Fairfax County Gift Deed Special Warranty Form (Virginia)

All Fairfax County specific forms and documents listed below are included in your immediate download package:

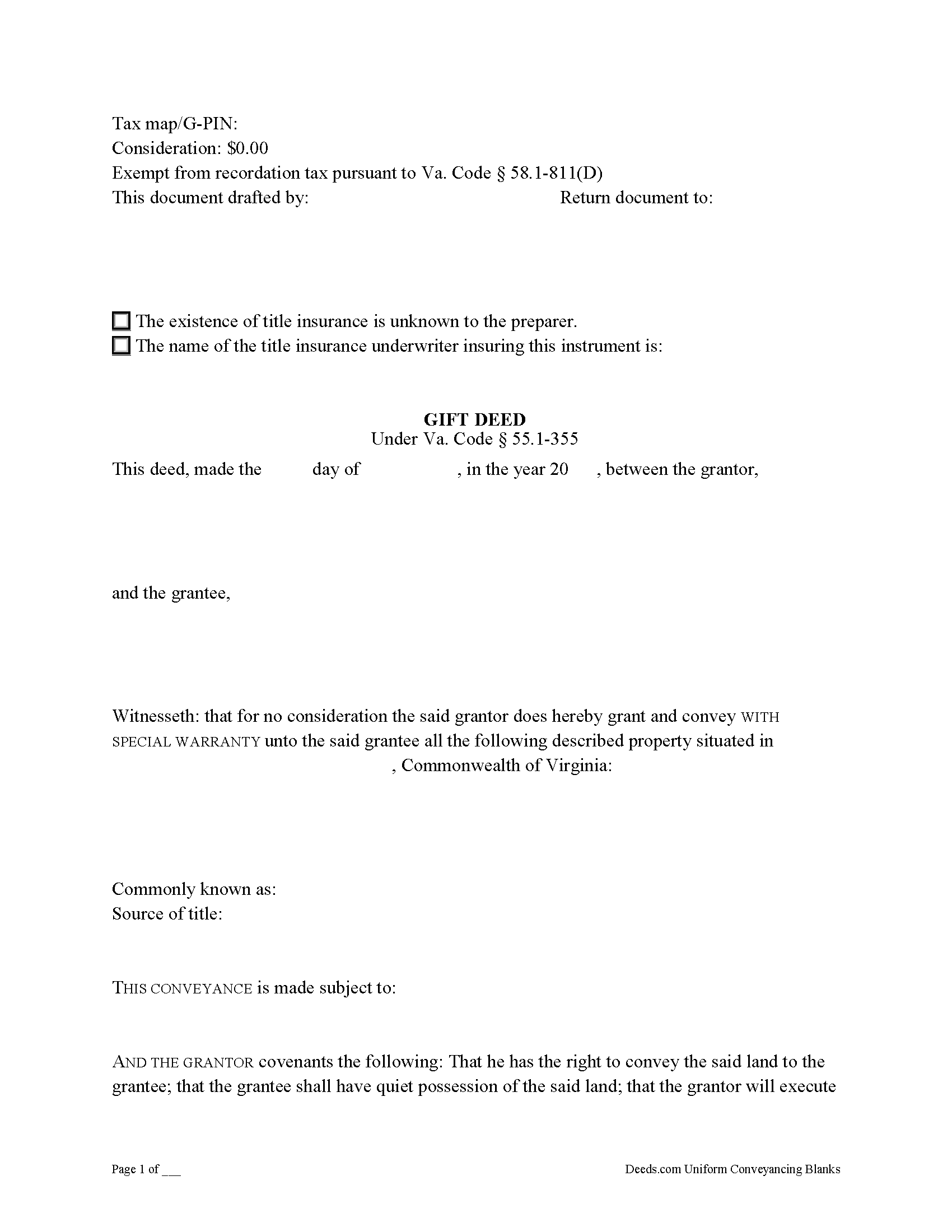

Gift Deed Special Warranty Form

Fill in the blank Gift Deed Special Warranty form formatted to comply with all Virginia recording and content requirements.

