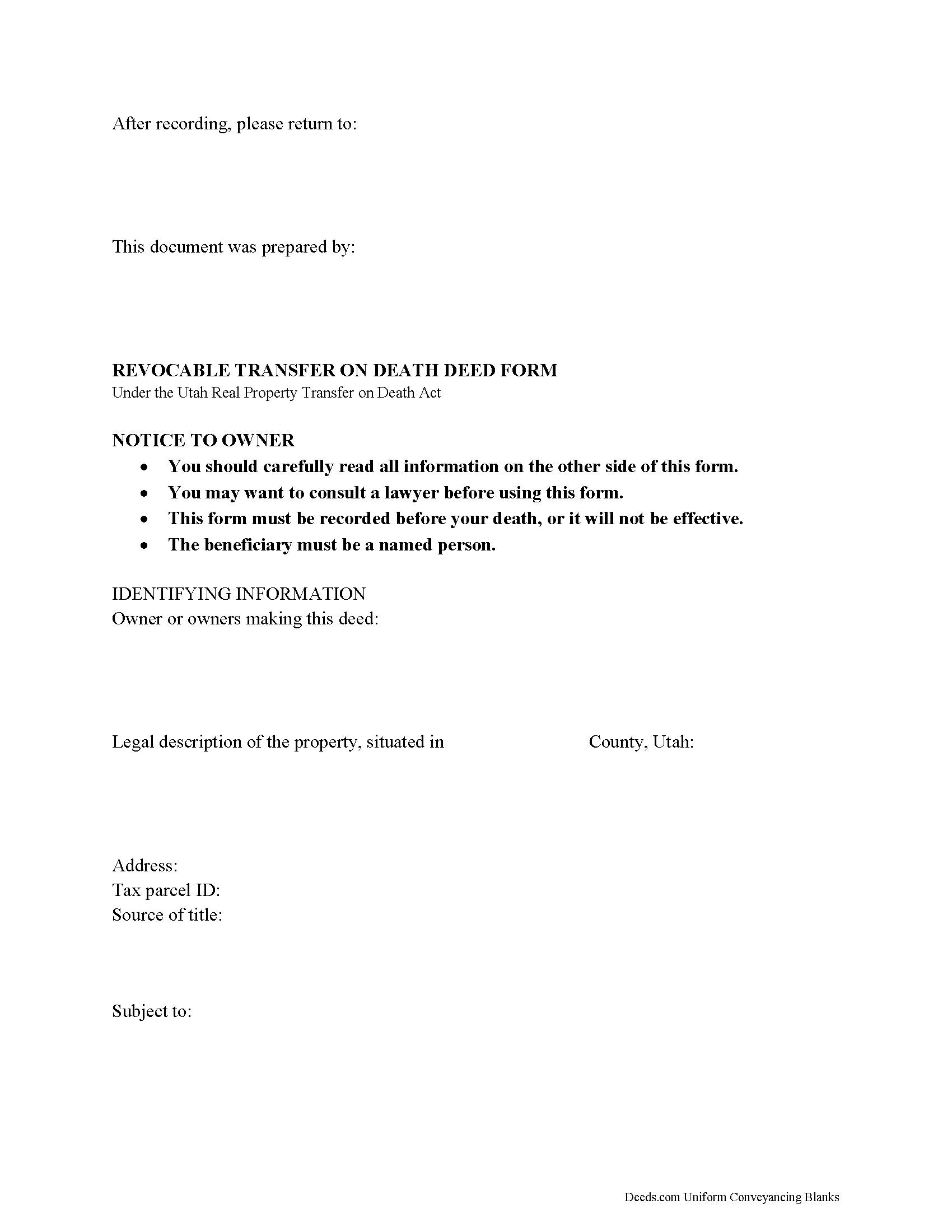

Davis County Transfer on Death Deed Form

Davis County transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

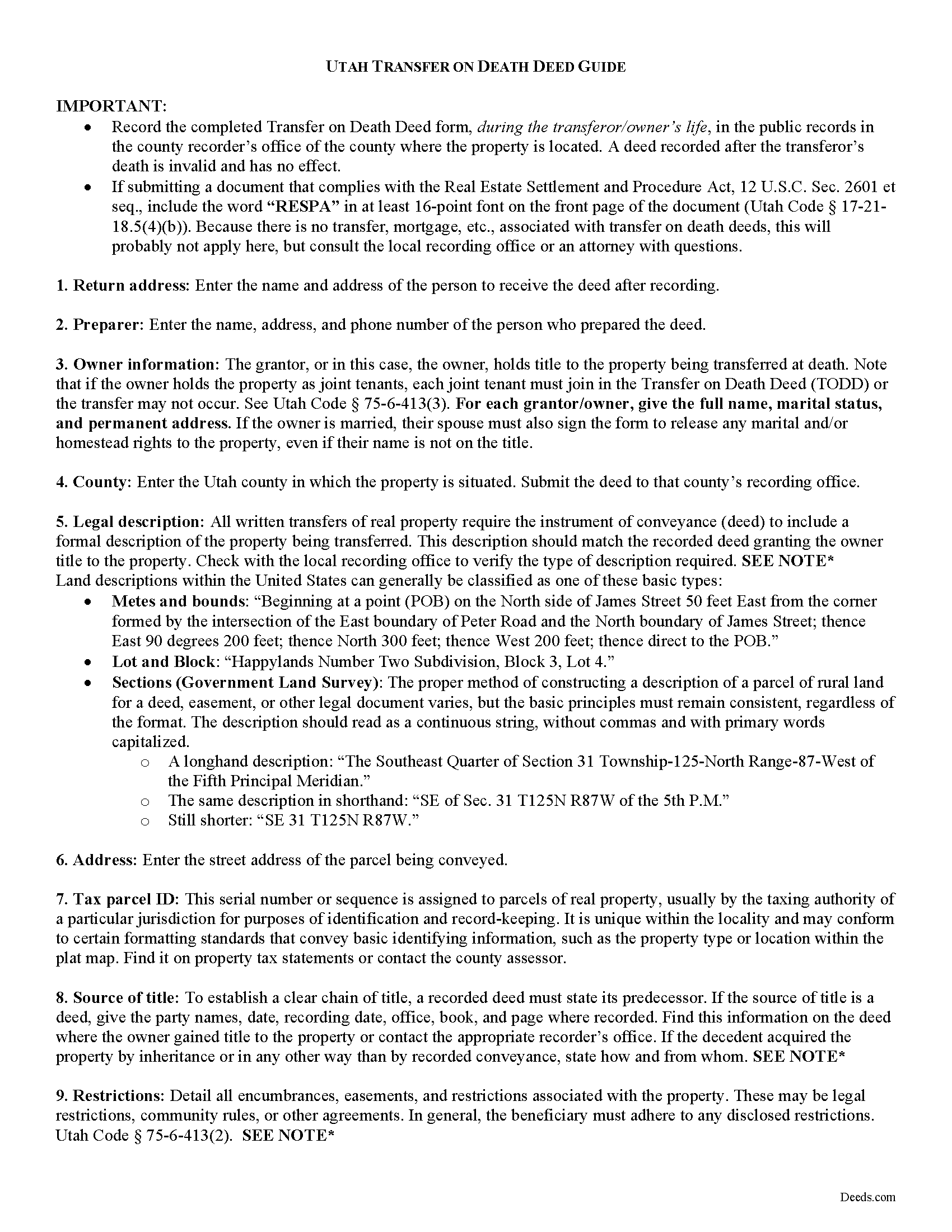

Davis County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

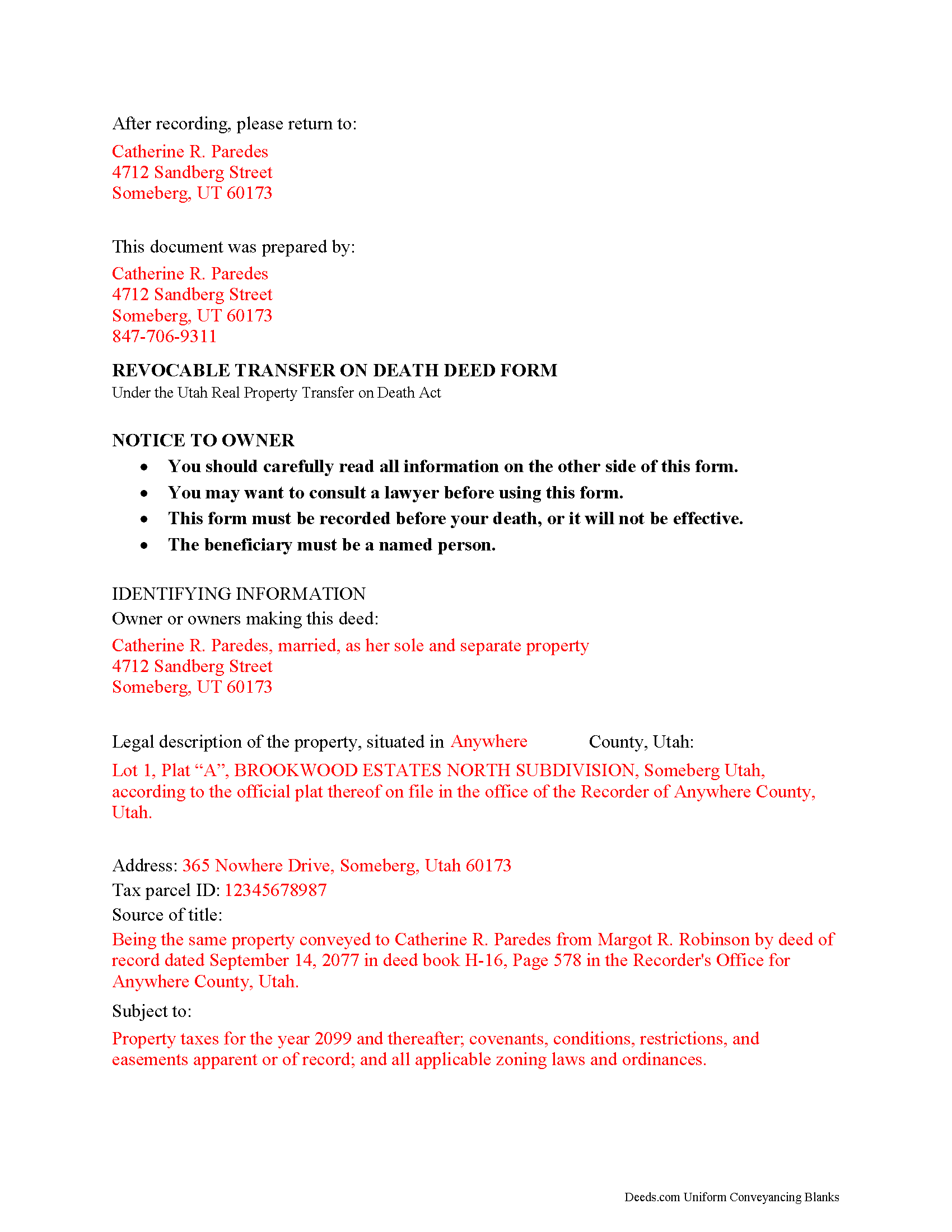

Davis County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Davis County documents included at no extra charge:

Where to Record Your Documents

Davis County Recorder

Farmington, Utah 84025

Hours: 8:00am to 5:00pm M-F

Phone: (801) 451-3225

Recording Tips for Davis County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Avoid the last business day of the month when possible

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Davis County

Properties in any of these areas use Davis County forms:

- Bountiful

- Centerville

- Clearfield

- Farmington

- Hill Afb

- Kaysville

- Layton

- North Salt Lake

- Syracuse

- Woods Cross

Hours, fees, requirements, and more for Davis County

How do I get my forms?

