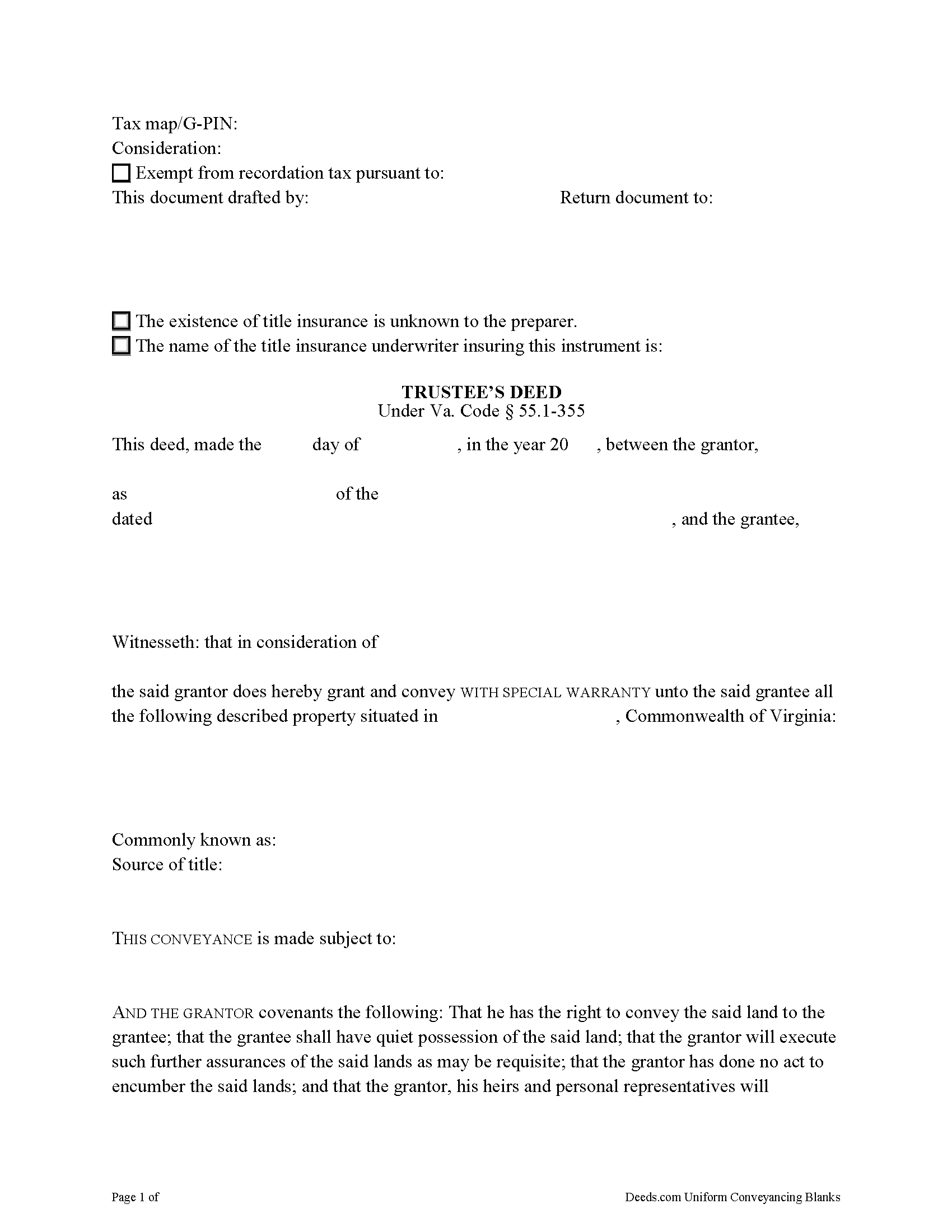

Shenandoah County Trustee Deed Form

Shenandoah County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

