent and timely responses. Do you offer an annual rate? Thank you.

Thanks again Jack. Unfortunately we do not offer any annual rates or subscriptions, sorry.

Cynthia H.

September 5th, 2021

Thank you for having these forms so reasonable and easy to access. I only WISH I would have looked here 1st, spent way to much valuable time trying to get help with this deed. This was so EASY and quick... THANK YOU THANK YOU Highly Recommend

Thank you!