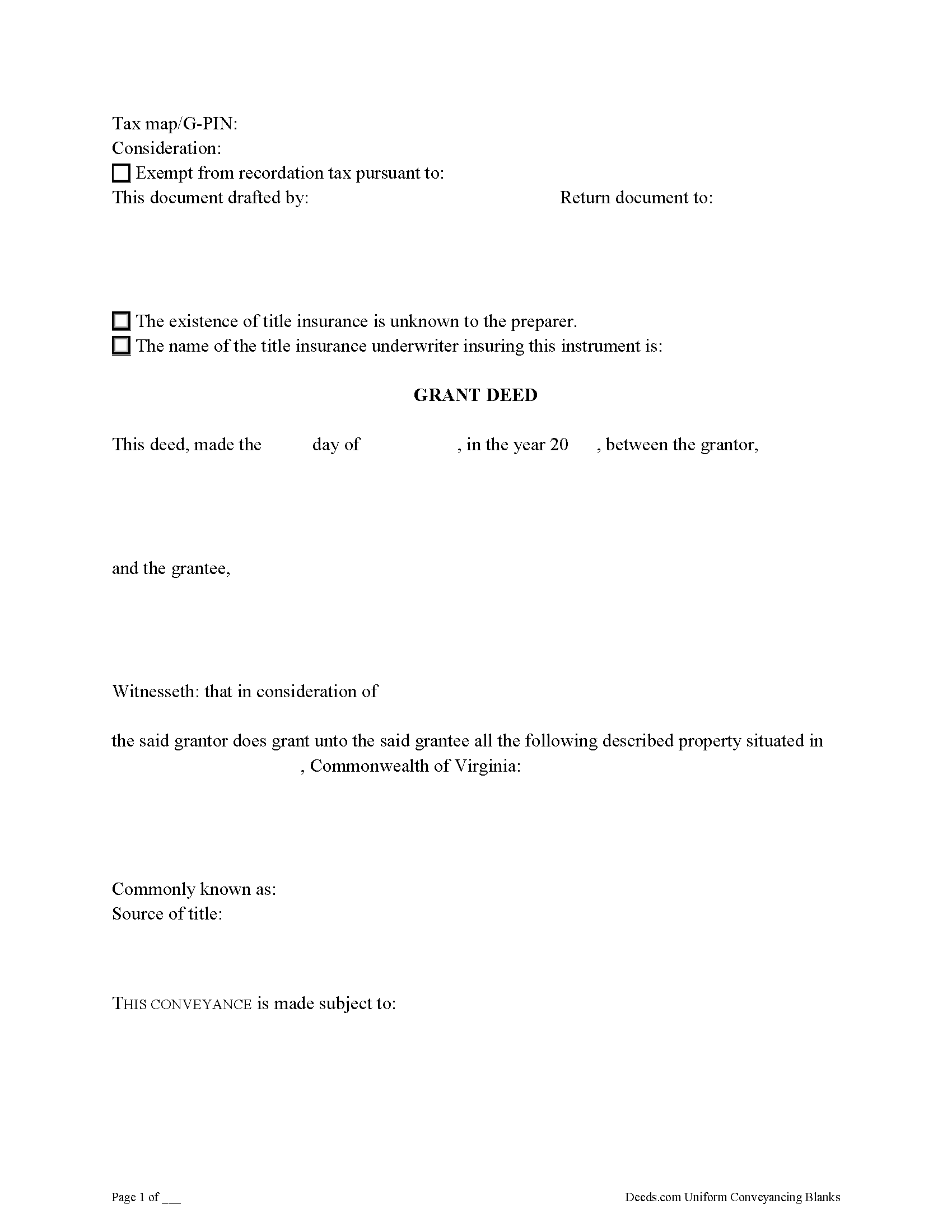

Surry County Grant Deed Form

Surry County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