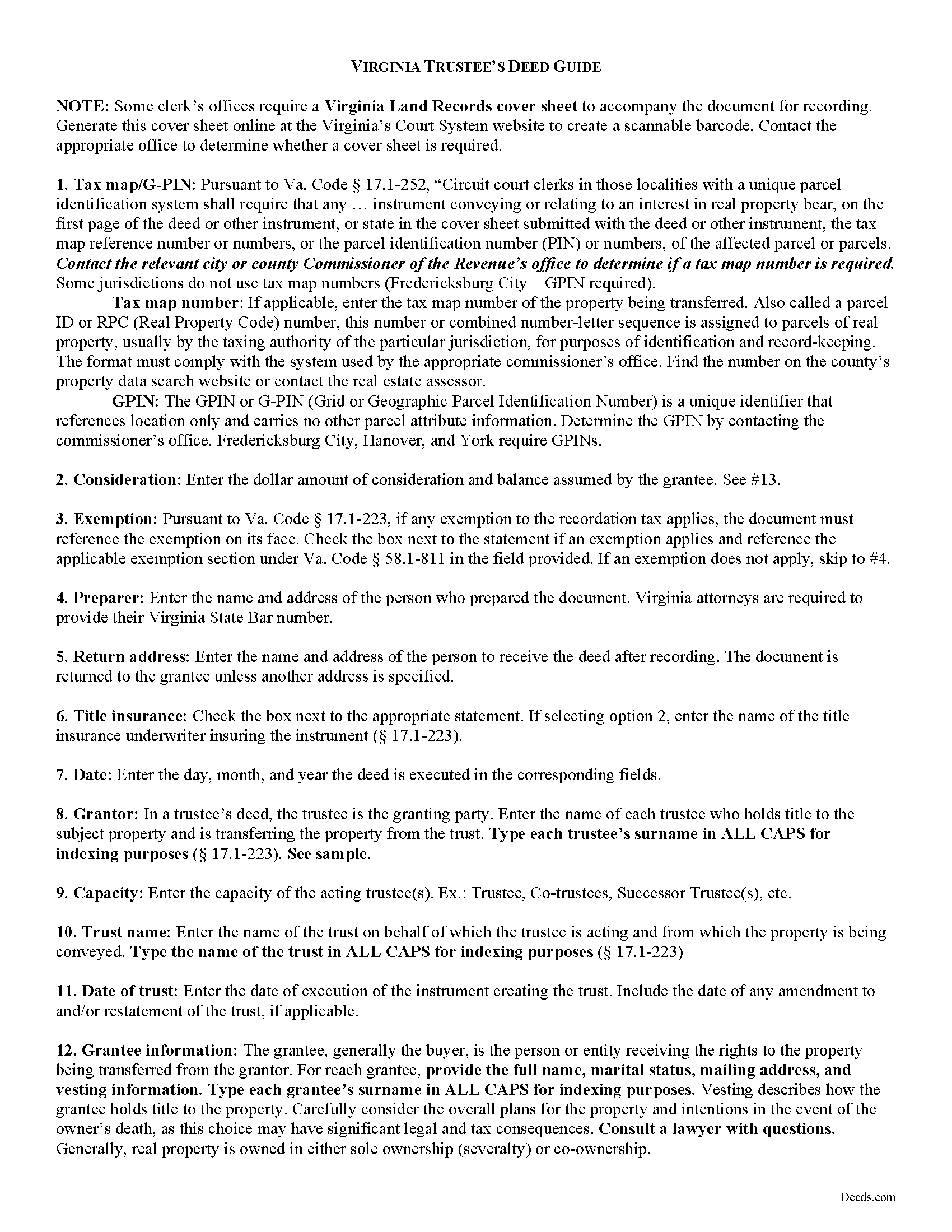

Shenandoah County Trustee Deed Guide

Line by line guide explaining every blank on the form.

