Cottle County Texas Affidavit of Heirship Form

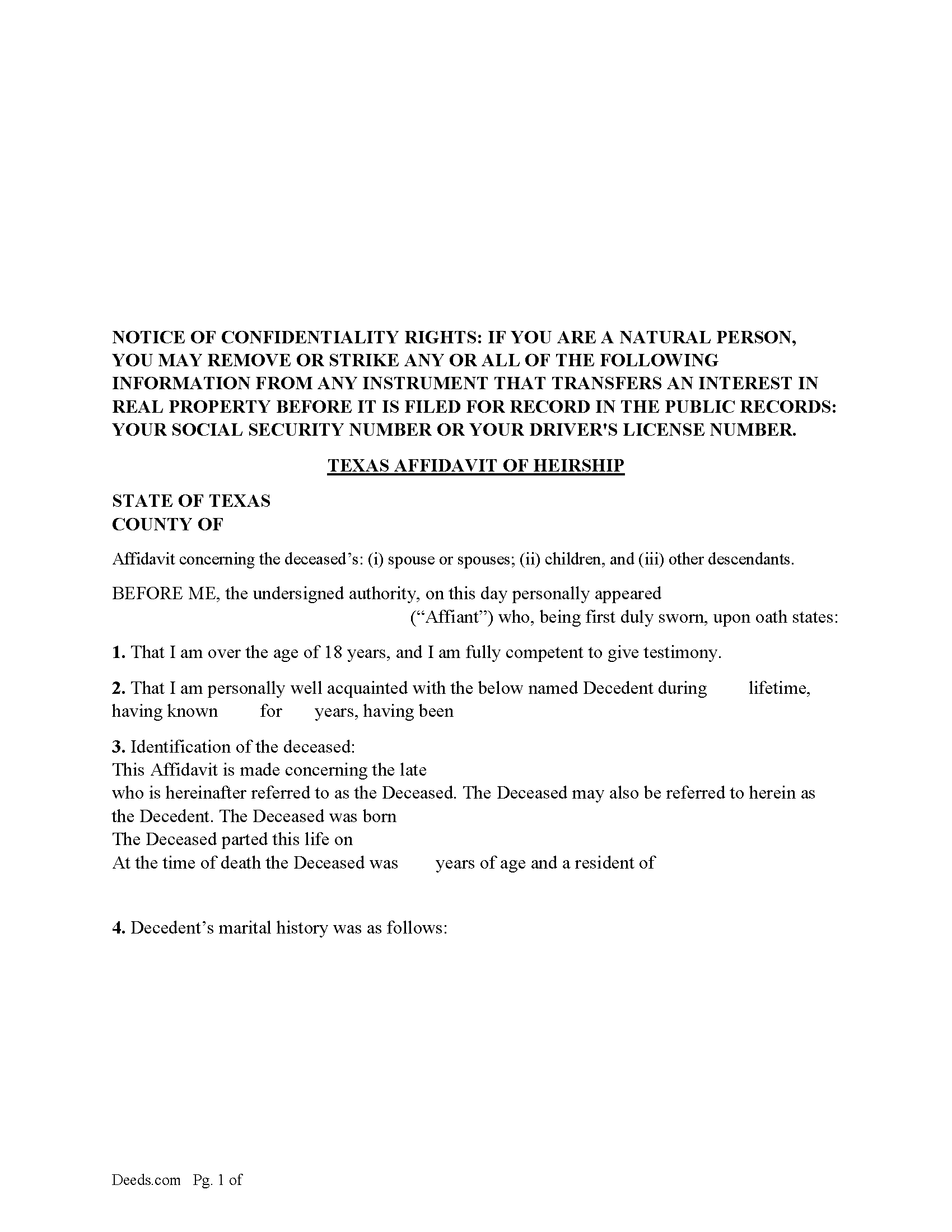

Cottle County Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