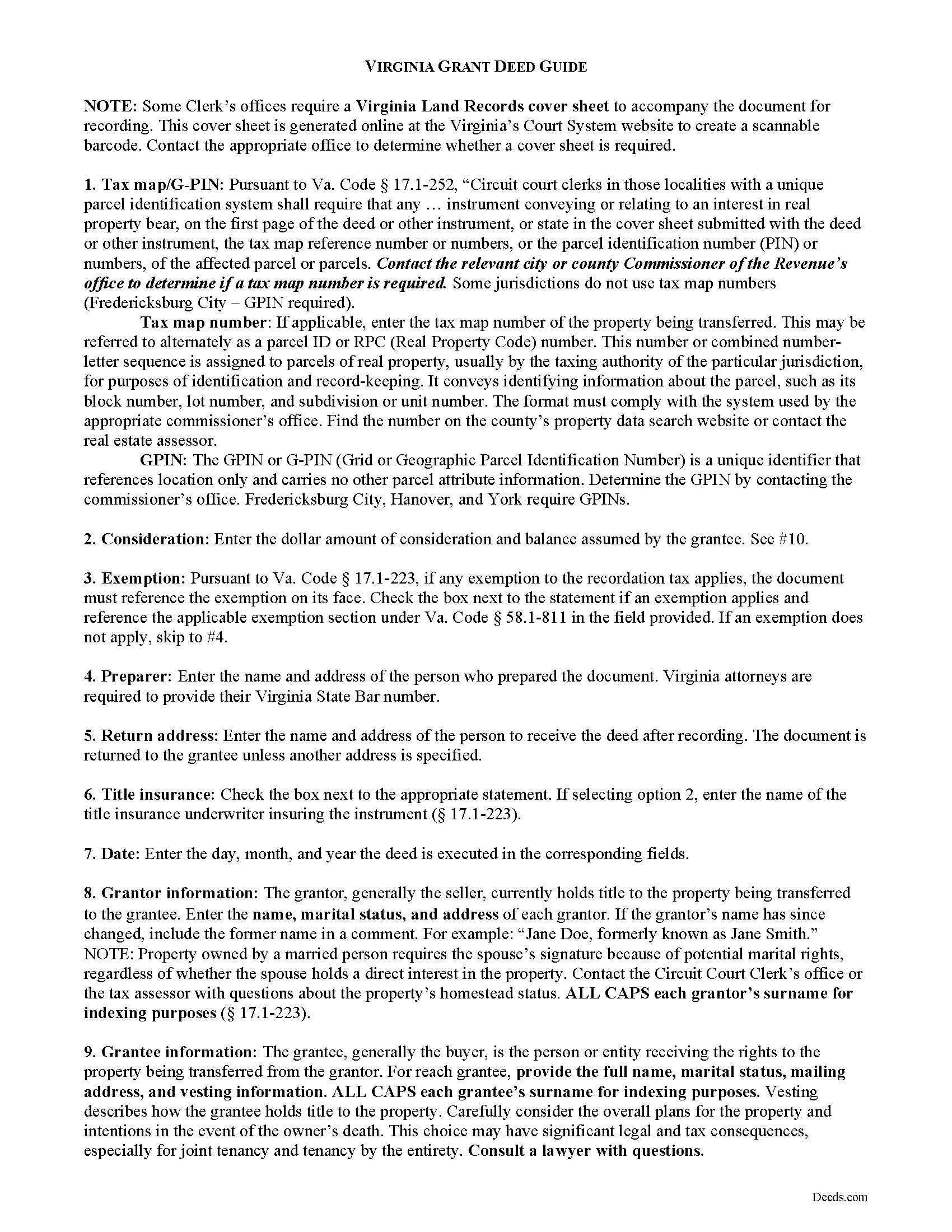

Surry County Grant Deed Guide

Line by line guide explaining every blank on the form.

