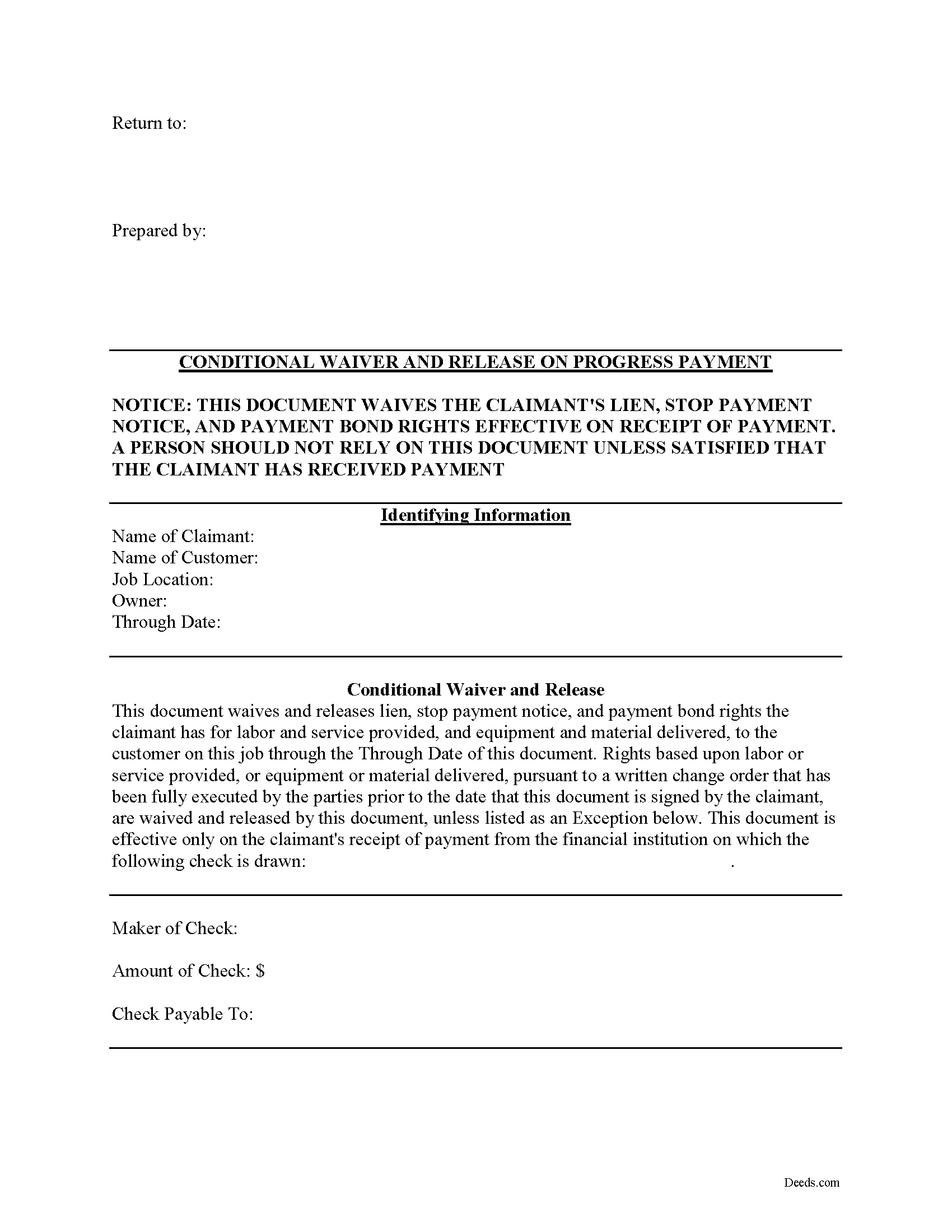

Cumberland County Conditional Lien Waiver on Partial Payment Form

Cumberland County Conditional Lien Waiver on Partial Payment Form

Fill in the blank Conditional Lien Waiver on Partial Payment form formatted to comply with all Virginia recording and content requirements.

