Scott County Transfer on Death Deed Form

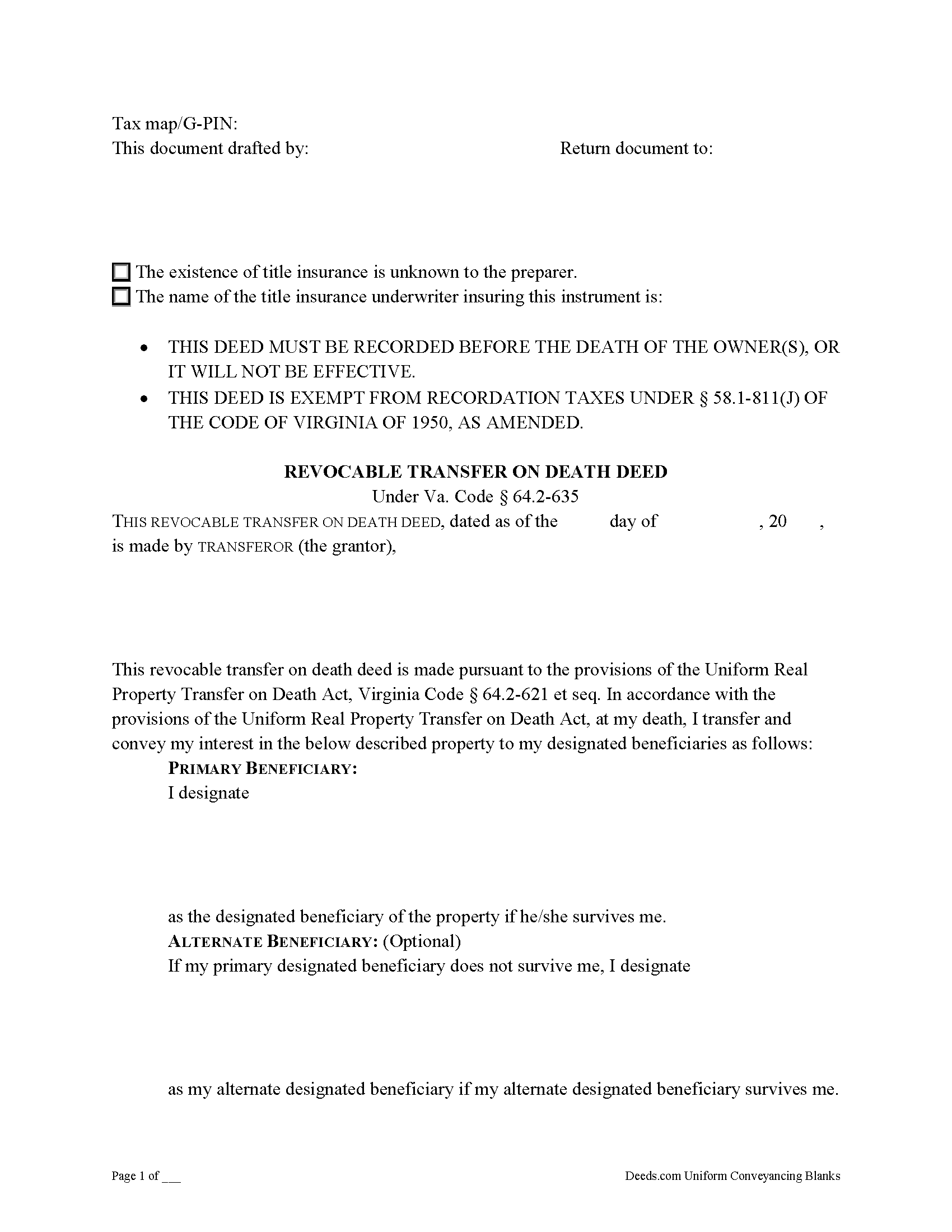

Scott County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

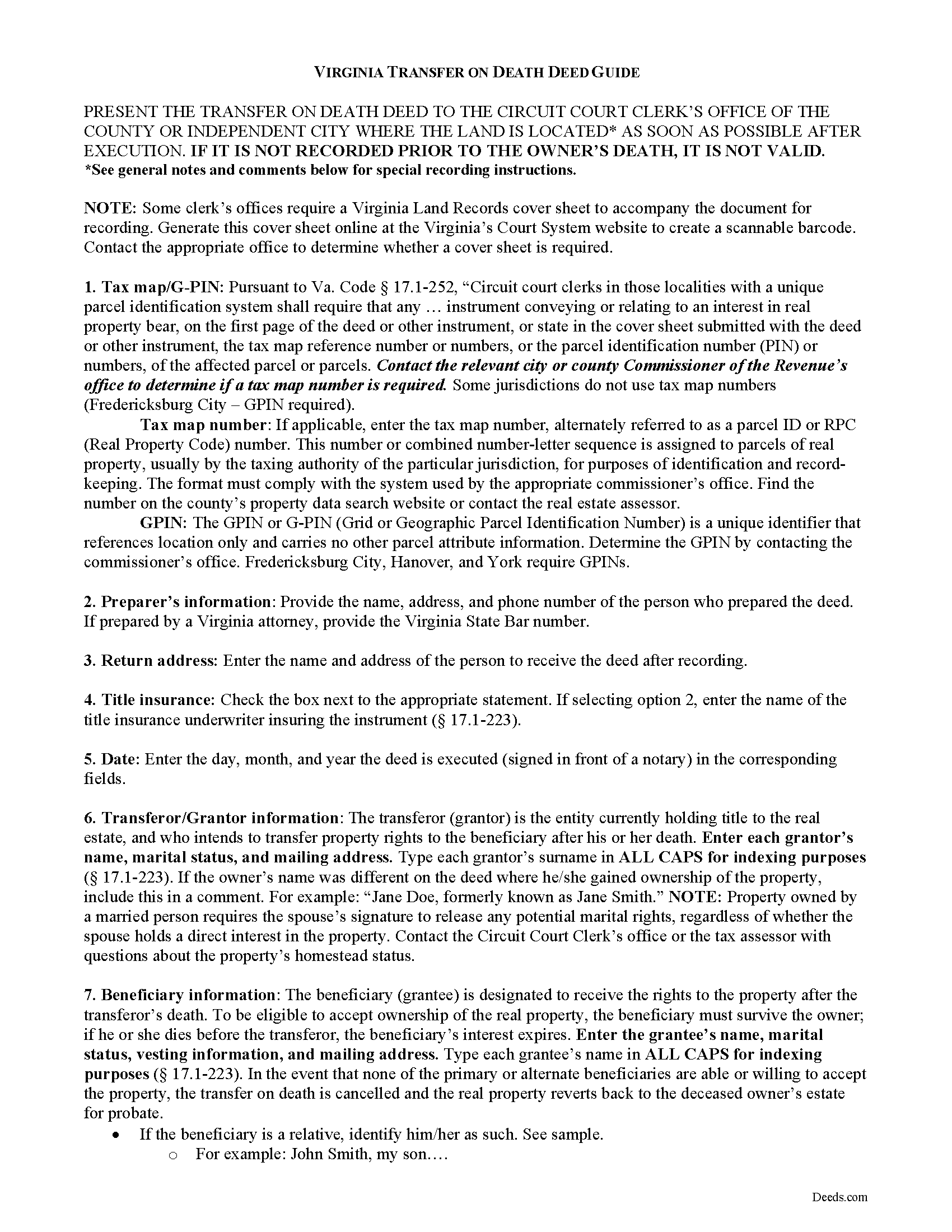

Scott County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

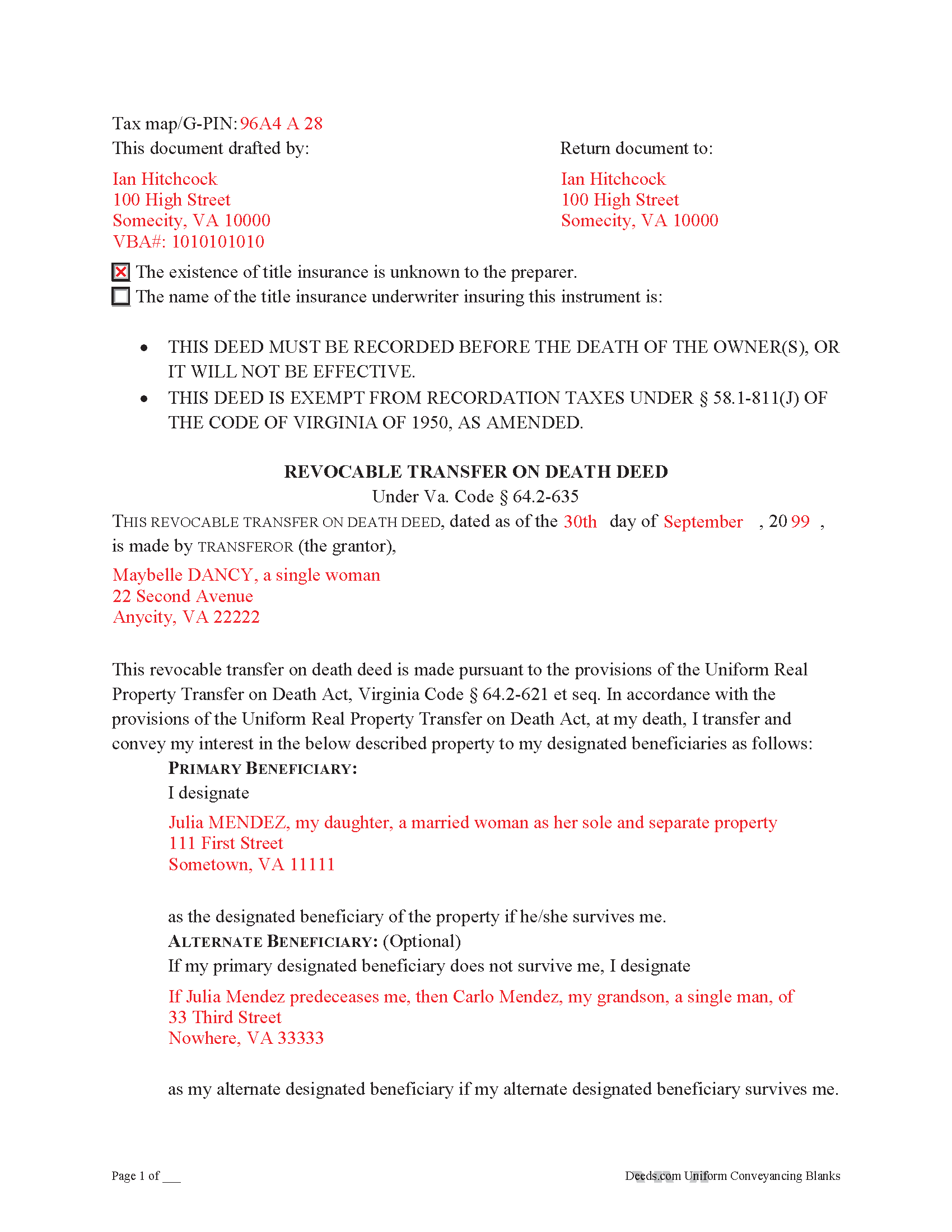

Scott County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Scott County documents included at no extra charge:

Where to Record Your Documents

Scott Circuit County Clerk

Gate City, Virginia 24251

Hours: 8:30 to 5:00 M-F

Phone: (276) 386-3801

Recording Tips for Scott County:

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Scott County

Properties in any of these areas use Scott County forms:

- Duffield

- Dungannon

- Fort Blackmore

- Gate City

- Hiltons

- Nickelsville

- Weber City

Hours, fees, requirements, and more for Scott County

How do I get my forms?

Forms are available for immediate download after payment. The Scott County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Scott County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Scott County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Scott County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Scott County?

Recording fees in Scott County vary. Contact the recorder's office at (276) 386-3801 for current fees.

Questions answered? Let's get started!

Virginia's statutory transfer on death deed became effective on July 1, 2013. These deeds are governed by the Uniform Real Property Transfer on Death Act (URPTODA), which is incorporated into the Virginia statutes at 64.2-621 et seq.