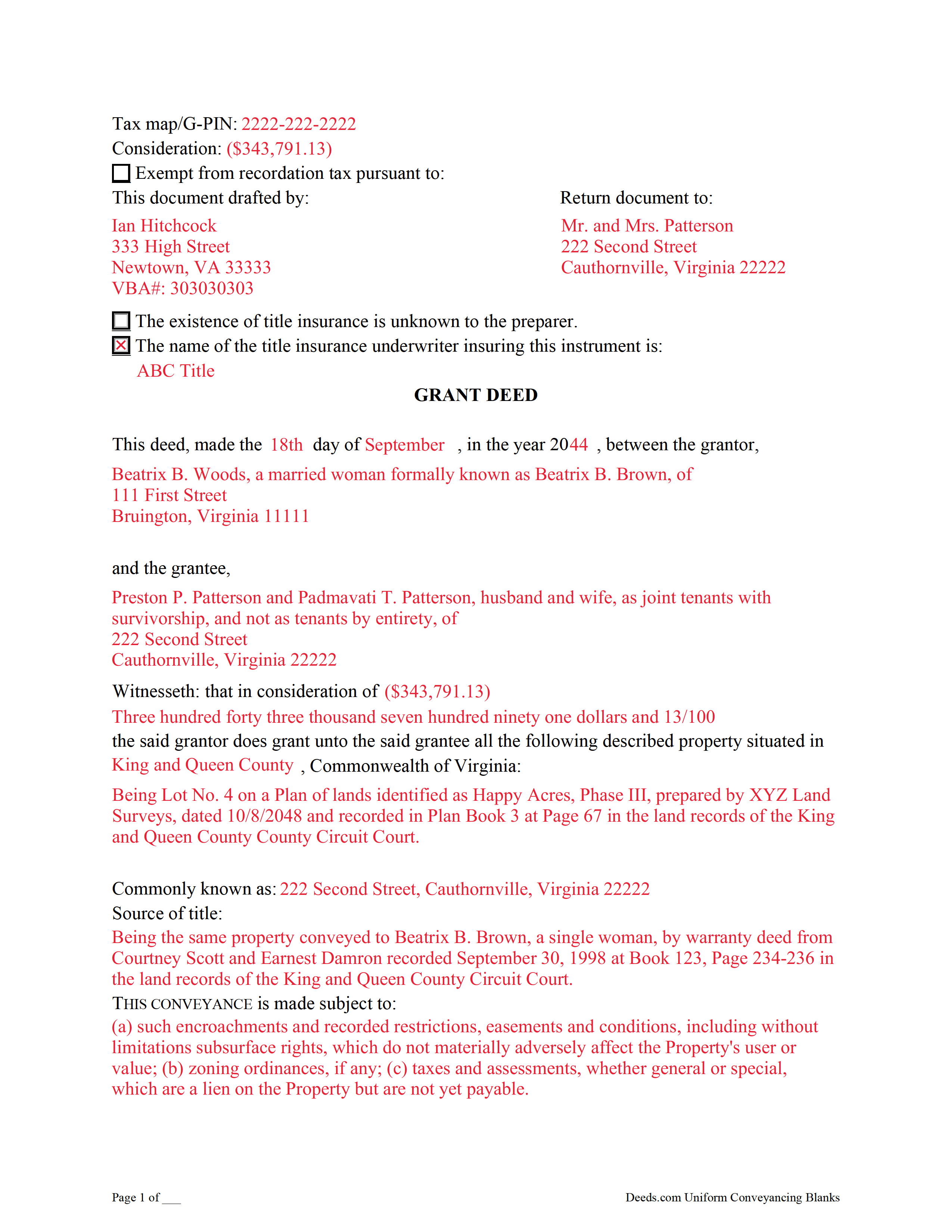

Surry County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Surry County documents included at no extra charge:

Where to Record Your Documents

Surry County Circuit Court Clerk

Surry, Virginia 23883

Hours: 9:00am to 5:00pm M-F

Phone: (757) 294-3161

Recording Tips for Surry County:

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Surry County

Properties in any of these areas use Surry County forms:

- Claremont

- Dendron

- Elberon

- Spring Grove

- Surry

Hours, fees, requirements, and more for Surry County

How do I get my forms?

Forms are available for immediate download after payment. The Surry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Surry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Surry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Surry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Surry County?

Recording fees in Surry County vary. Contact the recorder's office at (757) 294-3161 for current fees.

Questions answered? Let's get started!

In Virginia, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer a fee simple interest with minimal covenants of title. The word "grant" typically signifies a grant deed, but it is not a statutory form in Virginia.

Grant deeds offer buyers (grantees) more protection than quitclaim deeds, but less than warranty deeds. Grant deeds guarantee through explicit covenants that the title is free of any encumbrances, and that the grantor is seized of a fee simple interest in the property. Grant deeds do not require the grantor to defend the title against claims, as in a warranty deed.

