Burnet County Unconditional Waiver on Progress Payment Form

Burnet County Unconditional Waiver on Progress Payment Form

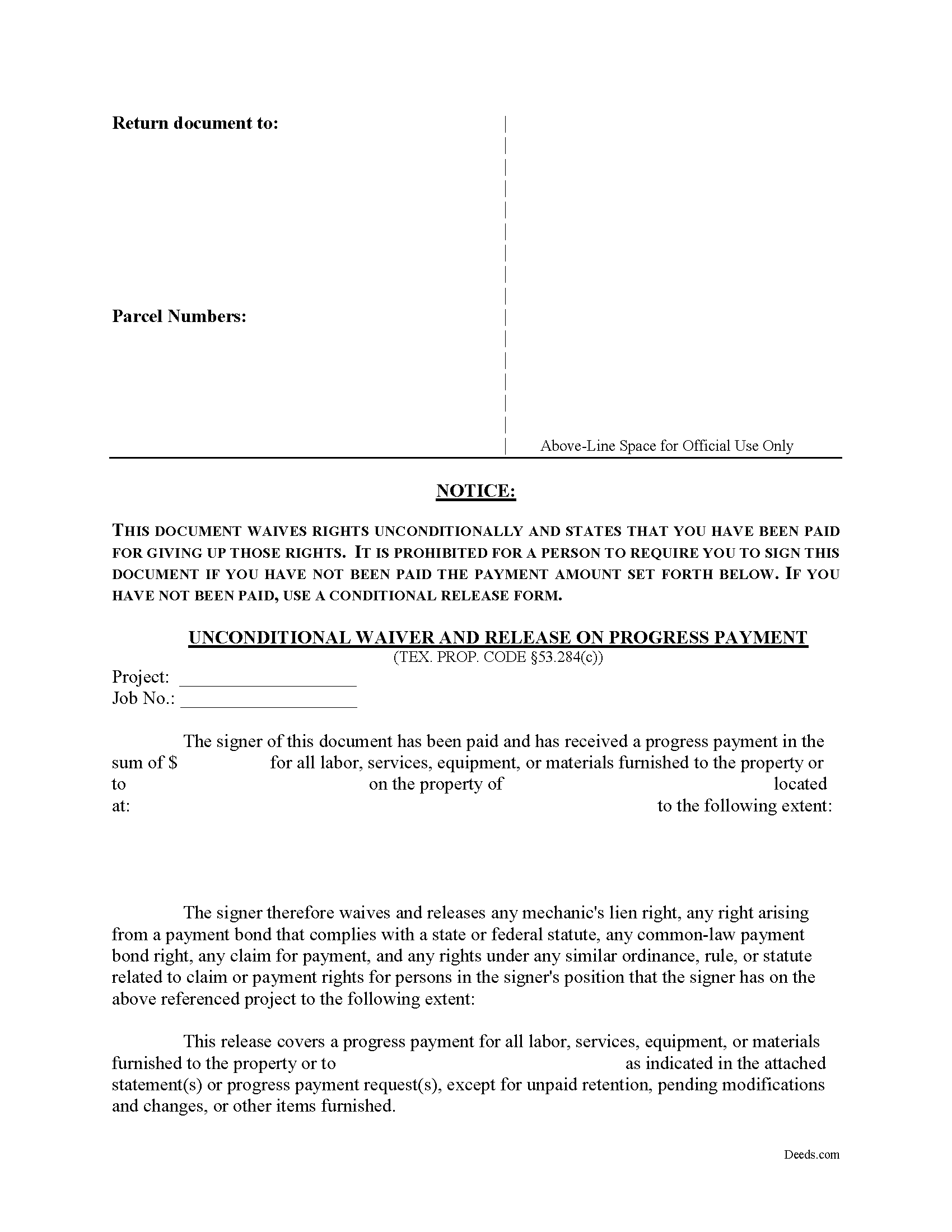

Fill in the blank Unconditional Waiver on Progress Payment form formatted to comply with all Texas recording and content requirements.