Included Fairfax County compliant document last validated/updated 4/18/2025

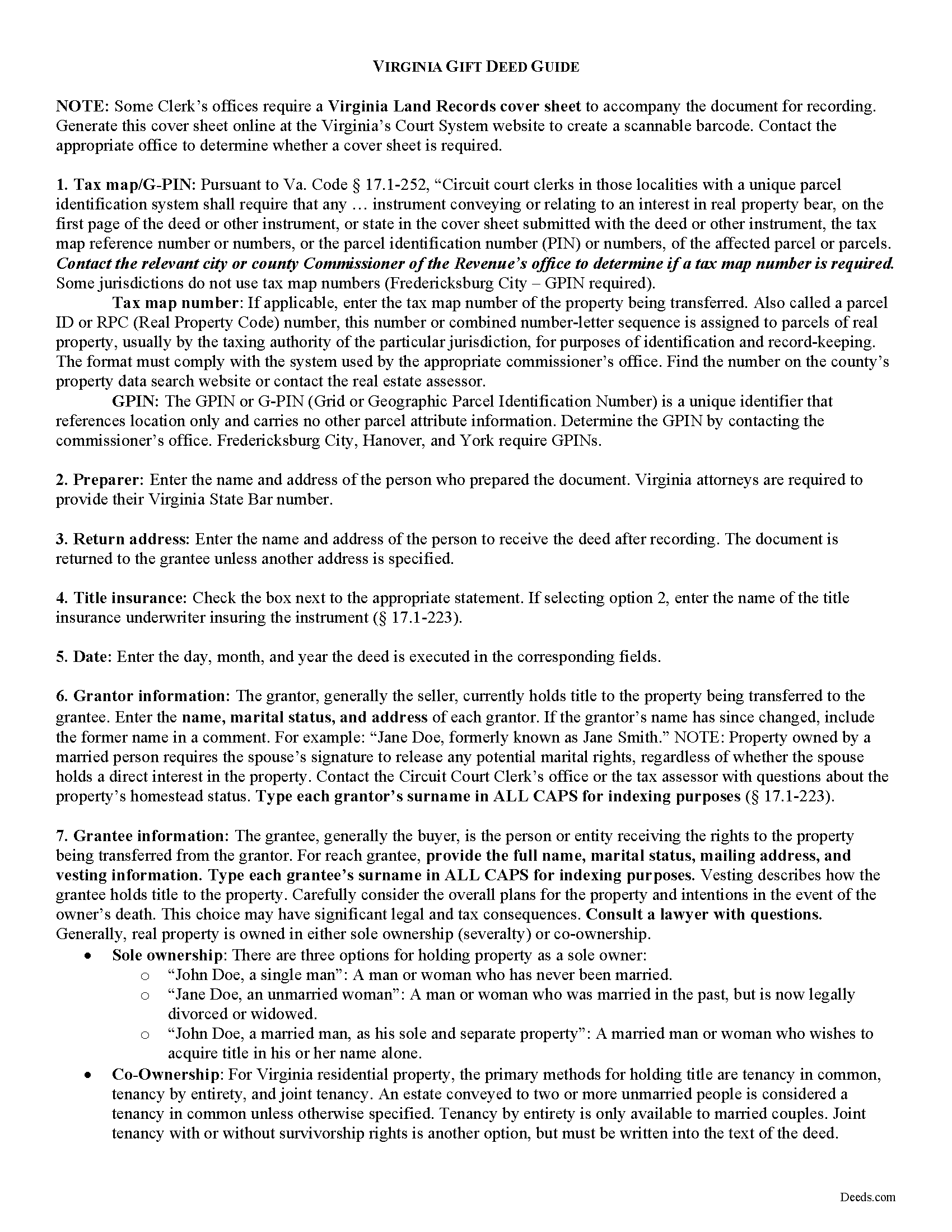

Gift Deed Special Warranty Guide

Line by line guide explaining every blank on the form.