In addition to meeting all state and local standards for recorded documents, a lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Virginia requires each party's name to be underlined or capitalized in the conveyancing instrument for indexing purposes (Va. Code Ann. 17.1-223). Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Virginia residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance of real estate to two or more persons creates a tenancy in common, unless another intention is clearly expressed. A tenancy by entirety is optional for married couples only, and must be explicitly stated (55.1-135, 55.1-136).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The finished copy of the deed must be signed by the grantor (and his or her spouse, if applicable) and notarized. Record the original completed deed, along with any additional materials, at the circuit court clerk's office of the independent city or county where the property is located. Contact the same office to verify recording fees and accepted forms of payment.

In Virginia, a state recordation tax is levied at the rate of 25 cents on every $100.00 of the consideration or the actual value of the property conveyed, whichever is greater (58.1-801). If the deed is exempt from the recordation tax, the exemption must be listed on the face of the instrument. A list of exemptions can be found at 58.1-811.

A Land Recorder's cover sheet is required to accompany deeds in certain Virginia counties. The form may be generated online to produce a scanning barcode. Contact the appropriate circuit court clerk for information regarding use of cover sheets.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Virginia lawyer with any questions related to the transfer of real property.

(Virginia Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Surry County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Surry County.

Our Promise

The documents you receive here will meet, or exceed, the Surry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Surry County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Jack B.

May 2nd, 2020

The service was fast, but I didn't learn about the results until I logged in. I would have liked to get email when the report was finished.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph E.

March 24th, 2019

I wish I had found this site earlier!!! Not only was it helpful and just what I needed but I got my information so fast AND on the weekend. I would recommend this site to everyone. I plan on using it more. Its cheap and I can get my information while sitting at home. Very impressed!

Thank you for the kinds words Ralph. Have a great day!

Rick M.

February 1st, 2023

Sign up process was fine. The search could be refined a bit to make it easier. Rather than being presented with a large number of fields and trying to figure out, it say street suffice (Drive, Street, Lane) are needed and with what spelled out, what abbreviated it would be nice to have them presented as questions with examples. The $30 price point of r a deed is way too high for me as an appraiser. This is why I didn't complete the transaction.

Thank you for your feedback. We really appreciate it. Have a great day!

James K.

January 12th, 2023

Gave me exactly what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey W.

October 20th, 2021

You should add a button to cancel a package. I uploaded a document for e-recording, but wanted to cancel because I got a more clear copy.

Thank you!

Susann T.

November 4th, 2020

I have been very happy with the prompt assistance that I have received from deeds.com! How refreshing this is when so often good customer service seems rare these days!

Thank you for your feedback. We really appreciate it. Have a great day!

Dora O.

August 27th, 2024

Best platform to buy forms. Simple and easy.

It was a pleasure serving you. Thank you for the positive feedback!

Arnold R.

March 11th, 2022

this online service worked efficiently and as quickly as the registry allowed it to record new deeds. Thank you for providing services

Thank you for your feedback. We really appreciate it. Have a great day!

Debbie G.

February 2nd, 2019

Easy to use, I would recommend deeds.com. I would recommend visiting your county recorder before having document notarized. They will review document and make sure everything you need is on the deed, before having notarized.

Thank you Debbie. Have a fantastic day!

Robert K.

September 6th, 2022

Easy site to use. Well worth the time spent to complete the form.

Thank you!

Jessica H.

March 3rd, 2021

As a first time user I was a little skeptical of the service. But Deeds.com put all my worries aside. Their service is quick and easy. I will definitely be using it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard H.

October 14th, 2022

It was a waste of time. I asked a question via your chat service. I received an acknowledgement that you received the question, that you might or might not answer it, and don't bother to reply to you email, as no one would read it. Confirming my belief that customer service is an oxymoron for most companies. (I doubt this review will ever appear on the site, or anyuhere else.)

Thank you!

Chad N.

March 16th, 2021

Thank you for taking care of a recording very quickly. I am very impressed by your service an would recommend to anyone. Easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Mallah B.

October 7th, 2021

I think this company offers a great service that is non-discriminatory and allows me to save time going downtown and hassle dealing with different personalities.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

July 27th, 2021

Appreciate the help with DC's non-intuitive forms. Superb service.

Thank you!