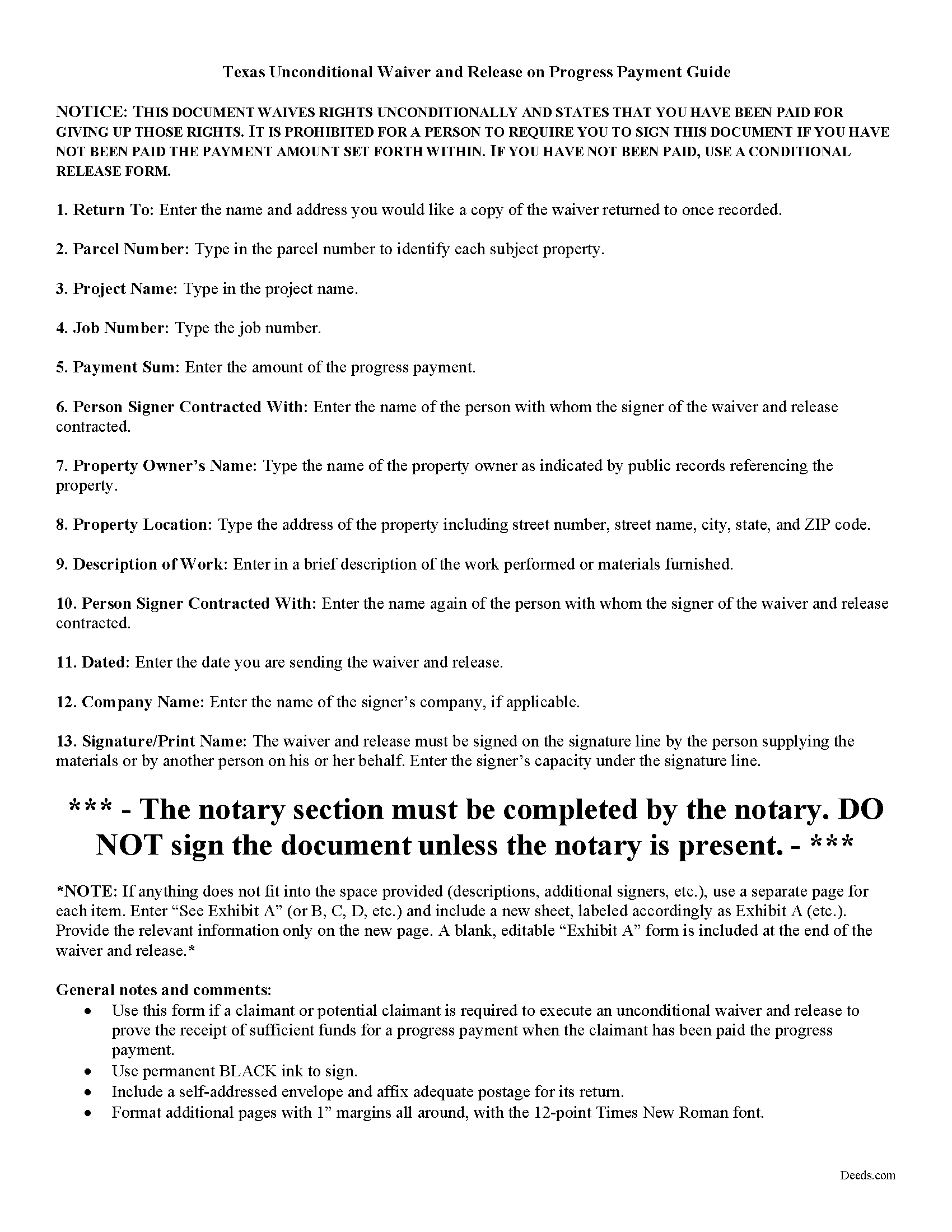

Burnet County Unconditional Waiver of Progress Payment Guide

Line by line guide explaining every blank on the form.

