Hemphill County Trustee Deed Form

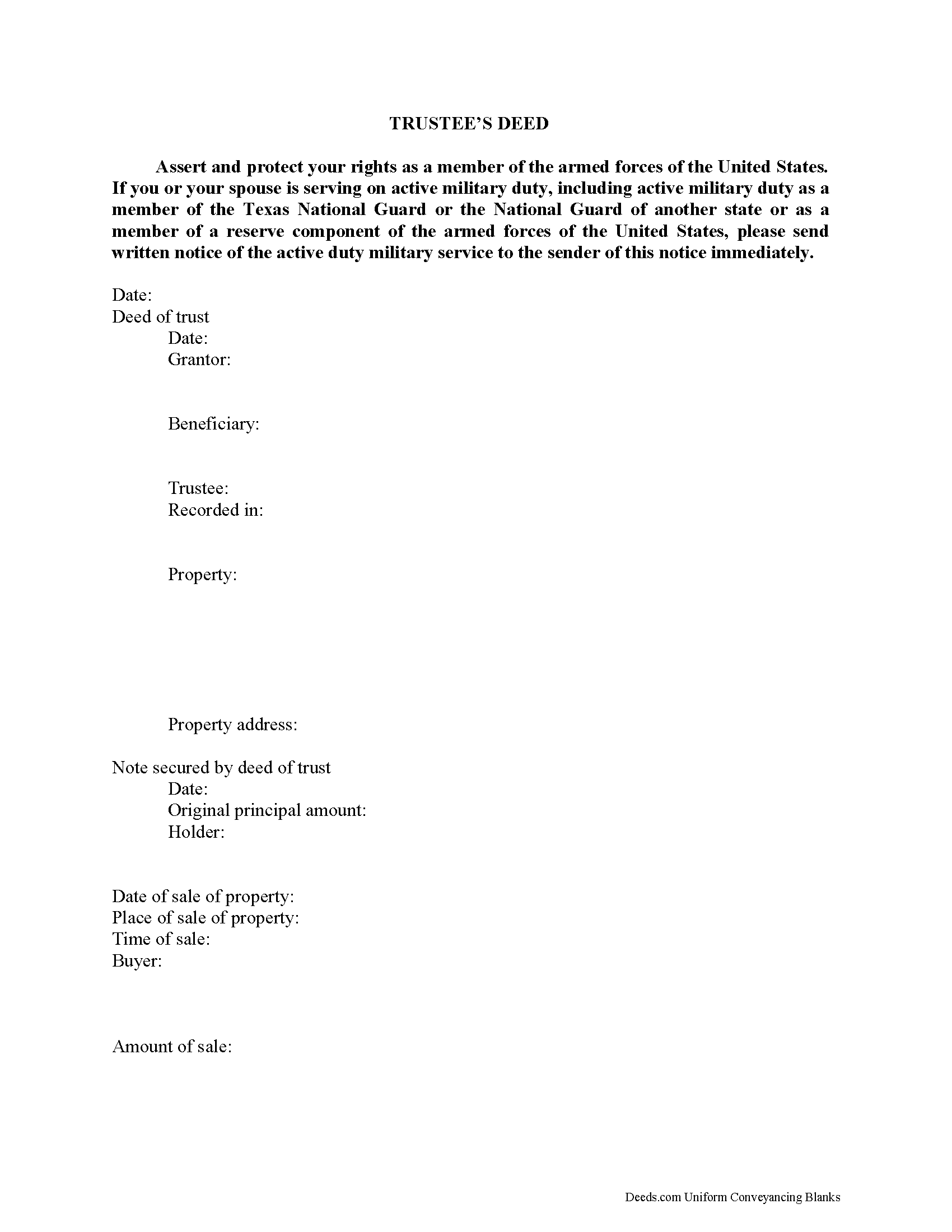

Hemphill County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