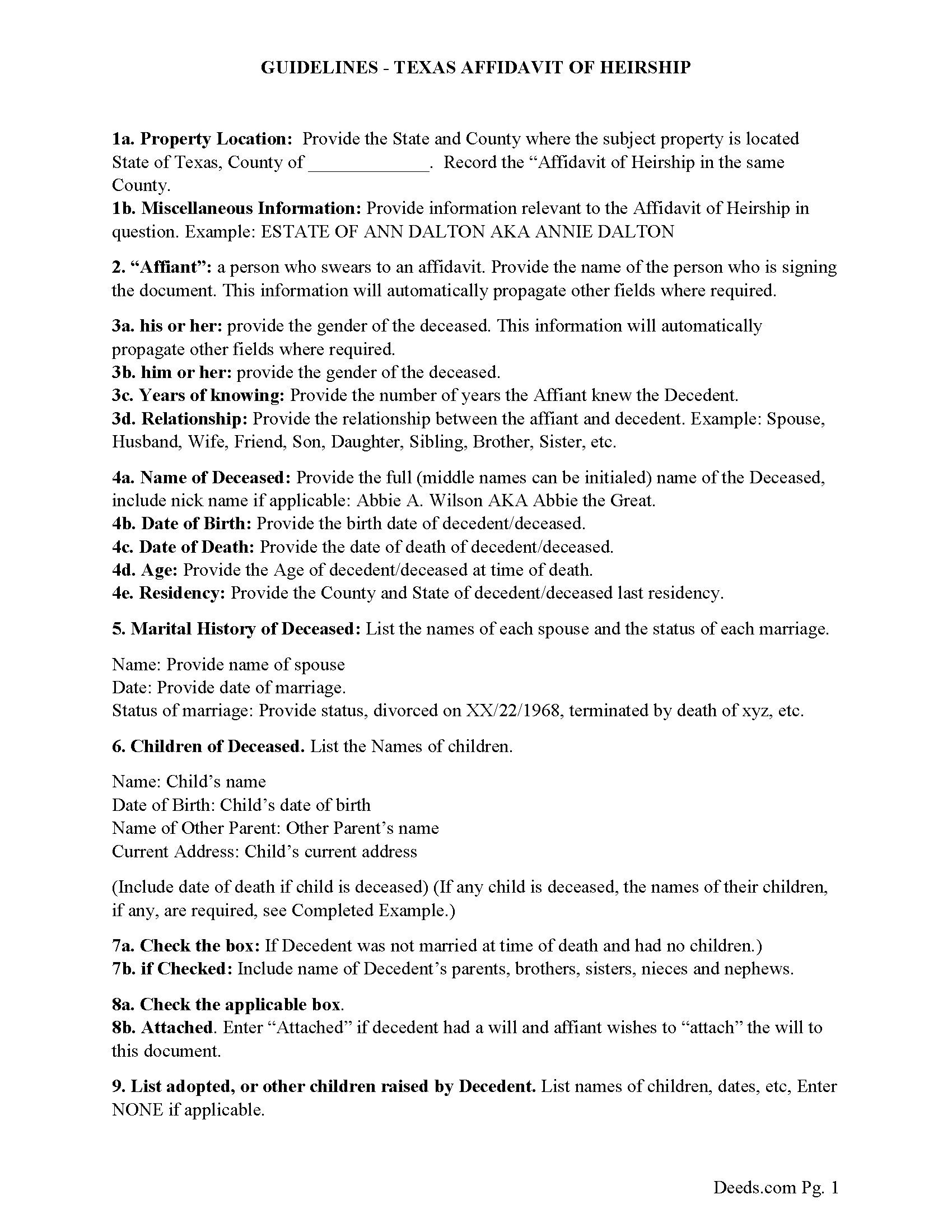

Cottle County Guidelines for Texas Affidavit of Heirship

Line by line guide explaining every blank on the form.