Included Fairfax County compliant document last validated/updated 7/1/2025

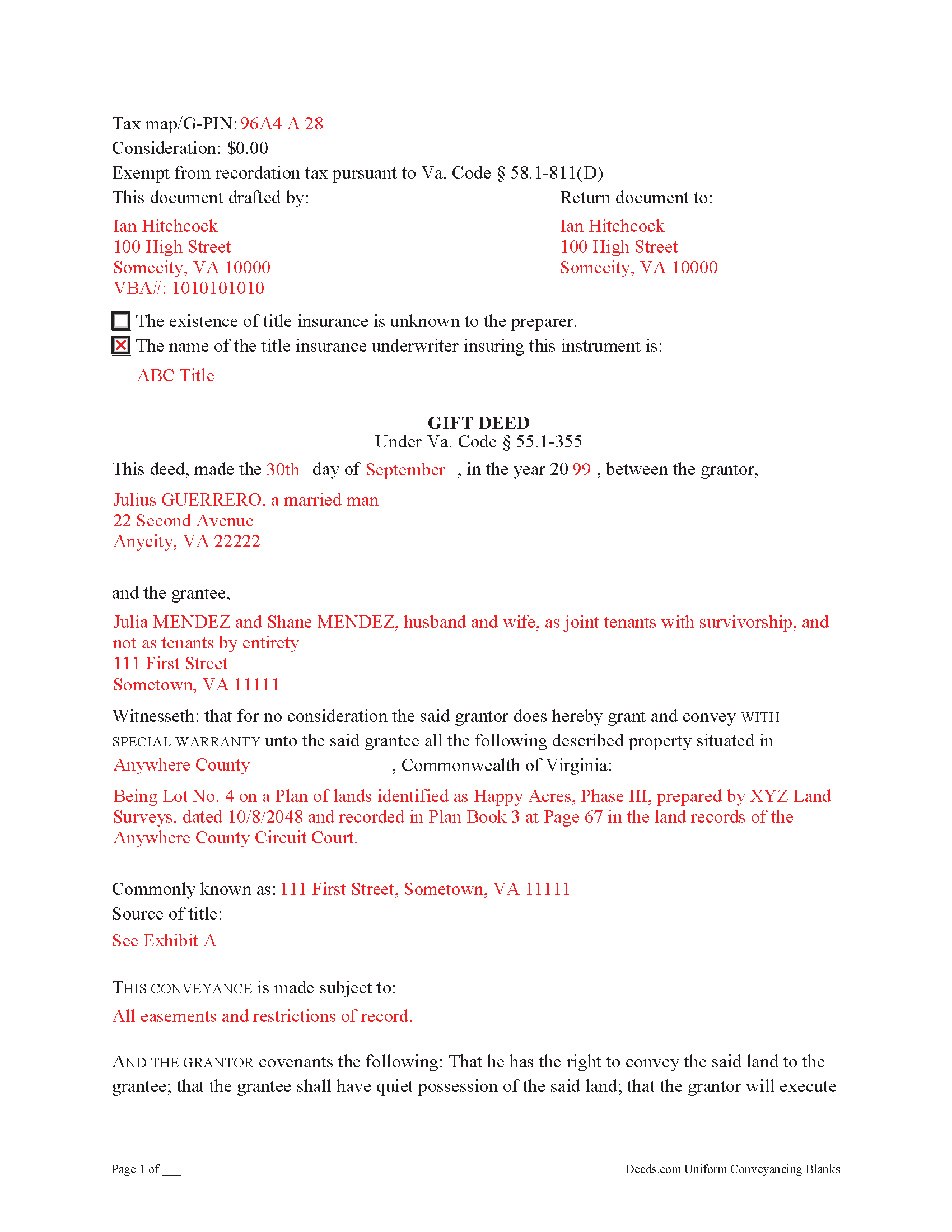

Completed Example of the Gift Deed Special Warranty Document

Example of a properly completed form for reference.

Included Fairfax County compliant document last validated/updated 5/19/2025

The following Virginia and Fairfax County supplemental forms are included as a courtesy with your order:

When using these Gift Deed Special Warranty forms, the subject real estate must be physically located in Fairfax County. The executed documents should then be recorded in the following office:

Fairfax Circuit Court Clerk: Land Records Division

Courthouse - 4110 Chain Bridge Rd, Suite 317, Fairfax, Virginia 22030

Hours: 8:00 to 4:00 M-F / Recording until 3:00

Phone: (703) 691-7320

Local jurisdictions located in Fairfax County include:

- Alexandria

- Annandale

- Burke

- Centreville

- Chantilly

- Clifton

- Dunn Loring

- Fairfax

- Fairfax Station

- Falls Church

- Fort Belvoir

- Great Falls

- Greenway

- Herndon

- Lorton

- Mc Lean

- Merrifield

- Mount Vernon

- Newington

- Oakton

- Reston

- Springfield

- Vienna

- West Mclean

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Fairfax County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Fairfax County using our eRecording service.

Are these forms guaranteed to be recordable in Fairfax County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fairfax County including margin requirements, content requirements, font and font size requirements.

Can the Gift Deed Special Warranty forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Fairfax County that you need to transfer you would only need to order our forms once for all of your properties in Fairfax County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Virginia or Fairfax County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Fairfax County Gift Deed Special Warranty forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). They typically transfer real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity.

Gift deeds, by definition, are transfers made for no consideration. To gift property to a donee, the donor may execute a quitclaim, special warranty, or warranty deed, depending on the level of protection they wish to provide. In general, though, gift deeds with full warranties are unusual; most donors choose either quitclaim or special warranty deeds.

Quitclaim deeds transfer the owner's property rights to the recipient with no assurances about the status of the title, or even a guarantee that they have actually own the property. Special warranty deeds confirm that the donor owns the property, has the right to transfer it, and will defend the donee against claims on the title that relate to their period of ownership.