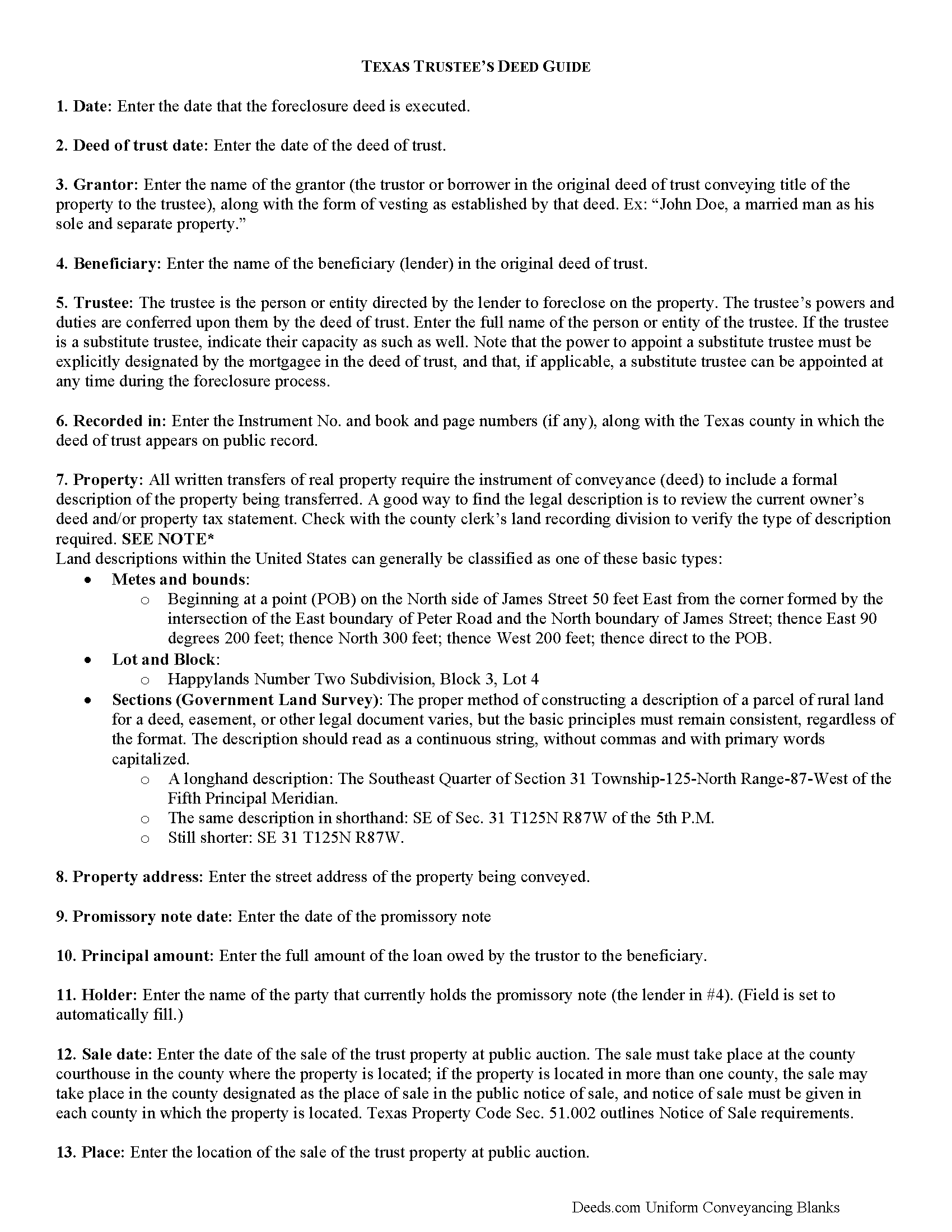

Hemphill County Trustee Deed Guide

Line by line guide explaining every blank on the form.