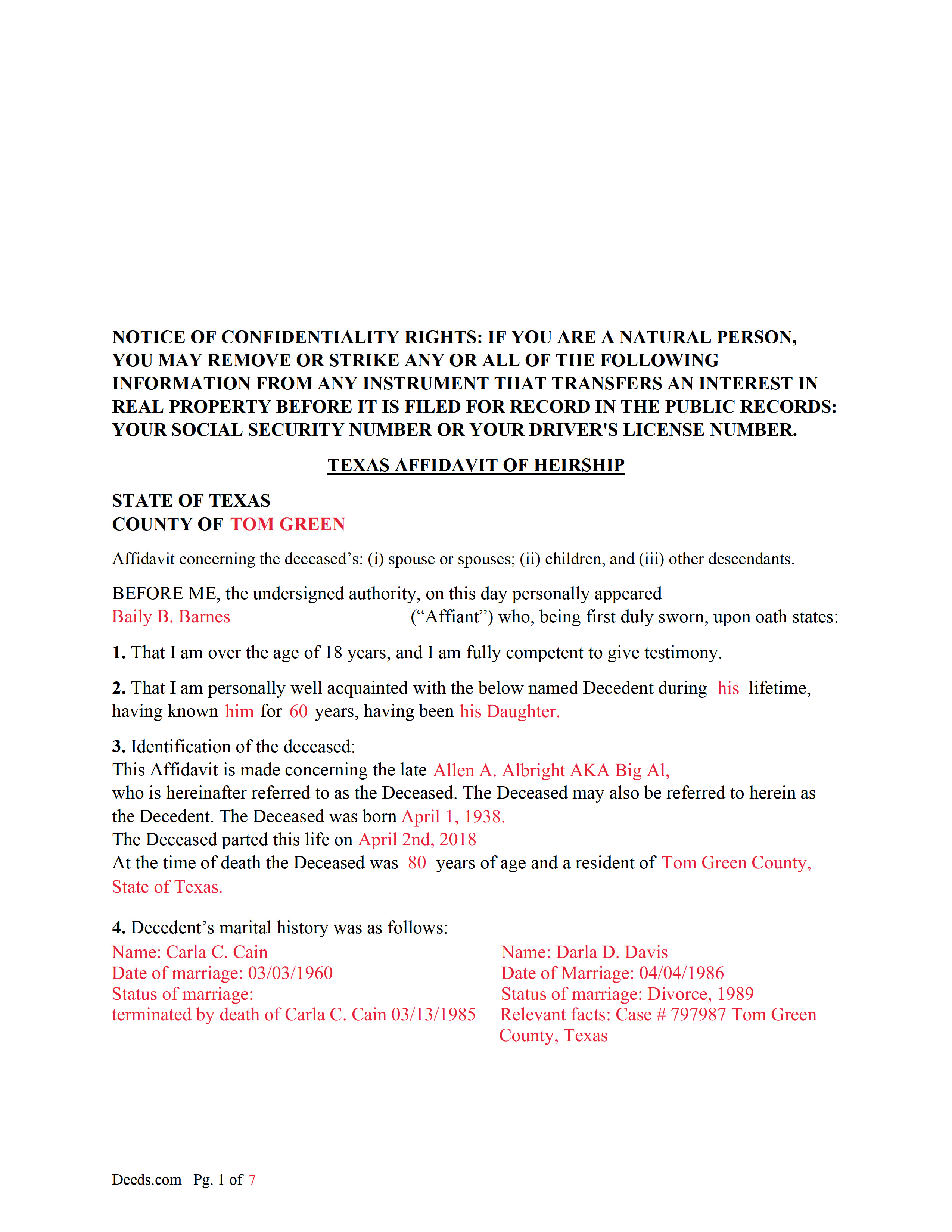

Cottle County Completed Example of a Texas Affidavit of Heirship Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Cottle County documents included at no extra charge:

Where to Record Your Documents

Cottle County Clerk

Paducah, Texas 79248-0717

Hours: Monday - Thursday 9:00am - 5:00pm

Phone: (806) 492-3823

Recording Tips for Cottle County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Cottle County

Properties in any of these areas use Cottle County forms:

- Cee Vee

- Paducah

Hours, fees, requirements, and more for Cottle County

How do I get my forms?

Forms are available for immediate download after payment. The Cottle County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cottle County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cottle County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cottle County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cottle County?

Recording fees in Cottle County vary. Contact the recorder's office at (806) 492-3823 for current fees.

Questions answered? Let's get started!

This form is typically used when the deceased did NOT leave a will or estate plan. The Affidavit of Heirship is a sworn statement used to establish the heirs of a property, with a goal of putting the property in their name. Sometimes this form is used to bypass probate when the deceased left a will that leaves the property solely to the direct descendants of the deceased or when 4 years have passed since the death of the owner, the general time frame to probate a will in Texas. An Affidavit of Heirship can be filed anytime. An Affidavit of Heirship alone does not transfer property title. It identifies the heirs of the property.

General parameters for a Texas Affidavit of Heirship document:

No valid will, or if beneficiaries and/or heirs agree to disregard the will.

Only real estate needs to be transferred to heirs.

The deceased does not have any debts.

No administration of estate required.

(Texas Affidavit of Heirship Package includes form, guidelines, and completed example)

Important: Your property must be located in Cottle County to use these forms. Documents should be recorded at the office below.

This Texas Affidavit of Heirship meets all recording requirements specific to Cottle County.

Our Promise

The documents you receive here will meet, or exceed, the Cottle County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cottle County Texas Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Craig M.

August 24th, 2020

Fantastic! So much easier than going and recording it at the recorders office!

Glad we could help Craig, thanks for the kind words.

A R M.

May 1st, 2021

Great so far. Just downloaded all the documents, and they seem to be easy to save and are fillable. A R M

Thank you for your feedback. We really appreciate it. Have a great day!

KRISSA O.

January 2nd, 2025

Smooth process, no issues.

Thank you!

MICHAEL D.

April 4th, 2020

I had a wonderful experience and am looking forward to doing business with you again.

Thank you!

Leroy B.

February 7th, 2020

I have a Timeshare in Florida and started looking to sell it. Just finally downloaded this site, it looks fairly simple. I will start getting more serious soon. Looking forward to working with Deeds.com.

Thank you!

Quinn R.

April 3rd, 2023

DEEDS.COM IS THE BEST WAY TO E-RECORD DEEDS. THEY ARE FAST, POLITE AND A FANTASTIC DEAL FOR THE SERVICE THAT THEY OFFER!!!

Thank you!

Sol B.

February 13th, 2020

Got me all the info I was looking for Thanks you deeds.com

Thank you!

Travis S.

May 6th, 2023

I couldn't even look for a deed because the website said that deed/title searching wasn't available. Very disappointed about it.

I'm sorry to hear that you had a disappointing experience with the website's deed/title searching feature. It can be frustrating when a feature you were hoping to use isn't available.

We do hope that you found what you were looking for elsewhere.

SUZANNE W.

December 29th, 2020

Very quick and efficient. Received recorded document within hours after beginning the process. Very reasonable fees. Highly recommended!

Thank you!

Michael L.

February 28th, 2021

Easy and quick. I will always use this efficient service even if the recorders office opens again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

susanne y.

July 13th, 2020

wonderful service, docs recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Charmaine D.

August 7th, 2022

Very easy to use.

Thank you!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

Darrel V.

September 27th, 2020

Pretty easy to use and timely, too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!