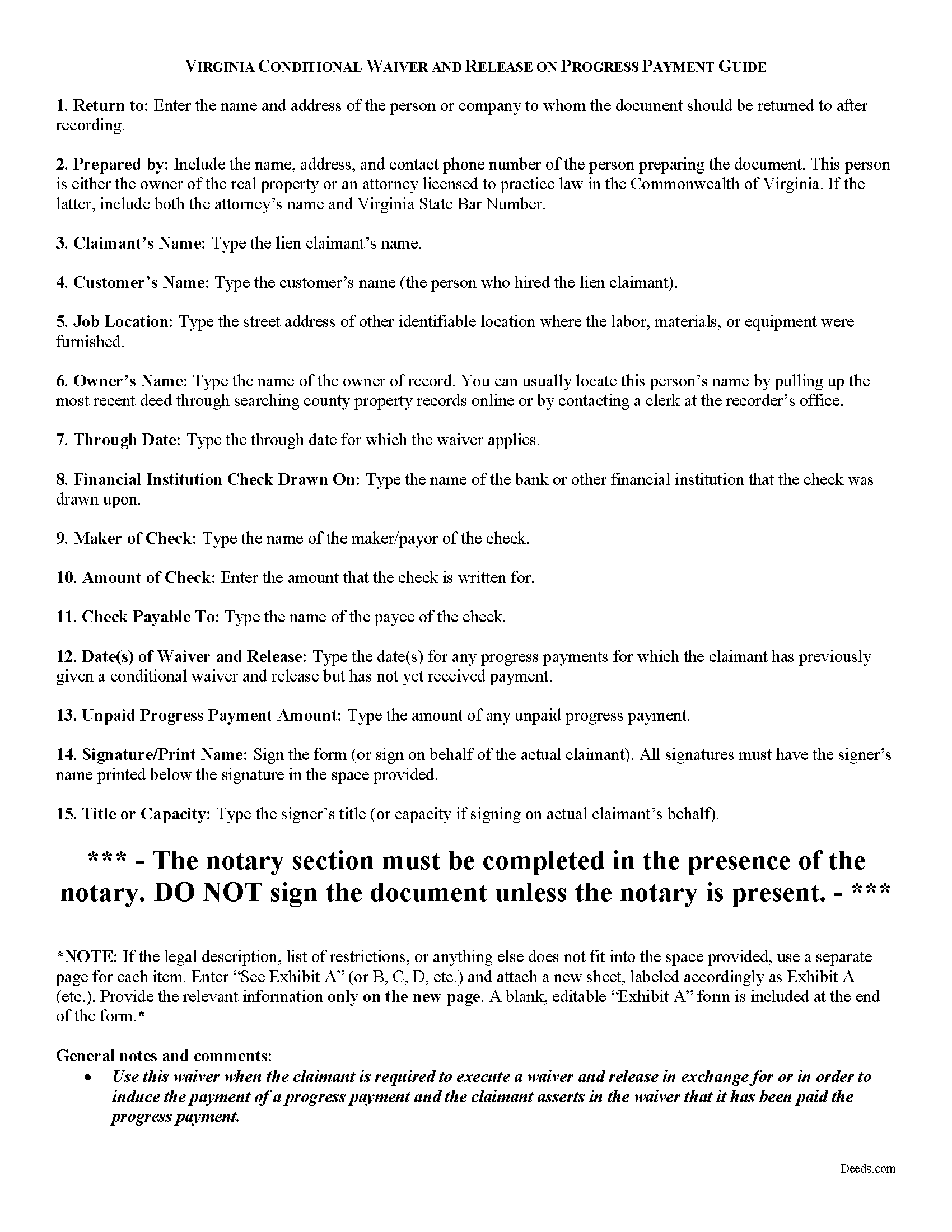

Cumberland County Conditional Lien Waiver on Partial Payment Guide

Line by line guide explaining every blank on the form.