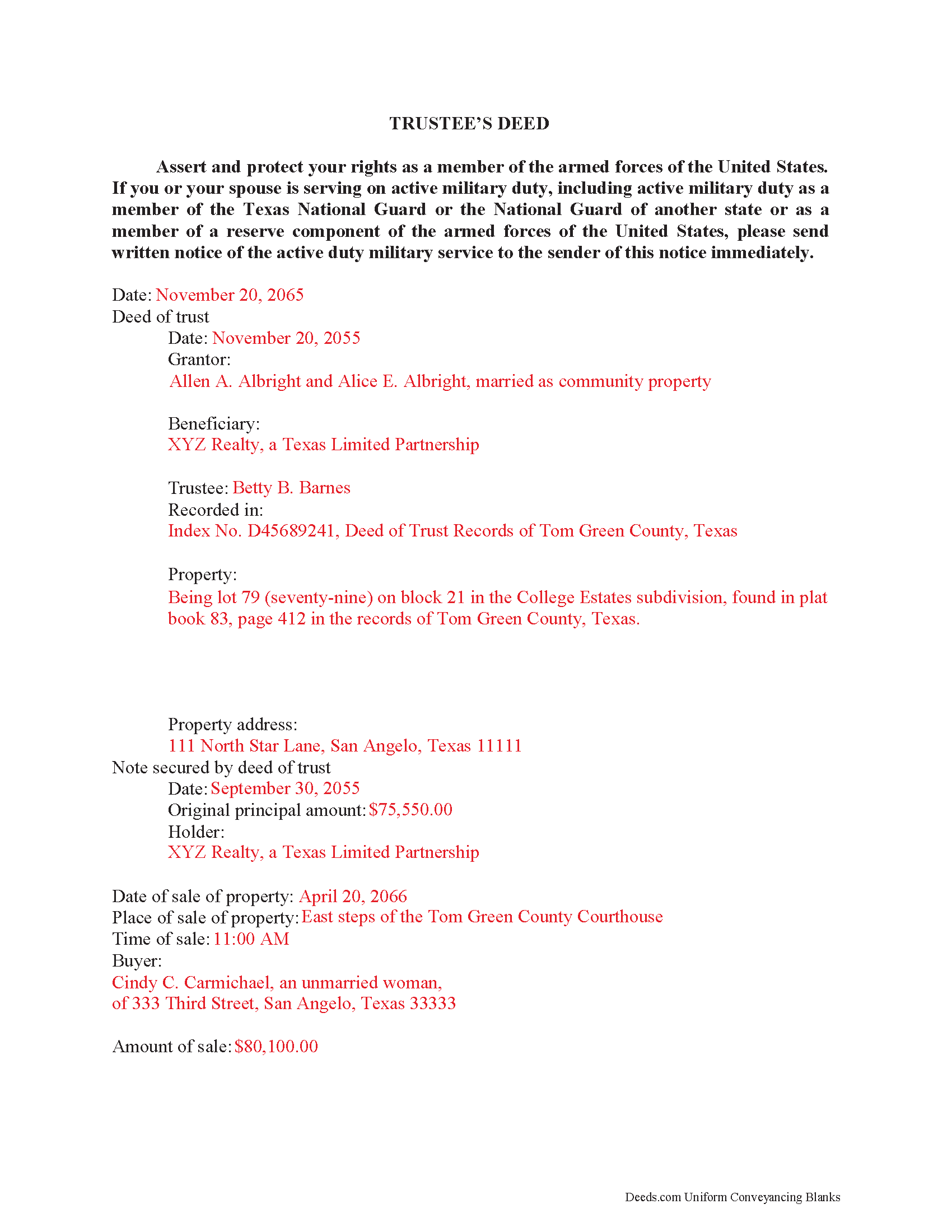

Hemphill County Completed Example of a Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Hemphill County documents included at no extra charge:

Where to Record Your Documents

Hemphill County Clerk

Canadian, Texas 79014

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (806) 323-6212

Recording Tips for Hemphill County:

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Hemphill County

Properties in any of these areas use Hemphill County forms:

- Canadian

Hours, fees, requirements, and more for Hemphill County

How do I get my forms?