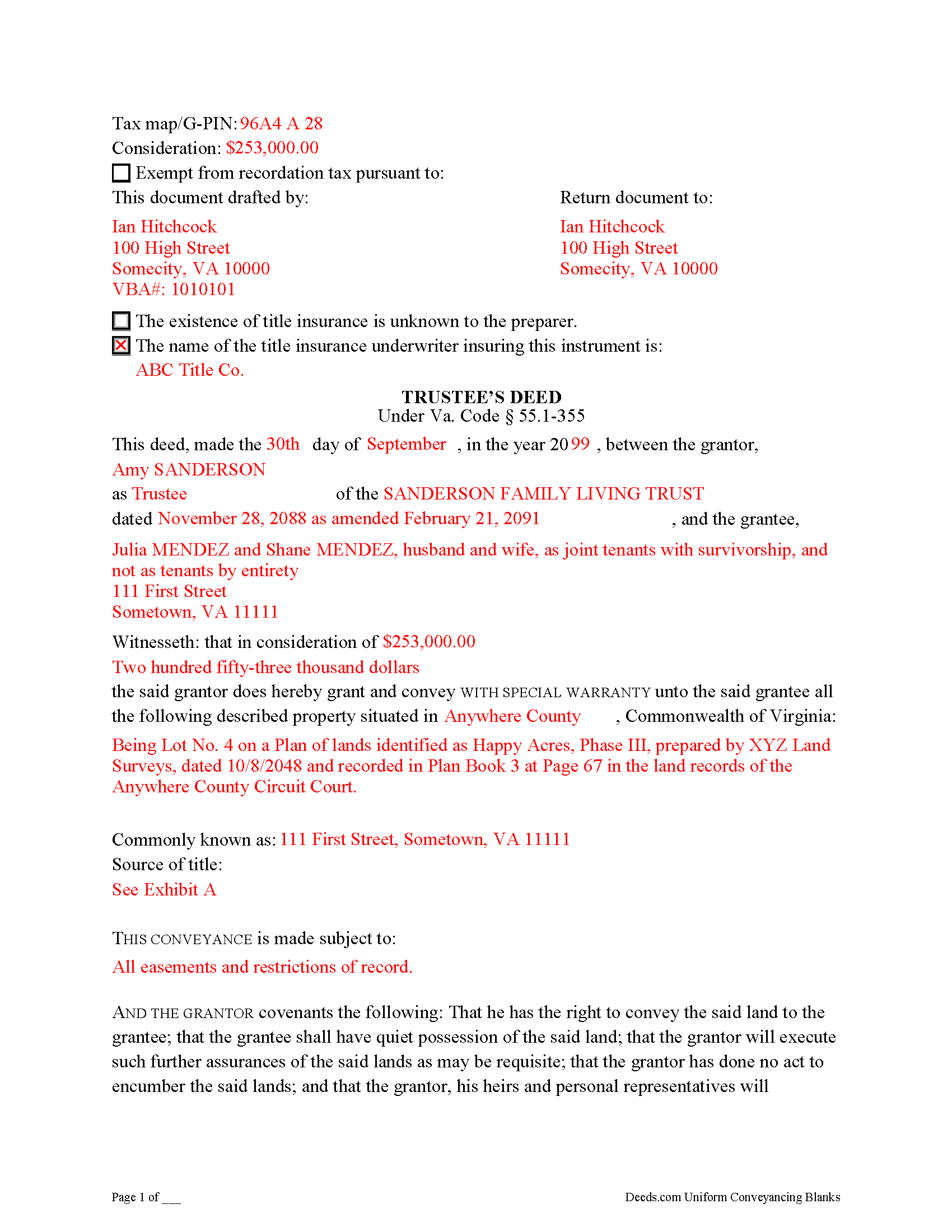

Shenandoah County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Shenandoah County documents included at no extra charge:

Where to Record Your Documents

Shenandoah Circuit Court Clerk

Woodstock, Virginia 22664-1423

Hours: Monday through Friday 9:00am – 5:00pm

Phone: (540) 459-6150

Recording Tips for Shenandoah County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Shenandoah County

Properties in any of these areas use Shenandoah County forms:

- Basye

- Edinburg

- Fishers Hill

- Fort Valley

- Maurertown

- Mount Jackson

- New Market

- Orkney Springs

- Quicksburg

- Strasburg

- Toms Brook

- Woodstock

Hours, fees, requirements, and more for Shenandoah County

How do I get my forms?

Forms are available for immediate download after payment. The Shenandoah County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shenandoah County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shenandoah County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shenandoah County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shenandoah County?

Recording fees in Shenandoah County vary. Contact the recorder's office at (540) 459-6150 for current fees.

Questions answered? Let's get started!

Transferring Real Property from a Living Trust Using a Virginia Trustee's Deed

A trustee's deed conveys interest in real property held in a living (inter vivos) trust. The deed is named for the granting party, the trustee, who holds legal title to property contributed to the trust by the trust's settlor. A settlor is any person who creates or contributes property to a trust by transferring it to another. Property held in trust is administered by the trustee for the benefit of a trust beneficiary. In most living trusts, the settlor designates himself as trustee and names a successor, who will take over fiduciary duties upon the settlor's death or incapacitation.