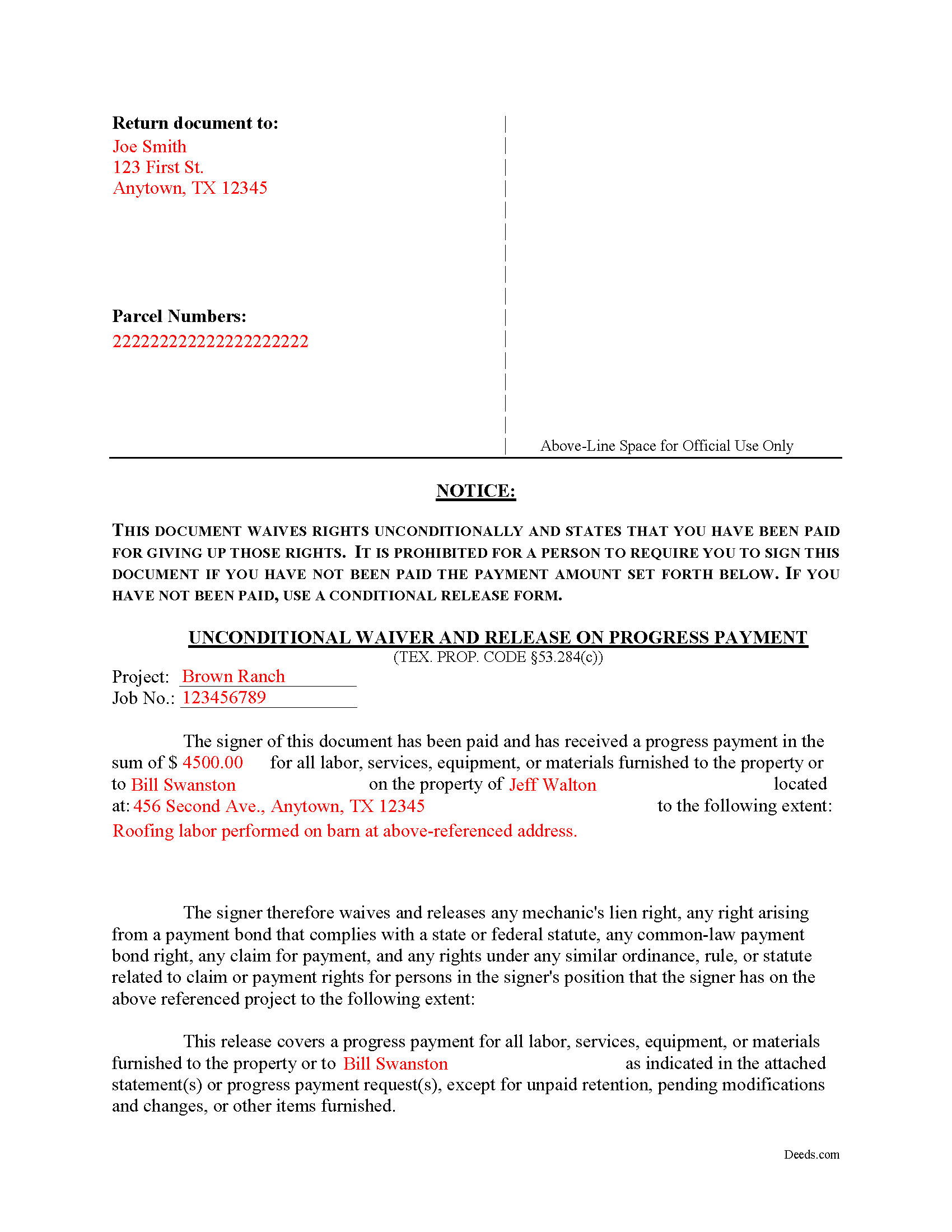

Burnet County Completed Example of the Unconditional Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Burnet County documents included at no extra charge:

Where to Record Your Documents

County Clerk

Burnet, Texas 78611

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (512) 756-5406

Recording Tips for Burnet County:

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Burnet County

Properties in any of these areas use Burnet County forms:

- Bertram

- Briggs

- Burnet

- Marble Falls

Hours, fees, requirements, and more for Burnet County

How do I get my forms?

Forms are available for immediate download after payment. The Burnet County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Burnet County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Burnet County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Burnet County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Burnet County?

Recording fees in Burnet County vary. Contact the recorder's office at (512) 756-5406 for current fees.

Questions answered? Let's get started!

A lien waiver is used by a lien claimant or potential claimant to forfeit his or her right to a lien upon a progress payment or final payment. The waiver can be conditional, meaning that the payment must clear the bank before the lien is released, or unconditional, meaning the lien is released upon the recording of the waiver regardless of whether or not the claimant is ever actually paid.