Forms are available for immediate download after payment. The Hemphill County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hemphill County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hemphill County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hemphill County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hemphill County?

Recording fees in Hemphill County vary. Contact the recorder's office at (806) 323-6212 for current fees.

Questions answered? Let's get started!

The majority of Texas foreclosures are non-judicial. They require a trustee's deed (alternately called a foreclosure deed or substitute trustee's deed, if applicable) to convey foreclosed property at a trustee's sale.

Trustee's deeds identify three primary parties: the grantor, who is the trustee in the deed of trust; the beneficiary, who is the lender and grantor in the deed of trust; and the buyer, who is the grantee and purchaser of the property at the foreclosure sale.

In a deed of trust, a trustee (the grantee under the original deed of trust instrument), appointed by the lender, holds the deed to the property as collateral for a loan to be repaid by the borrower (the trustor under the deed of trust). If the borrower fails to fulfill the terms of the deed of trust, the lender can direct the trustee to enforce the terms of the deed or begin the foreclosure process. This starts with a notice mailed to the borrower, now debtor, of the intent to accelerate. Notice of sale is also recorded and posted in the county where the subject property is located, as directed by Tex. Prop. Code 51.002 et seq.

A trustee's deed may sometimes be called a substitute trustee's deed, but it is functionally the same thing. The lender may appoint a substitute trustee if the original trustee is unable to administer the sale of property at public auction. A substitute trustee is a person named by the lender under the terms of the security instrument (deed of trust) to exercise the power of sale (Tex. Prop. Code 51.0001(7)). The power to appoint a substitute trustee must be expressly designated by the lender in the deed of trust, otherwise the appointment is invalid. A substitute trustee can be appointed at any time during the foreclosure process, so long as notice of the appointment is recorded. The foreclosing trustee, regardless, is generally an attorney for the lender. The trustee should identify in the deed whether they are serving as a trustee or substitute.

(Texas Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hemphill County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Hemphill County.

Our Promise

The documents you receive here will meet, or exceed, the Hemphill County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hemphill County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

DENNIS K.

July 22nd, 2020

I am a civil engineer, not an attorney. I deal with easements on a regular basis but not so much on the "recording" side of things. I normally prepare the graphic exhibits that accompany the dedication language but I am not the one who provides that language. Your forms solved that issue for me. Thanks.

Thank you!

Kelly L.

April 15th, 2019

So far so good. Please make the payment method easier after the information has been uploaded and submitted.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shantu S.

December 1st, 2022

Easy to follow directions and complete the Deed.

Thank you!

Evelyn L.

June 30th, 2021

very easy to print

Thank you!

Zehira D.

August 19th, 2025

Great service! fast, reliable, and very affordable. No contract, no subscription

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

SHIRLEY R.

August 22nd, 2019

This was Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wayne T.

November 11th, 2022

I found that it was easy-to-use and complete.

Thank you!

Suzanne R.

November 25th, 2020

I was very impressed with how user friendly, convenient, and efficient the whole process was. I will definitely use the service again sometime soon.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela A.

May 12th, 2022

The forms, instructions and example of the completed Interspousal Transfer Deed was very helpful. I was able to complete all necessary forms quickly and bring them to the County Recorder's Office for filing with no problems. It was a great relief, and I didn't even need to hire an attorney. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

tom s.

May 13th, 2021

Easier than I had expected. Was looking for the 'I have to get information that I don't understand' part which never appeared. Thank you

Thank you!

wendell s.

September 25th, 2020

The forms were everything promised. The guide was very helpful and made the process painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fernando C.

August 2nd, 2020

I was happy with my purchase. I honestly received more than I expected . I recommend you expand to offer more forms such as Living Will.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara C.

February 27th, 2020

Excellent site; easy to use

Thank you!

Marilyn B.

November 1st, 2019

I do not use the internet much and really am not good with it, but your site which my brother told me about was really easy to use. I would recommend your service to others any time. Thanks for making it user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!