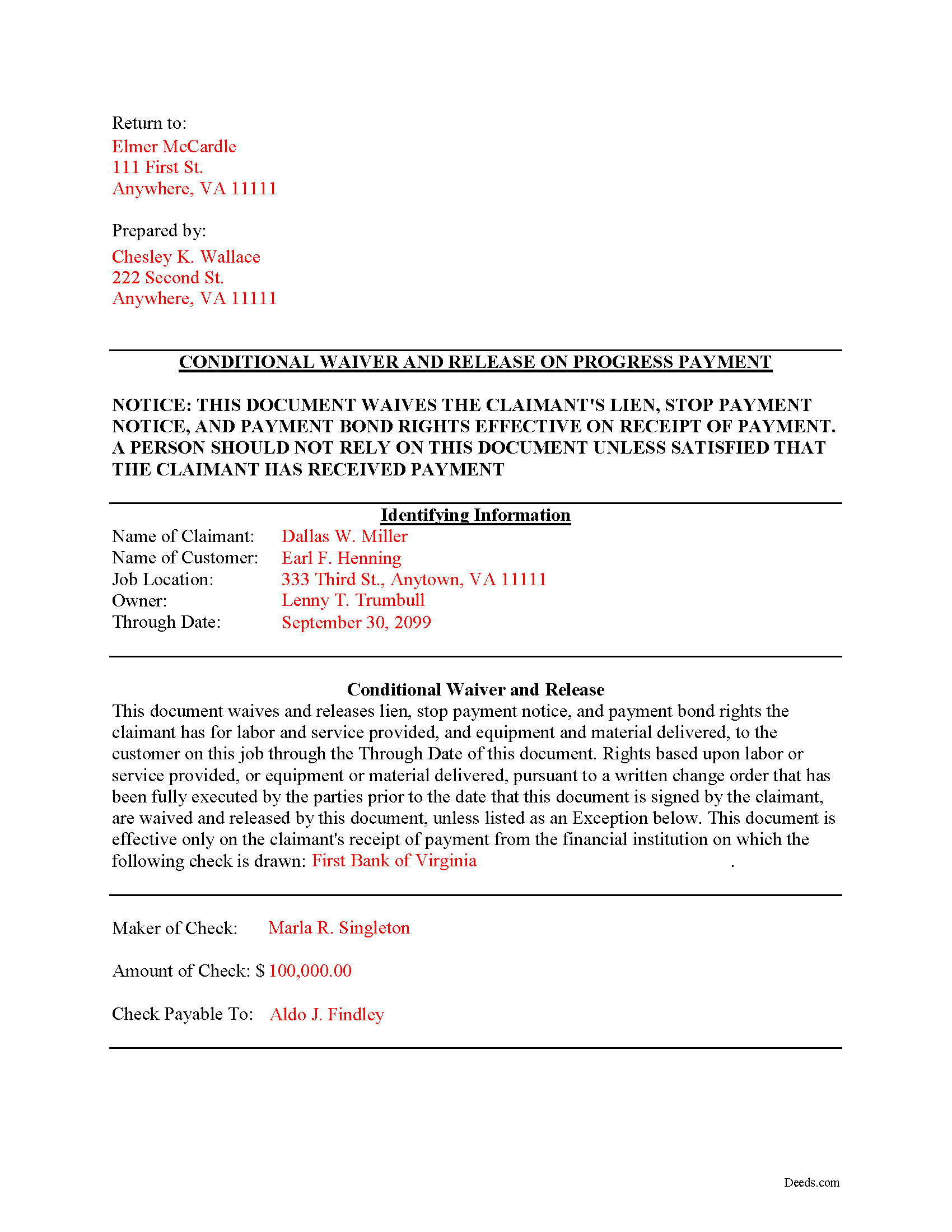

Cumberland County Completed Example of the Conditional Lien Waiver on Partial Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Cumberland County documents included at no extra charge:

Where to Record Your Documents

Circuit Court Clerk

Cumberland, Virginia 23040

Hours: Monday - Friday 8:30 am - 4:30 pm

Phone: (804) 492-4442

Recording Tips for Cumberland County:

- White-out or correction fluid may cause rejection

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Bring multiple forms of payment in case one isn't accepted

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Cumberland County

Properties in any of these areas use Cumberland County forms:

- Cartersville

- Cumberland

Hours, fees, requirements, and more for Cumberland County

How do I get my forms?