Forms are available for immediate download after payment. The Davis County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Davis County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Davis County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Davis County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Davis County?

Recording fees in Davis County vary. Contact the recorder's office at (801) 451-3225 for current fees.

Questions answered? Let's get started!

Utah code 75-6-405. Transfer on death deed authorized.

(1) An individual may transfer property to one or more named beneficiaries effective at the transferor's death by a transfer on death deed.

Use this form to transfer real estate at death, but outside of a will and without the need for probate distribution. Execute the TODD form, then record it during the course of your life.

75-6-409. Requirements.

A transfer on death deed shall:

(1) contain the essential elements and formalities of a properly recordable inter vivos deed;

(2) state that the transfer to the designated beneficiary is to occur at the transferor's death; and

(3) be recorded before the transferor's death in the public records in the county recorder's office of the county where the property is located.

Overall, the Simple Revocable Transfer on Death Deed offers a convenient, flexible option to consider as part of an overall estate plan. Even so, they may not be appropriate in all cases. Contact an attorney for complex situations or with any questions.

(Utah TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Davis County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Davis County.

Our Promise

The documents you receive here will meet, or exceed, the Davis County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Davis County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Jesse C.

December 29th, 2018

I had a little problem understanding how to copie and use.

Thank you for your feedback Jesse. If you are having any issues please contact us so our customer care department can help you out.

Sinh L.

January 13th, 2020

Deeds.com did such a wonderful job that I had to leave a positive review. I did a deed retrieval and ran across some hiccups. Deeds.com was able to help me get my deed and even went beyond to help me have a more in depth understanding of it's title history. They responded quickly to all my messages. Great customer service. Definitely recommend! Thank you Deeds.com and thank you KVH.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert C.

December 24th, 2020

Amazingly easy process and excellent response time - very impressed!

Thank you!

David G.

April 25th, 2019

Thanks got what I needed

Thank you David, glad to hear that.

Nancy D.

July 30th, 2019

Program works well. Saves a lot of time trying to find out what you need to do.

Thank you!

Andrea H.

February 10th, 2022

Easy! Reasonable cost over and above the actual recording cost. Will save me the time I would have spent driving to the county offices.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia E.

June 1st, 2019

good source

Thank you!

Heather R.

May 31st, 2019

Fast and convenient service.

Thank you Heather, we appreciate your feedback.

Harry C.

September 14th, 2021

Sign up was rocky. Tried to access documents and msg. said did not recognize my email (even though it had sent me an email). Contacted support and it was resolved. House transfer affidavit straight forward and easy to fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Natasha M.

January 9th, 2024

Your forms, guides, sample deeds and submission process were accessible, easy to understand and simple. I also was pleasantly surprised by the efficiency, professionalism and ease of staff communicating with me after I uploaded the document to ensure the county accepted it. I will continue to use this website to record deeds. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara R.

August 26th, 2020

Thank you for your services My first time to ever print anything from your service or print off of a computer like this so I'm praying that it works I'm doing this to my phone. Thank you

Thank you!

Louise J.

September 6th, 2020

I found your service to be very helpful. The documents were correct and comprehensive as well as easy to access. The cost is so reasonable. I think it's a great service and was impressed with it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon B.

August 11th, 2022

My questions were answered promptly. I was not able to locate the deed I was searching for because my county has not uploaded the documents to be accessed through this system. I am sure I could have found what I was looking for had the information been available through the system. Thank you for your assistance.

Thank you!

Robert C.

March 31st, 2019

I hope I have the right form. My deed should be for a mfg home.

Thank you for your feedback. We really appreciate it. Have a great day!

Noelle V.

December 31st, 2024

I requested a copy of some documents and within the hour, they were waiting for me in PDF form. It was easy and helped a great deal to have this service available.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!