A waiver and release given by a claimant or potential claimant is unenforceable unless it substantially complies with the applicable form described in Sec. 53.284 of the Texas Property Code.

The four types of lien waivers in the State of Texas include:

- Conditional Waiver and Release on Progress Payment;

- Unconditional Waiver and Release on Progress Payment;

- Conditional Waiver and Release on Final Payment; and

- Unconditional Waiver and Release on Final Payment

Let's say a contractor reaches an agreed-upon point a project where she recorded a lien. The owner wants the lien released up to that point, and writes a check for the amount due on the work completed. The contractor offers an unconditional waiver and release on progress payment, which protects her interests in case the bank refuses to honor the check. As long as the check is good, the lien gets released up to the date of the progress payment. Otherwise, the claimant retains the lien until the responsible party finds another way to pay the bill.

Texas lien law requires an actual payment before an owner may request an unconditional waiver. A person may not require a claimant or potential claimant to execute an unconditional waiver and release for a progress payment or final payment amount unless the claimant or potential claimant received payment in that amount in good and sufficient funds. See Sec. 53.283.

Under Sec. 53.284(c), if a claimant or potential claimant is required to execute an unconditional waiver and release in exchange for or to induce a progress payment, the waiver becomes effective immediately, up to the point set out in the document.

All unconditional waivers must be titled as such and contain the following required statutory warning: "This document waives rights unconditionally and states that you have been paid for giving up those rights. It is prohibited for a person to require you to sign this document if you have not been paid the payment amount set forth below. If you have not been paid, use a conditional release form."

Further, the waiver identifies the parties, the project, the work and/or materials provided, and relevant dates and payment amounts. Sign it in front of a notary and submit it to the local recording office.

In summary, a lien waiver is an important tool, but take care to use the proper form. The wrong choice can lead to a loss of lien rights before receiving payment. Each case is unique, and Texas lien law can be complicated. Contact an attorney for complex situations, with questions about waivers, or any other issues related to mechanic's liens.

Important: Your property must be located in Burnet County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver on Progress Payment meets all recording requirements specific to Burnet County.

Our Promise

The documents you receive here will meet, or exceed, the Burnet County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Burnet County Unconditional Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

David B.

January 27th, 2020

I'm not sure how a forms web-site could be so, but I find deeds.com to be sweet.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Diane C.

April 28th, 2021

This was just the info I needed

Thank you!

Jann H.

July 18th, 2019

Was helpful information

Thank you!

Rocio S.

March 4th, 2019

Great Help - very satisfied with the service - would recomend 100%

Thank you for the kind words Rocio. Have a wonderful day!

jon m.

November 7th, 2019

Great last minute forms saved me a critical time when I had no access to my own resources. Five Star Customer service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jason B.

August 8th, 2021

Deeds.com did a great job in explaining exactly what I'd need to file a deed transfer (quitclaim deed). I didn't have to order the forms piecemeal, but was able to order the whole package at once for a reasonable price. Once downloaded, their fill-in-the-blank PDF was easy to use with detailed instructions for each line item. I'd definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.

We are delighted to have been of service. Thank you for the positive review!

Hideo K.

September 12th, 2023

Very prompt and satisfied with the service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth R.

October 12th, 2021

Thank you. After searching for the correct forms and instructions on my county website, and finding nothing, I was very pleased with the Pinal County, AZ, acceptable forms and instructions I was able to download at a very reasonable cost from Deeds.com.

Thank you!

bill h.

June 10th, 2021

so far getting what i needed was easy the site is well done thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amanda M.

December 11th, 2019

Was very easy to use.

Thank you!

Gerry C.

February 6th, 2021

Forms appear to be most current and instructions clear. Inserting grantor/grantee information onto form a bit "clunky" however no major issues. I will be using services again.

Thank you!

Lisa P.

February 18th, 2025

It was easy to find and download the documents that I needed.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

James J.

July 28th, 2024

Ive been looking for a complete packet with all the forms needed!!

Thank you for your positive words! We’re thrilled to hear about your experience.