Forms are available for immediate download after payment. The Cumberland County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cumberland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cumberland County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cumberland County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cumberland County?

Recording fees in Cumberland County vary. Contact the recorder's office at (804) 492-4442 for current fees.

Questions answered? Let's get started!

Lien waivers are quid-pro-quo arrangements between contractors and owners, intended to induce payment from an owner in return for the contractor waiving some or all available mechanic's lien rights.

In Virginia, any right to file or enforce any mechanics' lien may be waived in whole or in part at any time by any person entitled to such lien, except that a subcontractor, lower-tier subcontractor, or material supplier may not waive or diminish his lien rights in a contract in advance of furnishing any labor, services, or materials. Va. Code 43-3(C).

Waivers fall under two broad categories of "conditional" and "unconditional," and there are two subcategories of waivers for a "partial" or "final" payment. Each type comes with benefits and risks, so take care to use the correct form for the situation.

A conditional waiver depends on the actual receipt of payment, so use it when a party pays by check, but the recipient is not sure that it will clear. Therefore, if the bank returns the check unpaid, it is still possible to claim a lien down the line. This type of waiver offers greater protection to the contractor.

Use a partial payment waiver to acknowledge a payment on account. Think of it as a receipt that shows the owner has at least paid up to that amount.

So, a conditional waiver on partial payment releases the claimant's lien rights, to an agreed-upon point, on the condition that the check clears at the bank.

When used properly, waivers are advantageous for both a contractor and owner, and can facilitate the flow of business and encourage prompt payment without any unnecessary delays.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. Please contact a lawyer with any questions about Virginia lien waivers.

Important: Your property must be located in Cumberland County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Partial Payment meets all recording requirements specific to Cumberland County.

Our Promise

The documents you receive here will meet, or exceed, the Cumberland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cumberland County Conditional Lien Waiver on Partial Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

SHIRLEY H.

September 21st, 2022

I like that they have all the forms, but I could not find it they would submit the forms to the recorders office

Thank you!

Alain L.

June 15th, 2021

deeds.com was able to turnaround my document in a matter of hours. I was also surprised at how easy their website was to navigate, considering other websites that offered the same service were so convoluted. Thank you again for the quick turnaround.

Thank you!

Paul A.

March 27th, 2020

Your service is awesome!

Thank you!

April K.

September 25th, 2022

Great service & quick response. Thank U.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen G.

January 22nd, 2021

Not difficult at all! Which is great for me...

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas B.

May 29th, 2020

My deeds were filed with Pinellas County Florida with a simple process and with no problems. 5 star for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Constance F.

August 27th, 2021

Quick and easy download with instructions and a sample document to ensure conformity to the different jurisdictions.

Thank you!

Gerald B.

April 5th, 2021

Thank you so much for the helpful service and quick action! If needed, I will definitely choose Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert V.

March 20th, 2019

Website seems to work great and documents are very clear and easy to review and download, thank you. Regards, Bob

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela L.

November 2nd, 2020

AWESOME!

Thank you!

Roger E.

August 30th, 2019

I have not yet used the product, but am confident that I will like it, because of this prompt request for a product review.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy F.

May 27th, 2022

The site was easy to use, I just wasn't sure which of all these documents I needed.

Thank you!

Ken J.

May 14th, 2022

I liked the software, it's very easy to use. Once it's saved as a .pdf document on your computer, the source document is lost when you log out. I wish it could be saved and then edited on their site later instead of having to create a new document from scratch each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Lorie S.

April 24th, 2024

It was available to download immediately

Thank you!

Christopher G.

August 20th, 2020

thank you - your service is awesome - i sent documents to the county - after 2 plus weeks they returned them with 'errors' - i went to your site - signed up - uploaded documents and submitted in less than 3 minutes - had it approved by the county in under 12 hours - THANK YOU - great service!!!!

Thank you Christopher, glad we could help. Have a great day!