A transfer on death deed is an instrument that allows owners of Virginia real estate to convey land to chosen beneficiaries without the need for a will or probate distribution ( 64.2-624). To be valid, the completed and notarized form must, among other things, meet the same standards as a regular inter vivos deed (one that transfers title while the owner is still living); state that the transfer will only occur at the owner/transferor's death; and be recorded <i>while the transferor is alive</i> in the land records at clerk's office of the county where the property is located ( 64.2-628).

The deeds are revocable, which means that while alive, the owner retains 100% control over the property, may use or sell it as desired, and may also redirect, modify, or even cancel the future transfer at will. As a result, there is no requirement for notice, delivery, acceptance, or consideration, all necessary for standard deeds ( 64.2-629). This is possible because the named beneficiaries only have a potential future interest in the real estate. The process and requirements for revocation are specified in 64.2-630.

During the owner/transferor's life, the recorded transfer on death deed does not change the owner's interest or rights to sell or mortgage the property; grant the beneficiary any interest in the land; change a creditor's interest in the real estate; affect the owner's or beneficiary's eligibility for public assistance; create a legal or equitable interest in favor of the beneficiary; or open the property up to claims from the beneficiary's creditors ( 64.2-631).

When the transferor dies, the title to the real property vests in the beneficiary according to the rules stated in 64.2-632. In some cases, however, the beneficiary may not wish to accept the property. If that happens, he/she may "disclaim all or part of the beneficiary's interest as provided by Chapter 26 (64.2-2600 et seq.)" (64.2-633).

Overall, Virginia's transfer on death deed adds an efficient, flexible tool for those considering options for estate planning. As with other important financial decisions, take the time to carefully review the different options. Each case is unique, so when in doubt, contact an attorney or other appropriate professional for advice.

(Virginia TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Scott County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Scott County.

Our Promise

The documents you receive here will meet, or exceed, the Scott County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Scott County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

John W.

January 9th, 2019

The forms were easy to acquire and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory B.

May 30th, 2020

I believe you need more instruction on the use of the web site. I would type and nothing would appear on the form. When I tried to save a completed form I ended with a blank form with no detail.

Thank you!

ROBERTA G K.

May 21st, 2023

I have looked and finally found a reliable source of updated legal documents that are current with local and state law that I can be readily downloaded for review, reference and use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elexis C.

November 14th, 2019

Easy, fast & amazing descriptions of all forms needed.

Thank you!

Dina B.

February 6th, 2021

The web cite is very easy to navigate through making a document process simple to obtain.

Thank you!

Robert F.

July 11th, 2023

This service is excellent. I submitted a Quickclaim Deed so my home would be in the name of a Living Trust I had just created. This was my first attempted at any of this and the staff person, KVH, who reviewed my Deed was extremely helpful and quick to respond to any questions I had and to make sure the Deed had the correct information before submittal to the county for recording. I started the process one afternoon and by the next day, the Deed was submitted to, and recorded in, my county. I will use them again whenever needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anthony C.

January 9th, 2021

Good information for solving my issue...

Thank you!

Carolyn G.

September 1st, 2021

I was extremely pleased with this experience, which literally took a minimum amount of time. One recommendation: make certain that when documents are uploaded that they have been received in the appropriate file. The lack of clarity caused me to upload twice or three times. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Joey S.

March 5th, 2022

This is the easiest process ever!

Thank you!

Julie G.

December 15th, 2020

Such a great site!! Everyone is so helpful! Thanks again! Julie

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Isaac T.

November 14th, 2022

Had no problem getting my forms. It was quick,easy, and reasonable priced. Will use again if needed

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Niki G.

January 13th, 2022

Absolutely love the Golden Girls homage in the quit claim deed example. Funny stuff!

Thanks for the feedback Niki. Glad you enjoyed our attempt to spice up the mundane. Have an amazing day.

Suhila C.

August 23rd, 2020

This site is awesome. It has everything I need to purchase and sell (transfer deed ownership) land and property. I cannot wait to get our new land and building for business. Thanks, Suhila

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael R.

April 11th, 2023

This process was so easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda s.

October 10th, 2020

This was such an easy process and even tho you had to pay a $15 - to me it was well worth not having to drive downtown etc or take the risk of mailing the documents (fearing that they would get lost). I'll be using this from now on...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!