Download Utah Deed of Distribution Legal Forms

Utah Deed of Distribution Overview

A deed of distribution is a legal instrument of conveyance recorded as part of probate proceedings. Probate is the process of settling and distributing a decedent's estate. The Utah Uniform Probate Code is codified at Title 75 of the Utah Code.

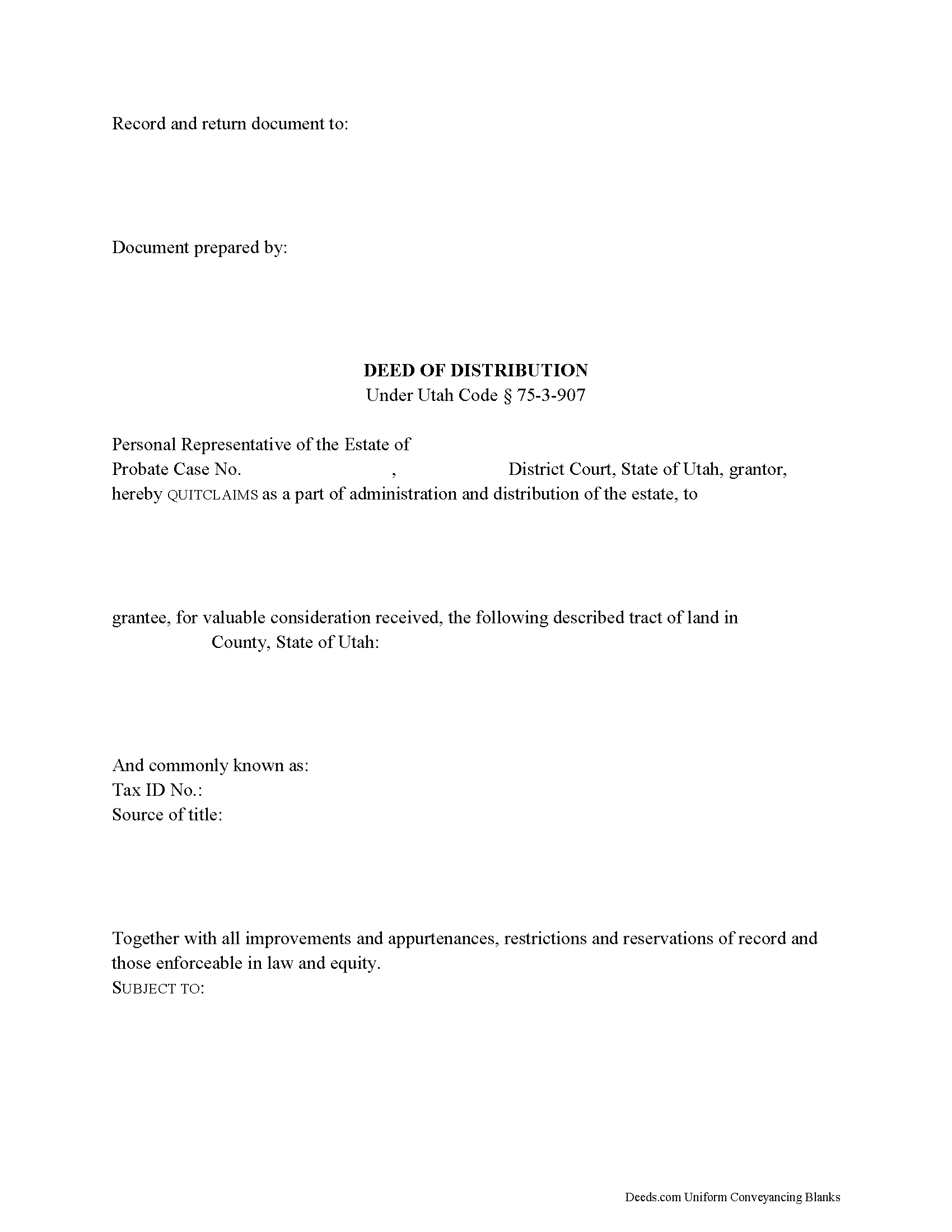

Following the payment of claims against the estate, the personal representative (PR) may execute a deed of distribution under 75-3-907 to transfer fee simple title to real property to the distributee of an estate. A recorded deed of distribution is "conclusive evidence that the distributee has succeeded to the interest" in the property "as against all persons interested in the estate" (75-3-908). The deed releases the PR's power over the property and establishes marketable title. The instrument is functionally equivalent to a quitclaim deed and carries no warranties.

Deeds of distribution name the personal representative as the granting party, reference the decedent by name, and cite information about the probated estate, including the district court in which probate is opened and the case number assigned to the estate. To properly transfer title, include the grantee's full name, mailing address, and vesting information. All documents must meet state and county recording standards for form and content.

As with all documents pertaining to an interest in realty, the deed of distribution requires a legal description of the subject parcel, the tax identification number assigned by the taxing authority, and a recitation of the grantor's source of title. Note any restrictions associated with the property on the face of the deed. The PR must sign the deed in the presence of a notary public before recording in the appropriate county.

Include a water rights addendum under 57-3-109. This form must be completed and signed by the grantor. Submit the deed and any required supporting documents, such as a copy of the PR's letters and the decedent's death certificate, to the recording office of the county where the real property is situated.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Utah with questions regarding deeds of distribution and probate procedures in that state, as each situation is unique.

(Utah DOD Package includes form, guidelines, and completed example)