The trust is established by a written instrument executed by the settlor and governed by the Uniform Trust Code, codified in Virginia at Va. Code Ann. 64.2-7. The trust instrument contains the terms of the trust and sets forth the settlor's estate plan. The document names the trustees and enumerates the trustee's powers in acting on behalf of the trust, and designates the trust beneficiary or beneficiaries. Generally, the settlor designates himself as the living trust's beneficiary during his lifetime, and identifies another in the trust instrument who will receive the benefit of the trust's assets upon his death.

Trustees rely on the terms of the trust instrument and statutory trustee powers to convey property held in trust. A deed executed by trustee to convey real property from a trust typically carries a special warranty covenant of title. This means that the grantor promises to warrant and defend the property for the grantee "against the claims and demands of the grantor, and all persons claiming or to claim by, through, or under him" (Va. Code Ann. 55.1-355). Because the trustee is acting "in a fiduciary capacity," a narrower covenant than a general warranty is offered "to warrant title [only] during the time they had legal possession of it" [1].

A trustee's deed requires additional information because the grantor is acting in a fiduciary capacity. When real property is held in trust, the assets vest in the name of the trustee on behalf of the trust. Therefore, the trustee's deed names the acting trustee, the trust, and the date of the trust when reciting the grantor's information. The trustee's deed should comply with the statutory form for deeds and satisfy recording requirements for documents pertaining to interest in real property in Virginia (55.1-300, 17.1-223 et seq.). A trustee may provide a certification of trust under 64.2-804 to confirm the trust's existence and his authority to convey real property.

Before recording the deed in the independent city or county wherein the subject property is located, the deed must be signed by each acting trustee and acknowledged in the presence of a notary public.

(Virginia TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Shenandoah County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Shenandoah County.

Our Promise

The documents you receive here will meet, or exceed, the Shenandoah County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shenandoah County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4607 Reviews )

Beverly A.

June 13th, 2019

The forms are incredibly easy to fill out. Thanks for the examples!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Suzette D.

February 20th, 2020

easy to use and gave examples!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!

Ena D.

May 5th, 2021

Very easy process. great customer service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael H.

November 5th, 2019

Site was easy to understand and use. Service was prompt. Good job Montgomery County!

Thank you!

Brian Z.

May 2nd, 2019

Great site with the forms I needed

Thanks Brian, we appreciate your feedback.

Elizabeth R.

April 20th, 2023

It was easy to download and save the Revocation of Beneficiary of Deed form. The example and instructions helped a lot. When I went to file with the county clerk's office, she read through it carefully and said "perfect" when she was through. Thank you for making it so easy!

Thank you!

Roger V.

April 26th, 2019

Very easy to use.

Thank you Roger, we appreciate your feedback.

Phillip S.

February 14th, 2024

I used the Oklahoma Gift Deed transferring property intra-family, and found it easy to complete. I could not find an Oklahoma Affidavit for the new law re citizenship verification, 60 O.S. Sec 121 and found it at another site that was not a fill in online. Oh well. Site was easy to navigate.

We are motivated by your feedback to continue delivering excellence. Thank you!

Kitty H.

February 19th, 2019

I have had it reviewed by a mortgage broker and a title manager and both said it was done correctly! Your product and the instructions are what made this possible. It took me several hours as I continued to review your information. I just finished printing and ready to file. Yeah! Thanks! Highly recommend the product!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Taylor W.

February 2nd, 2021

This was the quickest NOC recording i have ever done. I will definitely be using deeds.com from here on out for recordings!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John M.

November 18th, 2021

Just finished downloading all of the forms; so far so good

Thank you for your feedback. We really appreciate it. Have a great day!

Janet P.

July 30th, 2021

Extremely easy to use. The guide and sample were a great source of reference.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna R.

November 17th, 2021

This was a seamless process. It probably took one minute to fill out my information and upload the document. It was formatted and sent immediately. It was processed the next day at the county recorders office. I have zero complaints. Before finding this company I spent an entire day calling and leaving messages at other e-filing companies like simplfile and others but they all required subscriptions. I just needed to file a single document now and then so that was not a good fit. (And those companies I found out still require the customer to do all the work!). Deeds.com kept me informed throughout the process every step. I'm happy to write this review. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!