For a gift deed to be valid, the grantor must intend to make a gift of the property, deliver the property to the grantee, and the grantee must accept the gift. It must contain language that explicitly states no consideration is expected or required. Any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and manner of vesting title. As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property.

The granting party must sign the deed in the presence of an authorized official before filing the deed in the Clerk of Court's office in the independent city or county in which the property is situated. If married, the non-owning spouse should sign as an additional grantor to waive any interest in the estate. Gift deeds must meet all state and local standards for recorded documents. Some jurisdictions in Virginia require a cover page for recording. Generate the cover sheet online and submit it when recording (see supplemental forms). Contact the local recording office with questions.

Deeds of gift are exempt from recordation taxes under Va. Code 58.1-811(D). The deed must state on its face that the transfer is exempt from the tax.

Virginia does not levy a state gift tax, but the grantor must pay the Federal Gift Tax. The IRS implements a Federal Gift Tax on any transfer of property from one individual to another with no consideration, or consideration that is less than the full market value. As of 2020, individuals are permitted an annual exclusion of $15,000 on gifts. If there is any question about the gift's value, or if it is close to the exclusion limit, the grantor may wish to consider filing a Form 709 for the federal tax. Ask the local tax assessor or another tax professional for guidance.

With gifts of real property, the recipient (grantee) is not required to declare the amount of the gift as income, but if the property accrues income (such as rent) after the transaction, the recipient is responsible for paying associated state and federal income taxes. Note that the grantee, as the new owner, also becomes responsible for local property taxes and maintaining other agreements and restrictions associated with the property.

This article is provided for informational purposes only and is not a substitute for professional legal advice. Contact an attorney with questions about gift deeds or for any other issues related to the transfer of real property in the Commonwealth of Virginia.

(Virginia GDSW Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Fairfax County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fairfax County Gift Deed Special Warranty form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Clinton M.

January 8th, 2020

Very informative. I submitted my form.The county accepted it. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

albert C.

May 21st, 2021

thumbs up

Thank you!

Mary Ann H V.

May 4th, 2021

I'm very happy with your service! It saved me, at least, hundreds of dollars vs. going through a lawyer in a different state.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

January 21st, 2019

Order Process: 5 Stars - very easy

Material Received: 2 Stars

Issues:

1. Printing- Document would not print in format displayed. Format would continually shrink to approx 2/3 size thus not useable for formal doc submission to County Records office.

2. Document Format- Data insertion fields (addresses) were not of correct size for data input. I needed a 4 line input space but was limited to only 3 lines. Also, Date field (year) was mis-oriented in-so-much that the 3rd digit (inputted) overlapped on 2nd digit (pre-printed) and also was of noticeably different font.

3. Useability- Hand-written input space provided (for Notary) was deficient in space and spacing. It was a challenge to utilize the space available to complete fully and maintain legibility.

Overall - the document worked marginally as advertised, I did need to re-write the entire document myself. It is a good concept but I'd recommend that Deeds company improve the downloaded forms for actual useability, readability, functionability.

regards,

Jim S

Thank you for your feedback. We really appreciate it. Have a great day!

Tonya J.

December 14th, 2019

User friendly and fast response time!!

Thank you for your feedback. We really appreciate it. Have a great day!

cora c.

December 30th, 2021

ALTHOUGH IT TOOK A LITTLE LONGER THAN EXPECTED TO RECEIVE AN INVOICE TO ALLOW ME TO PAY THE REQUIRED FEES AND HAVE MY DOCUMENT SUBMITTED FOR RECORDING, I REALLY APPRECIATED THE SERVICE AND PROMPT RESPONSES TO MY MESSAGES, SEEKING ASSISTANCE. THANK YOU SO MUCH!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John B.

December 23rd, 2020

Thorough. Thanks!

Thank you!

Stephanie F.

August 15th, 2024

Thorough, efficient, couldn't ask for better support. I refer everyone I know in real estate to use Deeds.com

Thank you for your positive words! We’re thrilled to hear about your experience.

Jerry O.

July 10th, 2020

Everything I needed including detailed instructions to transfer the deed on my house from me alone to me and my wife as joint owners with right of survivorship. Formatting was compliant and blanks for all information required were provided in all the right places.

5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

June 10th, 2022

Thank you! You are so awesome. Its amazing to be able to get everything together in a download packet. You make it so easy for the user.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cindy A.

January 14th, 2019

Easy to understand and use. However, need to add line for phone number for preparer - Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

FRANK O.

March 1st, 2019

Easy to download and use the forms, however two forms needed for my county recording were not included.

Thank you for your feedback Frank. We'll look into finding and including the additional supplemental documents. Sometimes supplemental documents have to be generated by the county's system, specific to the transaction.